The Modernization of Bond Market Trading and its Implications

The structure of the bond market has been evolving, alongside an expansion in electronic trading and the rapid growth of fixed-income ETFs. As a result, improved liquidity and lower transaction costs are paving the way for wider adoption of systematic fixed income investing.

Key Takeaways

- The market structure for fixed income has been slowly changing from being dealer dominated to an “all-all” model, accompanied by an expansion in electronic trading.

- Rapid growth in adoption of fixed income ETFs in recent years has provided both a trading instrument and an additional source of liquidity to the entire bond market, with innovative techniques like portfolio trading coming to the fore.

- Buy-side market participants are diversifying their execution styles, amid the growing use of electronic execution tools for the more liquid and smaller-size tickets being increasingly executed on platforms in an “all-to-all” environment.

- This better pricing discovery, and market liquidity ultimately impacts returns to investors in the form of lower transaction costs, both explicit (bid-ask spreads) and implicit (opportunity/time cost).

- Improvements such as predictive adjustments based on market conditions and prior execution results, more accurate real-time pricing, and improvements in data availability are paving the way for more rules-based strategies where implementation reliability and cost are key elements of success.

The Evolution of Fixed Income Trading

Ever since the 1980s, advancements in technology have enabled financial markets to move continuously towards “electronification” – or electronic trading – and the use of technology throughout a trade lifecycle: execution, clearing and settlement. In this paper, as we focus on trade execution, we use “electronification” to refer to the transfer of ownership of a security by matching counterparties through an electronic platform.

Electronic trading has facilitated the goals of lowering costs, increasing speed and reliability of execution, enhancing risk management, or generally improving the market structure for trading any over-the-counter (OTC) instrument. However, the benefits that electronic trading begets will vary, particularly economies of scale - which are more readily achieved for markets with standardized products. With primarily exchange-traded products such as equities, the focus of electronification is on speed, whereas for primarily OTC-traded markets such as bonds, the focus is on improving the speed and agility necessary to access liquidity across different counterparties and trading platforms, while employing an increasing array of protocols to do so.

