EU Climate Benchmarks: Index Construction Matters

In this paper, we assess standard ‘off-the-shelf’ index offerings from S&P, MSCI, FTSE and Solactive, those most readily accessible to investors. Of course, there are other indices in the market and many providers are open to customised index solutions.

In our recent papers, we discussed the standards and implications of Climate Transition Benchmarks (CTB) and Paris-Aligned Benchmarks (PAB), and what to consider when choosing between them ('EU Climate Benchmarks: Standards and Implications' and 'EU Climate Benchmarks: Paris Aligned or ClimateTransition?'). The EU defined these climate benchmarks to establish minimum standards for indices to align with IPCC’s 1.5°C trajectory and net zero in 2050.

Current index offerings can be best understood collectively as climate strategies that comply with PAB or CTB minimum standards, rather than all PABs being the same, and all CTBs being alike: they vary by index design, active exposures and return profile (see Appendix 1 for details). In this paper, we assess standard ‘off-the-shelf’ index offerings from S&P, MSCI, FTSE and Solactive, those most readily accessible to investors. Of course, there are other indices in the market and many providers are open to customised index solutions.

Index Design Inputs: EU Climate Benchmarks Are Built Differently

There are many ways in which climate indices can be built, including the input data (how companies are assessed from a climate perspective) and index construction (how the data is practically utilised to yield an index). These differences are for good reason: investors have different rationale and motivation for implementing sustainable investments (see Figure 1) and therefore different portfolio objectives. Differences in index design often aim to meet different portfolio objectives, or combinations of these. Arguably, this is a benefit of the regulation, which sets standards while allowing room for innovation and meeting a variety of goals.

