Investment Outlook

As the market continues to face growth and inflation headwinds, fixed income investors can consider the following exposures:

- Convertible bonds and high yield can offer defensive attributes in a changing rate environment.

- Though Euro rates already look priced for the ECB to deliver a full cycle, longer duration has potential in the UK.

- Saudi Arabian bonds can offer solid budget dynamic and strong ratings profile in a world where budget issues have become prevalent.

Sticking With Risk-on

- Convertible bonds and high yield posted some of the strongest returns over the course of 2024. We continue to view these strategies as the most likely to perform in early 2025.

The Federal Reserve’s hawkish late-year pivot took some of the steam out of the rally in risk assets, with equities tumbling and bonds coming under pressure, as the market was rattled by the possibility that rate cuts over the coming 12 months will be limited. Smaller, non-investment grade companies are typically the ones that suffer the most from a persistently higher cost of funding. However, it is also the case that, for this rate profile to materialise, growth expectations need to remain elevated. This should be a positive for lower rated credit, just as it has been in 2024.

The persistence of firm US growth and slightly elevated inflation expectations, that are being flagged by the Fed, look likely to remain the backdrop to asset markets in Q1 2025. Two strategies that worked well in 2024 were convertible bonds and high yield. Despite the late year correction returns of 8.0% for convertibles, 10.0% for US and 6.7% for Euro high yield1 compare favourably against just 0.6% for Treasuries.

Both types of bond correlate well with small and mid-cap equity exposures meaning they should benefit from any broadening in performance beyond mega-caps as had been the trend after the US election. This is in part a reflection of the fact that smaller issuers are less likely to be affected by increased global trade frictions that could result from a round of trade tariffs.