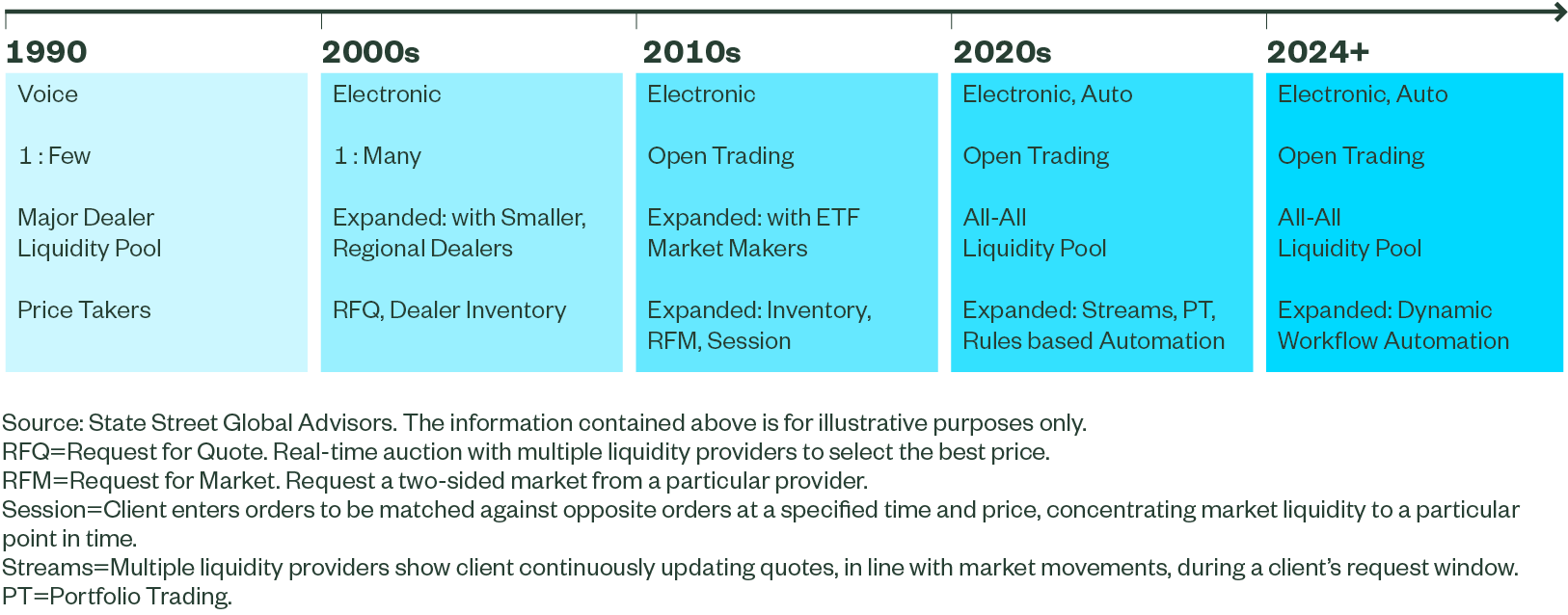

Historically, bond trading was dominated by dealers interacting with their clients by voice, while inter-dealer brokers acted as intermediaries among dealers themselves. These days, dealers facilitate movement of those bonds, and are able to quickly source the other side of the trade via electronic markets, with little or no holding period in between. Digitization of the trading process itself has resulted in emergence of a new breed of electronic trading platforms, which try to seamlessly connect investors, dealers, and other type of market participants in the quest to find avenues for new sources of liquidity. The buy-side asset management firms have stepped in as well, evolving from a traditionally passive role as a price taker, into a forceful market participant – as a price maker via the new trading venues, while actively shaping trading protocols, as well as providing liquidity in all-to-all platforms for anonymous (no market impact) trading. Figure 1 shows the consistent evolution of the fixed income trading ecosystem.

Figure 1: A Steady Evolution of Incremental Changes

Adoption: Electronification, ETFs, and Portfolio Trading

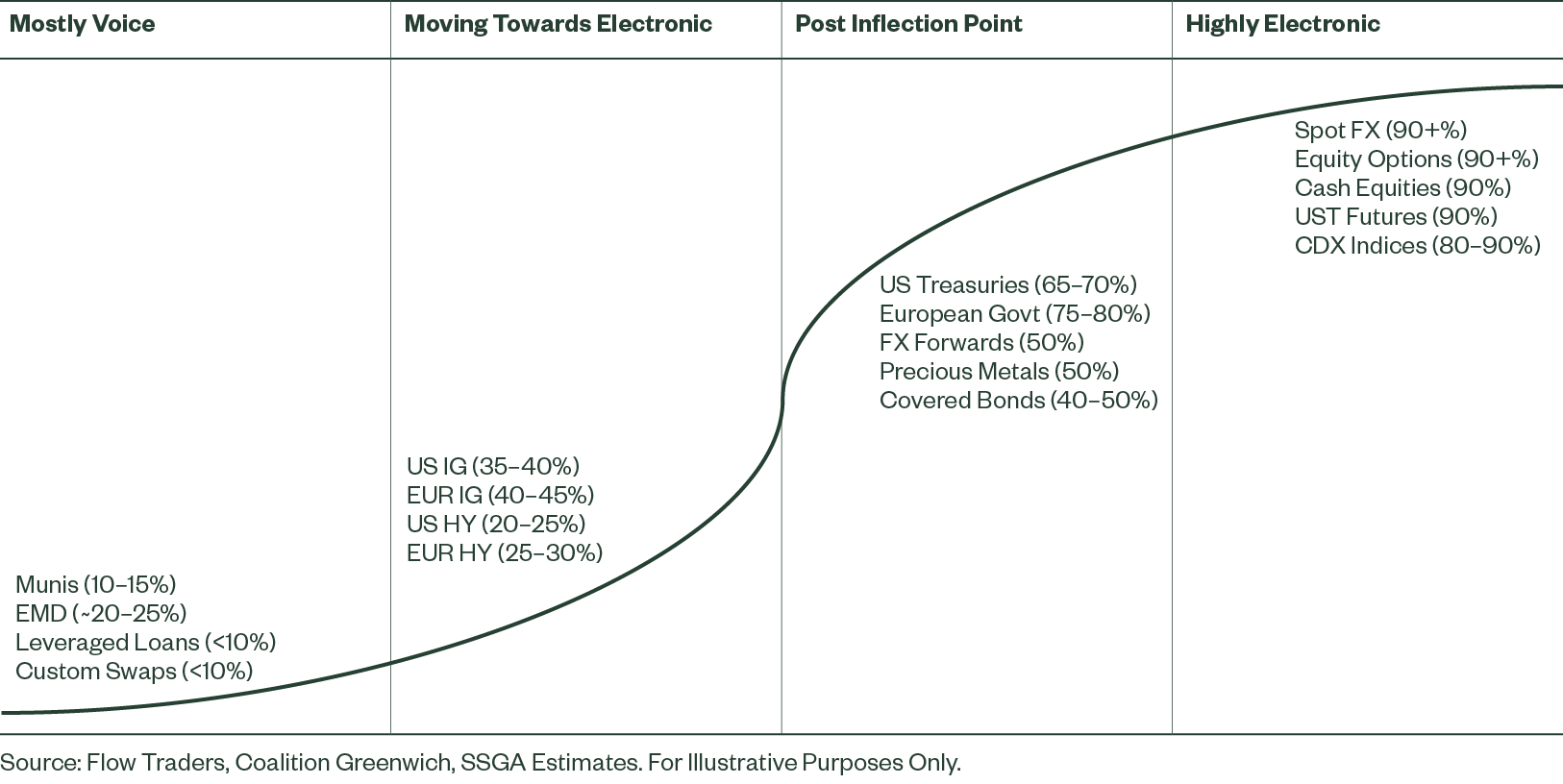

Adoption of electronification has not been uniform across the fixed-income product landscape. As shown in Figure 2, variability in market size, liquidity, number of instruments, minimum lot size, types and nature of market participants, as well as available trading protocols have led to varying levels of adoption across the fixed income spectrum.

