5 Questions Every Scheme Should Ask in 2024

With the dust still settling on the UK gilt crisis, we asked some of our key clients and consultants what questions were at the top of mind for 2024.

Their top questions ranged from the fundamentals of which vehicle to chose and how to build resilience, through to how easy it would be to implement manager changes:

- Should we move from a pooled scheme to a segregated one?

- How can we make portfolios more resilient?

- What is the better hedging instrument: gilts or swaps?

- Is it better to have cleared derivative positions or bilateral ones?

- How easy is it for schemes to change their LDI manager in 2024?

This article aims to help schemes answer these important questions alongside insights and practical guidance from our LDI team.

1. Should We Move from a Pooled Solution to a Segregated One?

The gilt crisis exposed the potential weaknesses of many existing pooled LDI fund structures, leading many pensions schemes to ask what could be improved upon. Some schemes are exploring moving away from pooled solutions and into segregated structures.

Segregated LDI accounts are run for one pension scheme only. Such structures allow full flexibility for schemes to implement their required hedging portfolio. Restrictions and objectives, including levels of leverage and eligible collateral are all customisable.

However, one of the prerequisites for a segregated account is that schemes must have their own custody arrangements and investment management agreements in place. The cost of these can be prohibitive for some schemes. Single-investor pooled funds also exist but they retain most of the costs of a segregated LDI mandate, making them costly for small-to-medium size pension schemes.

Multi-Investor pooled funds, in contrast, have a number of benefits:

- Delegated governance.

- Regulated fund structures.

- They avoid the need for a scheme to appoint a custodian.

- Unlike segregated accounts, schemes have limited liability in the face of losses.

However, with pooled funds, leverage is managed within rebalancing bands on a fund-level basis, so all schemes get capital calls and distributions at the same time. Furthermore, funds may be obliged to wait for all clients to provide their portion of the cash in the event of a collateral call. This creates co-dependency between clients.

We Believe There is a Better Way

We believe well-designed pooled funds are the optimal choice for schemes for which segregated accounts do not work due to cost, governance requirements or complexity. We analysed what scheme really need and designed our Target Leverage Funds (TLFs) from the ground up to offer many of the advantages of a segregated fund but in a pooled fund format. Our innovative fund design garnered industry recognition, earning us the UK LDI Manager of the Year award at the Professional Pensions Investment Awards in 2021.

TLF Fund Feature |

How does this increase resiliency? |

Bespoke client leverage |

Overcomes dependency between investors on collateral calls. |

Ability to access both Levered Equity and Leveraged LDI |

Diversifies sources of leverage. Reduces risk to adverse shocks in the gilt market. |

Efficient collateral pool |

Collateral is used where it is needed, no one fund holds surplus collateral. Likely to lead to fewer collateral calls overall. |

Flexible asset allocation |

Offers the flexibility previously only found in segregated solutions and allows clients to choose their own asset allocations. |

Source: State Street Global Advisors, as of 2024.

2. How Can We Make Our Portfolio More Resilient?

Expectations that the Monetary Policy Committee will pivot to cutting rates in 2024, the continuation of the Bank of England’s quantitative tightening programme and high ongoing levels of supply from the Debt Management Office, all mean that markets may continue to remain volatile in 2024.

So, it remains vital that schemes’ portfolios are resilient to changing market conditions. We are strong believers in partnering with schemes to ensure they can respond nimbly to such changes.

Facilitate Precision Hedging We have seen some schemes more regularly recalculating their liabilities in order to ensure a greater level of hedge precision. To help schemes do this more easily we’ve put processes in place where benchmark changes do not require formal amendments to their legal documentation, making their implementation a quicker and more efficient process.

Get Collateral Right Since the 2022 gilt crisis, many schemes and leveraged pooled funds now have larger collateral buffers within their portfolios. When additional collateral is called for, however, the shorter delivery timeframes now expected by regulators have meant schemes are looking for ways to increase their resiliency and preparedness.

From an operational standpoint, schemes may wish to delegate the handling of such collateral calls to their asset manager; this is something we offer not only to our segregated clients but also to our pooled fund clients through our straightforward and templated DB+ offering. We can

provide frequent reporting for our mandates — which can include detailed analysis sent out daily via secure file transfer protocol (SFTP) — ensuring schemes are kept fully informed on their portfolios and latest collateral sufficiency levels.

