Global Growth Slows, With Trade Wars the Biggest Risk

- Global growth will continue to slow in 2019.

- We expect synchronized monetary tightening in most advanced economies.

- Inflation is likely to remain contained.

- The United States will continue to stand out with ongoing fiscal stimulus. Trade remains the biggest downside risk.

More from our 2019 Global Market Outlook

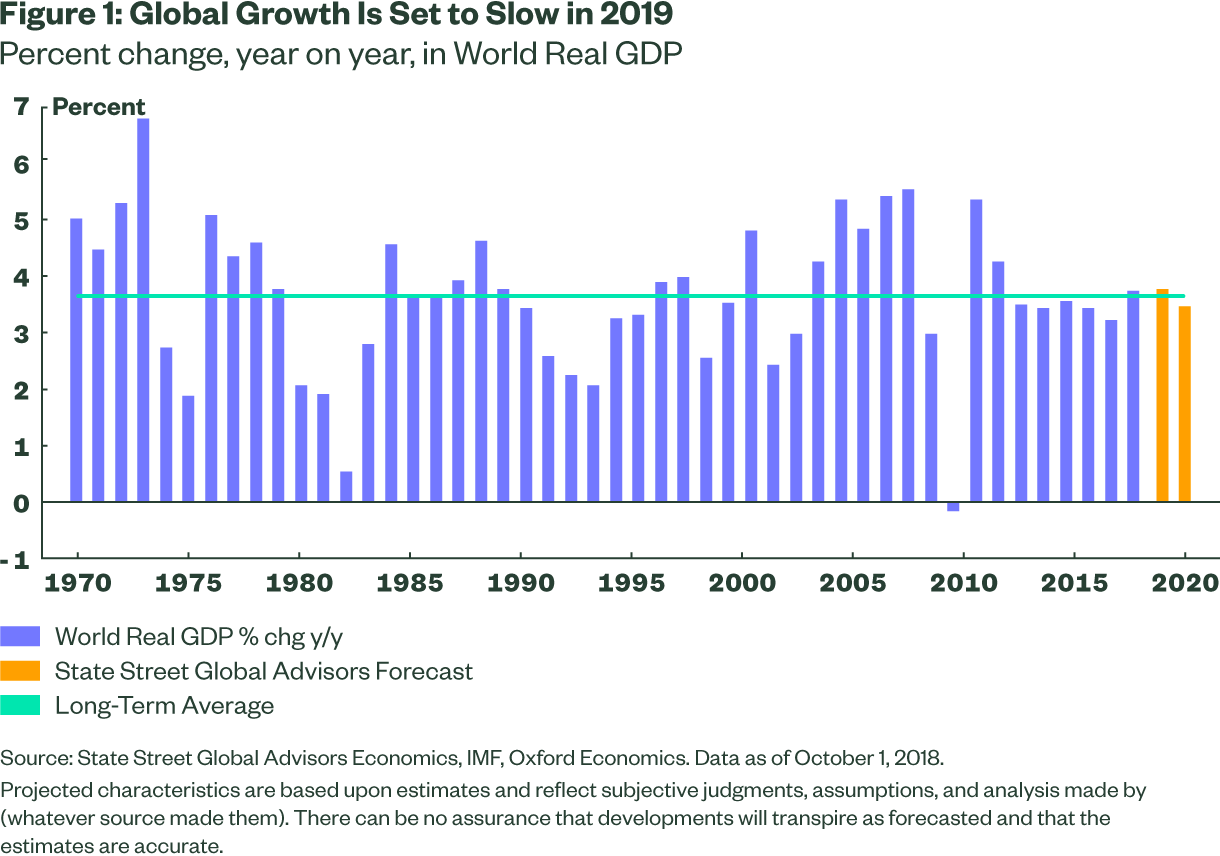

We expect global growth to slow from 3.8% in 2018 to 3.5% in 2019, with risks skewed to the downside reflecting continued uncertainty around trade disputes, even after the US mid-term elections (see Figure 1). Amid one of the longest economic expansions in history, we have witnessed “mini-cycles” over the past few years; growth slowed in 2016 and reaccelerated in 2017-2018, partly because of the effects of the oil price rebound on US activity, and looks set to slow again in 2019, partially because the fiscally induced late-cycle “sugar rush” will end in the United States.