In addition, there exists a spectrum within electronification itself, depending on the nature of the underlying market and segmentation within its securities. Using US Treasuries as an example, 65% trade electronically. Roughly half that volume is via the Request for Quote (RFQ) protocol on the lower end of the spectrum. This mix changes depending on market volatility, issuance patterns, age-distribution (on vs off-the-run), etc. We also see a broader network effect in play in that, once an inflection point is reached, adoption of electronification and concomitant volumes quickly increase – this has been the case with FX spot, US Treasuries, cash equities, and equity options.

At the moment, US and European investment grade (IG) and high-yield (HY) corporate bonds are getting close to that inflection point, so we focus more on those markets in this piece. However, it is a truly global phenomena, with the adoption of e-trading starting to take hold in major Asian and Latin American markets as well, particularly in hard currency bonds, which are increasingly being executed on electronic RFQ platforms, as opposed to other less-structured online channels.

Figure 2: Electronic Trading Adoption Across Markets

In addition, the rapid investor adoption of fixed income ETFs in recent years has helped to shape a new frontier, due to the additional layers of liquidity that ETFs provide as a product as well as the underlying cash market liquidity. (As little as 20% of daily ETF trading volumes are conducted in the underlying cash bonds.) Furthermore, the involvement of additional participants such as Authorized Participant (AP) market makers, high-frequency and algorithmic trading (HFT) etc., which have the ability to effectively price-discover an ETF’s intrinsic value and the economic incentive to arbitrage, has resulted in consolidation of pricing information quickly and efficiently.

