Central Bank Check-In: What’s Next Around the Globe

In previous cycles, the US has led the way in rate cuts, preceding the ECB and BOE. This year, European policymakers stand to cut rates before the Fed, a switch that is just one of many interesting threads in the ongoing story of pivotal actions from global central banks. Even with the latest data prints providing more clarity on the path of global policy rates, there are still plenty of question marks. We outline our thoughts on where central banks are headed.

The US: Labor (Not Inflation) Data Now Holds the Key

We (still) believe that a holistic analysis of the data calls for the Fed to begin easing sooner rather than later. Markets have dramatically changed their Fed rate cut expectations since the start of the year. Having at one point priced nearly 7 25 basis point (bps) cuts in 2024, markets now expect just 1.3.1 We remain more dovish, but have been forced to scale back our rate cut expectations for the year—not so much in response to data itself, but rather, in response to hawkish messaging from FOMC members. We look for 3 to 4 Fed cuts this year and another 4 to 5 in 2025, such that the Fed Funds rate reaches 3.25-3.50% by the end of 2025.

Whether our base case for a July cut actually materializes will depend on the performance of the labor market. Despite the overreaction to the stronger-than-expected January-March inflation prints, it is the employment picture that may ultimately determine the start of the easing cycle because the April inflation data has already shown sequential improvement. Furthermore, lower gasoline prices imply further inflation relief in May. Most importantly, there is no evidence of a wage-price spiral, and inflation expectations remain anchored. In a sense, the FOMC is simply “marking time” on inflation.

By contrast, the potential for a trend change in labor market indicators is more substantive. We have argued that the labor market is not as tight as generally believed. We are at a point in which labor demand has softened sufficiently to dampen wage pressures, but without triggering much of an increase in the unemployment rate just yet. We think this could change, as the unemployment rate has already risen to 3.9%, and is half a percentage point above recent lows. Notwithstanding monthly volatility, the direction of travel here is higher—not lower, which could help argue for a cut (Figure 1).

This is especially so because the cost of credit (average mortgage rate, average rate on corporate borrowing, etc.) is poised to continue to rise far beyond the point when the Fed begins to cut rates. This reflects the long-term fixed rate nature of the US mortgage market and rising corporate refinancing activity.

Two employment reports occur before the July 31, 2024 FOMC meeting. If the unemployment rate reaches 4.0% by then, a cut will be back on the table. Similarly, further moderation in wage pressures (we expect average hourly earnings growth, or wage inflation, to ease to 3.6% year-over-year by June) should add to the Fed’s conviction that the labor market is coming into balance. Just this week, the modest downward revision to Q1 2024 GDP growth and the massive downward revision to Q4 2023 wage and salary income were additional reminders that not all risks are to the upside.

Waiting for Inflation Could Lead to Missteps

We favor an earlier start to rate cuts to preserve the soft landing. We fear a non-linear response to high interest rates as the savings rate touches cycle lows, credit delinquencies rise, and consumers’ vulnerability to employment losses grows with each passing month. We worry that just as the Fed waited too long for compelling evidence that inflation was rising before hiking in 2022 (and was then forced into a rather abrupt hiking cycle), it risks making the opposite mistake now by waiting too long for “greater confidence”2 that inflation is moving sustainably to target.

Canada: Mixed Data Leaves Us Questioning a June Cut

Financial markets are assigning a 66% chance of a rate cut at the Bank of Canada’s (BoC) June 5 meeting.3 However, given mixed recent data in inflation, the real economy and spending (all discussed below), we expect the BoC will begin the rate cutting cycle in July. We expect around 75 basis points worth of rate cuts this year, and another 100 basis points of rate cuts next year.

Inflation. Inflation eased further to 2.7% year-over-year in April, within the BoC’s target range. However, the details remain divergent enough that the Bank may prefer to wait a little longer to ensure that “this downward momentum is sustained.”4 Specifically, shelter inflation—of critical interest to the BoC—remains very elevated, though the BoC has signaled its intent to look past some short-term stickiness in that space. Rent inflation is cooling, but remains 8.2% higher year-over-year. Meanwhile, mortgage interest costs are rising at the fastest pace on record, up 24.5% higher year-over-year.

