Fixed Income Midyear Outlook: Phase Transition

While some aspects of fixed income markets have changed since the start of the year, much remains the same.

While some aspects of fixed income markets have changed since the start of the year, much remains the same. Overall, bonds retain their place on center stage with impressive yields, abating (slowly) inflation, and a strong but slowing economy that has convinced the Fed that the next rate move will be lower. A similar picture is unfolding outside the US (with the exception of Japan), creating ample opportunities for global fixed income investors.

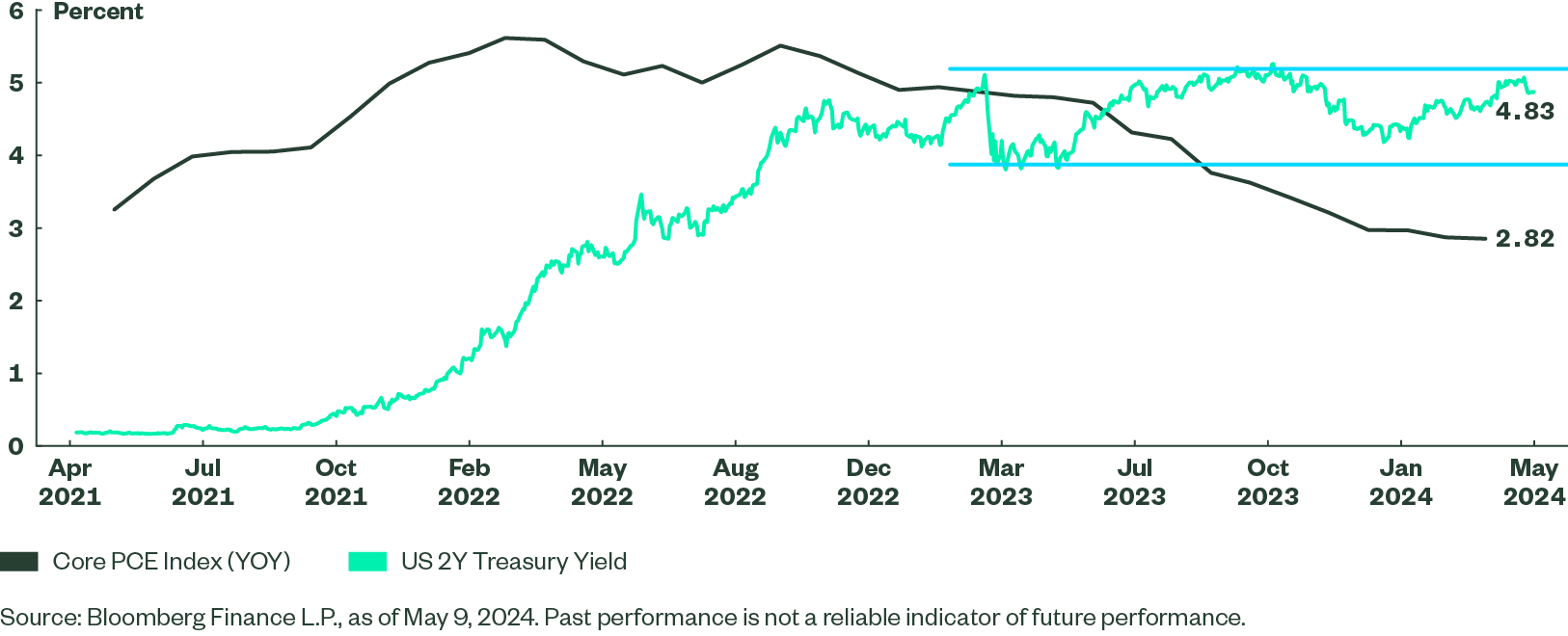

Separating the signal from the noise is critical in assessing fixed income data, and the level of noise can be an indicator of what type of regime we sit in. Increasingly divergent views based on inconsistent economic data can also cause difficulty in evaluating where markets are headed. Coming into 2024 on the back of lower inflation prints, expected cuts to the federal funds rate as early as March, and declining yields and spreads, two-year US Treasury yields fell close to 4% (Figure 3). As inflation metrics remained sticky in the first quarter, those yields retraced as expectations for Fed cuts declined and the timing was pushed back. Despite two very different narratives, and the associated headlines, two-year rates stayed range bound. This all describes a typical phase transition perfectly. Short-term trading and a fast-moving news cycle distract from the crucial question – where do we go from here?

Figure 1 : Two-Year US Treasury Yields Remain in Range

The most likely paths that will drive an exit from this range-bound stage of the cycle have the potential to drive meaningful returns for investors given current rate levels. With no shortage of noise in the data, our view focuses on longer-term structural and cyclical factors pointing to moderating inflation and diminished growth. Cracks in the economic and business cycle remain a point of concern. Even with stickiness in the inflation data during the first quarter, the federal funds rate remains firmly in restrictive territory relative to the neutral rate (that we believe is now about 2.75%). This will impact business fundamentals, perhaps compounding an otherwise moderate slowdown. Additionally, the strength of the consumer could subside amid higher mortgage and credit card rates, while small businesses may struggle to borrow.

Our core view is that inflation will continue to moderate, allowing the Fed to implement a series of rate cuts that take short-term rates to more appropriate levels. But getting inflation back to the 2% target may not be necessary given recent signaling by the Fed that unemployment readings also matter. Whether the first rate cut occurs this summer – or how many rate cuts the Fed can squeeze in before the New Year – is ultimately less important than getting the direction right. For that reason, we maintain an extended duration position as our primary risk stance.

Outside of US Treasuries, corporate credit remains less attractive due to extremely rich valuations. We see more opportunities in emerging markets and structured credit such as mortgage-backed securities (MBS) and commercial mortgage-backed securities (CMBS). However, in both sectors investors must wade through real underlying fundamental considerations — for example, corporate real estate or China —warranting a prudent approach. Whether a soft or hard landing comes next, we remain confident that current rate levels offer attractive entry points for investors.