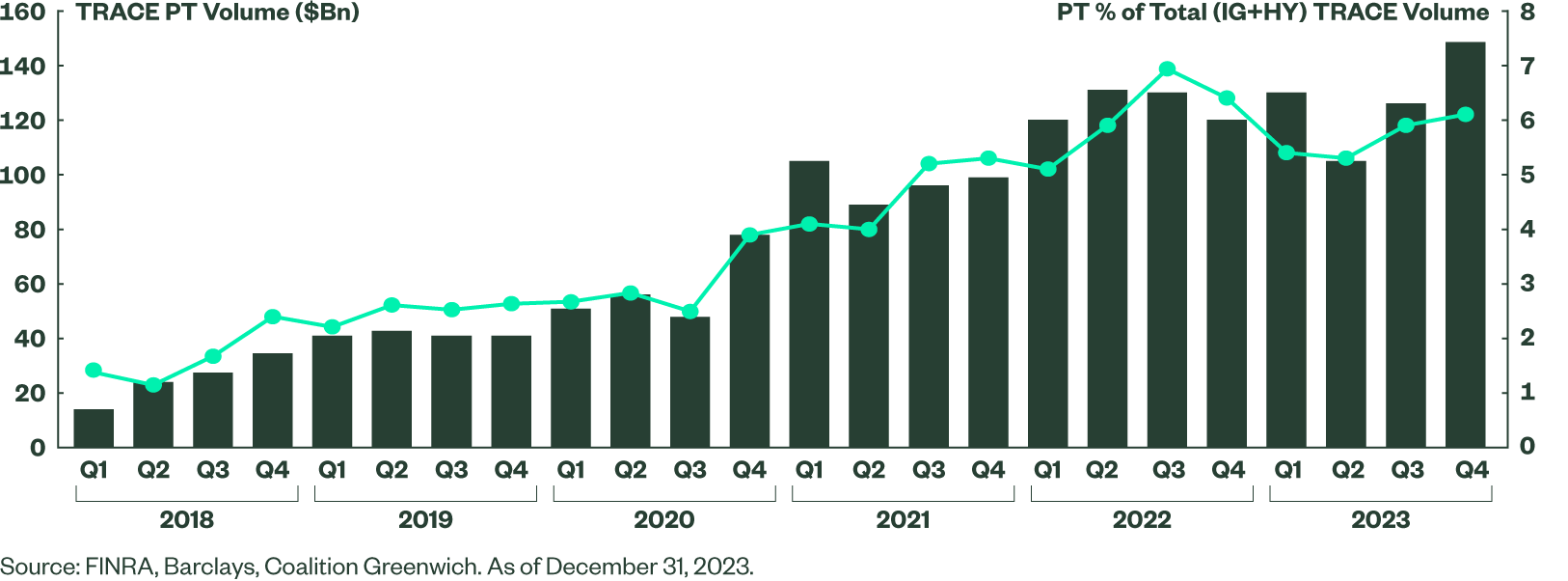

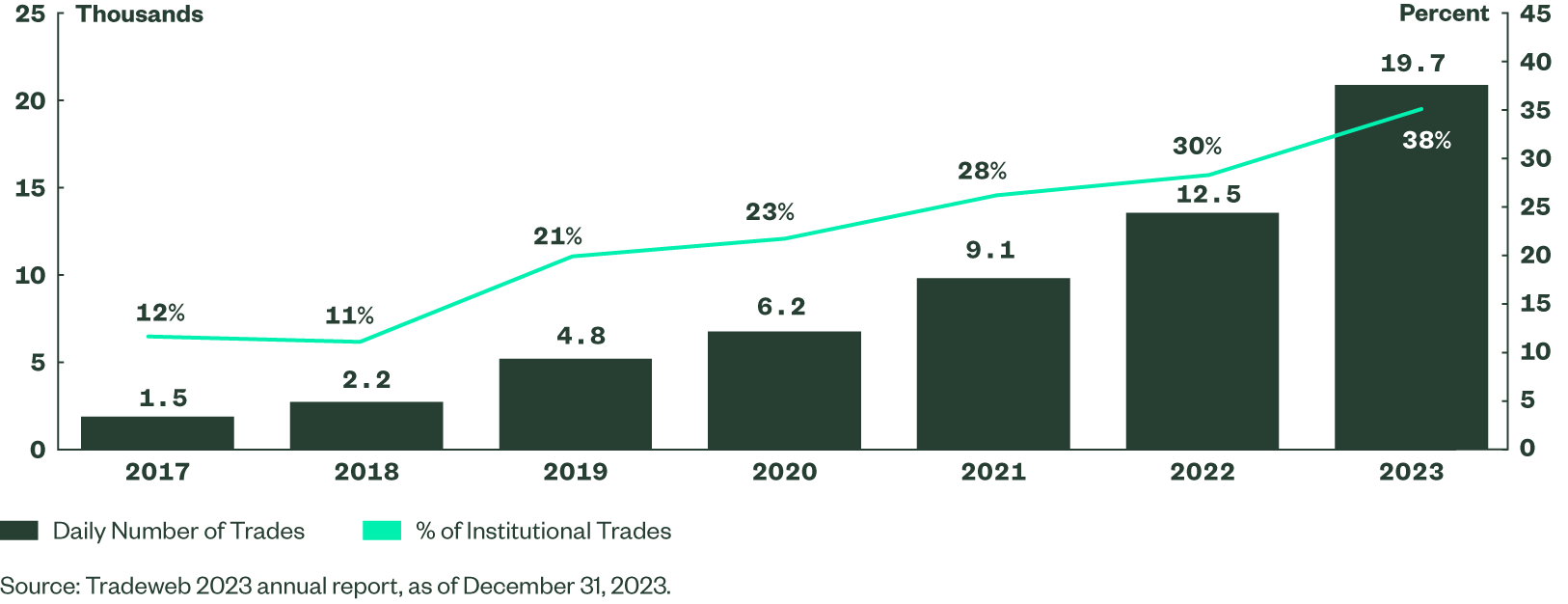

Portfolio trading, a trading protocol closely related to the concept of basketing in ETFs, has also seen strong growth over recent years (Figure 3), particularly in the corporate bond market. It allows investors to trade customized blocks of credit risk in a scalable manner, thus bridging the gap between the full flexibility but size limitations posed by e-trading, and with the ability to transact in larger sizes. Volumes have grown from almost nothing in 2018 to 5%-6% of traded corporate bond volumes in the US and Europe today, and the number of bonds in the typical basket has increased as well, from 30-40 bonds earlier, to almost 125 line items now. This protocol essentially entails investors asking for a quote on a basket of bonds and transacting it in its entirety with one counterparty. This all-or-none execution allows investors to get a better execution certainty and competitive pricing for the entire list at required block trade sizes.

Figure 3: Portfolio Trading in Corporates Has Gained Momentum

A typical portfolio trading use-case scenario for the buy side to is to manage larger flows or to implement a market view quickly – targeting a specific maturity, sector, and/or rating. Another advantage of this protocol is to unlock liquidity by including less liquid bonds with liquid ones. The overall liquidity of the basket may be only slightly worse than that of the typical median trade in that asset class, but the ability to trade the illiquid names in a time-bound manner is what is important, as it effectively becomes cross-subsidized by the more liquid names.

This is a common strategy in investment grade, where the liquidity of older bonds can fade quickly due to issuance of new bonds that take the market spotlight and over time these older bonds get locked away in buy-and-hold portfolios. The ability to trade baskets of risk quickly and reliably like this is what is important here; indeed, Tradeweb’s data between Jan 2020 – June 2023 show that the average time to trade a basket has come down from 90 minutes earlier in 2021 to less than an hour, and the average hit rate (number of instances of successfully getting the basket executed) has moved close to 95+%. The execution quality of trades, as measured by Tradeweb’s Ai-Price, has been still slightly better than the mid, and has remained fairly consistent over time, facilitating substantial volumes in illiquid bonds. We believe that portfolio trading would continue to grow as a proportion of the overall market, especially in this late-cycle environment where large-scale asset shifts, or portfolio strategy adjustments to credit-quality and sector, become essential and more common.

