Gold Nuggets: From Inception to Impact: Reflecting on 20 Years of GLD®

A Golden Opportunity

The SPDR® Gold Shares (GLD®) story begins in 2002. I was working for the World Gold Council and my boss, the then chief executive, called me into his office and said, “We have to do something to address the serious imbalance with gold demand.”

In 2002, industrial applications, primarily in electronics, accounted for about 10% of gold demand. Investments in small bars and coins added another 10%. And jewelry was a solid 80%.

The World Gold Council viewed that over-exposure to one industry as dangerous. So while I continued to work with central banks on structuring their official reserves, I also was tasked with moving the demand needle to increase the private investment in gold.

“Find a way to revitalize investing in gold,” World Gold Council’s chief executive instructed. “And do it as quickly as possible.”

And So, We Began

My team’s first move was to establish why gold had a demand imbalance. So we hired McKinsey, Bain, Boston Consulting, and just about any other organization in the US with the word “consulting” in its name. We asked them to talk to people who didn’t invest in gold and to find out why. They came back with remarkably uniform answers. The vast majority of non-investors said three things: Investing in gold was complicated. Gold was costly. And they saw no reason to invest in gold

We then asked our consulting firms to go back to the same people to find out what a new gold investment product would have to look like to get them to consider investing in gold. Again, overwhelmingly, our non-investors agreed on three points, must-haves for a gold investment product. The new product would have to be as close a proxy as possible for the spot price of gold. It would need to be traded on a regulated stock exchange. And it would have to be 100% secure.

That’s when light bulbs began to go on over our heads. Maybe what we needed was a gold exchange traded fund. I think the many responses that the product needed to trade on a stock exchange convinced us of that.

Partnering with State Street Global Advisors

Now, those of us working at the World Gold Council obviously knew a lot about gold, but we knew absolutely nothing about ETFs. After all, they were still pretty much a new invention. Only about a decade had passed since State Street Global Advisors had revolutionized the investment world by launching the very first US-listed ETF in the form of the SPDR® S&P 500® ETF Trust (SPY), grouping the shares in the S&P 500 index into one equity share traded on the New York Stock Exchange.

While we knew nothing about how to make an ETF, we did know some people at State Street Global Advisors who had worked to bring SPY to market in 1993. So we asked them to help us.

The State Street SPDR ETFs team helped us to develop the creation and redemption procedures that allow an ETF to function. They advised us on completing legal agreements with the Custodian, HSBC Bank in London; the Trustee, Bank of New York/Mellon; and the Authorized Participants, broker dealers who expressed an interest in making a market in the shares of our new product. Then they helped us shepherd our baby through the rigorous examination process of the Securities and Exchange Commission (SEC).

Eventually, we became partners in getting GLD approved for listing by the SEC. World Gold Trust Services, a specially formed subsidiary of the World Gold Council, became GLD’s sponsor, and State Street Global Advisors was appointed as the marketing agent. And on November 18, 2004, we introduced GLD for trading on the NYSE/ARCA platform.

From Launch to Global Leadership

The Chairman of the World Gold Council’s praise for our small team’s product launch was really more of a challenge. He said, “I won’t call you a success until GLD has $1 billion in AUM. And I expect to have that conversation in six months.”

GLD reached that milestone in its first three trading days. The second billion took longer — four trading days.

Over the succeeding 20 years, GLD has grown into an ETF with $74 billion worth of shares outstanding on the NYSE, backed by $74 billion worth of gold bars sitting in vaults in London and New York — no cash, no derivatives.1 That’s because the first lesson the State Street SPDR ETFs team taught us was that tracking error is the bane of any ETF, and the only way to avoid tracking error is that the ETF must only own the underlying assets, in our case, gold.

Today, as the largest and most liquid gold-backed ETF, GLD’s AUM is more than twice that of its closest competitor, accounting for 60% of the US market in gold-backed ETFs. GLD is also the easy leader in the global gold ETF space.2

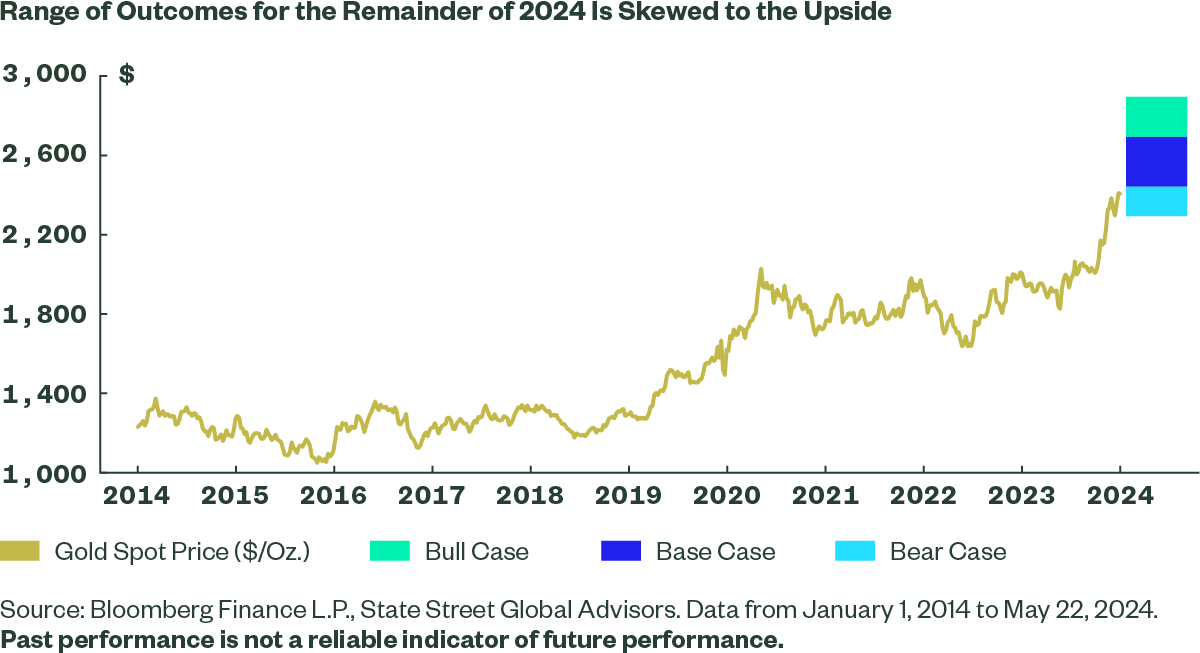

With gold prices continuing to hit all-time highs this year,3 these achievements underscore that GLD continues to deliver what investors wanted all those years ago. Putting gold in an ETF wrapper made it easy to access and store gold , reduced the investment cost, and supported liquidity. And investors now understand that gold’s unique characteristics and multiple sources of demand across global economic and business cycles make it a vital part of investment portfolios — during good times and bad.

With these momentous changes in mind, it’s interesting to speculate how the balance between gold’s supply and demand might change over the next 20 years.

Learn more about current gold market trends, the potential benefits of investing in gold, and how to choose a gold ETF.