Europe in the Spotlight

In June, the market spotlight turned to Europe facing European Union elections, UK elections, and the summer Olympics. The European Central Bank’s rate cut early in June highlighted increased hopes for a sentiment change for European equities.

Follow the Earnings, not the Economy

Elections, and election shocks may capture a lot of the headlines as we start the summer in the Northern Hemisphere, but our experience teaches us that these one-off events are hard to call, and the market’s reaction to them even harder to predict. We look for tangible evidence at the stock level to inform our investment decisions, and that starts with the economic backdrop.

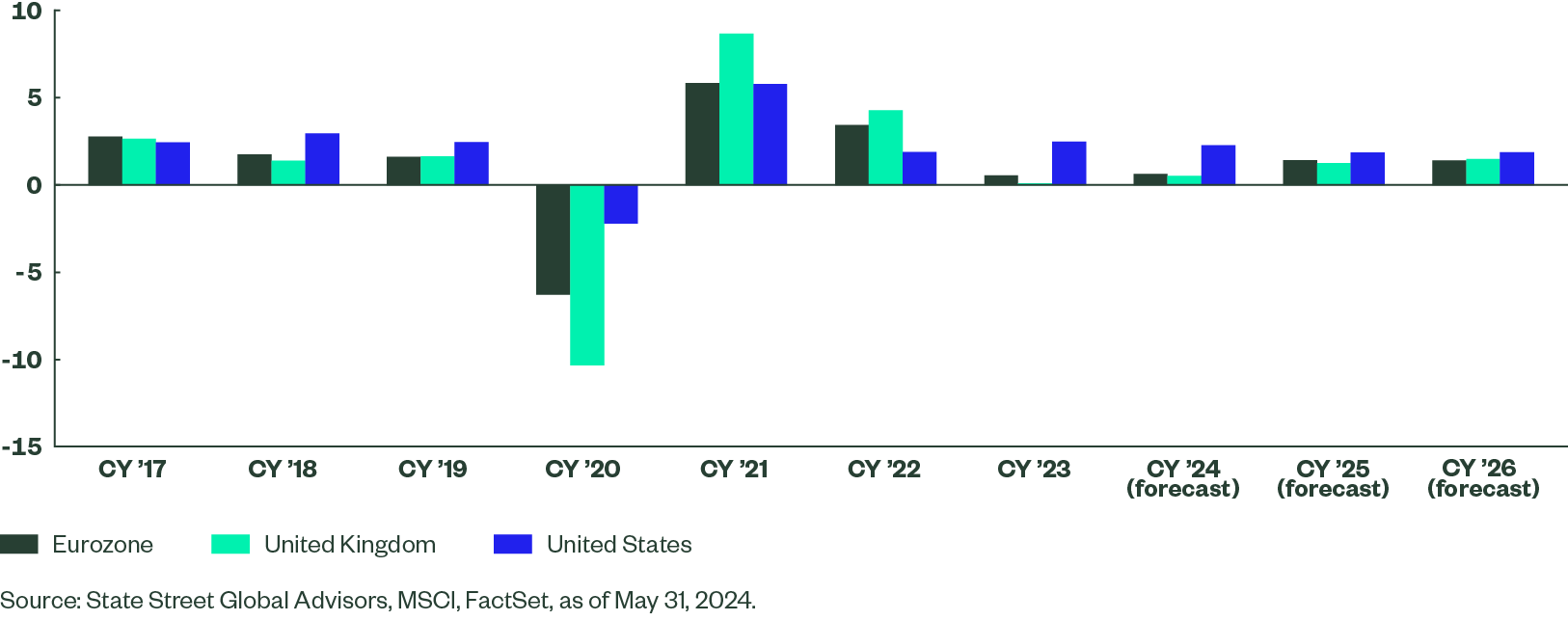

Economic forecasters are expecting European growth to continue to underperform the US, extending a trend that established prior to the COVID dislocations. Exceptional growth from the US has become an established narrative, certainly compared to other developed markets. While this narrative has undoubtedly weighed on European stock markets, we also caution that the tie between economic growth and company earnings growth is loose over anything other than very long horizons, particularly for large multi-national corporations.