Expansion: The Emergence of Different Trading Styles Automated Execution

It is important to note that, ultimately, the goal of recent technological advancements, workflow innovations, and integrated marketplaces are to provide traders with sufficient tools to help achieve reliable best execution, under different market conditions. The strategy or approach that a buy-side trading desk uses depends on multiple factors, and execution objectives are situationally different. For example, for executing a time-sensitive, block-sized trade in an illiquid asset class, a trader may use protocols that involve some form of bilateral negotiation such as voice OTC or RFQs. Whereas on a smaller-sized trade, even though it may need execution on a time-sensitive basis, a multilateral low-touch protocol such as all-to all (in which any market participant can trade directly with any other market participant) may be used with no concern about market impact, as information leakage is not important. For non-time sensitive, smaller-sized trades in an illiquid asset class, multilateral protocols involving some form of order-routing in which the order can sit and wait for the other side for the best price may be the best way to go. It all comes down to having scalability to cope with the explosion of volumes during flows and rebalancing days – all while dealing with liquidity and asset class peculiarities

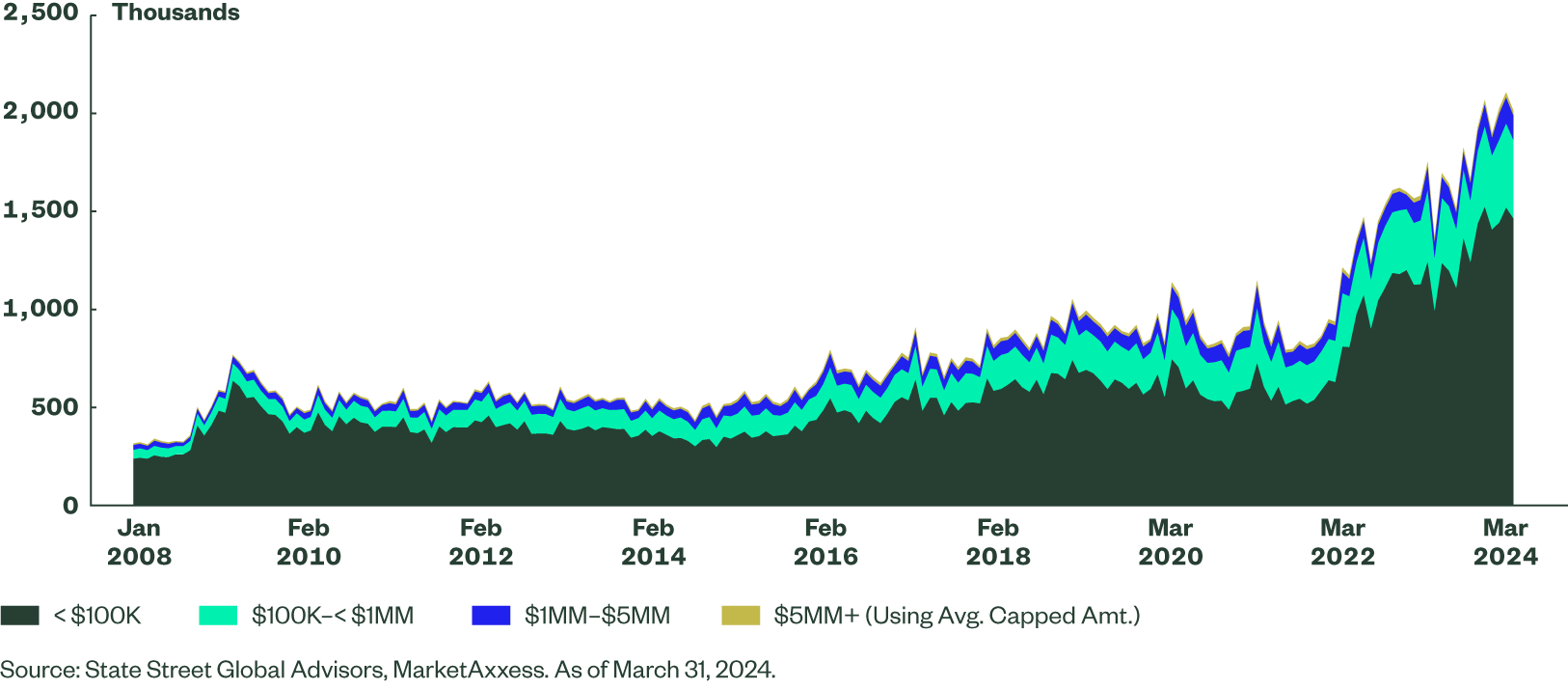

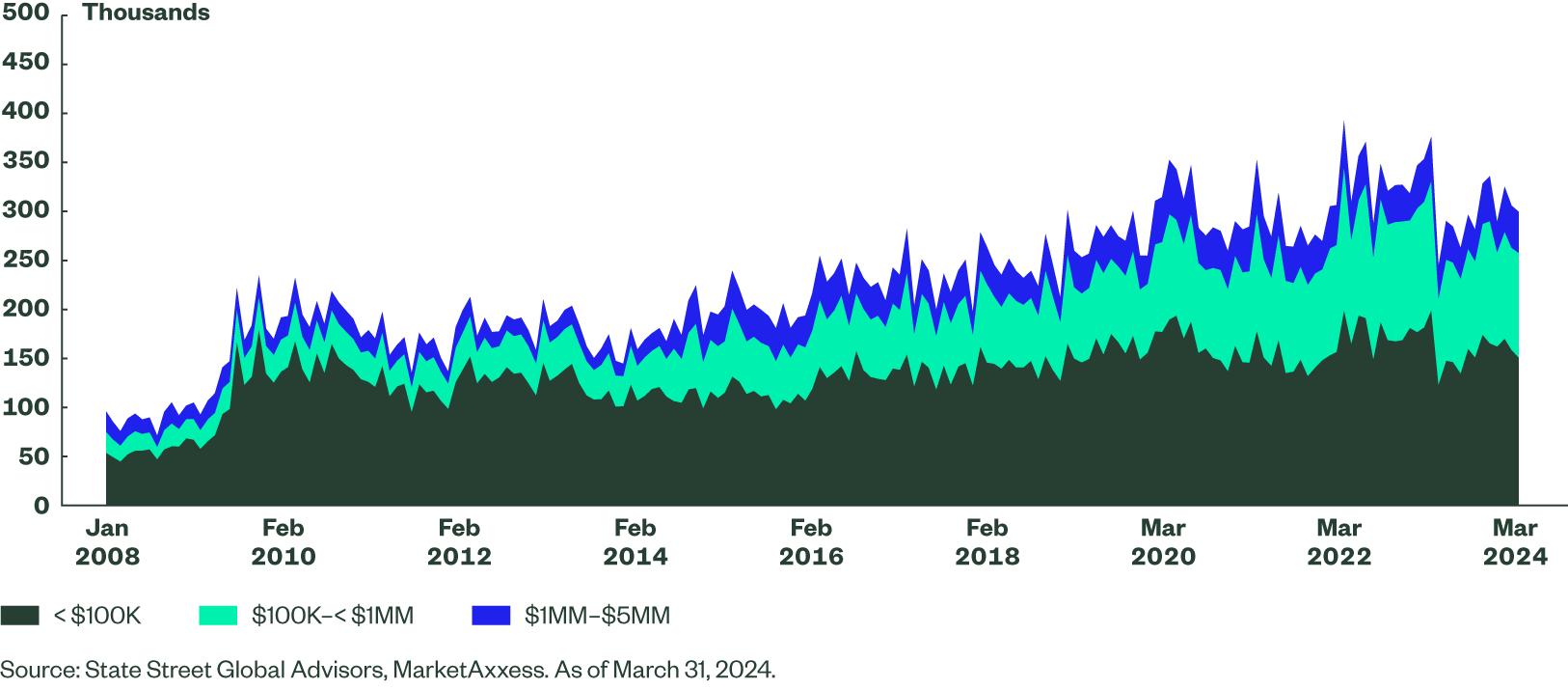