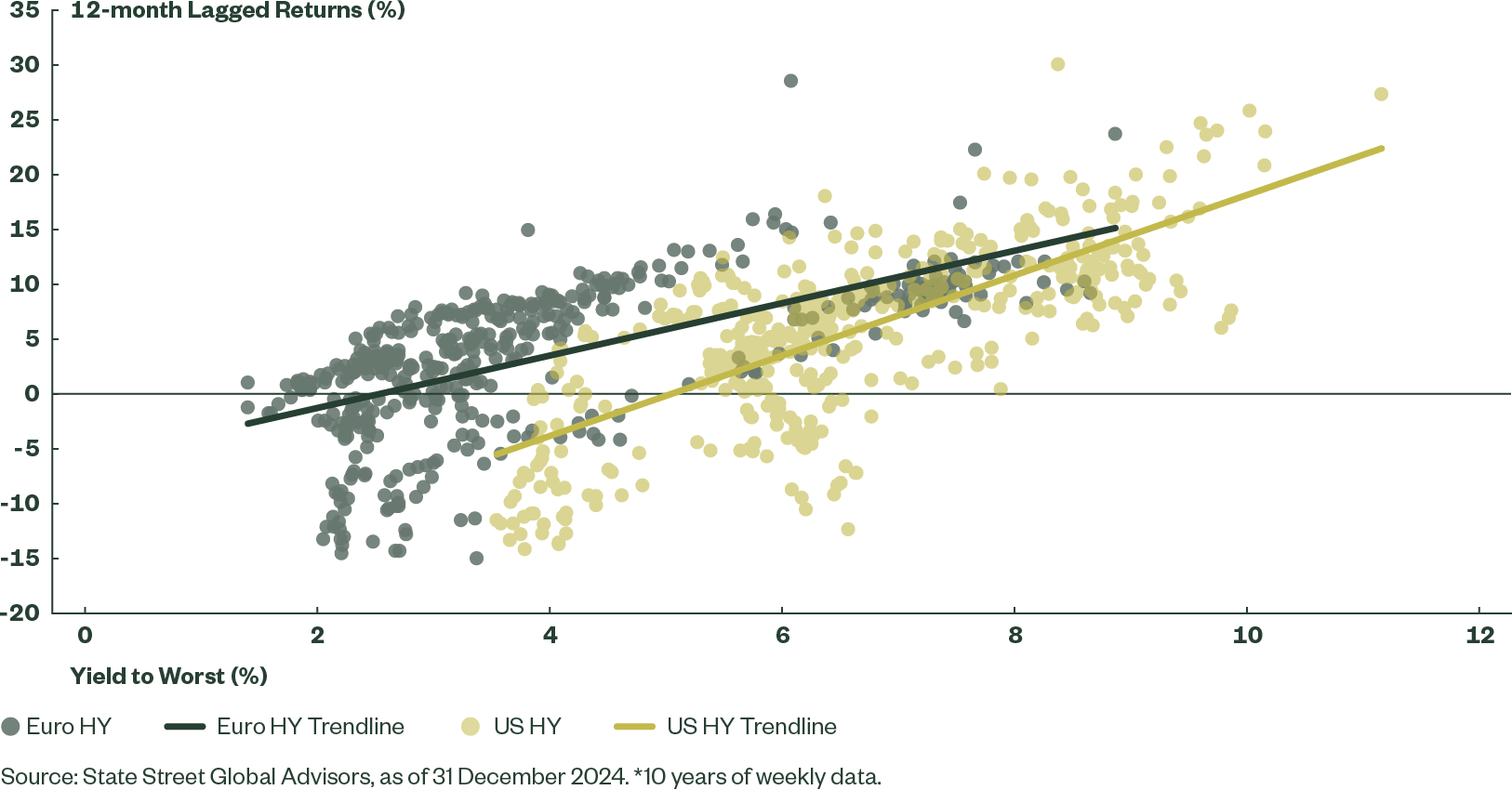

Figure 1: Yield Levels Still Point to Positive Total Returns

Hanging Onto High Yield

The high coupon and short duration of high yield combined to create robust returns in 2024 that were not overly influenced by moves in the broader rates markets. For investors that continue to fear the strong US growth dynamic, high yield should still hold an appeal:

- Credit spreads are historically tight but the yield on offer creates a different dynamic for investors. The duration on non-investment grade paper is generally short, which lessens the sensitivity of the strategy to big moves in the underlying market. The high yields available then provide protection against all but extreme moves in rates, with yields needing to push higher by over 230bp in both the US and European high yield indices before price losses on the index wipe out the annual yield to worst.

- As illustrated in Figure 1, the high yield to worst of 7.5% for US and 5.4% for Euro high yield indices have, in the past, been associated with positive returns over the following 12-months.

- Refinancing pressure is limited for 2025. US rates are down circa 200bp2 from their late 2023 highs. This has encouraged non-investment grade issuers to pre-finance and get ahead of their refinancing needs.

- Strong growth should be supportive of balance sheets. There are some signs of stress with more downgrades to US non-investment grade issuers than upgrades, but the upgrades/downgrades ratio remains above the lows seen in Q4 2022. It is perhaps it is natural to expect more stress in Europe, but the upgrades downgrades ratio there for Q4 was around 0.8, hinting at only a slow deterioration in credit quality.

Still Backing Convertibles

Convertible bonds also typically have a short duration, which has defensive attributes in a rising interest rate environment. They do not offer the yield that high yield can provide but do have some other advantages.

- They have a cross-over rating with the Refinitiv Qualified Global Convertible Index consisting of over 57% investment grade rated issuers. This will be reassuring to those investors who see risks of a potential deterioration in the balance sheet of non-investment grade issuers.

- There is a heavy IT and Communications bias (just under 30%)3. Both sectors which have typically been associated with strong growth. However, these issuers are skewed towards small and mid-cap companies meaning valuations are not as stretched as they are for the Magnificent 7.

- The Refinitiv Qualified Global Convertible Index consists of over 63% US issuers, where economic growth remains solid.