Inflation Still Contained

In 2018, we finally began to see some signs of wage inflation, as labor markets in major economies continued to tighten; however, this is still a very slow process. Together with our expectation that oil prices will hover around $80 a barrel in 2019, we see no indication of a sustained pickup in inflation. Energy prices have assumed the dominant role in the evolution of inflation since mid-2014. Indeed, because of the extent and timing of the oil price decline, inflation in the advanced economies plunged to just 0.3% in 2015. Inflation has subsequently reaccelerated as oil prices have recovered. But it is projected to slow slightly next year as oil prices drift sideways while core inflation fails to accelerate appreciably.

Synchronous Tightening Cycle

With advanced economies growing, though at a slower rate, and inflation contained, we expect to see a convergence of monetary tightening in 2019, with the notable exception of Japan. We expect the US Federal Reserve (Fed) to hike interest rates three times during the year, especially given the current momentum in the US economy. In addition, the European Central Bank, Bank of England, Bank of Canada and the Reserve Bank of Australia all look likely to raise interest rates in the coming year. Meanwhile, inflation remains too far below target for the Bank of Japan to tighten, especially given the country’s commitment to a value-added tax (VAT) hike next October. With the Fed continuing to normalize its balance sheet, global liquidity should continue to diminish, adding to the challenges of higher rates.

US Outperforms

While the rest of the world lost considerable momentum in 2018, the US experienced further acceleration, with broad-based strength in the mining and manufacturing sectors. Growth looks set to slow to 2.6% in 2019 after a strong showing of 2.9% in 2018. (See Figure 2 for GDP forecasts.) The fiscal multiplier of the Tax Cuts and Jobs Act (TCJA) may not be large, but should nonetheless be accretive to growth in 2019. The combination of tax cuts, immediate expensing of capital expenditures, the mandatory repatriation of overseas profits and a broad deregulation push should incentivize capital expenditure.

Trade policy is the single most important source of uncertainty and may act as a deterrent to both the capex wave already under way and to consumer spending.

Trade Uncertainty

Trade policy is the single most important source of uncertainty and may act as a deterrent to both the capex wave already under way and to consumer spending. But the appreciation of the US dollar against the yuan has thus far blunted the immediate impact of tariffs. Some degree of burden-sharing among importers, producers and consumers has also provided a cushion as has an augmented household savings rate. So while a fully-fledged trade war undoubtedly would be negative, how that plays out in the end will be subject to many competing forces.

The UK and Eurozone Struggle

Outside the US, advanced economies face stronger headwinds in 2019, mainly because of continued geopolitical uncertainty. In the UK, the most serious question as we head to the March deadline for leaving the European Union is whether a deal will be reached by a British government beset by internal dissent and Brussels negotiators with little incentive to make exit easy, lest they encourage further breakaways. Brexit uncertainty has certainly taken a toll on the UK economy, particularly business investment. Sluggish wage gains and slowing home price appreciation has hindered consumption, despite a tight labor market where the unemployment rate continues to hover around a multi-decade low of 4.0%. After UK growth slowed to an anemic 1.3% in 2018, the slowest since the global financial crisis, we see only a slight improvement, to 1.4%, in 2019. Our base case remains that a framework for leaving will be agreed, but all bets are off if a no-deal, “cliff-edge” Brexit occurs. After surprisingly strong growth in 2017, which brought unemployment down to 9.1%, eurozone leading indicators weakened materially in 2018. We expect growth to slow to 1.6% in 2019 compared to 1.9% in 2018 and 2.5% in 2017. Europe continues to be challenged by the structural contradictions inherent in a monetary union without automatic fiscal transfers. Structural reform since the global financial crisis has been limited to a handful of countries, while Italy still faces enormous fiscal challenges. Nativist movements across the continent continue to attack the European Union because of chronically divergent economic performance and the absence of a coherent immigration policy. European parliamentary elections in May could see significant gains by EU-skeptic parties.