Also, dynamics and trends within the market themselves might change the way how different protocols are used over time. For example, block trades - defined as those with a notional value of $5 million or more for investment grade and $1 million or more for high yield – remain predominantly executed via phone and chat. But block trades as a share of overall trade volumes have reduced (Figure 4). Buy-side traders value the aggressive pricing, market color, and guidance that dealers typically offer on those block trades, and are reluctant to risk potential slippage from market impact if they trade through a size-disclosed RFQ on a platform. As with other things, change is underway here as well, with large bond trading venues actively working to enhance their offerings to integrate automated and quantitative dealer selection into the pre-trade process, digging through dealer inventories, trading histories, specialization in a given sector or bond type – as well as breaking larger orders into many parts, comparing the average price from those partial fills from a diverse set of liquidity pools with a single dealer willing to take on the whole size.

Trades Under $1M Are Increasingly Dominating in the US Corporate Market

Figure 4a: TRACE US Investment Grade Trade Count

Figure 4b: TRACE US High Yield Trade Count

Buy-side trading styles & protocols used can be broadly classified into four categories:

- ‘No touch’ – These are order executions using pre-programmed trading instructions (time, price, volume etc.). If the criteria in the instructions are met by bids, then a trade/response will automatically occur.

- ‘Low touch’ – These are executions that allow traders to maintain some control over price negotiations, as well as how and when their order information gets shared in the market. Used to tap into shared buy/sell interests with opportunistic liquidity providers.