- The recent market correction has pushed the Refinitiv Qualified Global Convertible index delta back down to around 45 from over 48 at the end of October. This measure of sensitivity of the bonds to the underlying equity is important for assessing risks around the strategy and this reset lower brings it broadly into line with the long-term average4. This offers a defensive profile if equity markets decline, but plenty of upside if equities resume their upward trajectory.

In summary, if the economic backdrop seen in Q4 persists into Q1 2025, then it is logical for investors to continue to focus on the risk-on bond exposures that performed well in 2024.

Implementation Ideas:

SYBJ GY

JNKA FP

SJHYX I2

SYBK GY

SPPQ GY

ZPRC GY

SPF1 GY

Avoiding Duration Pitfalls

- Despite the start of central bank policy easing, extending duration did not pay off in 2024. There remain grounds for caution in US rates, Euro rates already look priced for the ECB to deliver a full cycle, but longer duration has potential in the UK.

The start to the central bank easing cycle usually heralds a rush into longer duration trades. As rates along the curve decline, the higher price sensitivity to moves in yields of longer dated bonds have typically resulted in higher returns, even if the curve steepens5. In 2024 the opposite has been the case with the best performance accruing to short duration strategies, while a duration overweight would have left an investor nursing negative returns unless it had been tactically managed6. Even in Europe, where the ECB has delivered cuts and continues to indicate there are more to come, the Bloomberg EuroAgg Treasury 10+ Year Index returned a paltry 0.3% in 20247.

Staying Underweight in the US

In the US, the fog of uncertainty that developed in late 2024 looks likely to persist into Q1 2025. A strong economy, coupled with the unknowns around the policies of a new US political backdrop have already been sufficient to produce a hawkish tilt from the Federal Reserve. The Fed Funds futures price just 40bp of easing for the whole of 20258.

This resets the dial in terms of the risk-reward trade-off.

- The pessimistic case for Treasuries would be heavy tariffs and aggressive deregulation from the new US government pushing up the deficit and inflation, and keeping Fed rates on hold. With less than 2 Fed cuts priced and the US 10Y yield close to the highs of 2024, much of this ‘bad news’ already looks to be in the price.

- The optimistic case would be a measured approach to tariffs and deregulation which could lead to a gradual slowing in the economy and inflation. This is the base case for State Street Global Advisors and is expected to result in around 75-100bp of cuts by the Fed.

