G10 Currencies to Remain Range Bound

Risk-sensitive currencies led the G10, while the Japanese yen and Swiss franc lagged. With the dollar stuck in a range, we expect most other G10 currencies to follow suit. Tactically, we are now negative on JPY and NZD.

We expect US data to continue to soften as labor markets ease and consumers feel the pinch of tepid — though positive — real income growth. This should keep modest pressure on the US dollar, though not enough to push it decisively out of its range. The US remains one of the highest-yielding and fastest-growing economies in the G10, with the added benefit of safe-haven behavior should the fully valued equity and credit markets experience choppier performance — something we think is likely. As we head through the summer, US election risk is also likely to support the US dollar.

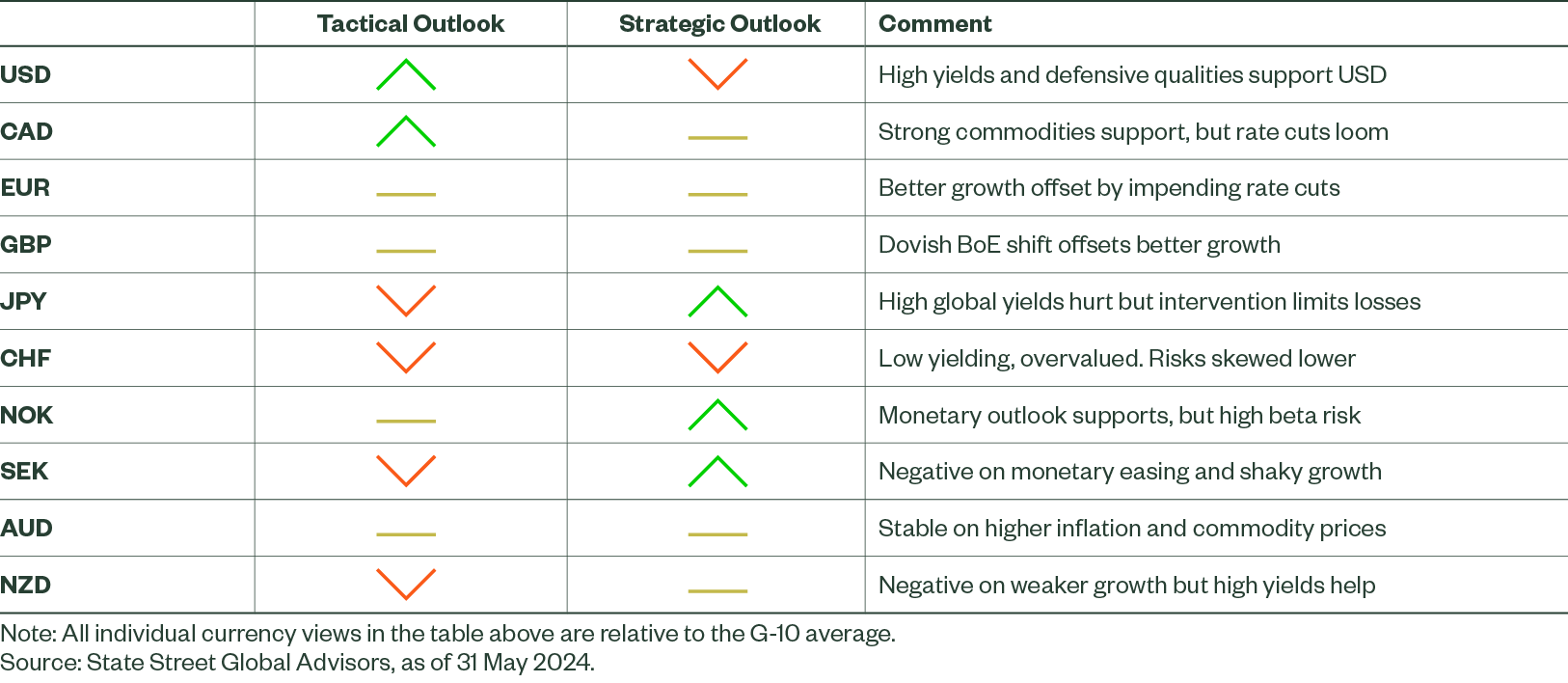

Figure 2: May 2024 Directional Outlook

With the dollar stuck in a range, we expect most other G10 currencies to follow suit. June brings a low-conviction environment — with only a slight negative US dollar bias — and volatility in specific currencies driven largely by idiosyncratic surprises in economic data or central bank actions. However, we do not foresee any major shifts in current trends that could alter the prevailing macro narrative, only modest positive or negative shifts in growth outlooks and the timing of expected central bank policy changes.

US Dollar (USD)

We have long held the view that the US dollar is likely to fall at least 10–15% over the coming years, but it is currently in a noisy transition period from a bull to a bear market — a protracted range-trading environment. We recommend long-term investors hedge a healthy portion of their US dollar exposure, while US investors should cut back on their foreign currency hedges.

For those with a shorter horizon, we believe the US dollar is rangebound, with risks skewed slightly lower in June if employment and inflation data continue to soften. However, over the multi-month horizon, the dollar remains the top-ranked currency in our models due to high interest rates, a fragile global environment (as defined by our macro regime model), and strong US equity market performance. The high likelihood that the European Central Bank (ECB), Bank of Canada (BoC), and perhaps the Bank of England (BoE) will cut interest rates before the Federal Reserve (Fed) should also provide near-term support. The Fed may lag other central banks, but ultimately over the next 6–12 months, the closing of the growth gap with and the start of the Fed’s easing cycle should unlock dollar weakness — barring a severe economic or political shock.

Canadian Dollar (CAD)

