Climate Integration with Clear Intention

The new Global Climate Transition Equity Strategy is a forward-thinking portfolio that is managed by our Fundamental Equity team. Recognized as one of Barron's Top Fund Families in 2024, the team is powered by proprietary research and a distinctive drive to gain a true picture of companies' climate exposures.

Lori Heinel, Global Chief Investment Officer at State Street Global Advisors, introduces the new Global Climate Transition Equity Strategy.

Video (01:08)

Our Approach

State Street Global Advisors harnesses the Fundamental Equity team’s 20 years of average experience, competitive track record, expertise, and established processes that have the potential to uncover insights before the market does, and applies them to a new Strategy that deeply focuses on climate risks and opportunities.

For investors seeking to integrate climate-related criteria into their portfolios, this Strategy offers an approach that is differentiated by:

- A proprietary climate scorecard generated from years of research and analysis

- High conviction in a select number of names

- An unwavering focus on quality issuers with durable growth and attractive valuations

The Strategy contains 30-40 names. Our culture of comprehensive research allows us to have the confidence to hold a select group of companies that have a reliable plan for meeting their climate targets, and that pass our rigorous standards for quality, growth and value. With the Strategy's low turnover, we invest in companies as owners—not traders—and we maintain a long-term view.

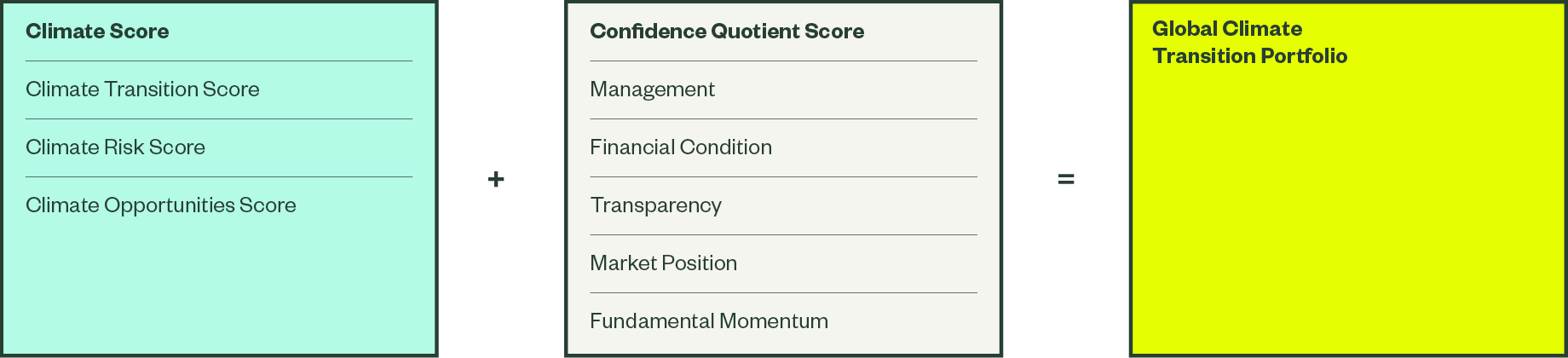

Weightings Are Based on Proprietary Scoring

Our Confidence Quotient (CQ) framework for assessing quality and durable growth is proprietary and time-tested. CQ adds discipline and rigor to our process – which we believe is essential for repeatability of results. The CQ is divided into five sub-measures: Market Position, Management, Financial Condition, Transparency and Fundamental Momentum. Sustainable and climate transition-related metrics and insights are fully integrated into our CQ process.

Global Climate Transition Strategy Research Process

Source: State Street Global Advisors, as of March 31, 2024.