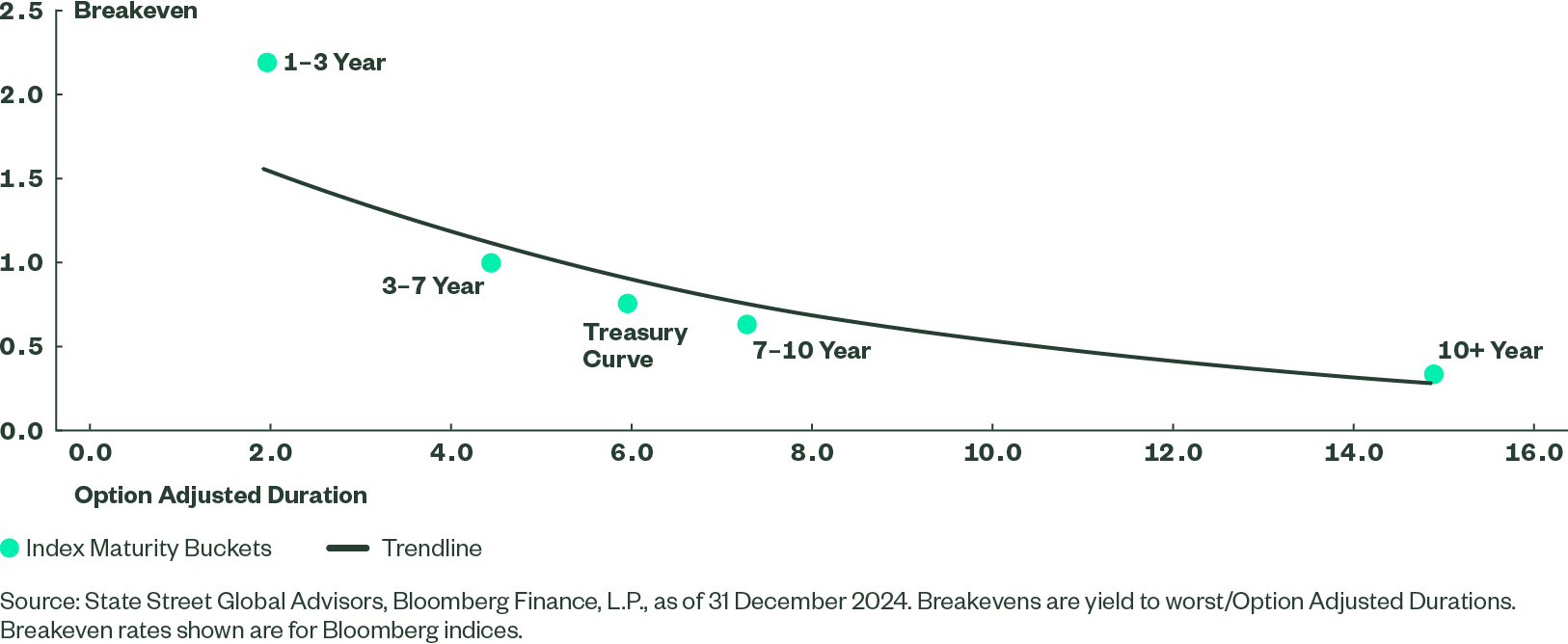

Figure 1: The Duration Trade-off

Figure 1 illustrates why the front end of the curve was, for 2024, the ‘safe’ place to be. The breakeven (yield to maturity/Option Adjusted Duration) is a rough indication of how much yields need to rise before the price losses on the index wipe out the yield received from holding the index for a year. Protection naturally decreases as investors extend to longer duration strategies.

With money markets pricing fewer than two 25bp cuts and yields along the curve having risen, there is less of a need of the high degree of protection afforded by the front end. It seems unlikely that yields would rise by over 200bp from current levels. Given the greater downside potential for US yields adding some duration could be an advantage. Figure 1 shows the decline in breakeven that results from moving out along the Treasury curve. The 3-7 year maturity bucket looks interesting as it has double the duration of the 1-3 year bucket but still retains a breakeven of 100bp.

Caution Around the Longer End of the Euro Curve

Weak GDP growth, CPI back down close to target and the ECB still cutting rates should create a positive backdrop for bonds. But the final quarter of the year was a challenging one for those with long duration positions, the Bloomberg EuroAgg Treasury 10+Year Index returned -2% and only the short 1-3 Year index registered gains of 0.55%9.

The State Street Global Advisors central case is that this low growth, low inflation backdrop persists, which should be supportive for fixed income. However, this glum outlook is already priced by markets with an excess of 100bp of policy easing factored in for the ECB. If delivered, this would take rates down below 2%, implying the ECB would be running expansive monetary policy. The low level of rates may not be sufficient to turn the economy around in the early part of the year but is likely to restrain how much further bond yields can fall. Additionally, there is the potential for some more positive economic shocks, such as a more durable revival in the Chinese economy or a ceasefire in Ukraine, both of which could push yields higher.

There could be some political positives for bonds if the French government manages to agree on a budget, spreads could narrow. And if the German election results in a more stable workable government – the CDU/CSU remains ahead in the polls - then European bonds could lose some of their political risk premium. But gains from this are likely to be limited, meaning the upside for European bonds rests on a full recession developing. This is not the State Street Global Advisors central case and hints that extending duration to any meaningful degree is likely to remain a frustrating trade.

UK Long End Has Cheapened

The UK has just 60bp of Bank of England cuts priced by the money markets but, unlike the US, it has weak growth. Q3 GDP was flat, the manufacturing PMI is below 50 and Services at just over 51, indicating sluggish growth may continue. Fear of persistent inflation is the main factor preventing the markets pricing more cuts, but the longer rates remain high the more likely it is to exacerbate economic weakness and result in more aggressive rate cuts later in the cycle.