Contrary to the weaker domestic demand data and high risk of a rate cut, our model remains positive on the Canadian dollar over the near term. Much of this optimism stems from the recent uptrend in commodity prices — though that trend has been rolling over with oil prices in the past couple of weeks. Thus, with weak local demand, deceleration of the commodity price trend, and a likely upcoming rate cut, we see risks around our model signal and Canadian dollar performance skewed lower.

In the long term, the Canadian dollar looks more stably attractive against a number of currencies. It is cheap in our estimates of fair value relative to the euro, the Swiss franc, and the US dollar.

Euro (EUR)

We maintain a neutral view on the euro against the G10 average and a negative view against the US Dollar. On the positive side, we have seen better economic data and a larger improvement in year-ahead growth forecasts for the European Union (EU), as well as improved short-run relative equity market performance.

On the negative side, continued disinflation trends suggest a potential rate cut from the ECB in June, contrasting with the expectations for the US, Australia, and Norway, to maintain higher rates for longer. While currency markets have been mostly focused on relative monetary policy outlooks, the expectation for structurally low growth driven by high levels of EU regulation, low productivity, and a difficult outlook for the German growth model is likely to limit enthusiasm to drive the euro higher over the near term.

British Pound (GBP)

Our factor models have moved back to neutral on the pound from negative at the start of May, driven largely by improved economic data, including a higher one-year-ahead consensus growth outlook. That said, we are far from positive on the pound. It has appreciated significantly this year due to positive economic surprises and higher-than-expected inflation. However, positive surprises are increasingly difficult to achieve, now that expectations have reset from recessionary fears to modest recovery.

Although inflation has been stubborn, it is trending lower. We see a high probability of an August rate cut, aligning with BoE Governor Bailey’s comments more than with market expectations of a first cut by November. Consequently, we foresee risks of fading yield support for the pound relative to current market expectations.

Our long-run valuation model has a more positive pound outlook, as the currency screens as cheap relative to fair value. However, we expect sticky inflation and chronically weak potential growth post Brexit to likely to weigh on fair value, somewhat limiting that potential pound upside over the next several years.