Japan Brings Up the Rear

Japan’s economic performance was highly uneven in 2018, with an outright contraction in the first quarter followed by a solid rebound in the second. Natural disasters in mid-2018 only added to data turbulence. 2017 almost certainly set the high-water mark at 1.7%, but growth remained above potential in 2018 so the labor market simply kept tightening, limiting employers’ access to suitable workers; there are already 163 job vacancies for every 100 applicants.1 Because the October VAT hike comes so late in the year, it will have a limited effect on the 2019 annual number, allowing growth to hold up at 1.2%. But 2020 could be a very different story.

Elsewhere in advanced economies, we believe Australia and Canada will also slow in 2019, but overall fundamentals seem solid, although household debt as a share of GDP is higher in Canada today than it was in the US in 2007.

Risks are skewed to the downside in emerging markets amid the escalating trade spat between the US and China and potential missteps in that globally critical relationship.

Emerging Markets on Shakier Ground

Under the weight of intensifying trade tensions, a strengthening US dollar, rising financing costs and less accommodative domestic policy settings, broad emerging markets growth looks poised to slow more noticeably in 2019, to 4.5%. While this remains a decent pace, risks are skewed to the downside amid the escalating trade spat between the US and China and potential missteps in that globally critical relationship. Moreover, the emerging markets recovery in 2017 had a very strong cyclical component, which has since dissipated, refocusing attention on fundamental challenges such as high debt levels and the lack of structural reforms.

Brazil, Russia and India all struggled against headwinds in 2018, which do not appear to be dissipating in 2019. In Brazil, disappointment over the lack of reform triggered a sharp depreciation of the real in 2018, so investors will be closely watching the new government’s reform signals in 2019. Russia’s recovery from its recession in 2015-2016 continues to be shallow and slow, and its long-term economic performance remains challenged by a stark lack of economic diversification and extremely poor demographics. Amid the broader emerging markets turmoil in the second half of 2018, India’s rupee hit record lows against the US dollar, forcing the central bank to shift monetary policy gears in support of the currency.

Greater Downside Risks for China

But all eyes will be on China in 2019. Even before the ratcheting up of the trade dispute with the US, we were expecting growth to moderate amid a multi-year deleveraging effort. Trade tensions likely render that slowdown more acute as deleveraging efforts take a back seat to the more immediate need to stabilize the economy. We see growth slowing toward 6.0% in 2019, although the outlook is exceedingly murky because so much depends on how severe the trade dispute becomes. In any event, China’s elevated debt-to-GDP ratio provides considerably less scope for aggressive debt-financed stimulus than several years ago. The longer the trade spat continues, the more likely we think it is that Chinese policymakers begin to diversify the response channels, deploying a range of other tools, including guiding the exchange rate lower and reassessing China’s foreign exchange reserves policy. While headlines in 2018 focused on the fiscal challenges of Argentina, Turkey and South Africa, we saw dramatic outflows from both emerging markets equities and debt. The big emerging markets question for 2019 is whether a faster-than-expected slowdown in China or other idiosyncratic risks in smaller emerging markets countries could lead to broader market contagion.

1 Japanese Ministry of Health, Labor and Welfare

Glossary

Hike: An increase in interest rates by a central bank.

Tightening cycle: An environment in which a central bank is raising interest rates.

Important Risk Information

All material has been obtained from sources believed to be reliable. There is no representation or warranty as to the accuracy of the information and State Street shall have no liability for decisions based on such information. The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street Global Advisors' express written consent. This document may contain certain statements deemed to be forward-looking statements. Please note that any such statements are not guarantees of any future performance and that actual results or developments may differ materially from those projected in the forward- looking statements. Generally, among asset classes, stocks are more volatile than bonds or short-term instruments. Government bonds and corporate bonds generally have more moderate short-term price fluctuations than stocks, but provide lower potential long-term returns. U.S. Treasury Bills maintain a stable value if held to maturity, but returns are generally only slightly above the inflation rate. Currency Risk is a form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged. Investing involves risk including the risk of loss of principal.