Figure 1: Differing Rationale for Implementing Sustainable Investment

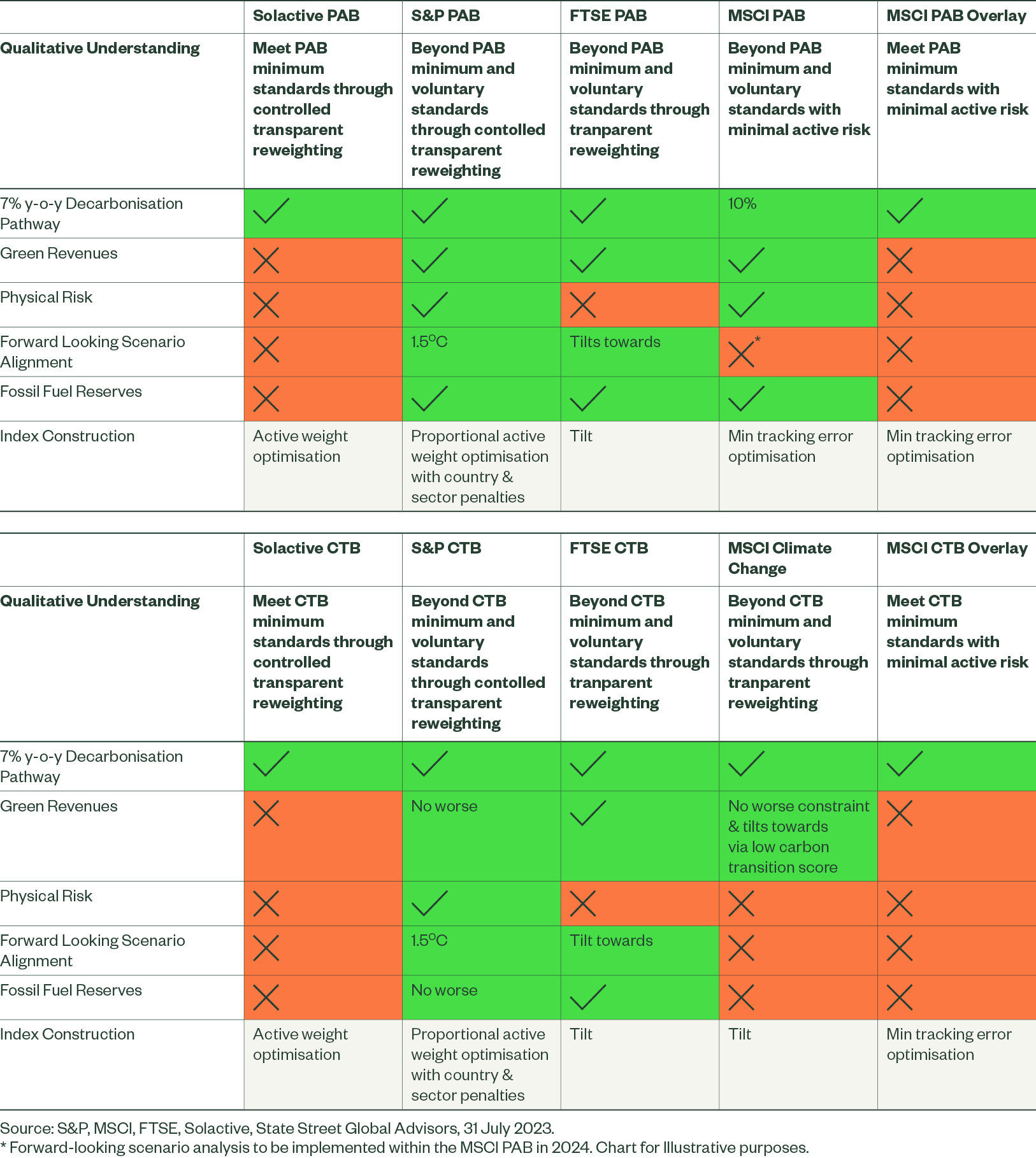

From an input standpoint (see Figure 2 for summary and Appendices 4 & 5 for further details), the Solactive and MSCI overlay indices largely aim to meet the minimum requirements laid out by the EU (see Appendix 2).1 This is a different approach from the S&P and FTSE indices, alongside the MSCI PAB and MSCI Climate Change indices, each of which measures companies with metrics that go beyond the minimum regulatory standards. These include green revenues, which the regulation deems ‘voluntary’, measures assessing the forward-looking climate pathways (as recommended by many investor bodies and others),2 and the physical risks companies may face from climate change. Additional metrics can yield a more nuanced view of companies’ climate risks, impacts and opportunities, similar to how fundamental analysts may look at a scorecard or range of metrics in assessing companies,3 rather than purely relying on carbon intensity.

A major difference between providers, and even within a provider’s own offerings, is the index construction method used. Some use more transparent tilted methods, such as the FTSE indices and the MSCI Climate Change Index series, while the MSCI PAB and overlay index series minimise tracking error through an optimisation process. Tracking error measures the difference in return between a strategy and its benchmark or parent index, measuring the volatility of excess return.4 The S&P and Solactive indices strike a middle ground and utilise the power of optimisation, albeit in different ways that do not use a risk model to estimate tracking error. More transparent weight allocations can help users better understand why companies receive the weight they do, potentially benefiting understanding of the indices. Transparent allocations would often receive a higher correlation between the active weights companies receive and the input data, which may be more suitable if the goal is to create real-world impact through capital allocation mechanisms. However, the lower tracking error generally observed from tracking error minimisation can often supersede the need for increased transparency.