Get Exposures Under Control From an asset allocation standpoint — alongside understanding the liquidity and speed with which assets can be provided as collateral to their leveraged portfolios — we see schemes considering various means of maintaining their desired exposures under such circumstances. This includes the use of credit holdings — either by including such assets in collateral agreements or by trading repo on corporate bonds. However, this can be problematic as it:

- May not be straightforward, for example, for schemes holding credit via pooled funds or in portfolios diversified across many lines of bonds.

- May not be reliable in times of market stress.

- May introduce other downstream impacts to consider (for example, pricing implications for derivatives with non-cash collateral agreements).

A better alternative for schemes to consider would be utilising their equity allocations. We have experience in managing this both for segregated clients, via use of futures/total return swaps as well as through pooled funds and our innovative Target Leverage Fund range which, alongside LDI, offers leveraged exposure to both UK and global equity markets.

3. What is the Better Hedging Instrument: Gilts or Swaps?

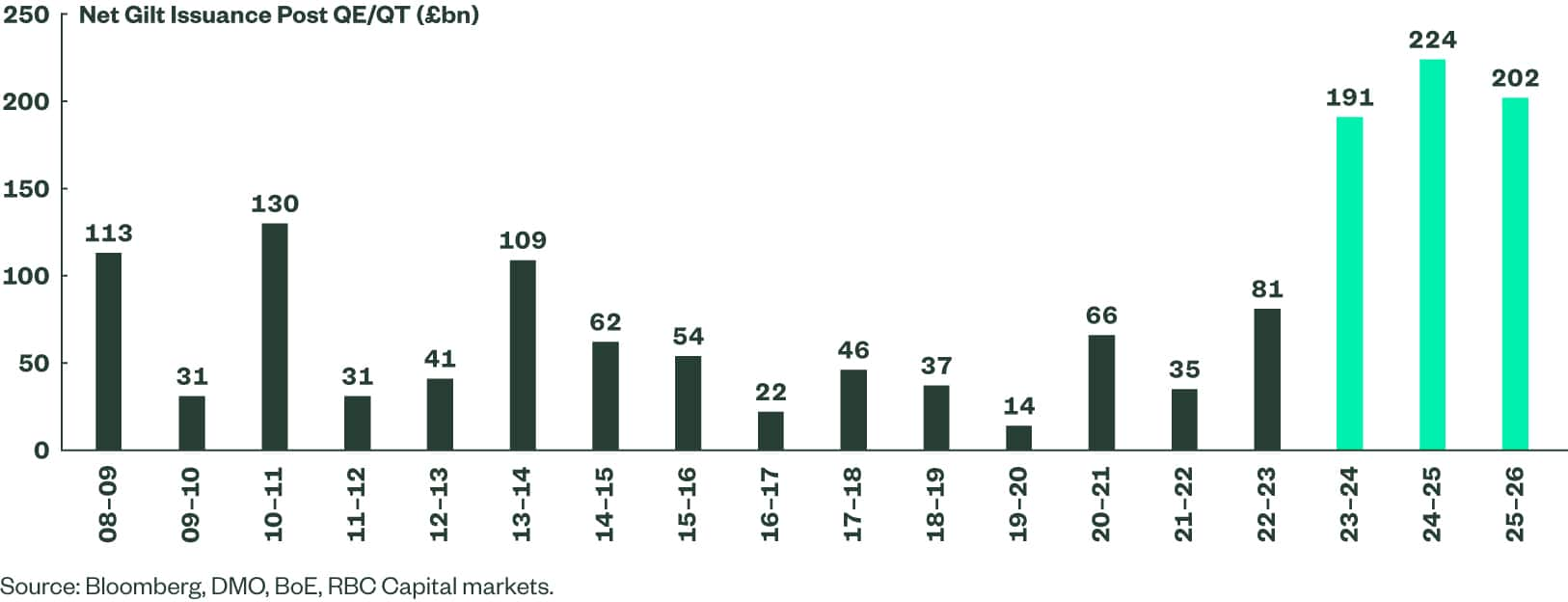

Fears about the levels of government debt and future bond issuance have continued to dominate government bond markets globally, including the UK. Repeated shocks to the UK economy, first from the pandemic and then the Russia/Ukraine conflict have highlighted the fragility of government finances. The chart below shows how gross gilt issuance is set to remain elevated for the foreseeable future, with net issuance including the impact of QE/QT by the Bank of England showing an even more marked increase in issuance.