Figure 1: European GDP Growth Lags the US

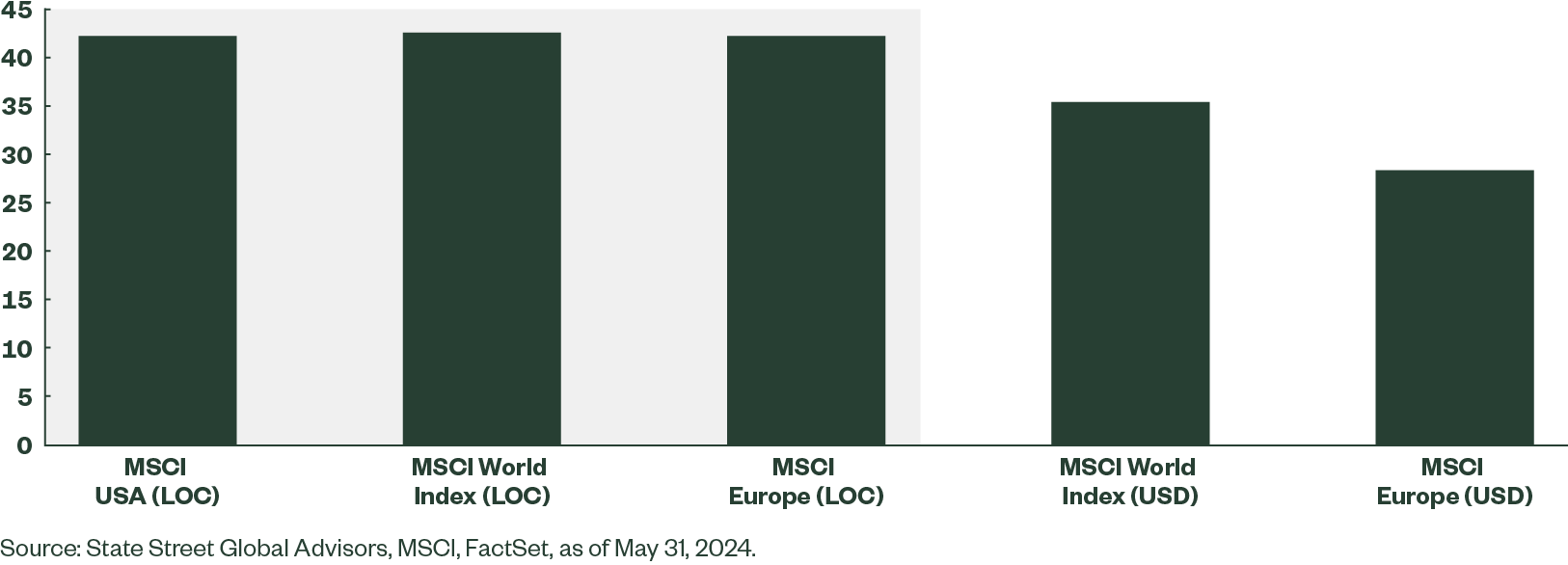

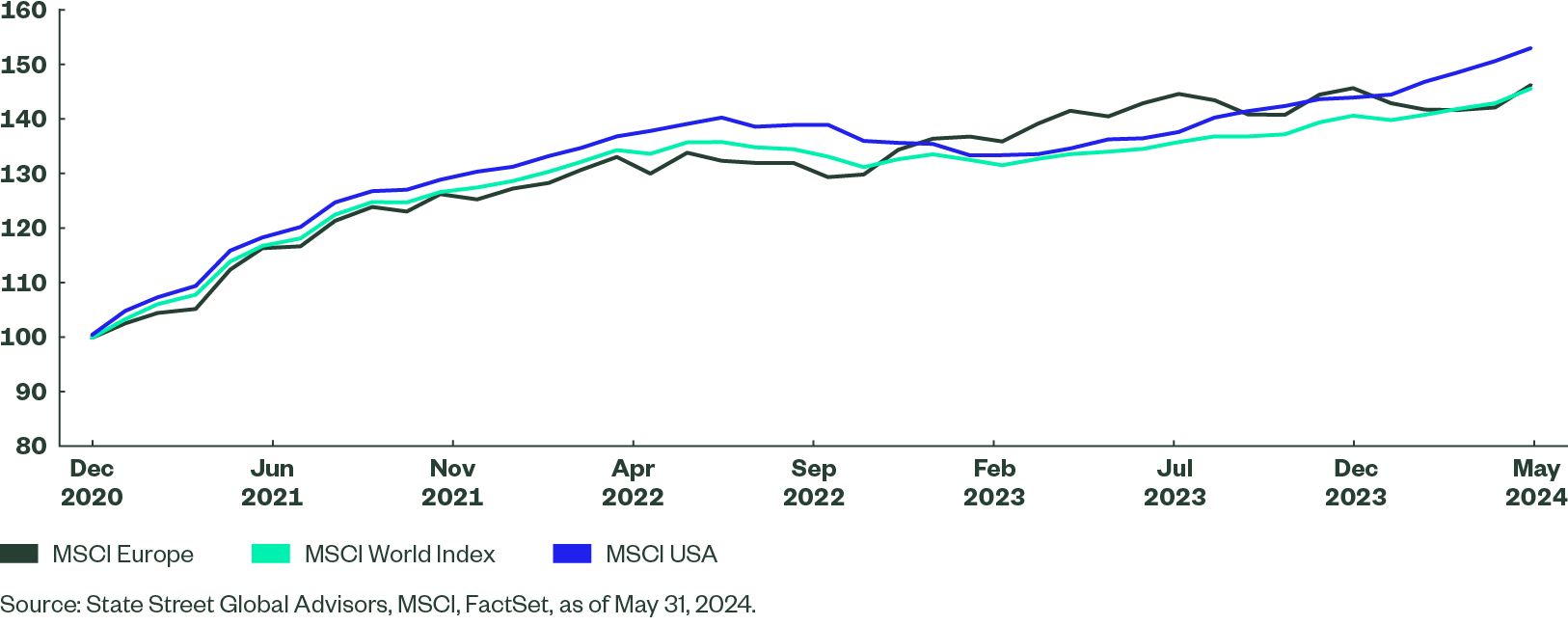

It may, however, still be surprising that in the post-COVID period since the end of 2020 European equity markets have performed broadly in-line with the US and rest of the developed world in local currency total returns. Strength in the US dollar, however, has led to relative underperformance for Europe when measured in a common currency.

Figure 2: Index Total Returns Since December 30, 2020

At an aggregate level earnings expectations for Europe have also kept pace with the developed world, but slightly lagging the US since COVID. There are signs, however, that earnings growth in Europe may have recently stagnated, or even slipped, while the US powers ahead turbo-charged by technology-related names and artificial intelligence hype. A significant lack of high-earning technology stocks compared to the US has held back the European market with only 8% by market capitalization in the Information Technology sector versus 30% in the US, for example.

Earnings growth in Europe has, however, been driven to a greater extent by Energy and Financial names where sector weights are higher than in the US. Within our investment processes we rely more heavily on stock selection than on large bets on country or sectors. Within Europe, though, our most preferred sectors are the Energy and Financial stocks where we find significant value and higher quality names on average than elsewhere in the world.

Despite almost matching the returns and earnings growth, European shares still trade at a significant discount to the rest of the developed world, trading at just 14 times next-twelve-months forecast earnings compared to 15x in the Pacific region and 21x in the US.

