Fixed Income: Preparing for the Big Shift

Our 2021 research uncovers four major trends transforming fixed income portfolios, revealing what is driving institutional investors across the globe to adopt new ways of fixed income investing.

Report at a Glance

Chief Portfolio Strategist Gaurav Mallik shares four key fixed income trends from our recent survey of institutional investors that together represent a big shift in how future fixed income portfolios will be constructed.

Video (00:39)

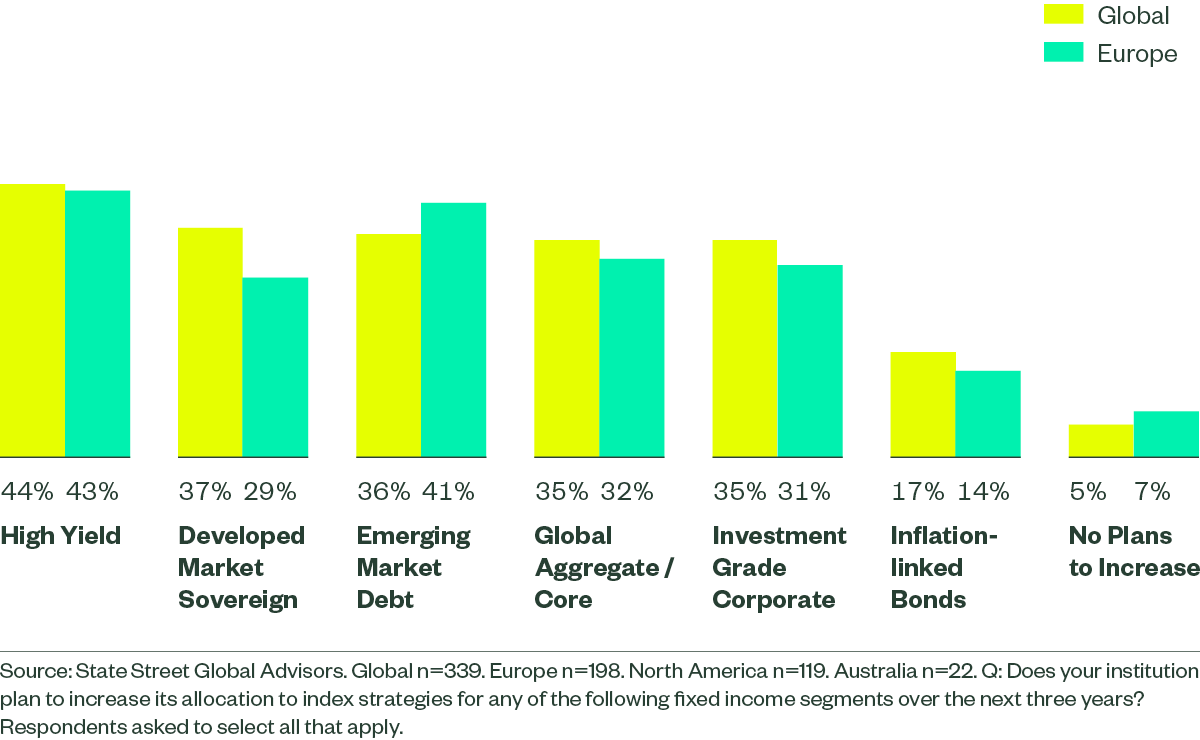

The Move to Indexed Fixed Income

Low yields, new capabilities, and structural changes are driving a move towards indexing across the fixed income (FI) spectrum.

say that increased use of indexing is a high priority for both core and non-core FI exposures over the next three years.

report that maximizing the impact of asset allocations is their key driver for index adoption.

will make the move because they believe the opportunity to add alpha is in decline.