Figure 2: EU Climate Benchmarks Are Not Built Equally

Active Exposures: Index Design Differences Drive Divergent End Results

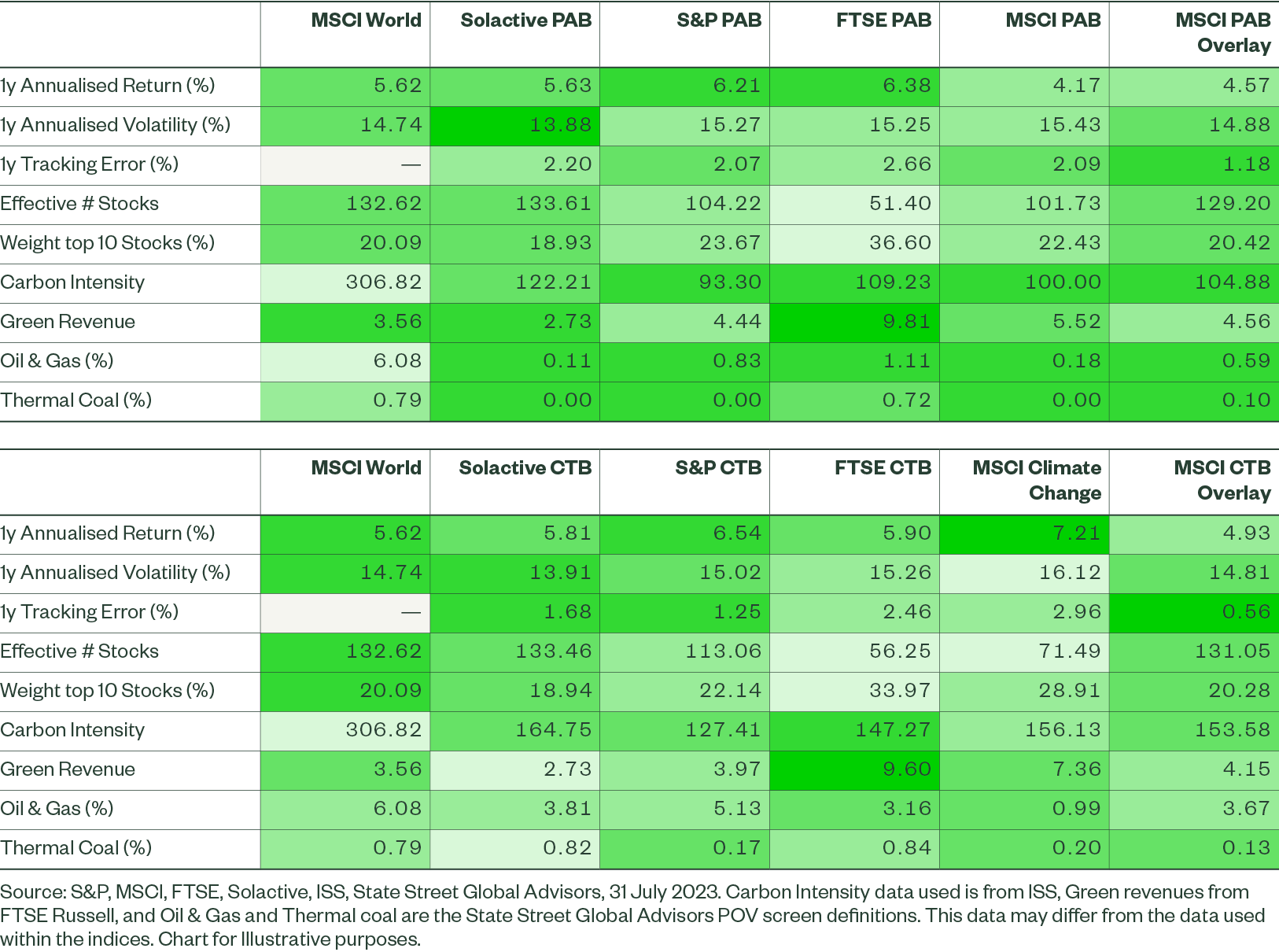

When indices share the same minimum regulatory standards, even if they’re built differently, how much can they really differ? The answer: quite a lot.5 We see this in multiple areas related to climate and other considerations within portfolios, such as active risk and concentration (see Exhibit 3).

For example, the FTSE indices tend to overweight companies with green revenues to a large extent, gaining close to three times the exposure, while the Solactive indices do not explicitly incorporate green revenues and actually see a tilt away from them. In contrast, the MSCI overlay indices do not control for green revenues but still show an improvement nonetheless.

Figure 3: EU Climate Benchmarks Outcomes Are Not Equal

Above: Paris-Aligned Benchmark; Below: Climate Transition Benchmark

Beyond the climate characteristics, we purposely focus more on active exposures rather than performance, given there is no obvious significant alpha6 since launch (see Appendix 77). To illustrate the impact index design can have on tracking error, we can compare the MSCI CTB Overlay and the MSCI Climate Change indices. Both comply with the CTB label and use the same data sources, but differences in the index construction method and the incorporation of other objectives beyond the CTB standards leads to strikingly different results. The MSCI CTB Overlay index can be interpreted as an approximation of the lowest tracking error possible while meeting the CTB label.8 Alternatively, the MSCI Climate Change uses a tilted methodology and has objectives beyond the regulatory minimum standards.

