Patents: Intangible Assets as a Signal for Innovation and Future Prospects

As we noted in the last SEA quarterly, technological innovation is a key input and driver of economic growth. Patents, being a critical indicator of a firm’s research and development efforts, play an important role in representing a company’s innovation and technological advancement. Obtaining a patent is the culmination of substantial investment in R&D, reflecting a commitment to innovation and, if successful, ultimately having a competitive edge in that domain.

Patents are particularly relevant in the pharmaceutical, technology, and renewable energy industries, where the pace of innovation moves at breakneck pace and is often disruptive. Understanding the scale, quality, and strength of a company’s patent portfolio is crucial in assessing its long-term prospects and sustainability.

Research has shown that firms with robust patent portfolios tend to experience higher future cash flows and earnings, which are key drivers of stock performance. Additionally, the market often reacts positively to significant patent announcements, reflecting investor recognition of the potential value of these innovations.

The strategic properties of patents, particularly in technology-intensive industries, also has a symbiotic role in mergers and acquisitions, joint ventures, and partnerships. Patents can also provide a competitive ballast, protecting a company’s market share and pricing power, which are critical components of long-term value creation and preservation.

What Does a Firm’s Patent Portfolio Reveal?

To test the properties of patent-related data and its implications for asset pricing, we take a multi-faceted analysis approach. We believe that the value and impact of a patent portfolio are not solely determined by its size, but also by the nature of its contents. In order to examine a patent portfolio of a firm, we assess various dimensions of patent data, including the number of patents granted, the frequency and quality of citations, the intrinsic quality of patents, and their alignment with various technological fields. By combining these diverse yet inter-related dimensions of patent data, our goal is to construct a more accurate and forward-looking assessment of a company’s innovation profile.

Innovation Productivity and Quality

Innovation productivity and quality are key concepts in understanding the true value of a company’s patent portfolio and its innovation capabilities. Innovation productivity is essentially a measure of a firm’s efficiency and effectiveness in generating new and viable ideas. While innovation productivity provides a quantity-based perspective, innovation quality delves into the impact and significance of the patents .It’s not just about the number of patents a company holds, but the ongoing influence and quality of those patents in driving future technological advancements.

It’s important to understand that innovation productivity is not just about the volume of patents, it’s about the consistent generation of valuable, impactful ideas. High innovation productivity suggests that a company is not only investing in R&D but is successfully converting these investments into potentially commercial innovations. This is a vital indicator of a company’s long-term sustainability and growth potential, as it reflects an inherent capacity to keep pace with or stay ahead of market trends and technological advancements.

However, this metric alone can be misleading without considering the quality and relevance of these patents. Therefore, we integrate patent citation analysis into our evaluation as a tangible measure of innovation quality. A high number of forward citations are a strong indicator of the patent’s quality, significance and influence in the field, reflecting the extent to which a company is contributing to future technological advancements. This is because when a patent is frequently cited, it signifies that subsequent inventors are building upon the patented technology, suggesting that the original invention has foundational value and is widely recognized by peers. Furthermore, patents that are cited across a diverse range of fields are often indicative of groundbreaking innovations with wide-ranging applications and implications. Therefore, forward citations serve as a robust indicator of a company’s market leadership and competitive advantage. These metrics of innovation quality are not just a measure of a patent’s quality but also of its breadth of influence.

Hence, we believe that a robust patent portfolio born of high innovation productivity and innovation quality often correlates with a company’s ability to maintain a competitive edge, attract strategic partnerships, and command market leadership.

Innovation Momentum

Firms do not exist as solo entities, but are linked to each other through many types of relationships. Some of these links are clear and fundamentally oriented Industry linkages, while others are implicit and less transparent such as Supply-chain based linkages. These connections mean that companies are mutually influential in their operations. Thus, any shock to one firm has a resulting effect on its linked partner. Investors, with their limited attention, overlook the impact of specific information on economically related firms. Their narrow focus disrupts the flow of information, leading to predictable patterns in the returns of related stocks.