Putting in the Work to Find Risks and Opportunities

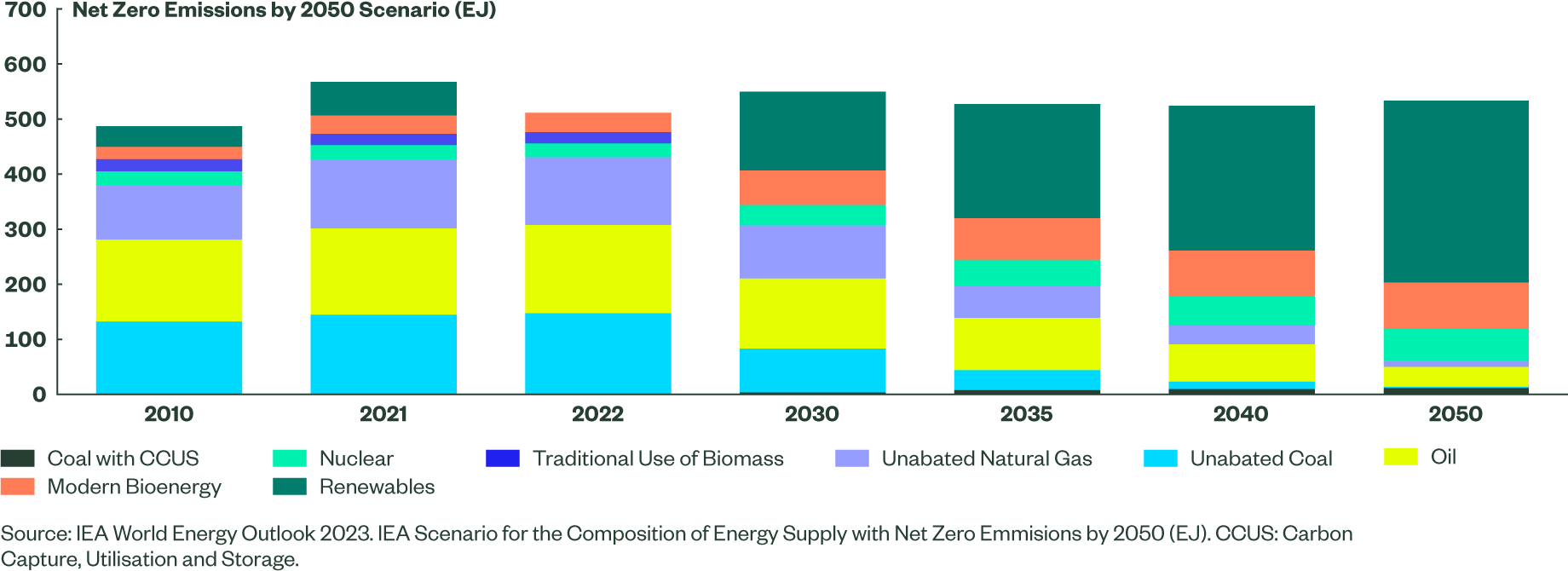

The global climate transition will include both risks and opportunities. Some investors may want to mitigate climate risks for a number of reasons, such as regulatory headwinds, concern over certain companies’ reputational risks, and costly operational changes related to climate. On the flip side, the increased use of renewable energy and the rising attention to extreme weather may have created opportunities for companies that can reduce emissions and help their customers do the same.

Sources of Energy Change

(Estimates of the Future Energy Trajectory from the IEA)

In this context, we partner with clients to help them prepare their portfolios for an expected global climate transition. At State Street Global Advisors, estimated and unaudited sustainable assets under management were $715 billion as of March 31, 2024.

Hiring a fundamental active manager involves a belief in the people as much as the process. Our impressive performance reflects the caliber and stability of our team - and our shared commitment to our fundamental, high-conviction investment philosophy.

As the global economy transitions from dependence on fossil fuels to one driven by clean energy, we expect opportunities for high-conviction equity investors.

Air Products, Saint Gobain, and Standard Chartered are all well-positioned to benefit from the climate-transition actions that companies and countries around the world are taking.

Climate-related risks can lead to unexpected value erosion. The Active Fundamental Equity team discusses the integration of climate risks into fundamental analysis.

This article takes a close look at the importance — and the mechanics — of carbon capture in achieving net zero targets by 2050.

The Fundamental Growth and Core Equity (FGC) team at State Street Global Advisors takes an active, concentrated, high-conviction approach to equity investing.

A core, index-based climate strategy, combined with a satellite, active-oriented, high-conviction climate strategy, can demonstrate alpha and diversification benefits while controlling tracking error.

Contact us about your climate integration goals.