Real Assets Insights: Q3 2024 Rate Sensitive Assets Shine

Real assets strategy posted a positive quarter and is poised to benefit from additional Fed rate cuts, geopolitical uncertainty, and a positive economic outlook.

The global economy showed signs of resilience in Q3 2024, with growth in the services sector offsetting weakness in manufacturing. Although global business activity continued to expand in September, the rate of expansion slowed. The Eurozone, Canada, and China showed signs of contraction or stagnation, while in contrast, the United States (US), the United Kingdom (UK), and Japan all experienced growth over the last quarter. The labor market exhibited signs of cooling, and inflation continued to decline. Geopolitical tensions worsened in the Middle East and Ukraine, contributing to a complex global economic landscape.

Quarter in Review

It was an active quarter for central banks with the US Federal Reserve (Fed) commencing its much-awaited rate cutting cycle. The Bank of England delivered its first cut in August and offered cautious guidance and the European Central Bank (ECB) cut again in September, after making the first rate cut in June. Lastly, the Bank of Japan (BoJ) delivered a 15 bp hike in a hawkish pivot in August, which introduced significant volatility as the yen carry trade unwound.

Despite increased market volatility, risk assets performed favorably over the quarter and ended with positive gains. Emerging markets outperformed developed markets and both groups posted positive returns. Chinese equities rallied after the announcement of new stimulus in China, which drove emerging market returns higher.

US Treasury yields fell notably over the quarter, and the curve steepened significantly with the 2-year yields dropping the most. The US dollar posted its worst performance since Q4 2022, which resulted from the combination of the BoJ executing the largest rate hike since 2007 and the unwinding of yen carry trades in August. Commodity performance was muted.

Real assets started the quarter with more confidence that the decline in US inflation would finally lead to a Fed rate cut. Many real assets gained in value over the quarter, while debate ensued as to how much the cut would be. The Fed did cut by 50 bp, larger than what was expected by many.

The real assets strategy had positive returns for each month in the third quarter of the year. The strategy’s return was 6.3%, ahead of the composite benchmark by 9 bp, with global infrastructure contributing the most to the positive return. The longer-term returns remain solid, and since its inception in 2005, the strategy continues to maintain its lead over the composite benchmark by over 20 bp annually, with an annualized return of 4.3%.

Commodities showed small gains for the quarter as declines in energy offset gains from metals and agricultural commodities, overall going up by 1.0%. Commodities started off the quarter strong with positive returns in July, but returns were flat in August, and most of the positive gains from the beginning of the quarter were erased with negative performance in September. Growing concerns around the health of the global economy weighed on oil prices. The energy sector returned -11.2% for the quarter as both oil and gas declined. Oil saw its worst quarter so far this year, and its second worst since 2022, despite a weaker dollar, elevated geopolitics, and China stimulus.

The industrial metals complex advanced by 3.0%, led by zinc (+5.3%) and copper (+4.1%). The precious metals sub-index rose significantly, up 11.3%, led by gold. A weaker dollar and the start of the Fed easing cycle served as tailwinds for gold (+12.9%) and silver (+6.3%). Gold registered its largest quarterly increase since the first quarter of 2016, setting multiple all-time closing records along the way. The agricultural sector was up 3.7%, driven by strong coffee and sugar amid extreme weather conditions in major coffee-producing countries fueling crop concerns. On the other hand, soybean and wheat were the detractors due to ample supply.

Global natural resources performed better than commodities, led by the metals and mining companies that gained on improved metals prices. Solid demand for natural resources, such as copper and lithium for electric vehicle production, and lower yields have driven prices in the upward direction. However, the energy group detracted for the quarter. Overall, global natural resource stocks rose 4.6% for the quarter.

Infrastructure equities also performed notably well this quarter, with highest gains in August and September. With interest rates in a declining trend during period, infrastructure stocks performed well, rising by 13.2%, with utilities contributing 7% to that return in the quarter.

US real estate investment trusts (REITs) continued to outperform the broader market due to the declining yield environment. In this quarter, most property sectors were positive with the most notable performances by office and self-storage, up over 20%. Healthcare, industrial and retail REITs closely followed behind.

TIPS underperformed compared to Treasuries in Q3 2024. The full TIPS Index (Barclays Series-B) returned 4.18% and the 1–10-year returned 3.43%, while Treasury indices returned 4.84% and 4.22%, respectively. Headline US consumer price inflation (CPI) declined from 3.3% (in May 2024) to 2.5% (in August 2024), while core readings also declined from 3.4% (in May) to 3.2% (in August), encouraging the Fed to cut rates more than expected and guide for an accommodative policy stance.

Investment Outlook

Sentiment around energy remains extremely pessimistic with speculative positioning very low, suggesting investors are positioned for lower energy prices. However, we are more optimistic on energy prices and believe the supply and demand fundamentals are more balanced than what is currently priced in. Oil demand has remained strong, hovering around 103 mbd, while global oil stocks have trended lower. Concerns over OPEC+ plans to add barrels and increase global supply have weighed on markets, but threat of Saudi Arabia looking to flood the market to gain market share seems unlikely. It is more probable that their main goal is actually to keep markets balanced given the tensons in the Middle East. Looking forward, heightened geopolitical risks, China’s stimulus, improved manufacturing activity from interest rate cuts, the potential refilling of the Strategic Petroleum Reserve, and overall demand fueled by data center improvements for AI could all provide tailwinds for energy prices from current levels.

