Growth Fuels Currency Moves

As central banks pivot towards easing and inflation retreats, growth takes center stage in driving currency markets. Shift in growth outlooks will drive movements in high-beta currencies, while the US dollar faces new challenges. We are now positive on JPY and CHF, and turned negative on EUR and GBP.

As inflation continues to decline and central banks accelerate their easing cycle, we shift our focus to growth as perhaps the most crucial driver of currencies. Growth will shape how lower global yields impact currencies. Under the two scenarios — hard landing versus soft — the outcomes are very different. If central banks are easing into a recession or an uncomfortable soft landing, then the US dollar would likely strengthen against most high-beta currencies, underperform the yen and possibly the franc, while remaining flat or slightly lower against the euro. In a true soft-landing scenario, the US dollar would steadily decline against everything, with high-beta currencies — Norwegian krone, Australian dollar, New Zealand dollar — and to a lesser extent, British pound and Swedish krona leading the way higher. The euro, Canadian dollar, and yen would do well versus the US dollar, but likely underperform those higher-beta currencies. The Swiss franc may beat the US dollar in either scenario, but likely may lag most other currencies as it becomes a more attractive carry funding currency.

Our base case is for an uncomfortable soft landing: the economy avoids a recession, but employment and consumption slow enough to spur periods of recession anxiety. In this context, the US dollar will enjoy periods of safe-haven demand, but we believe the bias should be to sell into those rallies, expecting a breakdown below its two-year range. The yen appears to be the best all-weather currency, benefiting in both scenarios as it wins in a soft landing and wins big in a hard landing. Higher-beta, commodity-sensitive currencies will likely be most attractive in a soft landing, though they remain high-risk assets. They would be hard-hit by additional volatility shocks, which are increasingly probable as growth slows and election/geopolitical risks remain elevated.