CPI inflation excluding shelter stands at only 1.2% year-over-year, indicating that remaining inflationary pressures are quite narrow. Core inflation measures are indeed making good progress towards the target, opening the door for rate cuts this summer. Notably, April marked the first time since June 2021 that the weighted median, common, and trimmed mean measures of inflation moved into the target 1-3% range (Figure 2).

Real economy. Following March's slight contraction, job gains soared far more than expected in April thanks to strong gains in the private sector. The added jobs were split fairly evenly between full- and part-time positions. The unemployment rate was unchanged at 6.1% even as the participation rate ticked up modestly. Since this is the last employment report before the BoC’s June meeting, the more dovish BoC officials may opt to hold off on rate cuts for a little longer.

Spending. Admittedly, March retail sales came in softer than expected, but preliminary data suggest a sharp rebound in April. This leaves the Q1 GDP data (to be released May 31, 2024) as the most crucial data point for the bank to decide if the first rate cut could be in June.

UK: Still On the Road to Cuts, but at a Slower Speed

Stubbornly-high services inflation, evident in the April 2024 data, has now taken June off the table for the first Bank of England (BoE) rate cut. We retain our base case of an August start to the easing cycle. We have scaled back our 2024 rate cut expectations, mostly due to the global repricing of rates following hawkish-leaning data, rather than the data itself. That said, broadening signs of labor market cooling mean we still look for at least two cuts this year (possibly three).

As we expected, headline and services CPI inflation came in hotter than both BoE and market expectations in April, favoring another “hold” decision in June. Admittedly, the headline inflation rate eased sharply to 2.3% year-over-year (from 3.2% year-over-year previously), but this was still two tenths above expectations. The deceleration in headline inflation was led by food and utilities, offset by sticky services inflation, which came in well above consensus and BoE expectations. Core inflation eased less than expected due to the high services inflation, although goods inflation slowed.

Near-Term Caution, but Improving Trends Support Multiple 2024 Cuts

After a steep rise in April, the latest flash PMIs readings suggest wage pressures eased in May, even in the services sector. Given disinflation in food and core goods, as well as further declines in utility prices expected to begin in July, we expect headline CPI will fall below 2% in May and fluctuate around the BoE’s 2% target for the rest of the year.

Meanwhile, the labor market continues to slowly loosen (Figure 3). Wage pressure came in above consensus but that was due to strong public sector earnings growth. Private sector wage growth, which the BoE also pays attention to, edged down. The unemployment rate for the three months ending March 31, 2024 inched up a tenth to 4.3%, which marks the twin-highest level since October 2021. Vacancies in the three months ending February 29, 2024 fell for the 22nd consecutive period and the vacancy-to-unemployment ratio has nearly normalized back to pre-pandemic levels.

Eurozone: Shakiness of Data Supports the ECB’s Beeline for Cuts

The ECB Governing Council has signaled in no uncertain terms that it plans to cut rates at the June 6 meeting. This will not be a one and done exercise—despite some trepidation to the contrary. Rather, this will launch a sequence of actions and a steady process of policy normalization. That said, the aggressive market repricing related to reduced rate cut expectations globally makes it more difficult for the ECB to cut as aggressively as previously expected. As a result, we now expect three rather than four rate cuts this year.

The arguments for easing are straightforward and compelling. Inflation has retreated dramatically, and with labor market tightness easing at the margin, fears of a wage-price spiral are receding in spite of elevated nominal wage growth. Headline inflation has declined to 2.4% and core inflation is not far behind at 2.7%. While wage inflation remains quite elevated, this reflects lagged adjustments to the earlier inflation spike related to the oil shock, and is bound to moderate going forward. Specifically, the ECB negotiated wages metric rose 4.7% y/y in Q1 2024, matching the record high reached in Q3 2023. However, with eurozone inflation now below 3.0%, any future benchmarking exercises are almost certain to result in more modest outcomes.

Furthermore, while wage inflation remains more elevated in the eurozone than in the US, growth outcomes remain decidedly weaker in the euro area. The regional economy experienced a technical recession in the second half of 2023 (although it was very marginal). The eurozone has since rebounded to 0.3% quarter-over-quarter in Q1, but we look for growth of only 0.8% this year, following a 0.5% expansion in 2023. Given this context, a calibration lower in the level of rates makes sense, especially given the lagged impact of monetary policy on the economy.