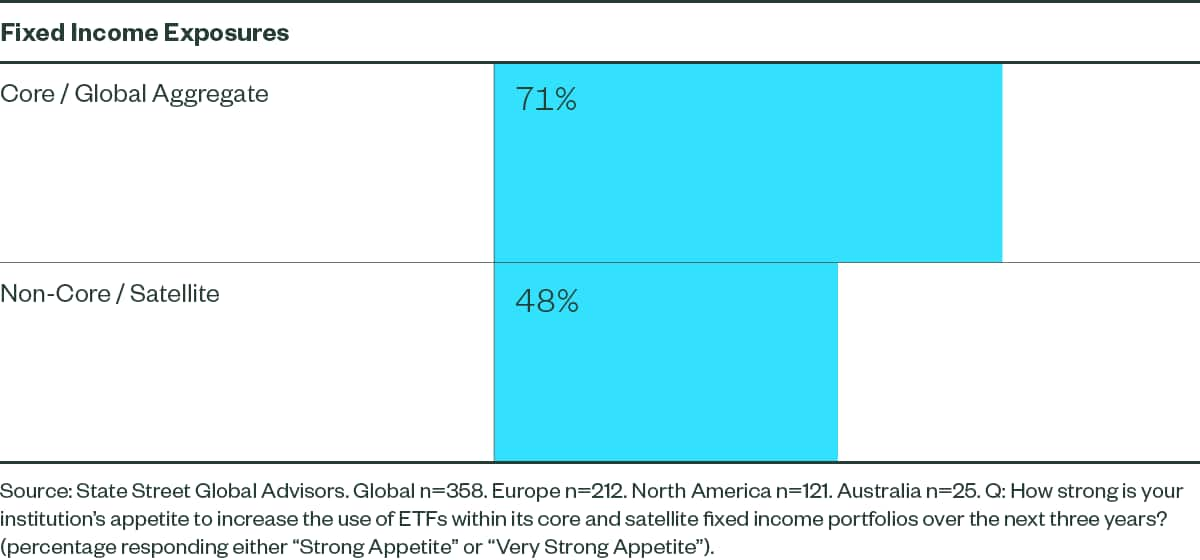

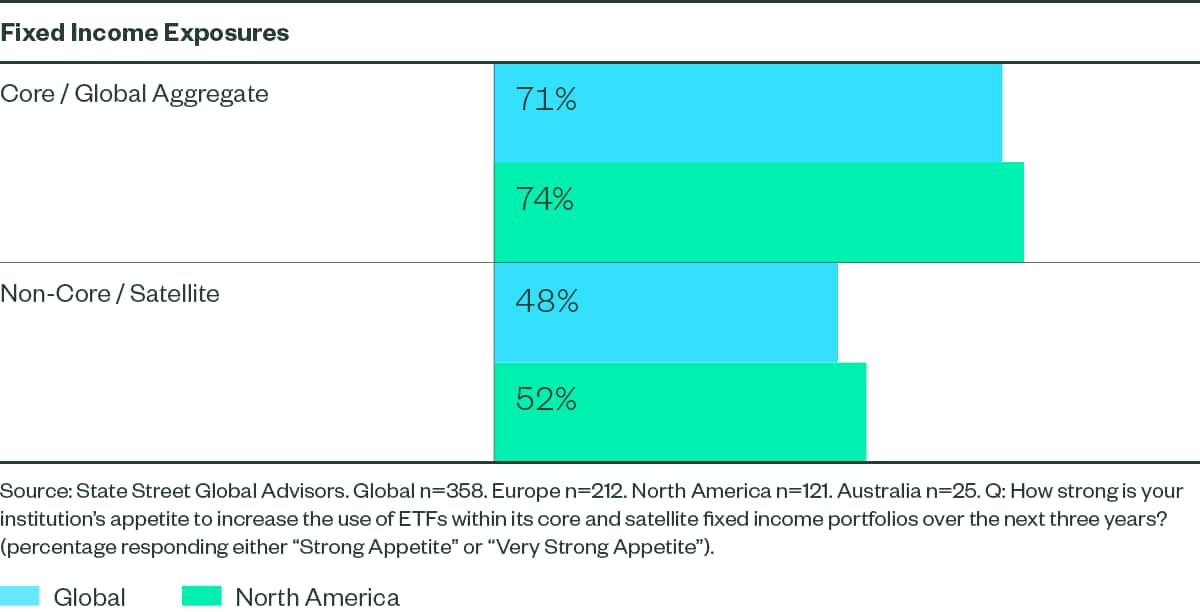

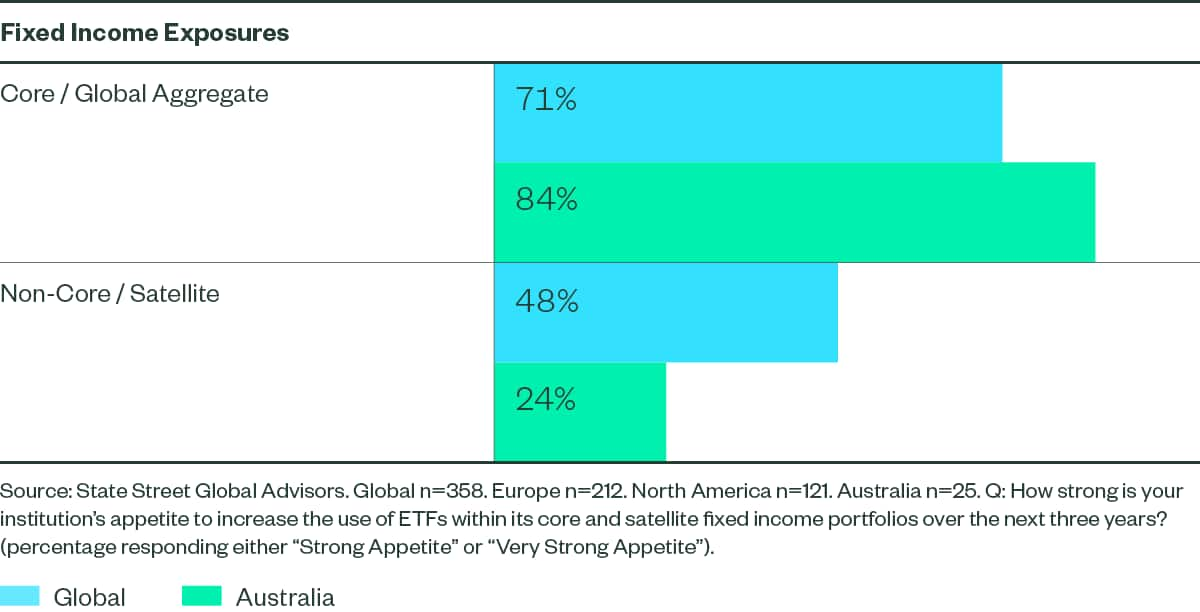

ETFs in the Fixed Income Toolkit

ETF performance during 2020 pandemic-related market stress highlights new investment possibilities for institutions.

say that ETFs will play a bigger role in portfolio construction.

cite ETFs' liquidity and price discovery benefits during the pandemic as key to their increased attraction.

say they have a strong appetite to increase use of ETFs in their core fixed income portfolios.

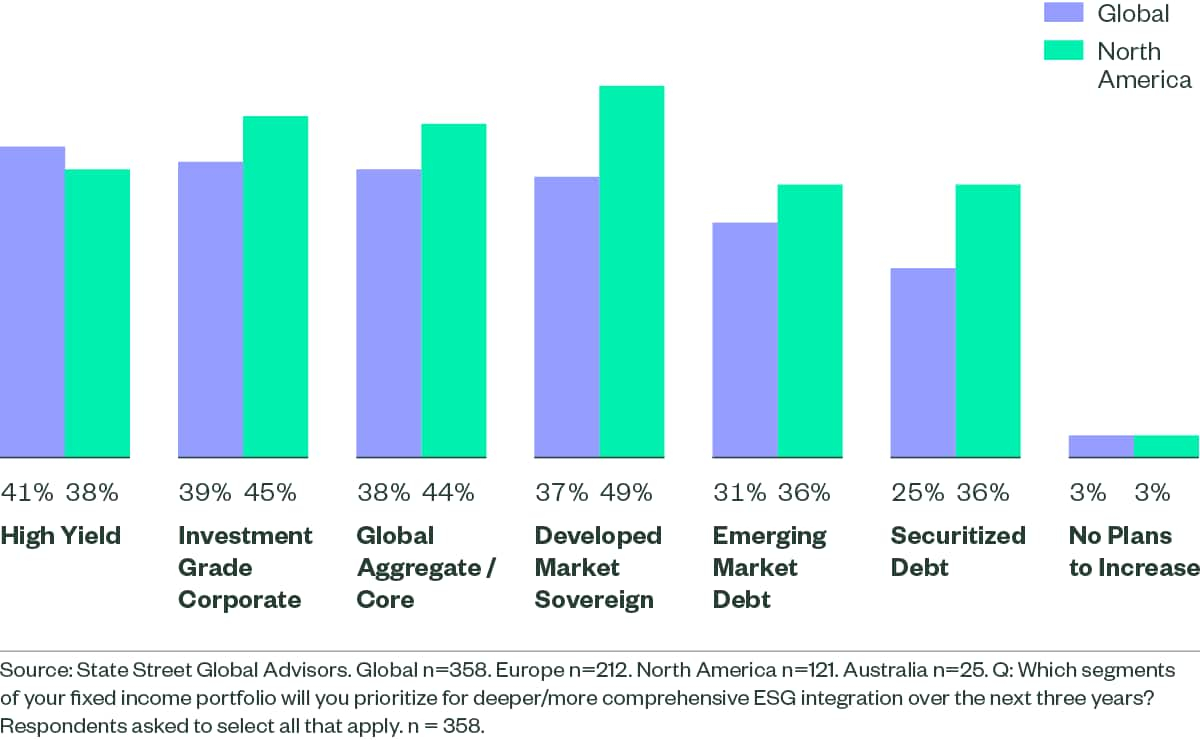

ESG Moves Mainstream for Fixed Income

No longer only for equities, ESG is coming for fixed income in a major way.

say ESG integration into their fixed income portfolios is a high priority over the next three years.

of European investors cite Best-in-Class as their preferred approach.

of North American respondents cite Impact as their preferred approach.

China, EM Come Online

Most institutions will maintain or increase Emerging Markets exposure, and China's entry into key indexes is a rich source of potential.

of the largest, most sophisticated investors say that having a dedicated China fixed income exposure is a high priority.

overall intend to increase their China allocation within the next three years.

will increase their allocation to EMD over the next three years.

About the Survey

State Street Global Advisors conducted a survey of 358 institutional investors in May 2021. The global survey respondents came from pension funds, wealth managers, asset managers, and sovereign wealth funds. Their responses confirmed that the evolution in fixed income investing is very real and, in fact, that institutional fixed income investing could be at a tipping point where "evolution" will become "revolution."

More on Fixed Income

Learn more about Fixed Income at State Street Global Advisors.