Weakness in manufacturing activity and slower growth in China have weighed on demand for industrial metals. Uncertainty leading up to the US election and the lack of clarity around the stimulus in China could be a headwind over the next few weeks. However, numerous potential tailwinds could drive metals higher towards the end of 2024 and into 2025. Clarity around US policy, further Fed rate cuts, the ongoing decarbonization of global economies, and better supply and demand fundamentals could propel the performance of industrial metals.

The outlook for precious metals remains sanguine. Despite record prices, gold continues to benefit from numerous tailwinds including heightened geopolitical tensions, investor, and central bank demand, expanding deficits, and the potential for further rate cuts. Silver should benefit from a soft landing and the potential pickup in manufacturing activity as central banks continue to reduce rates. Additionally, the ongoing green transition should support silver prices.

Weakness in China is a headwind for commodities and emerging market countries, but natural resource equities offer good value with attractive price-to-earnings measures and should benefit from falling rates. Furthermore, long-term structural trends such as de-globalization, energy transition, and increased power generation combined with capital expenditure restraint should support the equities. Natural resource equities are leveraged to commodities and could benefit if geopolitical tensions push commodity prices higher.

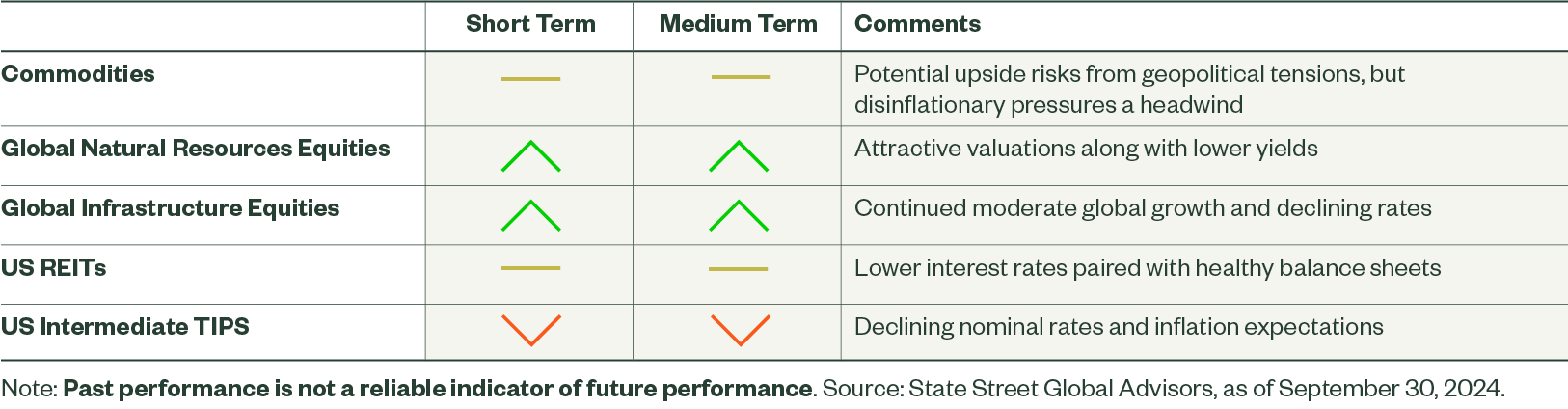

Figure 3: Short- and Medium-Term Directional Outlook

Public infrastructure valuations appear well supported with price-to-earnings below 10-year averages. The group should continue to benefit from falling yields as the Fed moves forward with additional rate cuts into 2025. Further, the defensive attributions of infrastructure companies should provide support if economic growth softens as expected. Finally, utilities should benefit from the buildout of renewable projects, such as electric charging stations, while larger power generation needs from AI and data centers should continue to bolster the sector’s performance.

Public real estate rebounded sharply in the third quarter as yields fell and investors anticipated lower rates. Macroeconomic conditions have become a potential tailwind for REITs with economic growth proving resilient, and the Fed embarking on a rate cutting cycle. Fundamentals remain steady with disciplined balance sheets, positive net operating income and solid occupancy rates. However, the possibility of heightened volatility, a more gradual cutting cycle than initially expected, and the potential for rates to move higher tempers the outlook for REITs.

Real yields offer competitive returns with the 10-year around 1.74%. Inflation-linked bonds could also rally and perform positively as the Fed continues to cut rates. Additionally, breakeven rates could rise heading into the election or if inflation starts to tick back up again. However, the gradual decline in inflation should limit the ability for breakeven rates to materially rise leading investors to focus more on gold and nominal treasuries for any risk-off positions.