Japan: The Yen Is the BoJ’s Most Important Consideration

The Bank of Japan (BoJ) is making its intentions of raising rates increasingly clear, as the freefalling yen becomes a key consideration. Governor Kazuo Ueda already clarified that the Bank may respond to the weak yen through monetary policy, but we believe that hikes will be gradual. We see the BoJ hiking to a terminal rate of 1.0% now, instead of our 0.75% earlier forecast. We favor the next hike in September, as the BoJ may want to see the impact of rate cuts in other advanced economies before acting. We also see the Bank’s monthly JGB purchases gradually declining from the current 6 trillion yen level.

The yen has been both a blessing in disguise, and an Achilles’ heel for Japan’s economy. Its weakness helped corporates earn higher profits from more competitive export prices, revive inflation, and boost wages. At the same time, the yen has been the weakest among G-10 currencies, and is trading above the key 155 level against the US Dollar—even after two interventions from the Ministry of Finance (Figure 5).

Since April, the yen depreciation has gained pace due to the diminishing likelihood of interest rate cuts in the US. While we disagree with the assessment of no cuts in the US (see the US section above), we still see the US economy growing near or above its potential growth rate, a case that favors an elevated US-Japan interest rate differential. This could lead to even higher import costs and perpetually subdued consumption.

As the BoJ moves forward with hikes, a key concern is the ideal level for the yen. The USDJPY is trading about 15% above its fair value, but we see it best for the yen to remain at weaker levels, for two reasons:

- The yen’s current levels support corporate profits. A Nikkei survey of 380 corporate firms revealed that they forecast foreign exchange rates more conservatively, which if realized, could drag profits due to less competitive export pricing.5 This undermines the concerted efforts by authorities for years to revive corporate governance, which helped to form our bullish case for Japanese equities (see: The Bullish Case for Japanese Equities).

- A weaker yen raises prices on imports and lifts inflation. Although the 2.0% target has been met for 25 months now, the BoJ’s metric for underlying inflation declined sharply in Q1. We expect a reacceleration starting in May as energy subsidies phase out. A slightly weaker yen would also help ensure that upward price pressures remain intact, as businesses would pass on higher input costs to consumers, per a recent BoJ survey.

Rate hikes mean Japan’s yields will keep rising and regardless of where the yen lands, hikes may attract domestic institutions into the long-end of the curve. Already, we have seen the 10y JGB recently hit the key 1.0% level.

Australia: Decision Time for the RBA

The Aussie markets have been facing a real conundrum of late: do interest rates need to be cut, maintained, or hiked? The Reserve Bank of Australia (RBA) is the only major central bank that is still considering a hike at its next meeting, and market pricing has been swinging between hikes and cuts. However, we see a path for gradual easing given lower inflation and cooling labor markets. Cuts could help revive consumption and support labor demand. We still see two cuts this year and three in 2025, to a terminal cash rate of 3.10%. However, we now expect the first rate cut in September, as opposed to August earlier.

We sympathize with the view that the oncoming stage three tax cuts could revive inflation. Hence, we think the RBA’s ideal path ahead could be a shallow cutting cycle. We view a hike as an outright policy mistake, for two main reasons:

Homeowners are facing higher mortgage rates. Per an RBA study, 880,000 mortgages transitioned into higher flexible interest rates last year, and this ‘mortgage cliff’ likely induced some economic stress.6 A flurry of refinancing helped support homeowners, but there is still significant financial stress for households. An index measuring household finances tracked by the Melbourne Institute is hovering just a touch above the worst ever stat recorded in 1991. Their debt service ratio has risen to 19.3% in Q3 2023 – the highest among advanced economies after Norway (19.5%), per the BIS.

Higher mortgage rates have been constraining consumption, which has been treading water for five quarters and had likely declined in Q1 2024, which will be only the sixth time in over 60 years. The RBA’s latest research found that 75% of hikes had already been fed into mortgage rate increases, and mortgage rates will likely rise further as the 450,000 remaining mortgages transition to higher flexible rates this year.7 RBA’s Financial Stability Review (FSR) highlighted in March 2024 that a 0.5% rise in unemployment rate will push most mortgage borrowers into cash flow shortfalls.