Figure 1: Gross gilt issuance set to remain elevated for foreseeable future (£bn) ...

Figure 2: … which combined with QT will keep net gilt issuance post QE/QT towards historic highs (£bn)

Given the elevated levels of gilt supply, the natural question to ask is: Who will buy all these gilts? When looking at UK institutional demand, UK pension funds who have long been strong buyers of gilts within their LDI portfolios may not have as high a level of structural demand in the future, since hedge ratios are now much closer to desired levels. In addition, life insurers typically have a preference to use swaps rather than gilts for their interest rate hedging needs, so if a scheme goes to buyout, this leads to further selling pressure in the gilt market.

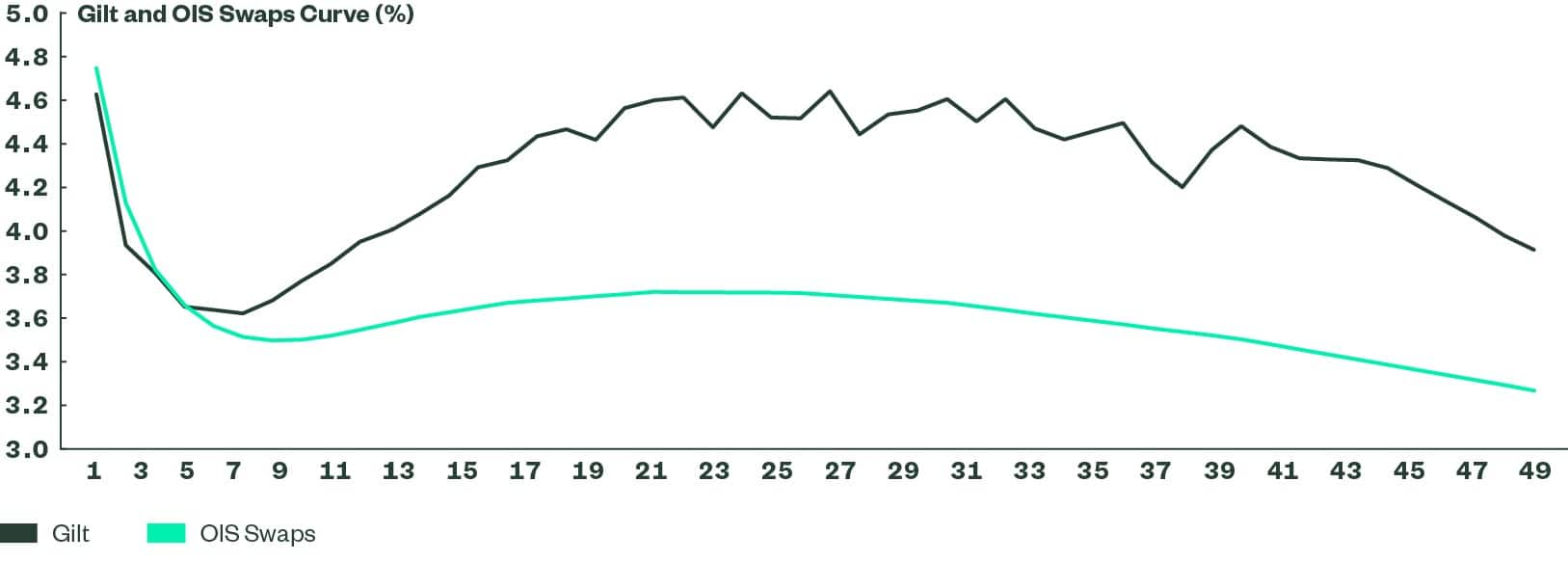

Some schemes may be concerned about whether it is still appropriate to use gilts in their hedging portfolios. Pension scheme liabilities are typically discounted using a gilt-based discount curve, so this should still remain the default option for schemes. The chart below shows the gilt and interest rate swaps curves and highlights how the give-up in yield to hold interest rate swaps is substantial. At current valuations, gilts are close to the cheapest level compared to interest rate swaps that we’ve seen since 2016.

Figure 3: Gilts and Swaps Curves

Source: SSGA. As of January 2024.