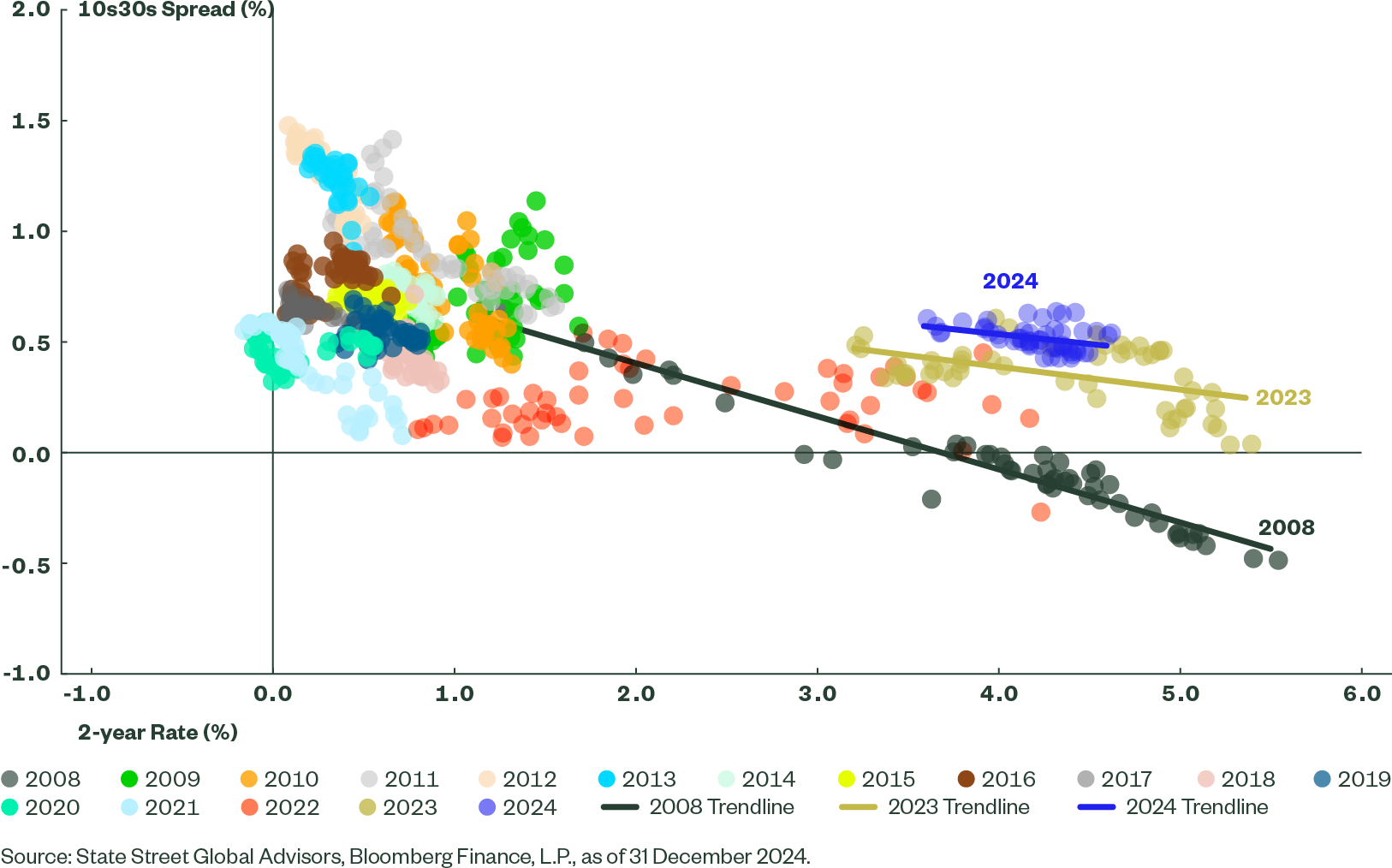

The weak growth backdrop points to high levels of issuance but with around GBP300bn of gross financing needs required for fiscal year 2025-26 announced at the Budget, the market has already factored that in. Gilts have cheapened substantially to swaps and the curve has steepened. The long end of the curve has undergone a material repricing since the rate hike cycle started in 2021 and the 10-30Y spread now looks steep relative to where it was in 2008, the last time short-dated rates were at similar levels (Figure 2).