- ‘Manual and High touch’ - Typically used for large block sizes and less liquid instruments, where relationships with dealers/other counterparties and knowledge of “axes” (market makers central to the pricing action) become extremely important to achieve best execution with minimal market impact.

Traders have increasingly begun to use automated/low-touch style trading (Figure 5), especially for smaller-sized tickers, and this can be attributed not only to electronification, but also the increased availability and use of data. The demand for low-latency, high-quality market data is on the up, and spending on alternative data is on a multi-year growth trend as well. Trading platforms these days are able to aggregate historic and intraday bond pricing data from multiple public and platform-specific data sources, as well as machine-learning algorithms and prediction engines to generate real-time pricing predictions, both on the bid and offer side. With more data being available now for pre-trade analysis, as well as platform innovations and automation tools, traders have been able to efficiently utilize their time for improving dealer relationships for more complex transactions, enabling them to execute high volumes, even providing an opportunity for price improvement, on behalf of clients.

Fig. 5: Increasing Usage of Automated Execution

A background factor to all of this has also been relevance of regulation in ensuring the durability of this push for transparency. The introduction of TRACE reporting in the US reduced dealers’ information advantage relative to investors/brokers, and all parties were able to assess the competitiveness of their own traded price by comparing it with recent and subsequent transactions in the same and similar issues. More recently, the SEC has been focused on liquidity in US Treasuries, given its importance in times of stress, and finalized rules requiring a broader group of market participants to centrally clear Treasury and repo trades. It has required implementation of the clearing rule and associated risk management changes over the next two-and-a-half years. Another important upcoming regulation with a proposed mid-2025 implementation, Basel III Endgame, significantly alters the regulatory capital regime for US banks, further pressuring balance-sheet based trading models.

Experience and Implementation: State Street Global Advisors

Being a large global fixed income asset manager with a large book of indexed fixed income assets across institutional accounts, commingled vehicles and also ETFs, State Street Global Advisors regularly trades significant volumes, both intraday and also around index events and rebalancings. Our ticket sizes however are quite small, with about ~80-90% of our trading activity occurring in sizes of less than 1 million, given that we stratify trade flows to align with index exposure. Hence some of our own experiences could be used as a good proxy to see how the market has been evolving. We use almost all electronic trading platforms (Bloomberg, Tradeweb, MarketAxxess, Trumid, etc.), depending on the sub-asset class, and almost all trading techniques mentioned in Figure 5. Each of those protocols have advantages that vary depending on market liquidity, timing, and the size of the trade – and the decision on which one to use is left to the skill and expertise of our traders. We consider maximum trade thresholds and adjust the size of trades based on what we believe the liquidity in the market can bear, and continually fine-tune order routing processes to effectively handle our buy and sell orders. We partner with our in-house transaction cost analysis team to regularly review dealer and algorithm performance and adjust the volumes that are routed to them, based on how they’re performing.

We have moved towards an almost fully electronified workflow using RFQs primarily, in our Developed Market rates (US and non-US), structured products, as well as in the non-USD IG and HY credit book. However, half our trades in US HY, a quarter of our trades in US IG, and a major part of Hard Currency EM are still executed by voice, given the wide ranges between quotes, and to make use of strong pricing levels that we get from our counterparties there.

We collaborate with vendors at the development stage, and along with our own internal IT desk, develop tools such as an internal pricing model, that allows us to rest orders in a platform, and then wait for the liquidity to come to the market, making us a price maker rather than a price taker. We take in all relevant data pertaining to bonds such as benchmark prices, our previous ownership of these bonds, where correlated/linked bonds are being priced, and information from trading platforms such as missed or passed trades, streaming prices, inventory, and axes - for the pricing model’s evaluative pricing and to see where other people in the market were seeking liquidity.

However, we do not solely rely on electronic trading platforms alone; we trade the breadth and width of fixed income markets and maintain strong relationships with over 300 counterparties, ranging from large international banks to more specialized domestic dealers and non-traditional liquidity providers. This helps ensure that we get consistent access to liquidity even in stressed market scenarios.