Finally, it seems increasingly likely that central banks are now at interest rate peaks. The yield curve is now consistent, with all major central banks cutting interest rates back again in 2024. Historically, government bond returns are influenced more by the economic cycle and less by the levels of government bond supply, so they are likely to enjoy greater levels of support going forward, which may limit any further cheapening against interest rate swaps. In addition, the Debt Management Office is likely to respond to the changes in the sources of demand by skewing future gilt issuance to shorter maturities, which will appeal to a broader group of investors. In future this should help alleviate some of the pressure on longer-dated gilts.

In conclusion, current valuations already have a healthy premium for the factors described above, and as a result we believe that gilts are the optimal hedging instrument for most pension schemes.

4. Is it Better to Have Cleared Derivative Positions or Bilateral Ones?

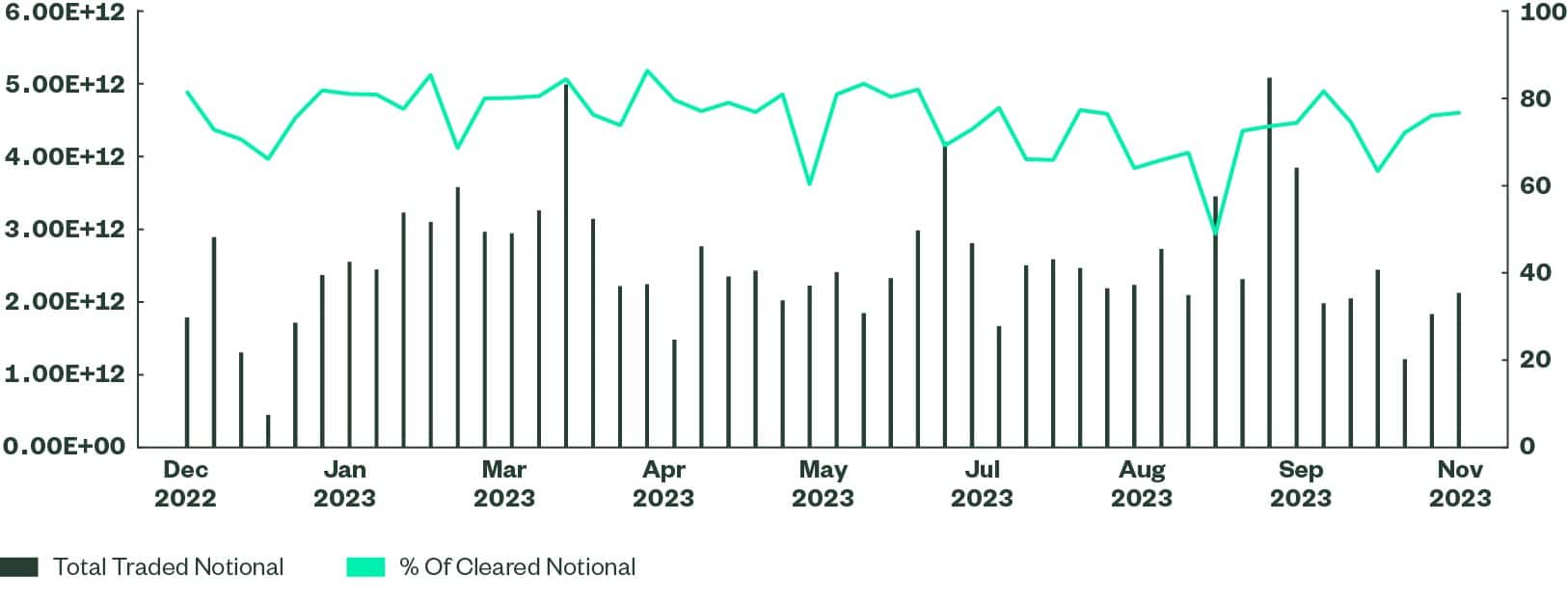

There has been recent renewed interest in trading derivative instruments on a bilateral basis with counterparties, rather than on a cleared basis facing a clearing house. Bilateral trades can mean greater flexibility over what assets are posted as collateral. Schemes, for example, could use their corporate bond holdings as collateral against their interest rate and inflation swap positions. There has also been an increase in interest in posting corporate bonds as collateral against gilt repo and gilt total return swaps. While using corporate bonds as collateral can be a useful backstop, in our opinion it should not be used as the primary source of liquidity for most schemes, and we continue to believe that cleared derivative positions are most often the optimal choice.