Figure 2: The 10-30Y Spread in Gilts Is Steep Versus 2Y Rates Relative to 2008

The steepness of the curve also means that yield to maturity increases as you extend out along the curve with the yield on the Bloomberg 1-5 Year index of 4.2% against over 5% for the 15Y+ Index10. For investors with patience, it does not looks like a bad time to add duration.

Implementation Ideas:

SYBW GY

SPP3 GY

GOVA NA

SYBB GY

SYBL GY

SYBG GY

Building the Saudi Arabian Bond Market

- A solid budget dynamic and strong ratings profile make Saudi Arabia standout in a world where budget issues have become prevalent. It is better rated than broad EM exposures but still provides a yield uplift to US Treasuries.

Emerging market investors faced an uphill struggle in 2024 and it wasn’t until Q3 that the strategy came into its own. In Q4 the paths of hard and local currency exposures diverged, with the strength of the USD deflating local currency performance. Overall hard currency had a reasonable year with the J.P. Morgan EMBI Global Diversified Index returning close to 6.5% as spread compression offset some of the volatility in the Treasury market11.

Given the uncertainties around US politics and therefore the USD, hard currency exposures continue to look more interesting, near-term, than local currency. In addition, if the Fed eases by as little as is priced by markets (just 40bp during the course of 2025) this could well end up restraining the degree to which local EM central banks can ease policy.

For those concerned about taking on too much USD duration risk, maturity constrained strategies can cut exposure to the underlying volatility of the Treasury market. The higher coupon then provides additional yield versus plain US Treasuries. For instance the ICE BofA 0-5 Year EM USD Government Bond ex-144a Index has a duration of just 2.2 years. In the 18 months since the Fed’s rates peaked, monthly returns have averaged 0.56% (6.9% annualised) against 0.37% (4.5% annualised) for the Bloomberg US Treasury 1-5 Yr Index.