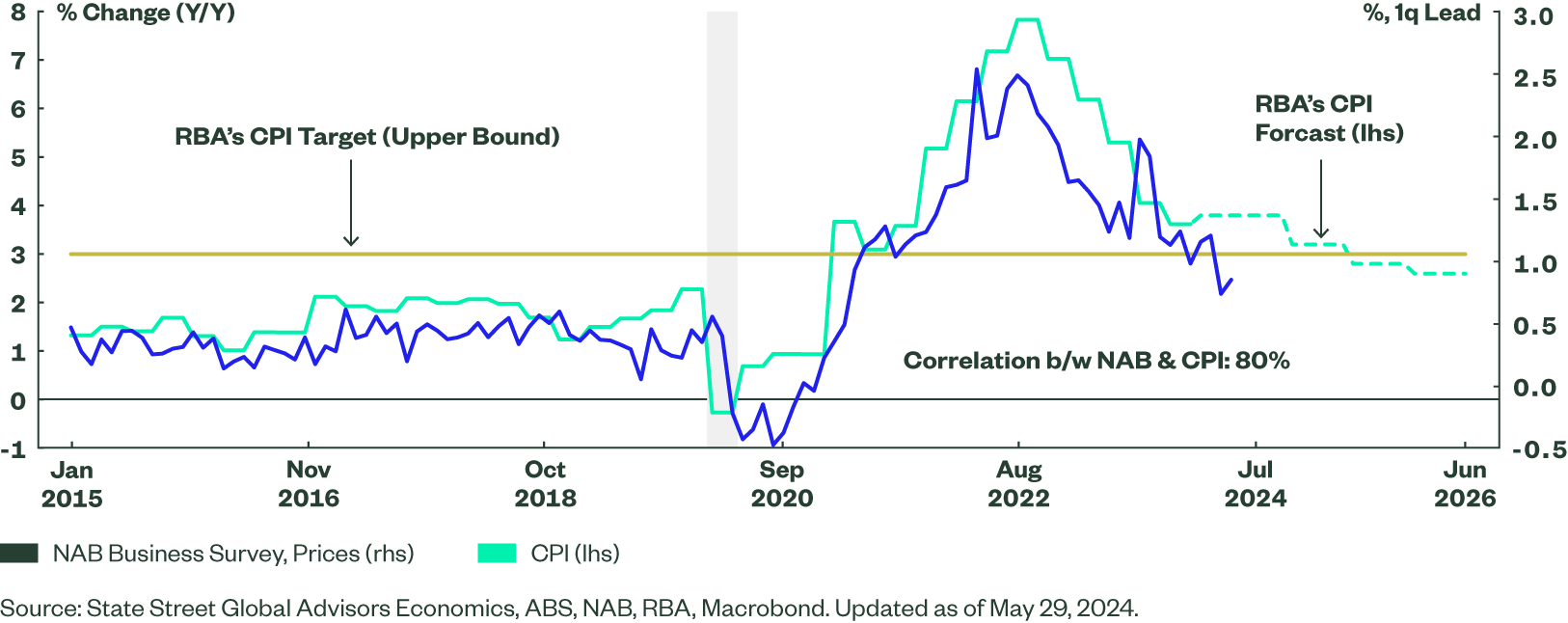

Inflation has slowed. Inflation has already cooled from a peak of 7.8% year-over-year in Q4 2022 to 3.6% in Q1 2024. The RBA expects inflation to decline into their target zone in H2 2025, but leading indicators indicate that this may happen much sooner (Figure 6). Although April CPI surprised to the upside, we are mindful of the limitations of the sample survey being skewed to services in the first month of every quarter.

Figure 6: Australian Inflation Is Expected to Hit RBA Target This Year

We have been arguing that the labor market has been cooling in line with historic cycles since September last year, and now, the consensus is that labor markets will slow further. The unemployment rate rose to 4.1% in April, but the RBA projects it to peak at 4.5%. Nonetheless, we still see a peak occurring below their pick. While higher unemployment may support further rate hikes, we view it as unwarranted, as it could interfere with the goal of a soft landing.