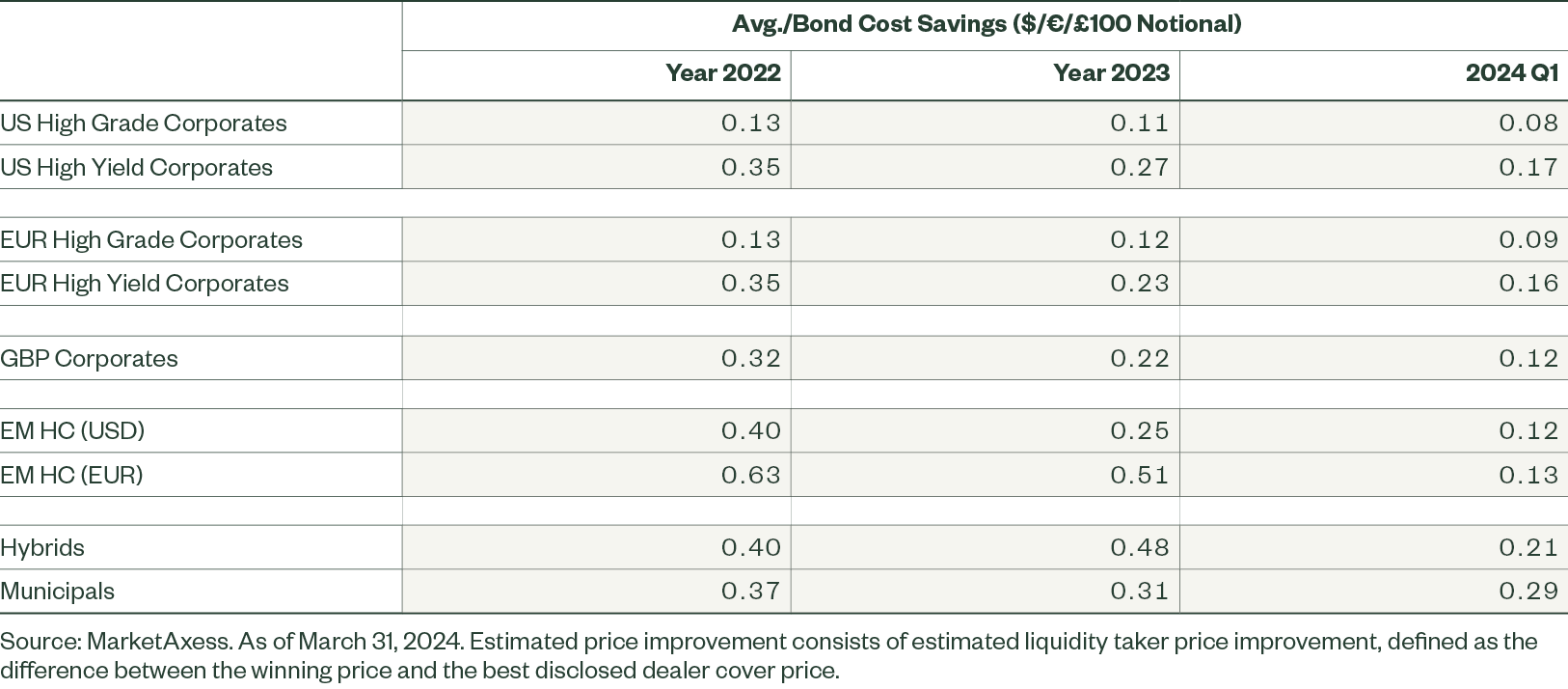

We calculated the overall cost savings that we have experienced in the last two years from trading complex bond market segments through an electronic platform in Figure 6.

Figure 6: All-to-all Trading Through a Platform Driving Significant Price Improvement

The Implications for Systematic Fixed Income

The increased use of algorithms, availability of big data, and increased push for transparency from regulations has implications far beyond more productive buy-side bond trading desks and lower transaction costs. Previously, a significant barrier to quantitative approaches in fixed income has been the question of implementation, i.e., the ability to execute reliably on the optimized/model portfolio, at the transaction cost assumption upon which the portfolio is modelled.

That is all changing now. These innovations in trading automation are now pushing new boundaries, such as the ability to:

- profile trades;

- suggest or auto-select protocols, parameters, and sequencing based on predictive analytics;

- and to dynamically adjust based on market conditions or execution results.

This has led to increased pricing transparency and confidence in execution – particularly for smaller trade sizes - with accurate, real-time pricing and demonstrable liquidity. We believe that we are on the cusp of a significant growth in systematic approaches to managing fixed income exposures, particularly in corporate credit where the size and breadth of the market lends itself naturally to a rigorous, rules-based, quantitative approach, providing a compelling alternative to the traditional fundamentally driven and analyst based discretionary active management. Higher fixed income assets under management, managed on a systematic basis, would further reinforce electronic and algorithmic trading in a positive feedback loop.

While market liquidity remains an underappreciated risk in fixed income, this presents opportunities for expert trading desks to add value at the trade execution stage. The next big wave in electronic trading will likely come from less-standard exposures, such as EMD, Loans, Asset Backed Securities, and CLOs, through innovations in trading protocols and an increase in available data – as opposed to more buy-side traders giving in and putting down the phone. With more trading activity moving towards platforms, regulators will also need to ensure their robustness in dealing with market stress episodes and ensure that risks due to abrupt price swings and flash crashes are contained.

The Bottom Line

The now rapid adoption of electronic trading across fixed income markets has catapulted the previous arcane market structure into the 21st century. Changes to the old-fashioned way of bringing fixed income buyers and sellers together across liquidity pools and geographies has led to further innovations, fueling greater pre-trade price transparency and more reliable and lower execution costs. What’s more, it’s opening up feasibility of more systematic approaches to fixed income exposure management, which in turn are forcing a rethink on how fixed income exposures are designed, constructed and implemented.