High Yield Still in Focus

Each month, the SSGA Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) to guide near-term investment decisions for client portfolios. Here we report on the team’s most recent discussion.

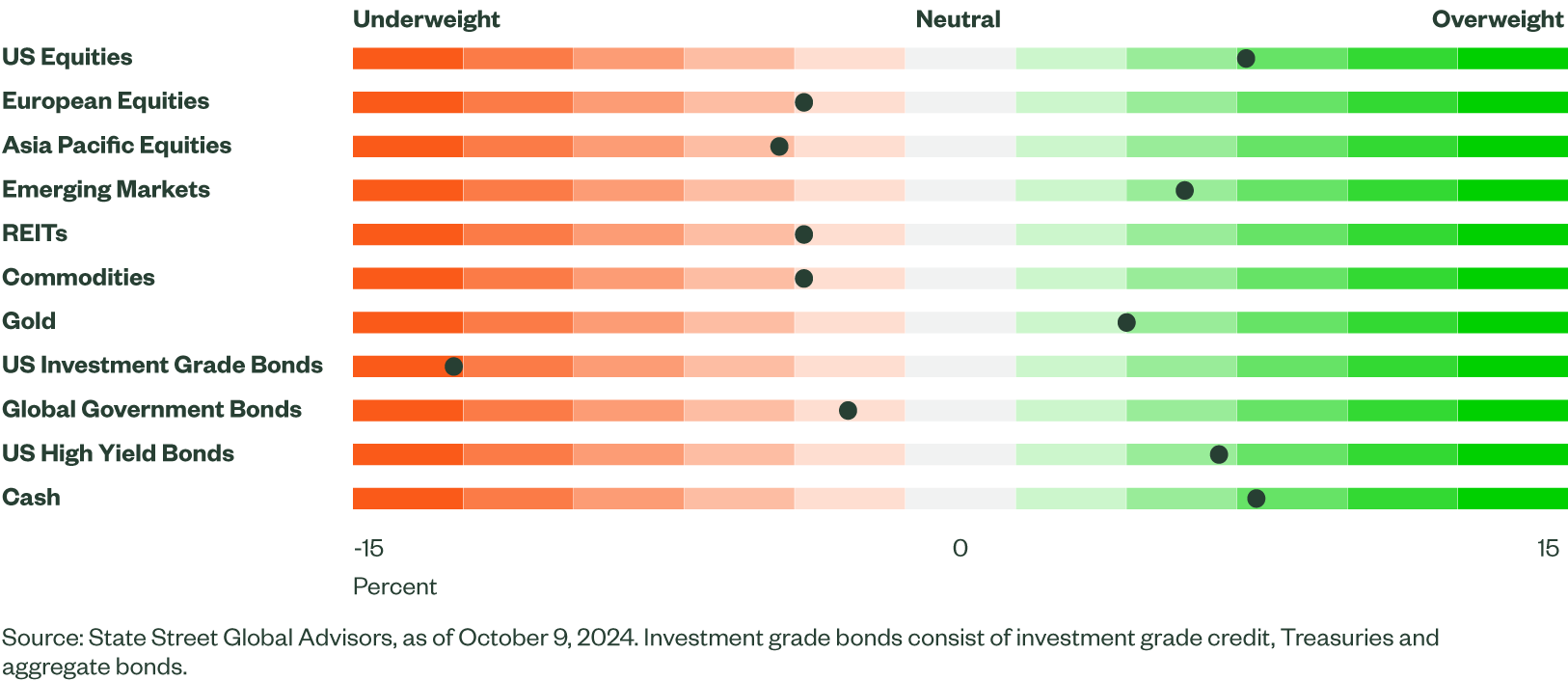

Figure 1: Asset Class Views Summary

Macro Backdrop

As we enter the final quarter of 2024 and reflect on recent developments, it is amazing how much difference a month can make. Recent data has shifted the labor market narrative, with sentiment less bleak. Consequently, recession fears appear to have decreased, in line with our long-held view. Economic growth has been resilient, disinflation has generally progressed, and central banks have begun easing cycles — all of which support our view for a soft landing.