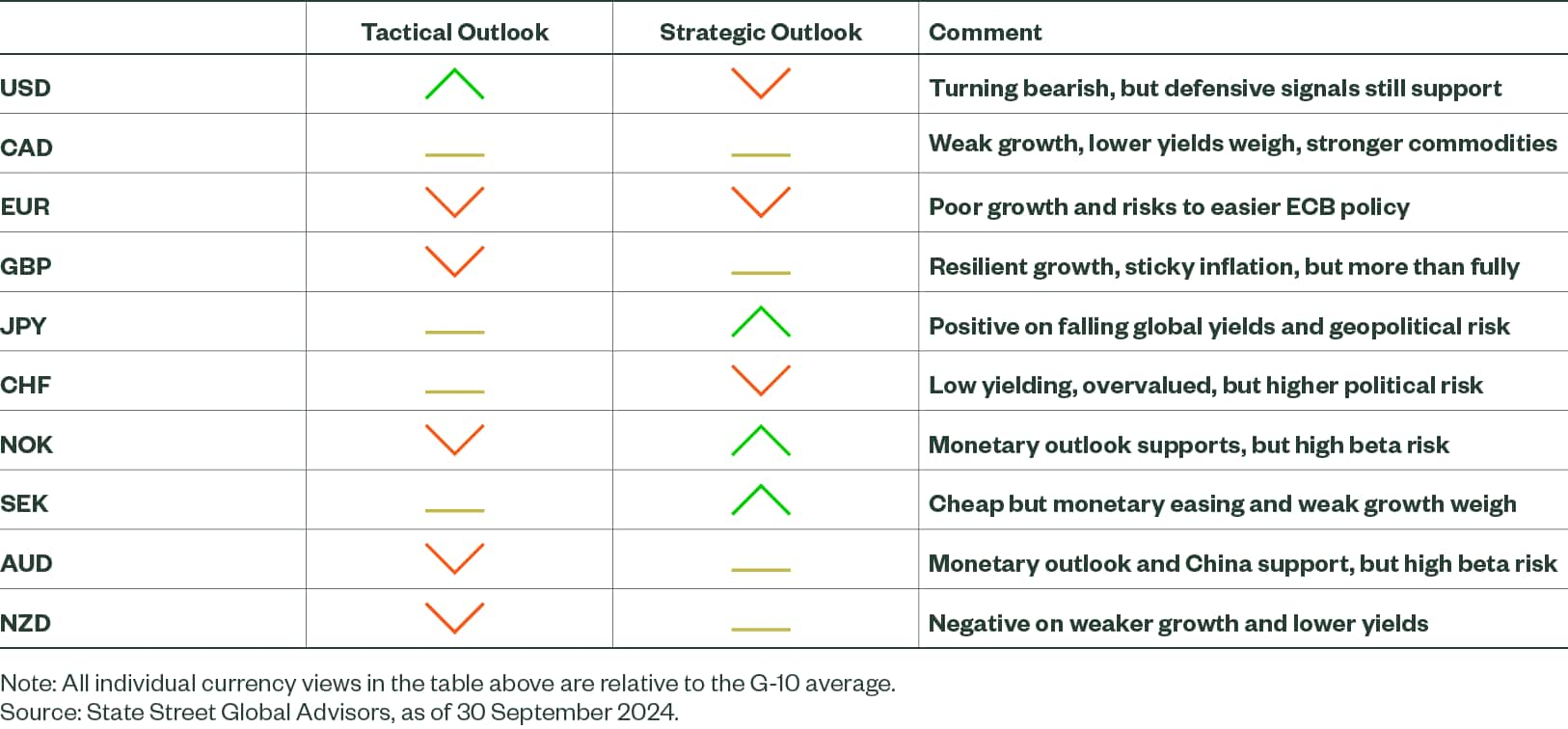

Figure 2: September 2024 Directional Outlook

US Dollar (USD)

We have long held the view that the US dollar is likely to fall at least 10–15% over the coming years as US yields and growth revert to the G10 average, and the US grapples with high fiscal and current account deficits. For investors with a two-year or longer horizon, we have strongly recommended short US dollar positions. The transition from a bull market to a bear market has been bumpy, but we believe it is now time for tactical investors to be biased towards selling rallies rather than buying dips. In other words, we see the end of cyclical US exceptionalism clearly on the horizon and approaching fast.

That said, a dollar bear market starting now or even in the next six months is far from certain. This would require an obvious soft landing for the economy alongside a steady normalization of US interest rates. A recession — or even the fear of one — could temporarily support the dollar, as would any anxiety surrounding the upcoming US election. US rates are likely to remain relatively high compared to the G10 average, while US equities continue to outperform, and the US remains a relative safe haven as the global reserve currency. This makes it difficult to buy more cyclically sensitive currencies against the dollar at this point, as they are vulnerable to recession risk, equity volatility, and the medium-term downtrend in commodity prices.

Canadian Dollar (CAD)

Our tactical view on the Canadian dollar shifted from mildly negative to mildly positive, though it remains largely in the neutral range. This shift was driven entirely by the rebound in commodity prices during the latter half of the month, a move that may persist if China unveils additional stimulus. Otherwise, our growth indicators remain weak, and the monetary outlook remains dovish, suggesting that a better commodity outlook may support the Canadian dollar but is insufficient to drive a significant appreciation. The outlook may improve heading into next year. Since the Bank of Canada cut rates earlier and at a faster pace than most other central banks, it is also likely to see the benefits of those cuts earlier as well, which is reflected in improved growth expectations for 2025.

Euro (EUR)

We have shifted to a modestly negative tactical view on the euro due to weaker-than-expected economic data and softer inflation. The risks appear tilted toward a more aggressive European Central Bank rate-cutting cycle than currently priced in. Our short-term value score suggests that the recent rebound in the euro is excessive given weaker growth and poor local equity market performance, despite a slight improvement in relative yield differentials. Longer-term challenges, such as high debt levels and low potential growth, continue to cast a shadow — one that has grown darker as French and German politics become more fractured, reducing the likelihood of necessary European Union-wide reforms. This is particularly concerning as the German economy heads toward recession. Moreover, our long-term fair value model indicates that the euro is expensive compared to most G10 currencies, with the exceptions of the US dollar and Swiss franc.

British Pound (GBP)

We shifted to a negative tactical view on the pound during September due to weakness in our economic factor model. Growth is lackluster but has held up reasonably well in absolute terms. However, more recent data has skewed toward negative surprises. While the situation is okay, it is not as strong as investors hoped. Meanwhile, the pound remains the best-performing G10 currency year-to-date by a wide margin, up more than 4% against the second-best performer, the Australian dollar. This recent strength largely stems from the relatively more hawkish stance of the Bank of England. The market is currently pricing the UK to have the highest policy rates in the G10 by mid-2025. Decent expected growth and relatively attractive yields suggest the pound should remain well supported, validating its year-to-date strength. However, most good news is already priced in, and with absolute growth levels being lackluster and limited potential fiscal support in the upcoming autumn budget, there is little room for further appreciation and potential for a modest pullback.

Our long-term valuation model shows a more positive outlook for the pound, as it appears cheap to fair value. However, sticky inflation and chronically weak post-Brexit growth are likely to weigh on fair value, limiting the pound’s potential upside over the coming years.

Japanese Yen (JPY)

The yen has moved a long way since its July low and is likely to consolidate its gains and experience periods of weakness over the very near term. Going forward, we see further upside in the yen, with 140 against the US dollar in sight by year-end and 130–135 by the end of 2025. This outlook is consistent with another 25–50 bps increase in Japanese policy rates and 200 bps in cuts from the Federal Reserve — even in a soft-landing scenario. If recession risks intensify, the yen could easily trade well down into the 120s against the dollar, with even greater gains against higher-beta, commodity-sensitive currencies.