An Alternative: Kingdom of Saudi Arabia Bonds

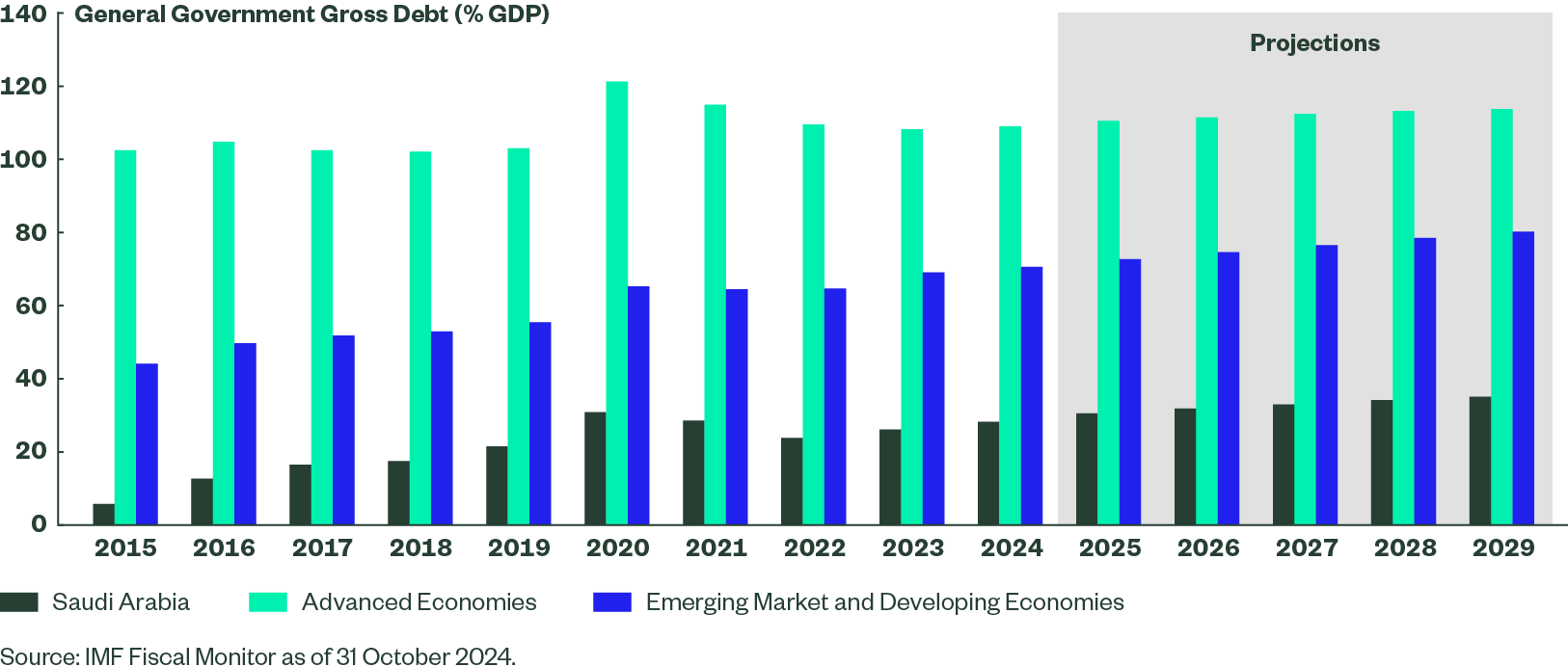

For investors concerned by the deterioration in the budgetary dynamics of many of the world’s key country issuers, there is usually some advantage to focusing on fast growing economies. The problem is that many of these have relatively low credit ratings12. However, Saudi Arabia is projected to have relatively high but stable levels of growth, in part driven by the Vision 2030 project to modernise the economy and to re-orientate it away from its traditional petro-chemicals base. Saudi Arabia has recently been upgraded to Aa3 by Moody’s (the same rating as the UK and France) and as a developing market there are several reasons why Saudi Arabian bonds are of particular interest:

- The budget dynamic looks solid with the IMF’s Fiscal Monitor projecting a deficit to GDP ratio of just 35% in 2029. This compares to over 70% for broad EM countries and over 100% for many DM countries.

- The rating means that yields may not be as high as a broader EM exposure, but the J.P. Morgan Saudi Arabia Aggregate Index, offers a yield pick-up of around 100bp over US Treasuries.

Figure 1: IMF Debt-to-GDP Forecasts

- The J.P. Morgan Saudi Arabia Aggregate Index offers a combination of hard and local currency sovereign and quasi sovereign issuers. Local currency exposure is tricky to access but is where greater potential lies, in our opinion. It provides some additional yield but, more significantly, the depth and liquidity of the market is expected to broaden over time and ultimately it could gain entry into EM and global indices.

- This can provide some portfolio diversification. Figure 2 illustrates that the J.P. Morgan Saudi Arabia Aggregate Index has relatively low correlations to several key fixed income exposures, most notably US Treasuries.

Figure 2: J.P. Morgan Saudi Arabia Aggregate Index Correlations

| J.P. Morgan EMBI Global Diversified Composite | J.P. Morgan GBI-EM Global Diversified Composite | Bloomberg Global Aggregate | Bloomberg Global Agg Treasuries | Bloomberg US Treasuries | |

| Correlations since inception | 0.809 | 0.543 | 0.767 | 0.720 | 0.634 |

Correlation on weekly changes 01 February 2019 to 13 December 2024.

Implementation Ideas:

KSAB GY

ZPR5 GY

ZPR6 GY