Emerging Opportunities

Emerging markets have significantly lagged their developed counterparts in recent years. There are, however, tentative signs of a recovery in corporate earnings and improving market sentiment, which could herald a change in fortunes.

Follow the Earnings

We have previously commented1 on the relative performance of emerging equity markets compared to their developed counterparts in recent years, and how that weakness has been driven in large part by an earnings disparity. In the post-pandemic period, while developed market earnings have powered ahead, emerging markets have floundered, notably dragged down by weakness in the largest economy China.

Weak sentiment towards emerging markets (EM) has also been a factor in the underperformance, especially concerns over the trajectory of China’s economy. Global economic conditions and policy also play a part but until the narrative turns more positive towards the EM complex, a lack of inflows will likely mean the large valuation discount they offer relative to developed markets will remain.

More recently, however, there are signs of self-help from emerging markets companies with earnings expectations taking a sharp turn upwards in local currency terms over the past six months. Strength in the US dollar, a traditional headwind for emerging markets, has arguably masked this improvement for dollar-based investors. A rewind of the dollar strength could reveal EM’s underlying voracity.

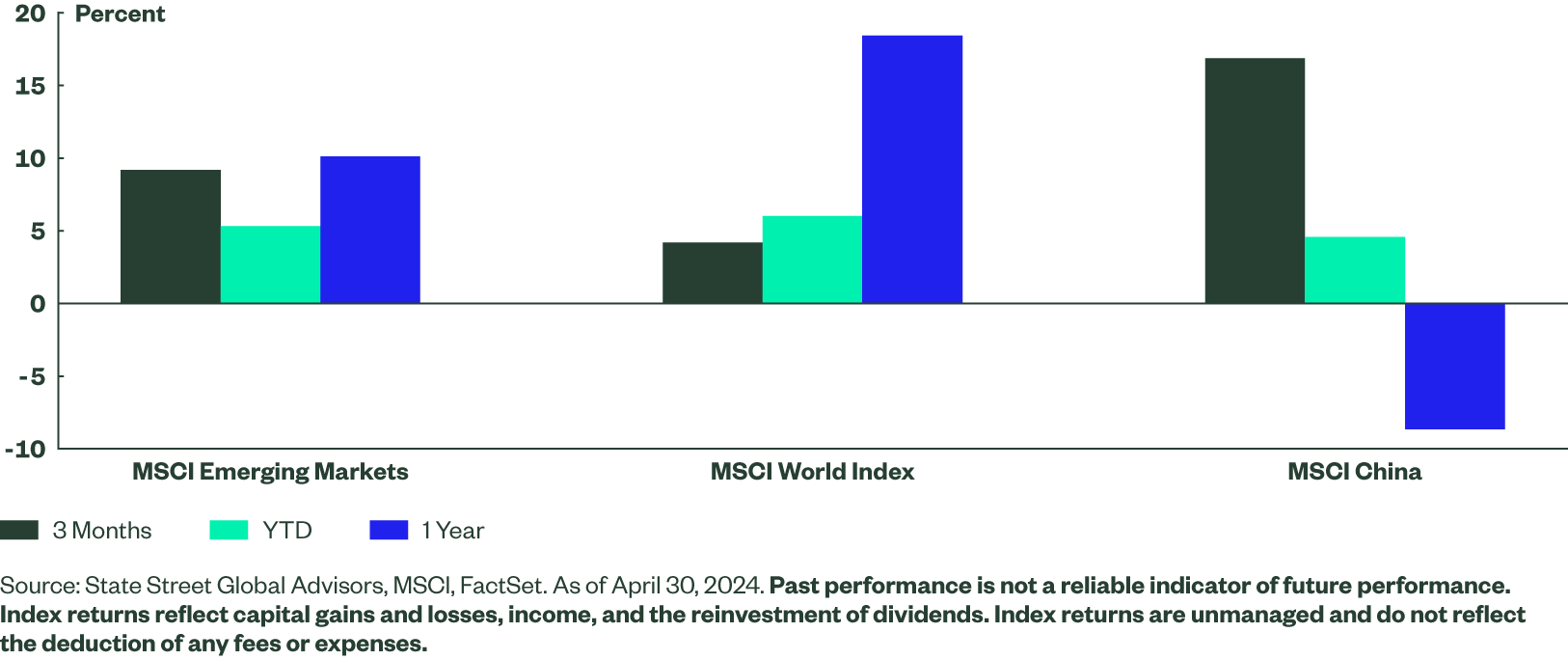

While earnings forecasts for China have not shown the upward inflection of other emerging markets, Chinese companies’ share prices have started to rally as a result of targeted stimulus, improving factory activity, and anticipation of more policy support. Over the past three months, MSCI China Index has returned 17% in local currency terms, compared to 4% for the MSCI World Index. However, there is still a long way to recover the lost ground, but this recent uptick offers a positive sign for a continuation.