Figure 3: Evolution of Aggregate Next-12-Months Average (NTMA) Earnings Expectations

Short Interest

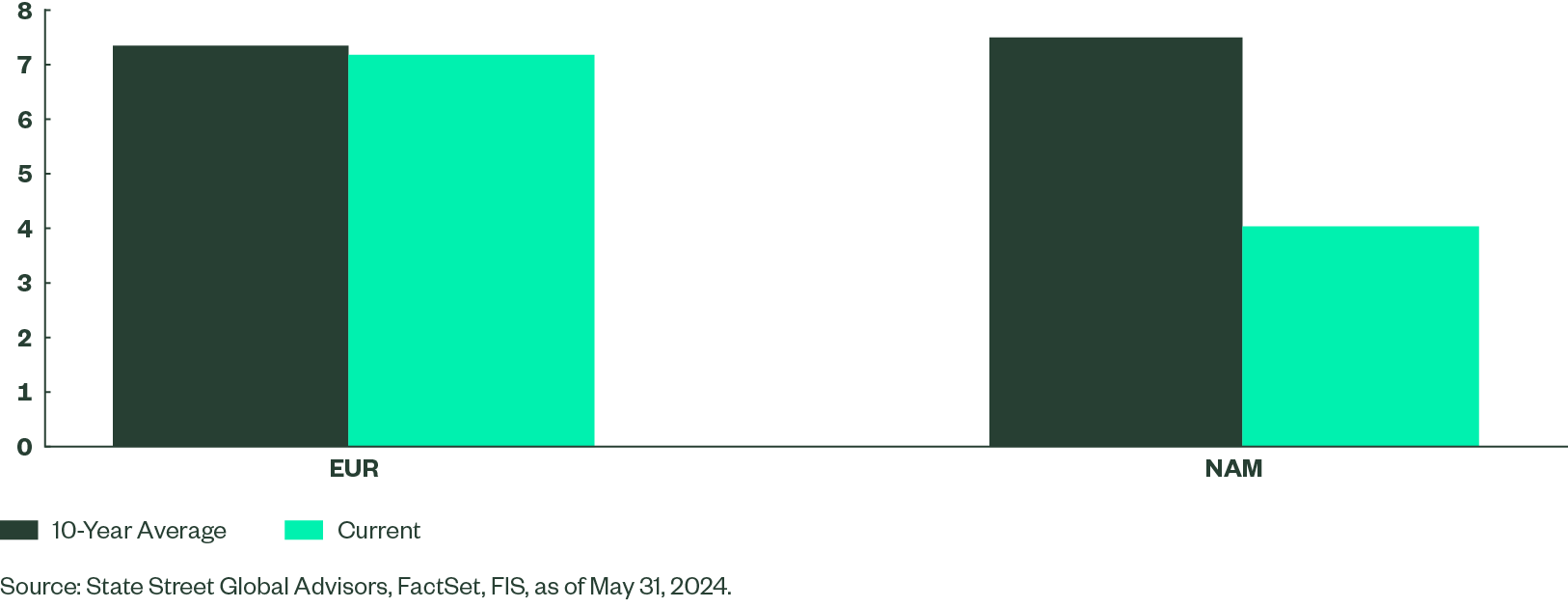

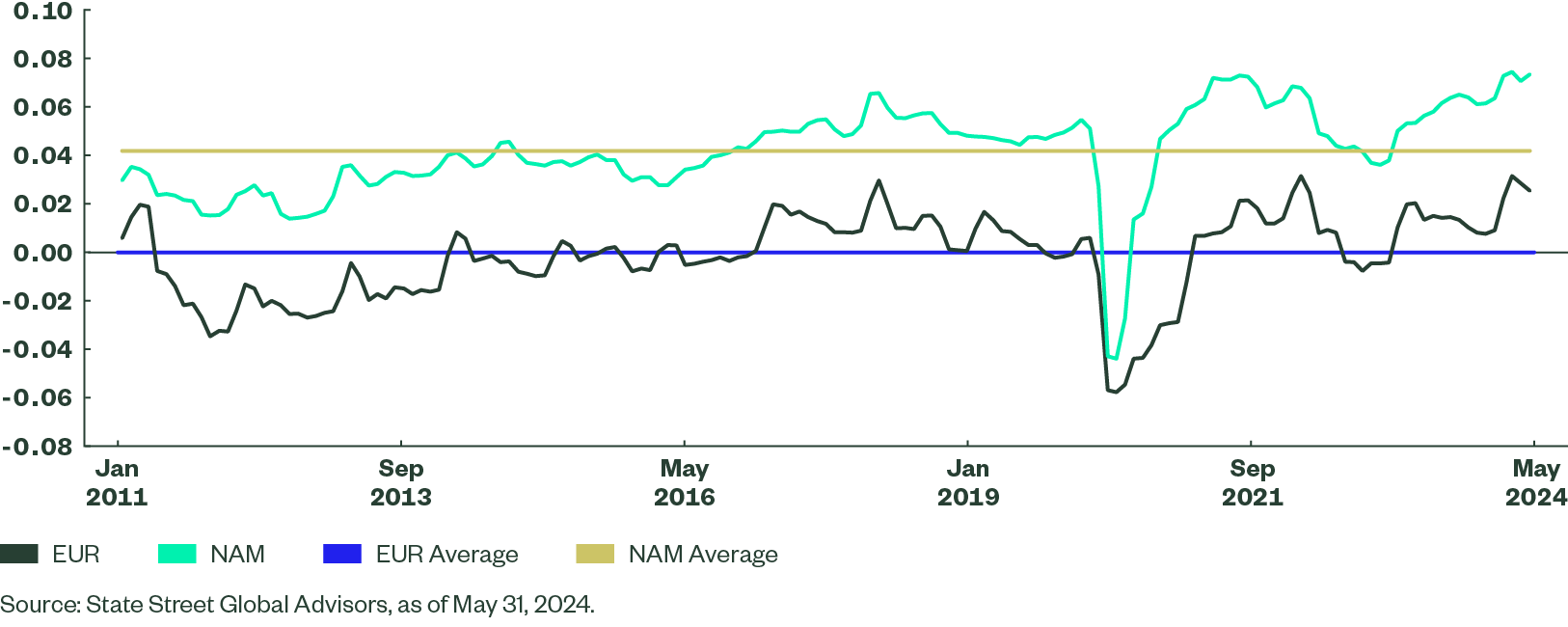

On these measures, it seems that market sentiment, rather than fundamentals in terms of earnings, seems to be holding Europe back from closing the valuation gap with the US. Market participants demonstrate a more bearish view on Europe as measured by the average level of short interest for European stocks relative to North American names. Short interest in North America has stayed stubbornly low and is currently significantly below the average level of the last 10 years. In Europe, a recent spike has brought bearish bets back up to their longer-term averages.

While we believe there is information in short interest at individual stock levels, this is not necessarily a warning sign for the overall market. Rather, this trend demonstrates that investors still prefer North America on the short as well as the long side.

Figure 4: Current and 10-Year Average Short Interest

CEO Confidence

Within our investment process we monitor the language and tone of company management in conference calls. This information can give insights into a CEO’s confidence and expectations for the company’s outlook. European managers, on average, tend to be significantly less upbeat in their language than their North American peers. However, a comparison between historical corporate management messaging in both regions suggests the findings are at the high end of effusiveness since the time that our data gathering began.

This data shows few signs of concern amongst company management about the twin headwinds of higher interest rates and slower economic growth hurting prospects at the current time in either region.

Figure 5: Net Tone of CEOs in Earnings Conference Calls in Europe and North America

The Bottom Line

Sentiment, rather than just fundamentals, seems to have weighed on European equity markets recently, driven by exceptional growth in the US economy compared to the rather anaemic profile in Europe. While European stock markets have performed in line with the rest of the world in local currency terms in the period since COVID, they have lagged more recently. The strength of the US dollar has also reduced returns in Europe for unhedged US-based investors.

We are keeping a close eye on earnings. We continue to also closely monitor where there are signs that Europe may be starting to lose some ground to the rest of the World. The interplay between slowing inflation, slowing growth, and corporate earnings is also likely to create uncertainty as investors watch how the data plays out. This uncertainty may lead investors towards higher quality (safer) corners of the market where the US holds an upper hand.

Overall, however, we believe these headwinds are at least partially compensated for by the significant valuation discount for Europe. With the ECB now on an easing path ahead of the Federal Reserve (Fed) and many other developed countries, an engineered soft landing later in the year could see Europe close the valuation gap with other developed markets and the US, in particular.