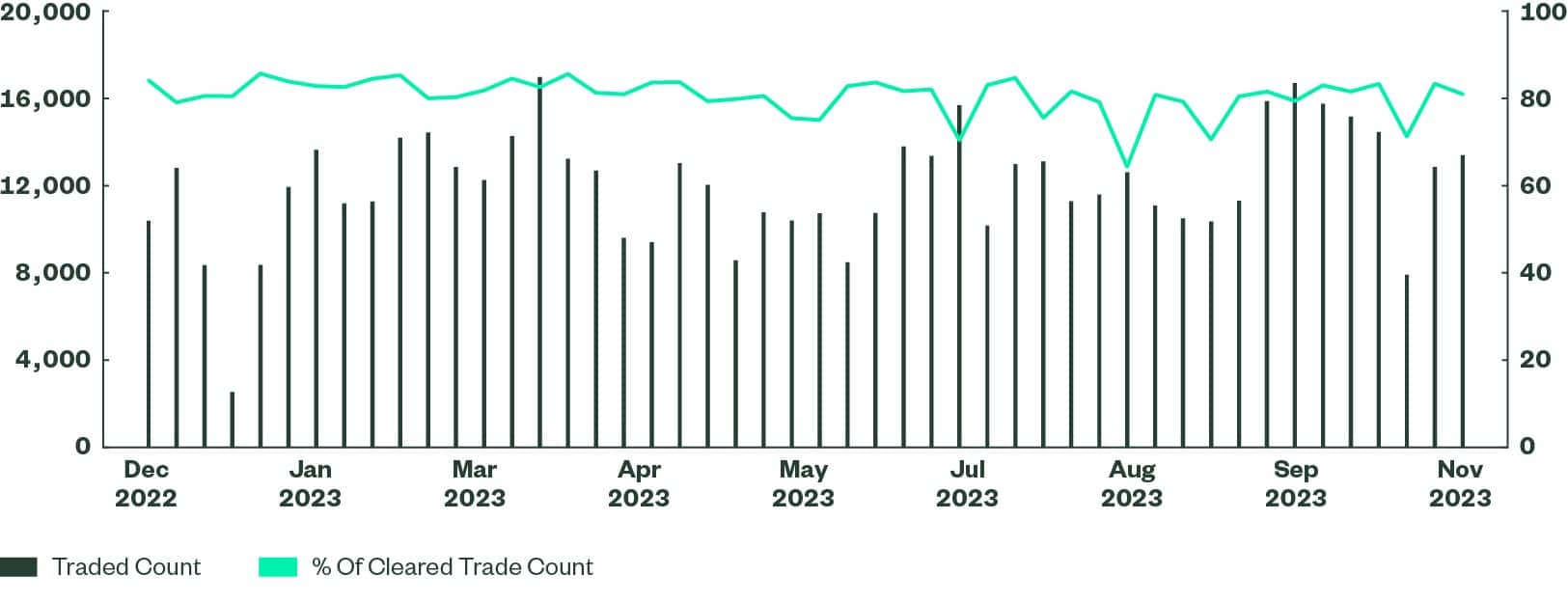

Cleared derivative positions have much greater liquidity, more transparency and quicker pricing. Standard documentation makes it easier to trade with a wide variety of counterparties. The chart below shows that cleared trades continue to dominate the market with over 75% of derivatives cleared on a consistent basis:

Figure 4: UK IRD Weekly Traded Notional And % Of Cleared Notional

Source: UK APAs and TVs.

Figure 5: UK IRD Weekly Trade Count And % Of Cleared Trade Count

Source: UK APAs and TVs.

As schemes consider their endgame, it is worth remembering that portfolios that have standardised instruments may find it easier to place a value on their derivative positions and to transfer their exposure to a third party.

|

Cleared |

Bilateral |

Counterparty Risk |

No – face the clearing house for the life of the trade. |

Yes – counterparty risk for the life of the trade. |

Liquidity |

Majority of trading volume. |

Smaller trading volume and reducing. |

Pricing |

Full transparency in and out of trade. |

Price taker when closing a trade before maturity. |

Collateral |

Cash collateral required for daily margin. |

Flexibility on collateral posted. |

Source: State Street Global Advisors, as of 2024.

5. How Easy is it to Change Your Manager in 2024?

Following the 2022 gilts crisis, we have seen an increase in schemes looking to transition to a new LDI manager. Pension schemes are re-evaluating not only the cost of their existing provider but also the level of service that they receive. And, with markets expected to remain volatile, more importance than ever is being placed on the quality and timeliness of reporting, not to mention the level of engagement LDI providers offer.