Manufacturing activity remains sluggish as indicated by the J.P. Morgan Global Manufacturing PMI, which continues to fall. After staying in expansionary territory during the first half of the year, it has now moved further into contraction. While September saw slight improvement in China, activity fell in Europe and Japan. Service activity has cooled in regions like Europe and China, but strengthened in the US and Japan. Overall, service activity remains expansionary across regions.

In the US, the economy appears resilient and should benefit from a strong consumer base and further Federal Reserve (Fed) easing. Employment risks have dissipated for now, with strong data reported across the board in September. Non-farm payrolls significantly outpaced expectations, with upward revisions for July and August. Job creation was strong across healthcare, government, construction and social assistance, while wage growth accelerated for a second straight month.

Additionally, the unemployment rate fell, and the labor force participation rate held steady, implying increased job creation. Elsewhere, September’s ADP payrolls showed widespread job gains, JOLTS increased, and unemployment claims remained low.

The upward revision of the savings rate to 5% and stronger gross domestic income suggest more excess savings than previously thought, which should support consumption. The Atlanta GDPNow estimate has improved, forecasting solid third-quarter GDP growth of 3.2%.

To be sure, there are pockets of weakness. Credit card interest rates are high, at an average over 21%, while credit debt has reached a record high of $1.14 trillion, indicating households are spending significantly on interest payments. Furthermore, credit card and other delinquencies have been rising. Although data has been volatile and individual readings should be viewed with caution, the labor market remains sound, and consumption appears supported overall.

Outside of the US, the outlook is mixed. We are optimistic about Japan, where higher wage growth is supporting consumption. However, the outlook for the Eurozone is less favorable, with Germany – the largest economy – struggling while households continue to save. Interest rate cuts from the European Central Bank (ECB) should help bolster consumption, but this may be offset by fiscal restraint, as some countries face excessive default procedures.

In France, proposed measures aimed at reducing fiscal impulse to cut the budget deficit include a combination of tax increases (mainly on corporations and share buybacks) and spending cuts. However, these actions could also stunt job creation.

In China, growth has been weaker, and its outlook depends on the stimulus details expected to be released over the next few weeks. These measures will need to be material enough to boost consumer confidence, structurally lift consumption, and support the property sector.

The Fed’s 50 bps rate cut in September was likely a recalibration due to restrictive rates rather than a signal of a faster pace of cuts to come. While another 50 bps cuts remains possible, it would likely require a considerable weakening of the labor market. The Fed is not expected to react aggressively to recent data and is on track to cut rates by another 25 bps in November. The labor market’s strength and the slow pace of disinflation warrants a gradual reduction in rates, and we still anticipate 50 bps cuts for the remainder of 2024.

The Bank of Japan may face challenges in raising rates due to opposition from the new premier, who favors loose monetary policy. However, the gradual recovery in wages and consumption should support additional rate hikes, with December still a possibility.

The ECB has already reduced rates twice in 2024 and is poised for another cut. In our view, two additional cuts are justified, given inflation near target and concerns over economic growth. ECB President Christine Lagarde has acknowledged the headwinds to growth and the progress on inflation, while the Fed’s easing cycle should give the ECB more leeway to lower rates.

Election and geopolitical risks remain, but sturdy labor, combined with easing interest rate pressures as the Fed cuts into a resilient economy, should continue to support a soft landing.

Directional Trades and Risk Positioning

Risk appetite remains lackluster when evaluated through our Market Regime Indicator (MRI). The announcement of stimulus in China, solid service sector activity, stronger US jobs reports, and the first Fed rate cut have supported investor outlook. However, escalating conflict between Israel and Iran, hurricanes, election uncertainty, and concerns about non-US economic growth continue to weigh on investor sentiment.