The Bottom Line

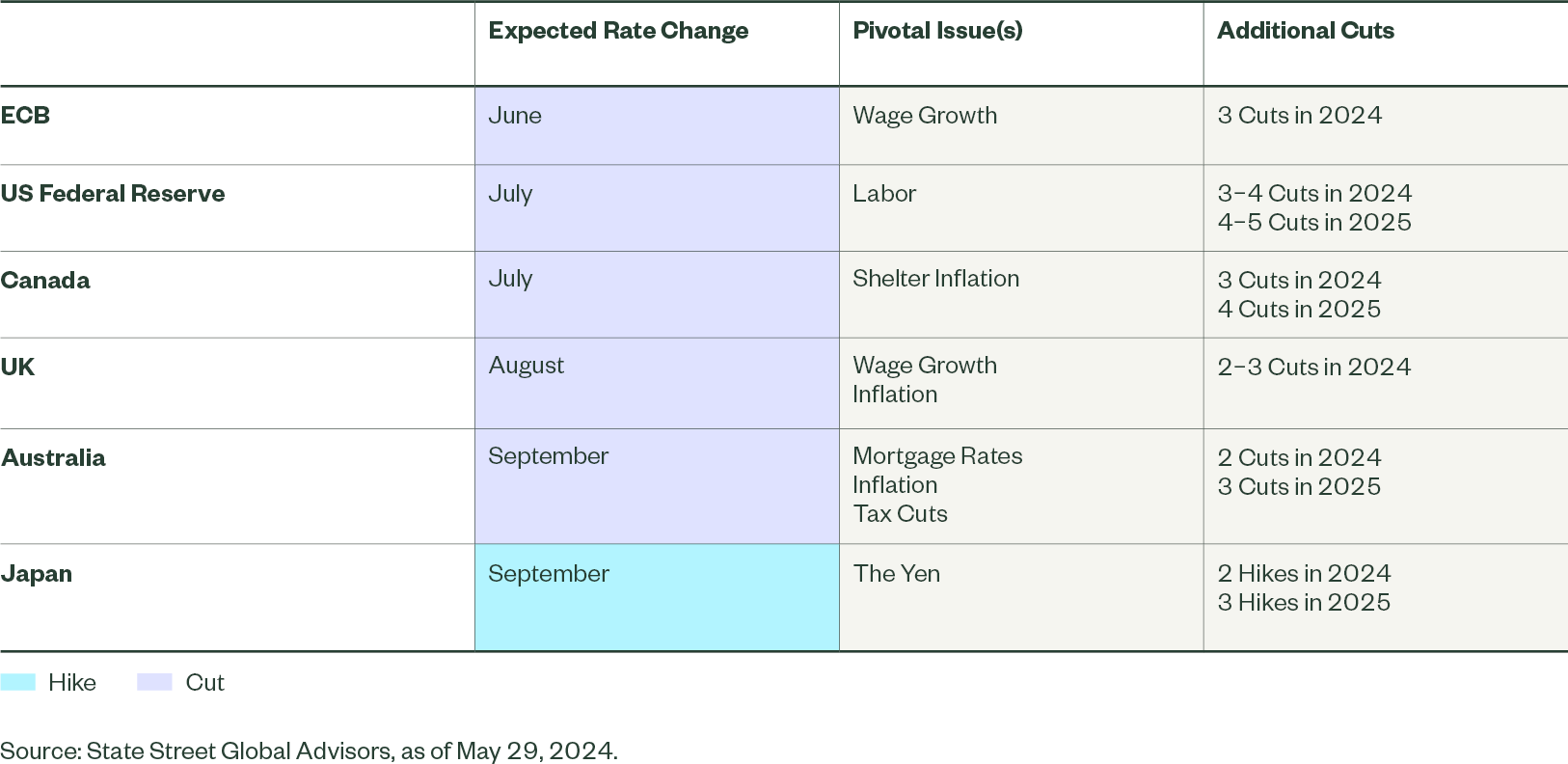

In areas like the US and the UK, inflation and labor data have been concerning in recent months. But cuts are happening nonetheless because much of the central bank motives are to unwind previous hikes. The cuts that are coming in 2024 (and even in 2025) are related to reducing the extent of policy restrictiveness, rather than shifting the policy stance to an accommodative one. As the market’s attention remains focused on who cuts when (see Figure 7 for a summary of our forecasts), data will continue to take center stage. However, it is important to look past any noise in the data, consider how market repricing may impact central bank actions, and brace positioning for policy actions that are mistimed.

Figure 7: Our Current Expectations for Central Bank Timing