The MSCI Climate Change index had over five times the tracking error9 of the MSCI CTB Overlay index, resulting in a very different active return potential. Historically, the MSCI Climate Change Index had a maximum active return over a six-month period of 710 basis points (bps), eight times that of the MSCI CTB Overlay, with a maximum active return of 88 bps over any six-month period since the end of 2016 (see Appendix 9 for visualisation). The role of the index construction is also evident when comparing the S&P CTB which has even more ambitious climate objectives than the MSCI Climate Change index. Despite this, the S&P CTB has a significantly lower tracking error (less than half) than the MSCI Index. This shows how decisions related to index construction and the inclusion of insights beyond the minimum standards can cause meaningfully different exposures and performance outcomes.

With respect to index construction, we understand generally that tracking error minimisation helps to control active risk (as used within the MSCI CTB Overlay indices) efficiently per unit of active exposure. This is challenging to manage to the same extent with a simpler tilted framework, as shown by State Street Global Advisors research.10

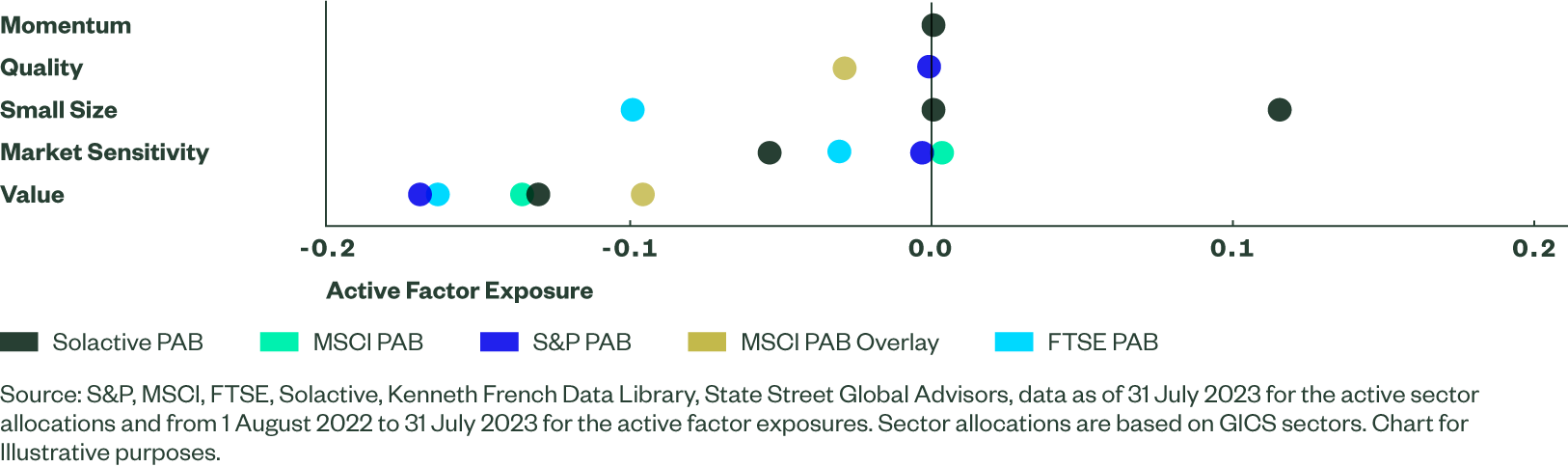

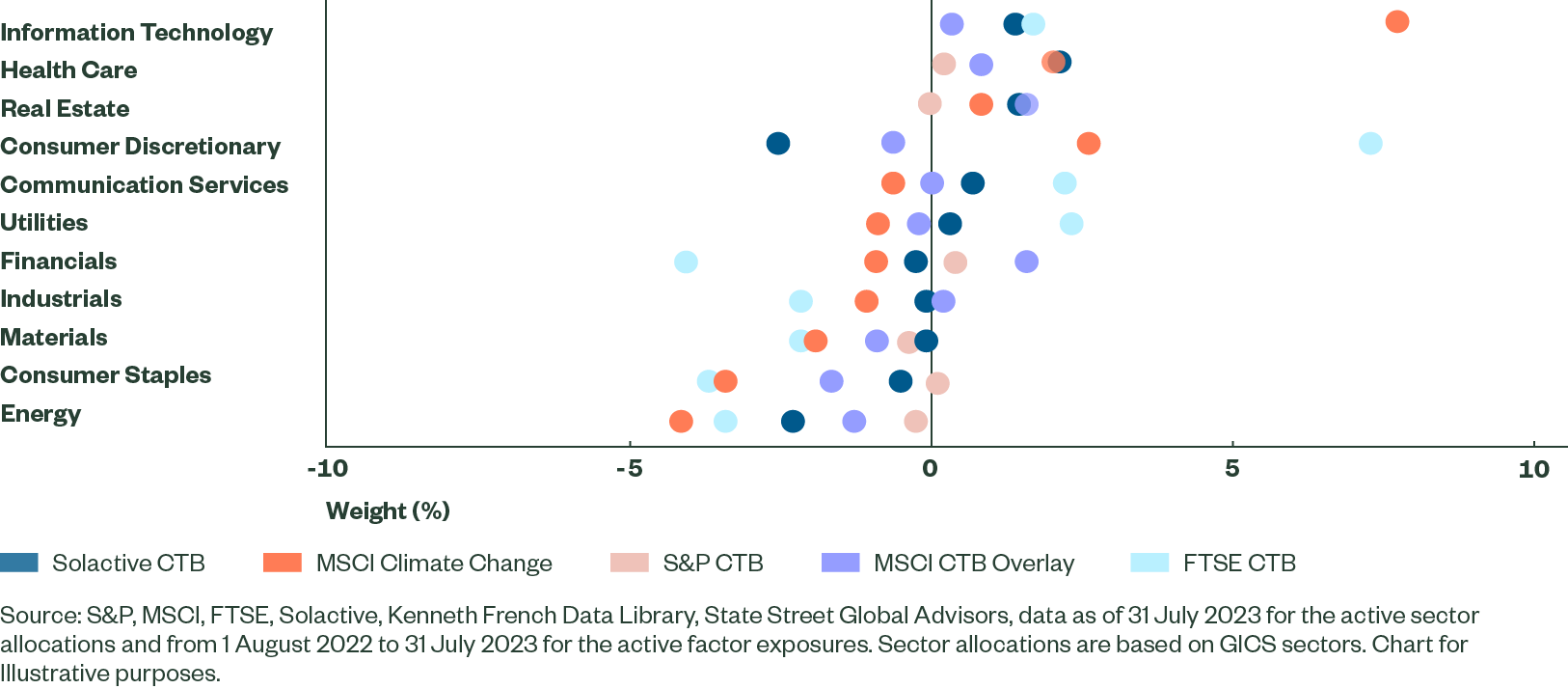

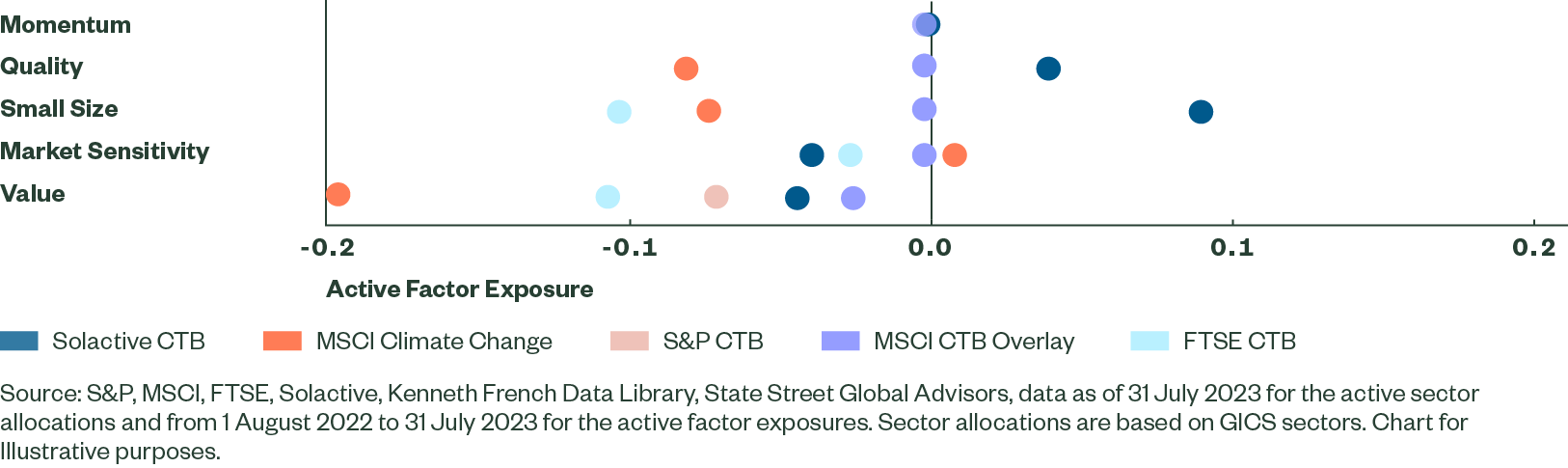

Generally speaking, the indices active sector and factor allocations are directionally similar. Across all indices, both PAB and CTB, they are underweight the energy sector and overweight tech, with a growth (negative value) tilt (see Exhibit 4). However, the magnitudes of these active positions are very different. S&P Indices tend to take the lowest active sector positions, with an average active sector weight of less than 30 bps for their CTB and around 1% for the PAB, while the FTSE indices take a 3% and 3.6% average absolute sector weights for their respective EU Climate Benchmark classes. Again, the portfolio construction likely plays a significant role here, where S&P minimise active sector weights directly, while the tilted methodology employed by FTSE and the MSCI Climate Change index don’t have these features.

Two areas where indices also diverge noticeably are in their consumer discretionary sector and size exposures. For example, the FTSE indices show a large overweight in the consumer discretionary sector, while most others show neutral to underweight positions. This is primarily caused by very large active positions in a couple of large names, rather than the average company being overweighted. Differences in size exposure are likely driven by the portfolio construction method. Tilted indices tend to a large size bias, whereas indices utilising active share from Solactive tilt towards smaller-cap stocks. These takeaways are consistent and as one may expect, but illustrate the importance of index construction. Not all PABs are the same, nor are all CTBs.

Two areas where indices also diverge noticeably are in their consumer discretionary sector and size exposures. For example, the FTSE indices show a large overweight in the consumer discretionary sector, while most others show neutral to underweight positions. This is primarily caused by very large active positions in a couple of large names, rather than the average company being overweighted. Differences in size exposure are likely driven by the portfolio construction method. Tilted indices tend to a large size bias, whereas indices utilising active share from Solactive tilt towards smaller-cap stocks. These takeaways are consistent and as one may expect, but illustrate the importance of index construction. Not all PABs are the same, nor are all CTBs.