Along similar lines, we believe that firms do not pursue their technological research in isolation. In contrast, they frequently interact with each other, leading to an innovation process characterized by common shocks and knowledge spillovers. This trend of innovation diverges significantly even among firms within the same industry. Investors can categorize companies based on their technological similarities by examining patents data.

Patents data uncovers a unique type of interconnectedness between companies that transcends traditional sector or industry boundaries and is typically not readily discernible from firms’ financial reports. Firms across diverse sectors may utilize similar technologies, creating a group of ‘technology peers.’ They might also be working on areas of innovation that substantially overlap with each other and are subject to similar supply-chain linkages, which serve as important transmission channels for common economic shocks. Technology spillovers could occur due to explicit inter-firm collaborations or, more frequently, the existence of overlapping expertise in the same technological domain. Thus, this analysis enables investors to identify technological commonalities between firms across various sectors.

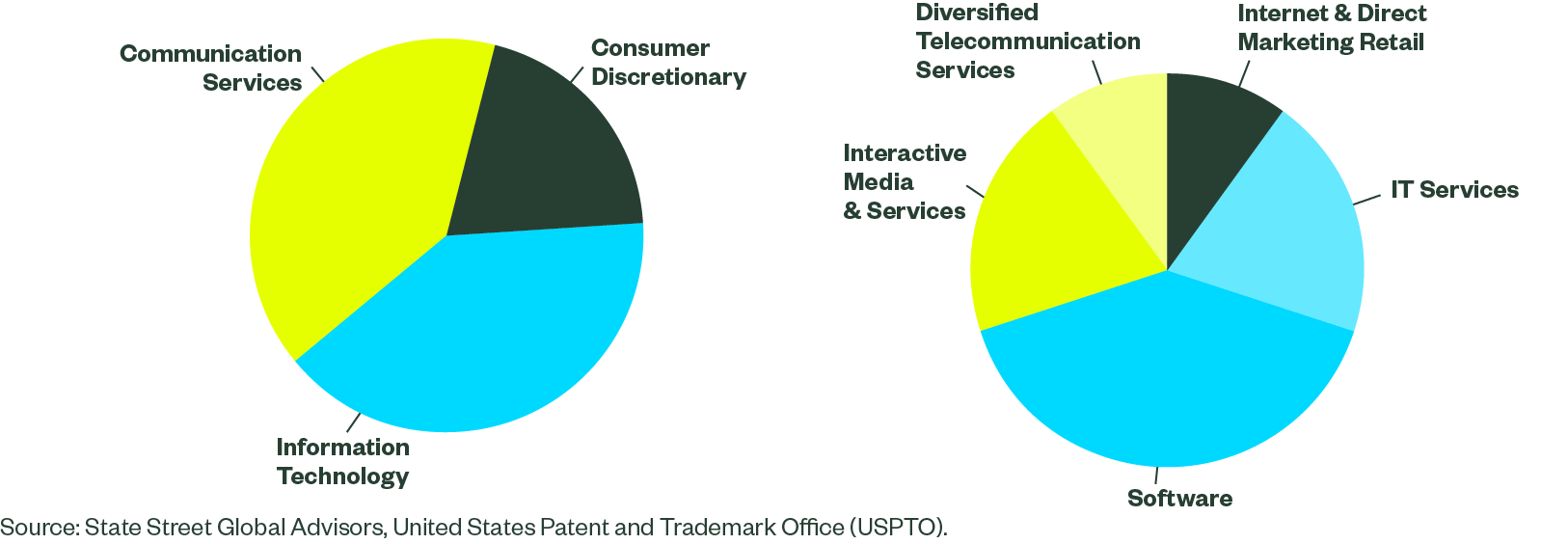

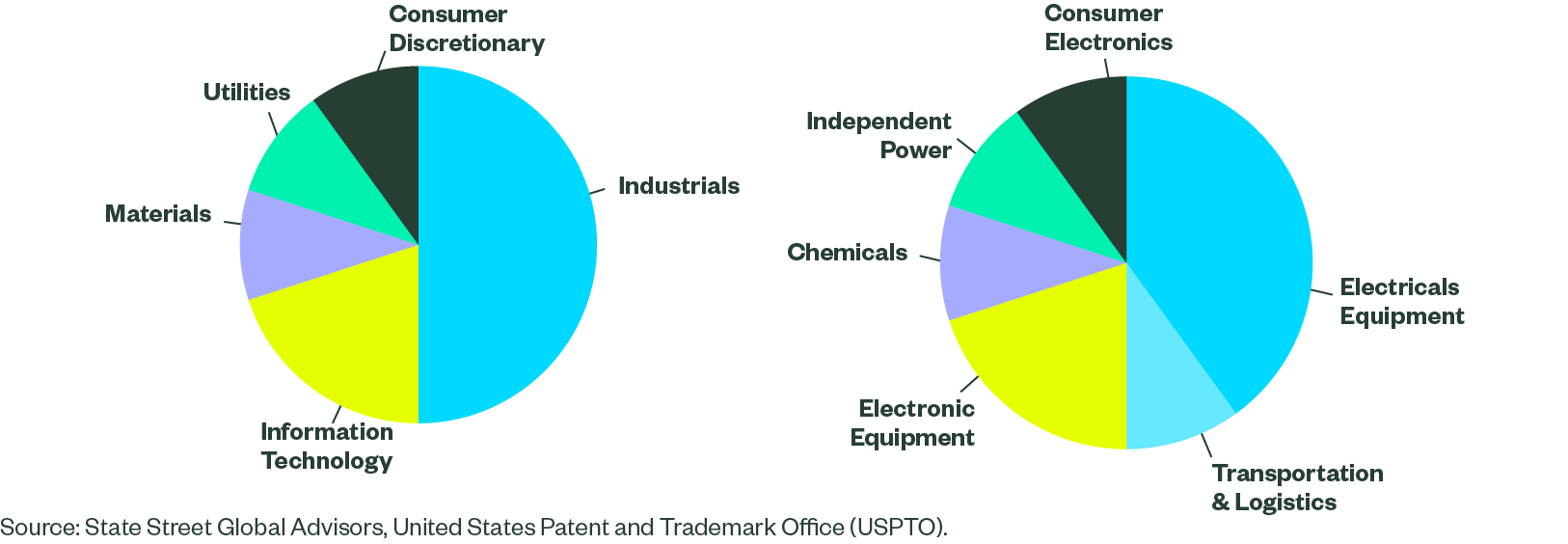

As a case study, we examine the top 10 stocks with highest ‘patent portfolio similarity’ to a parent stock. We then seek to observe whether patents-data based Innovation linkages tell us anything meaningful about the similarity between firms across sector and industry classifications. Below are two such examples for Amazon and Tesla. In the charts below, the inner concentric circle demonstrates the Industry classification of those top 10 similar firms, while the outer circle demonstrates Sector classification for those top 10 similar firms. We can clearly see that the Innovation profile of Amazon and Tesla, despite both being members of the Consumer Discretionary sector, are quite dissimilar. On one hand, Amazon has the largest Innovation linkages with IT and Consumer Services firms; on the other hand, Tesla has largest Innovation linkages with Industrials and Electronic Equipment. This case study clearly illustrates that patents uncover a unique type of interconnectedness between companies that traditional sector or industry classifications don’t capture.

Figure 1: Amazon Innovation Linkages

Figure 2: Tesla Innovation Linkages

Research has shown that there is a correlation in the stock performance of companies within the same industry, as well as those linked by supply chains or analyst networks. Given the critical role intellectual property plays in a company’s valuation, we observe that the stock prices of businesses with comparable patent portfolios tend to move together, demonstrating what is known as technologically linked momentum. This distinction provides investors with an additional advantage. By integrating this technology momentum aspect into their existing strategies, investors can potentially gain a better understanding of the dynamics of asset prices that goes beyond traditional sector/industry-based analysis.