In our quantitative framework, the equity trend signal, which evaluates price trends over multiple look-back periods, suggests strong risk appetite. Similar to last month, this enthusiasm is being offset by other factors, indicating a more muted risk environment. Our measures of implied volatility have improved and become more neutral, but they have been trending higher recently. Demand for risk assets remains poor, and credit market sentiment indicators signal higher levels of risk aversion.

Lastly, our evaluation of sentiment spreads – comparing pairs of risk-on and risk-off market segments – has improved but continues to indicate less risk appetite. Overall, while our MRI has marginally improved, it still indicates a slightly elevated level of risk aversion, which could be a headwind for risk assets.

From an asset class perspective, our forecast for equities continues to soften, while our fixed income expectations remain relatively unchanged.

The reduced equity forecast is driven by a continued deterioration in sentiment, with both sales and earnings expectations turning negative. While price momentum remains firm and quality factors are supportive, unattractive valuations and poor macroeconomic factors weigh on our outlook.

For fixed income, our highest expected returns continue to be in high-yield bonds and cash, while we maintain negative forecasts for longer-duration bonds. Yields have recently reversed higher and our quantitative model shows a slight bias towards higher rates. September’s manufacturing PMI report indicated weaker activity, but remains below our lookback value, implying lower yields. However, nominal GDP is running above the yield on long-term Treasury bonds, suggesting that yields should move higher. Our model anticipates a modest steepening of the yield curve due to lower inflation expectations and slope momentum. For high yield, our model anticipates minimal spread tightening over the next month, due to positive equity momentum and lower government bond yields.

Given the weaker equity forecasts, we have meaningfully reduced our allocation to equities, maintaining only a small overweight. Although risk aversion remains slightly elevated, it has improved to some extent, so we reduced our exposure to the tail risk assets such as gold and long government bonds. Proceeds from these adjustments were deployed into high-yield bonds, resulting in a healthy overweight position.

Relative Value Trades and Positioning

Within equities, our forecasts for developed markets have weakened, but there were no changes to our regional rankings and we made no changes to our positioning. We continue to allocate to the US and emerging markets. The US ranks well across all factors except value, with relatively firm price momentum and strong macroeconomic factors buoying the region.

For emerging markets, sentiment has softened, but price momentum remains robust, quality factors are supportive and macroeconomic indicators are positive. We continue to underweight non-US developed equities due to a weaker relative outlook for both Europe and the Pacific.

In Europe, sentiment indicators – both sales and earnings – continue to worsen and are firmly negative. While valuations remain attractive, price momentum has turned negative. Although valuations for Pacific equities have improved, our reading is neutral, and quality factors remain weak. Additionally, while sentiment indicators remain positive, they have declined.

On the fixed income side, expectations for slightly higher rates led us to reduce our allocation to aggregate bonds in favor of cash. At the total portfolio level, we now hold a healthy overweight to both high yield and cash, with underweights to aggregate bonds and non-US bonds.

At the sector level, we maintained exposure to communication services and consumer staples, while removing our allocation to technology and splitting an allocation between energy and financials. Although technology still ranks well in our modelling, valuations have become very unattractive, and both price momentum and sentiment indicators have weakened, pushing the sector down our rankings.

Communication services ranks well across all factors except macroeconomic, showing particularly strength across price momentum, value, and quality. Consumer staples benefits from broad-based support across factors, exhibiting strong quality factors, while sentiment and quality indicators are constructive.

The improved energy outlook stems from stronger macroeconomic indicators, which, combined with attractive valuations, support the sector. Financials benefit from favorable sentiment indicators, robust price momentum, and encouraging macroeconomic indicators.

Click here for our latest quarterly MRI report.

To see sample Tactical Asset Allocations and learn more about how TAA is used in portfolio construction, please contact your State Street relationship manager.