Figure 3: Index Total Returns, Local Currency

Factors and Themes

Although the overall path of developed and emerging equities may have diverged of late, within markets there have been similar dynamics at play globally. Several of these dynamics have been supportive of our ability to generate significant alpha in our emerging markets strategies over the past few years.

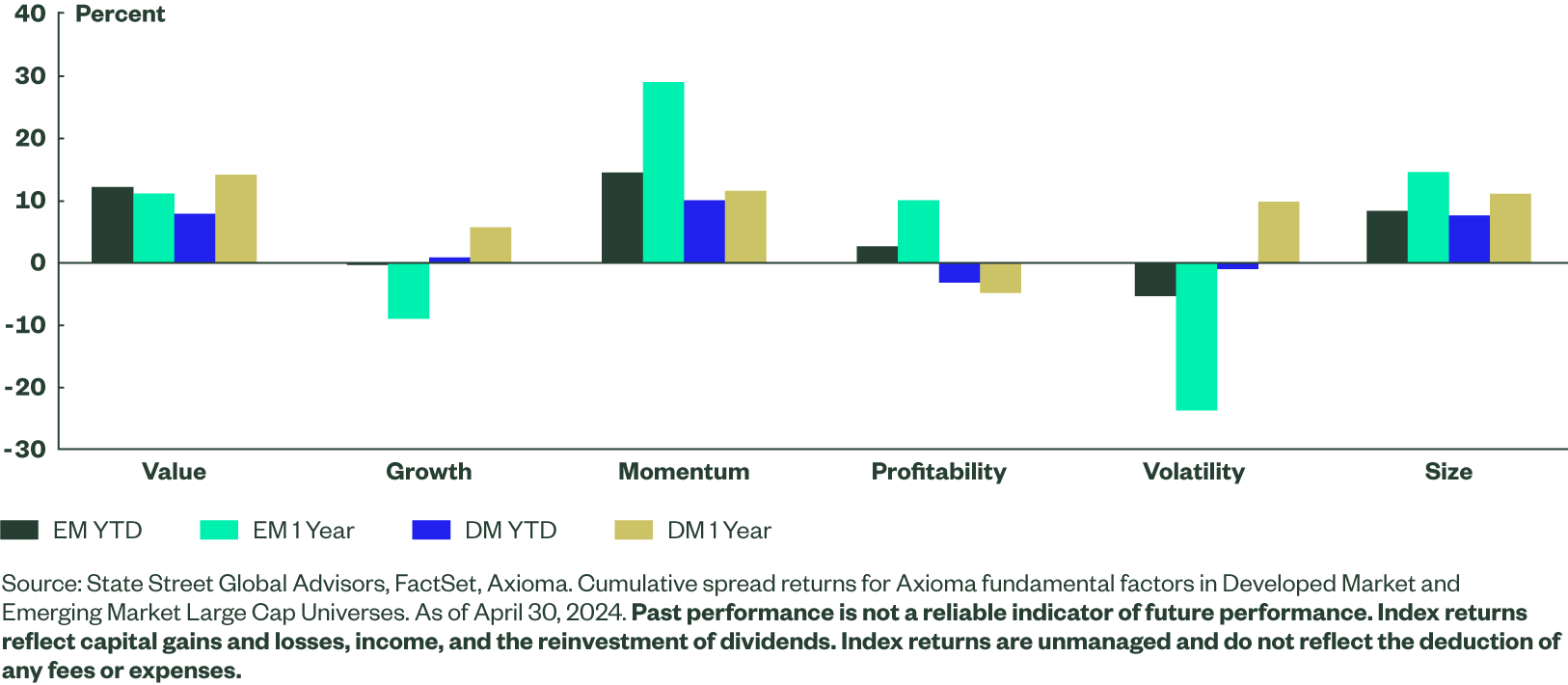

As previously discussed,2 in developed equities Momentum has been the standout factor so far this year, and our Sentiment theme (which is somewhat aligned with Momentum) has been a significant contributor to the alpha we have generated this year. We have witnessed similar return profiles across factors in EM. In fact, there is a high correlation between factor returns in developed and emerging markets over the past year. The major exception is volatility, with emerging markets being risk-adverse while developed markets have embraced a stronger risk-onstance.

Figure 4: Factor Returns in Emerging and Developed Markets

The broader market environment is also normalizing and supportive of alpha generation. For example, the cross-sectional correlation between stocks has normalized in both markets back towards long-term averages, implying markets that are less macro-driven and allowing greater differentiation between stocks.

The Bottom Line

Emerging markets have been overlooked by investors in the post-pandemic equity bull market and have significantly underperformed. Despite differences in market returns at the headline level, the dynamics within the emerging and developed markets have shown significant correlations. This supportive environment has enabled our alpha model to generate strong returns across the investment spectrum in which we operate.

Within the EM complex, we are seeing signs of recovery in corporate earnings, which if maintained, could invite renewed investor attention, particularly if coupled with stabilization within China. Market timing is of course tricky, but we believe from a diversification standpoint, that investors should now be positioned to benefit from the shift in positive sentiment toward emerging markets.