Inflation and Real Assets

While we acknowledge inflation has moved lower, we look for inflation to continue to move towards the Fed’s target. Although our view has not changed, we still want to highlight potential risks that could challenge this outlook. These risks could either create that second wave of inflation which has historically materialized or keep it sticky through next year. While the most recent CPI reading was not outright poor, it does highlight some of the components’ stickiness.

As we have mentioned before, goods deflation is less likely to be a major support given current levels, and this could be tested by delicate labor situations (i.e., US dock workers, Boeing strike, Stellantis auto workers) and solid demand. The Fed has chosen to focus on the second part of their dual objective, the labor market, as weaker labor markets can create economic softness. However, by our account, the labor market is solid and recent data has calmed fears. Employment data in September was strong across the board with nonfarm and ADP payrolls reflecting broad-based job growth.

The higher unemployment rate had been inflated due to an increased participation rate. Recently, the unemployment rate fell with the labor force participation rate holding steady, implying an increase in job creation. Furthermore, wage growth accelerated for a second straight month while the US savings rate was revised higher to 5% and the amended gross domestic income printed stronger than initially reported. Both indicators suggest the US consumer has more excess savings than previously believed, which in turn, should support more consumption coming into the holiday season. While month to month data has been volatile, wholistically, the labor market remains sound and consumption appears supported. Continued demand from increased savings, and any revived tightness in labor markets could challenge disinflation, especially with the Fed on pace to gradually reduce interest rates further.

Almost universally, expectations for lower inflation are dependent on a further reduction in rental inflation. However, significant downside could be limited given the current fundamentals in both the rental and housing markets. Housing prices have continued to move higher despite rising rates as seen with the S&P/Case-Shiller US National Home Price Index continuing to grind higher. It is possible that prices will continue to rise with greater demand from falling mortgage rates combined with a significant increase in immigration and limited supply.

The knock-on effect from higher house prices is higher rent prices. Some of the increased demand will be offset by better supply from current homeowners that may be more willing to move after being locked into low mortgage rates, but they will also need to find new housing. While housing completions have jumped over the past year, the pace of new supply is likely to slow given building permits, housing starts and housing units under construction have been trending lower for both single unit and multi-unit housing (Figure 4).

Further, rental measures in the CPI tracked the Zillow Observed Rent Index (ZORI) before COVID-19 but have significantly lagged other measures over the past four years (Figure 5). The different rent measures should converge over time, but with real time rent measures like the Apartment List median rent paid and the ZORI having leveled off on a year-over-year basis, we could see further increase in the CPI rent measures. Without a meaningful pickup in unemployment or an economic recession, easing rent pressures could be less beneficial than anticipated.

One last component to keep an eye on is used vehicle prices, which tend to track the Manheim Used Vehicle Value Index with a one quarter lag (Figure 6). Used vehicle prices have been moving higher recently and tighter inventory could keep upward pressure on prices moving forward. Given the supply issues following the COVID-19 pandemic and higher interest rates, fewer cars were leased in 2021. This means, current turn-ins, a key source of used vehicles, are lower and may not return to normal for a couple more years. With affordability on new cars low and interest rates falling, demand for used vehicles should remain supported.

Gold Prices Should Remain Supported in the Near Term

We continue to highlight gold in this quarterly insight and for good reason – the yellow metal continues to achieve new highs. Gold has benefited from numerous tailwinds, many of which are still supportive of future price appreciation. To that end, we have seen 2025 price estimates ranging from US$2,600/oz up to US$3,000/oz and we believe that gold should remain well supported over the next few months. Looking forward, macroeconomic uncertainty and the potential for higher equity volatility in the near term bode well for gold. The Fed has begun their easing cycle, which provides another support, but the magnitude will depend on the pace of Fed cuts moving forward. Chinese demand may have dipped, but demand in India is high with the World Gold Council noting that gold imports from January to August reached US$32 billion, up 30% YoY, helped by the recent reduction in import duties to 6% from 15%, which could also induce restocking by retailers.

In China, recent stimulus measures have drawn skepticism. Should the People's Bank of China succeed in its effort to support a weak housing market and low consumer demand, gold demand would likely soften. However, if supports fall short, Chinese retail buying could improve. Central bank demand eased over the first half of 2024 but has ticked up more recently as central banks stay dedicated to increasing their gold holdings. Given the ongoing geopolitical tensions and desire by some countries to ease off the US dollar, central banks should continue to buy gold. Speculative interest has been a driving factor and may limit upside, but gold ETF holdings should be a major driver moving forward. ETF gold holdings have historically increased as prices rose, but there has been a divergence which could reverse.

Real Assets Strategy

At State Street Global Advisors, we have a seasoned, diversified multi-asset strategy that combines exposure to a broad array of liquid real asset securities that are expected to perform during periods of rising or elevated inflation.

The asset allocation is strategic and utilizes indexed underlying funds. It is being used by a variety of clients as a core real asset holding or as a liquidity vehicle in conjunction with private real asset exposures. The strategy is meant to be a complement to traditional equity and bond assets, providing further diversification, attractive returns, and a meaningful source of income in the current environment.