Altogether, this makes the yen one of the most attractive currencies in the G10, if not the most attractive, particularly against the US dollar and Swiss franc. The yen is likely to outperform both the US dollar and Swiss franc in either a soft or hard landing. That said the yen remains at risk in a global resurgent growth, reflation scenario which we think is very unlikely.

Swiss Franc (CHF)

Our models shifted to neutral from a slightly positive tactical franc outlook, mostly due to the positive shift in the commodity factor, which favors higher-beta currencies. We caution that this sanguine view is likely temporary; our medium- to long-term view is decidedly negative. The franc remains the most expensive G10 currency, per our estimates of long-run fair value; it has the second-lowest yields in the G10, and core inflation is the lowest in the G10. All this while the real trade-weighted franc is at the upper end of its 30-year range, and the SNB is cutting rates. We expect them to become more amenable to intervention to prevent excessive franc strength once the policy rate gets down to 0.5%. In fact, given that a major source of the undershoot in inflation is directly related to franc strength via import prices, we think it makes sense for the Swiss National Bank to shift focus away from rate cuts and toward a weak franc policy.

Overall, we see the franc in transition to a prolonged reversion back down toward our estimate of its long-term fair value. Any near-term strength should prove to be temporary support from the increased political and market risk premium being priced into more cyclically sensitive currencies.

Norwegian Krone (NOK)

Our tactical model signals remain negative on the krone, though slightly less so than last month due to the rebound in commodity prices. Our growth indicators are positive but not strong enough to offset poor local equity performance and our broader risk regime indicator, which points to a fragile global macro environment—a negative for the krone. On a more positive note, the krone is historically cheap relative to our estimates of fair value and is supported by steady long-term potential growth and a strong balance sheet. For now, however, we believe it is likely to remain volatile in the near term, as political risk rises, oil markets struggle with the risks of increased OPEC+ production, and investors appear quicker to price in hard-landing risks on any negative growth surprises.

Swedish Krona (SEK)

Our tactical krona signal remains near neutral but shifted slightly weaker due to disappointing economic data. Weak equity markets, lower yields, and signs that the currency is overbought relative to recent deterioration in fundamentals all point to further downside. The economy remains near recession, with inflation effectively at target, justifying the dovish Riksbank outlook. If investors price a greater chance of a global recession, it should heighten equity market volatility, which would also weigh on the currency. Thus, we stress that the risks to our current neutral model signal are to the downside. We expect the krona to continue struggling over the coming months. Looking further ahead, consensus expectations for an economic recovery in 2025 — partly due to the aggressive easing by the Riksbank — anchor a more solid medium-term outlook.

In the long term, the outlook is more favorable. The currency is significantly undervalued relative to its long-run fair value and cyclically depressed. However, we currently see no cleat catalyst for a sustained rally.

Australian Dollar (AUD)

Our tactical models remain negative on the Australian dollar due to weak local equity market performance and a fragile global macroeconomic and geopolitical environment. That said, the pickup in commodity prices makes us less negative than last month. We also see emerging factors that run counter to our negative signal. Reserve Bank of Australia policy is likely to be tighter for longer, with US rates falling to or below Australian policy rates over the next six months. While the economy is sluggish, growth remains positive, and decent fiscal spending should slow the deterioration in domestic demand. We expect external demand to receive some support from the Chinese stimulus, though it is too early to credibly gauge its efficacy. Thus, while we remain negative on the currency, we do not expect substantial downside and eventually see a more positive shift on the horizon in 2025.

In the long term, the Australian dollar outlook is mixed. It is cheap relative to the US dollar, British pound, euro, and Swiss franc, with room to appreciate, but it is expensive against the yen and Scandinavian currencies.

New Zealand Dollar (NZD)

Our tactical model remains negative on the New Zealand dollar. In fact, our model ranks it as the weakest in the G10. The benefit of New Zealand’s high yields is rapidly evaporating as the Reserve Bank of New Zealand eases policy in response to disinflation and near-recessionary conditions. To the extent that current short-term yields remain high, any benefit is fully offset by ongoing challenges to growth and a weak external balance—the current account stands at –6.8% of GDP. Heightened geopolitical risks related to the Israeli conflict and lingering concerns that the US and EU economies may slow more than expected introduce higher equity market volatility, creating another headwind for the New Zealand dollar. We agree with the market’s apparent reaction that rate cuts are necessary and beneficial, but their effects will take time to materialize.

In the long term, our outlook is mixed. Our estimates of long-run fair value suggest that the New Zealand dollar is cheap relative to the US dollar and Swiss franc, with ample room for appreciation, but it is expensive against the yen and Scandinavian currencies.