We believe schemes can benefit from bringing their asset management and custody together under one relationship with State Street. LDI portfolios are managed on State Street’s Charles River Investment Management Solution, a best-in-class portfolio management system that offers clear operational and efficiency enhancements.

Getting the Transition Right

In onboarding our new client Van Lanschot Kempen, our dedicated transition project management team have recently once more demonstrated our ability to transition clients quickly, efficiently and at minimal cost.

We have moved clients who had both pooled and segregated exposures with their existing provider — with portfolios that have included derivatives and repo positions — for little or no transaction cost and no out-of-market exposure. We would be happy to talk to you in detail about how our experience, quality of service, pricing and portfolio management technology can help with the management of your scheme.

In collaboration with your investment consultant we can model the current exposure of the LDI mandate with the incumbent manager and propose trading or transfer of assets that would replicate the level of hedging against the liabilities.

We would determine a suitable transition period, which is normally dependant on the amount of trading required, and carefully manage the implementation over this period. Throughout the transition our LDI team would provide regular updates on the progress and, upon completion, provide a full summary report of the transition, detailing the portfolio before and after trading.

Concerns raised when considering changing LDI manager often focus on whether there are market risks and transaction costs involved. Let’s look at some of the considerations:

Pooled Fund Investors

- To successfully transition, a common dealing date between the incumbent manager and SSGA can be agreed, and transition can then happen on that day to avoid any out of market exposure.

- If holdings are within unleveraged and leveraged gilts and index-linked gilt funds, the transition can usually happen without any transaction costs (we, for example, aim to trade our gilt-based funds at Tradeweb closing prices, resulting in no broker transaction costs).

- Transition of swap-based funds may incur some transaction costs but, where of benefit to the mandate, it could also be combined with a move from swap to gilt-based funds, to alleviate the transaction cost of buying new swaps. This may also make sense from a relative value perspective, as well as reducing basis risk if the scheme has gilt-based liabilities.

- Depending on the size, we can also manage the transition across multiple dealing days to minimise transaction costs and market impact.

Segregated Mandates

SSGA can often simply step in on the account previously managed by the incumbent manager at no cost to the client. Where the portfolio includes derivatives, there are several approaches to help avoid out-of-market exposure and minimise or eliminate costs depending on the type of instrument and legal agreement, for example:

- If the Scheme has its own legal trading documentations (ISDAs, CDEAs, GMRAs): we can simply take over the management of the derivatives, as we would do for physical holdings, without incurring costs.

- If the Scheme trades under the asset manager umbrella trading documentation: the swaps can either be novated to the new account, with or without transaction costs, depending on the nature of the legal agreements. Alternatively, back-to-back positions can be entered where the incumbent manager closes its positions at close of business on a given day for SSGA to enter the same positions. Given the advent of cleared swap trading and standardised legal documentation, such transitions can be done for minimal transaction costs and no out-of-market exposure.

There are different strategies to employ when transferring repo positions if novation is not possible, the approach taken may depend on the term of the repo.

Changing Your LDI Provider Can Unlock Substantial Benefits

Whilst potential one-off costs associated with a transition to a new manager are a valid consideration, they can quickly be outweighed over the long term by the benefits to the scheme such as:

- Potentially lower fees.

- Access to improved, more efficient products, such as our Target Leverage Fund Range.

- Bespoke services, such as our DB+ service for pooled fund investors which is individually tailored to clients but in a pooled fund format. We also offer weekly monitoring of portfolios against targets and tolerances to improve the accuracy and efficiency of the LDI portfolio.

Our One State Street solution, brings together both the asset servicing and asset management components of your segregated LDI mandate, allowing for operational and commercial efficiencies that benefit the scheme and its stakeholders. Schemes will also benefit from our scaled global asset management business, across the cash, fixed income and equity elements of their mandates.

State Street Global Advisers uses the Charles River Investment Management Solution, an enterprise-wide system that manages every aspect of LDI mandates including portfolio management, trading, compliance and collateral management. The system allows us to not only manage portfolios accurately but also to provide state-of-the-art timely reporting to clients including detailed performance attribution.

For more information about our LDI solutions please contact your relationship manager or UKSales@ssga.com