Figure 4: Active Allocations Are Directionally Similar, But Varied

Paris-Aligned Benchmark

Climate Transition Benchmark

Index Return Profile: Maybe Not As We Would Expect

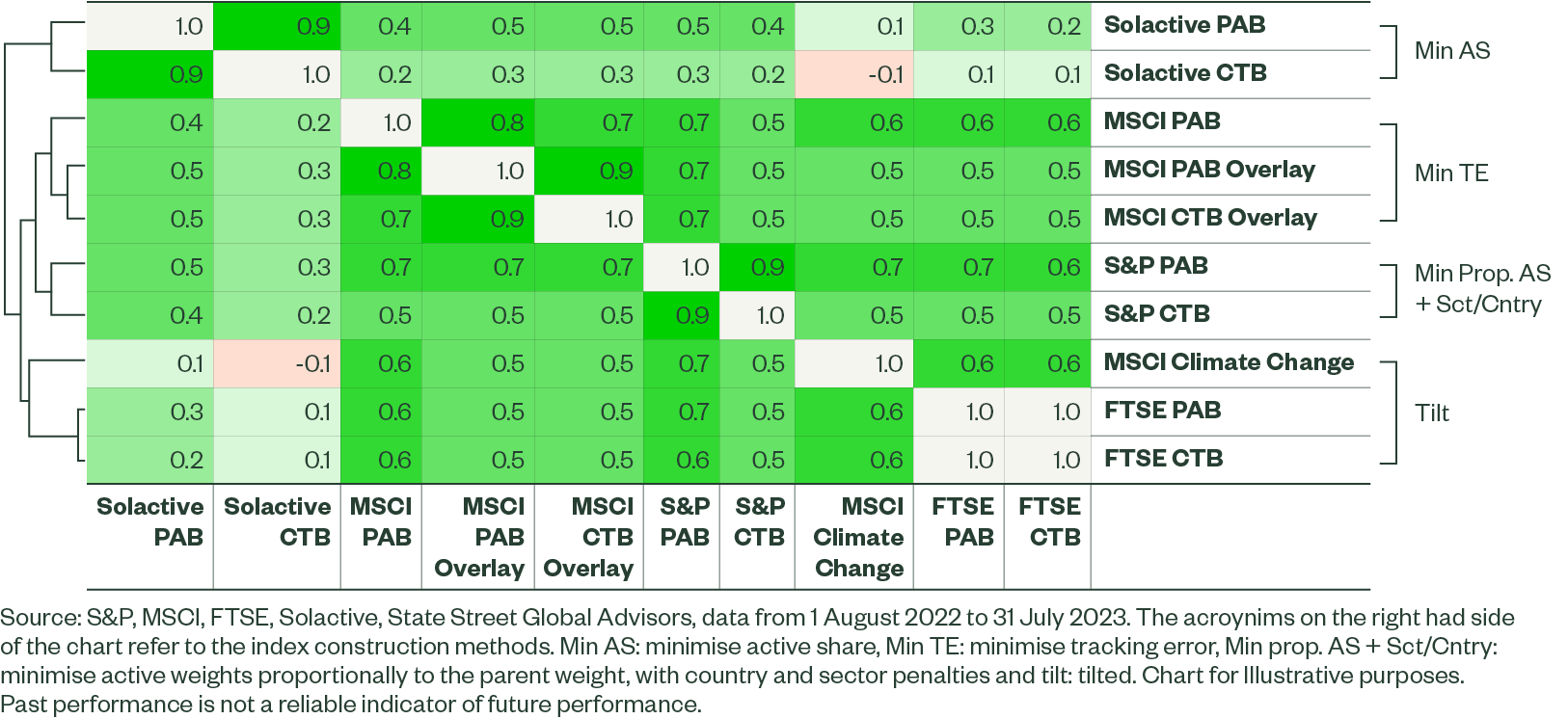

While we see that active sector and factor exposures tend to be directionally similar across EU Climate Benchmark aligned indices, with varying levels of active risk, what is the difference in the indices’ return profile? Specifically, we consider whether EU Climate Benchmark aligned indices have similar return characteristics to each other; whether PABs across providers show returns that are distinct from CTBs; if index construction methods yield characteristics specific to that method; and whether the index provider (including the data they use) affect the pattern of return.

To answer these questions, we assess the correlations of excess returns.11 In the graphic below we ‘cluster’12 the correlations — a process that helps to break down the indices into smaller groups that have similarities in their return profile. On the left-hand side of Figure 5, we can see a graphic that displays these clusters as a hierarchy or a tree-like structure. Where the vertical line is further to the right, it represents two indices (such as the two FTSE indices at the bottom) that have a more similar return profile. The inverse is also true.

Figure 5: Index Construction May Better Explain Return Profile Than PAB or CTB Alignment

We see that EU Climate Benchmarks, with the exception of the Solactive CTB and MSCI Climate Change indices, are directionally similar showing a positively correlated excess return. Within this universe, the Solactive indices appear to differ the most from other indices, possibly due to their index construction method and factor exposures that diverge from other providers.

Interestingly, among the indices analysed, the index construction method (i.e. optimisation or tilting) had more similarities versus the PAB or CTB classification ‘label.’ Clustering indices in this way suggests that two indices with the same portfolio construction method may be most similar, which cannot be said for PABs or CTBs.

Unfortunately, it is not easy to separate what is specific to an index provider and portfolio construction method, given that S&P and Solactive use methods that are unique to them. However, MSCI use both tilting and tracking error minimisation, with their tilted methodology (MSCI Climate Change) appearing more similar to the FTSE tilt than to their other indices that minimise tracking error. This further highlights the importance of an index construction technique when assessing the return outcome of EU Climate Benchmarks.

The Bottom Line

Investors have an abundance of choice when it comes to selecting EU Climate Benchmark aligned indices. Given the differences noted, indices should be thought of as climate strategies adhering to PAB or CTB minimum standards, rather than being looked at uniformly as a PAB or a CTB. This is evidenced in the index design inputs, such as index construction method and data leveraged, as well as in the active exposures (i.e. sector and factor allocations), and the pattern of returns over time. This in turn means selecting the ‘right’ index to meet specified goals is important.

In our next paper in this series we examine some of the key considerations around differences in index design inputs and portfolio construction methods that investors can apply when selecting the right index to meet their climate goals and objectives.