Japanese Yen (JPY)

The recent strength in US inflation and growth makes the timing of Fed rate cuts and sustained yen appreciation highly uncertain. So, as long as US growth and inflation keep the Fed on the sidelines, we expect the yen to remain weak and weaken further if US yields break to new highs. That said, the ongoing intervention in support of the yen, our expectation of limited additional upside in US yields, and the large short yen positions in the marketplace should limit further yen downside over coming months.

In the long-term, we see a rally in the yen of around 20% over the next 2–3 years versus the US dollar (a fall in the USD/JPY exchange rate). This move is consistent with an anticipated compression in USD/JPY interest rate differential by 200–250 bps, potentially bringing the USD/JPY down to 125–130 versus the US dollar from its current level in the mid-150s.

Swiss Franc (CHF)

We are negative on the franc in both our tactical and strategic models. It remains the most expensive G10 currency as per our estimates of long-run fair value, has the second lowest yields in the G10, and inflation is falling faster than expected. The real trade-weighted franc is still at the upper end of its 30-year range and with the Swiss National Bank (SNB) cutting rates and open to intervention to prevent franc strength, we believe we are in the early stages of a prolonged reversion lower toward our estimate of its long-term fair value.

However, there is room for a modest, but temporary recovery in June, due to the recent rebound in inflation and our expectation that the central bank will maintain its current stance at the June meeting.

Norwegian Krone (NOK)

Despite lackluster growth data, our models maintain a neutral-to-slightly positive view on the krone — it is the third strongest signal behind the US and Canada. Core inflation remains uncomfortably high at 4.4% YoY. At that level, we expect the Norges Bank to remain hawkish longer than the ECB, BoE, Riksbank, and BoC.

Our economic growth-based models remain pessimistic on the krone, but from the perspective of both short-term valuation relative to commodities and expected yields, it is more of a buy than a sell against most G10 currencies. In the long-term, the outlook is more convincingly positive. The krone is historically cheap relative to our estimates of fair value and is supported by steady long-run potential growth.

Swedish Krona (SEK)

Our models shifted negative on the krona in April and remain so going into June. While we welcome the rebound in Q1 GDP, growth continues to look sluggish in Q2. The easier relative Swedish policy monetary outlook favors sustained krona weakness. We believe that the Riksbank will follow its May cut with 2–3 additional cuts this year, which will be very welcome news for the heavily indebted household and property sectors, but not beneficial for the currency over the short run. Although the currency is very cheap to long-run fair value and cyclically depressed, at this point, we struggle to see a catalyst for a sustained relief and extending the May rally.

Australian Dollar (AUD)

Our models remain in the neutral-to-negative range for the Australian dollar, slightly weaker than the signal going into May. On the positive side, our growth signal is improved very slightly and market expectations for a steady monetary policy rate are favorable compared to the growing number of central banks expected to cut rates in Q2–Q3. However, recent commodity price pullbacks and a sluggish, albeit positive, growth outlook are weighing on the currency.

In the long term, the Australian dollar outlook is mixed. It is cheap against the US dollar, the British pound, the euro, and the Swiss franc, and has room to appreciate, but is expensive against the yen and the Scandinavian currencies. The Chinese story is less positive, with a structural downtrend in growth and a shift towards domestic consumption and higher value-added industries, which may gradually reduce the growth rate of Australian commodity export demand.

New Zealand Dollar (NZD)

We are negative on the New Zealand dollar over the near term, though less negative compared to last month due to improved commodity prices. Ongoing growth challenges and the weak external balance — the current account is -6.9% of GDP — more than offset the benefit of New Zealand’s high yields. We also see some support from stabilization in China, but risks surrounding the China–US relationship are likely to increase as the US election draws near.

In the long-term, our New Zealand dollar outlook is mixed. Our estimates of long-run fair value suggest that it is cheap versus the US dollar and the Swiss franc and has ample room to appreciate, but is expensive against the yen and the Scandinavian currencies.