The French Election and the Markets

The recent downward repricing of French sovereign risk is likely to continue past the upcoming French election (held in two stages on 30 June and 7 July). In our view, upside scenarios are limited. Depending on the outcome, we could see a divergence in the performance of French versus other European assets.

The 9 June European Union election results, which closely matched election polls, were on their own a neutral event for markets. However, it was Emmanuel Macron’s dissolution of the French parliament that triggered a repricing of French sovereign risk, which continues to weigh not only on French but also on European assets as well.

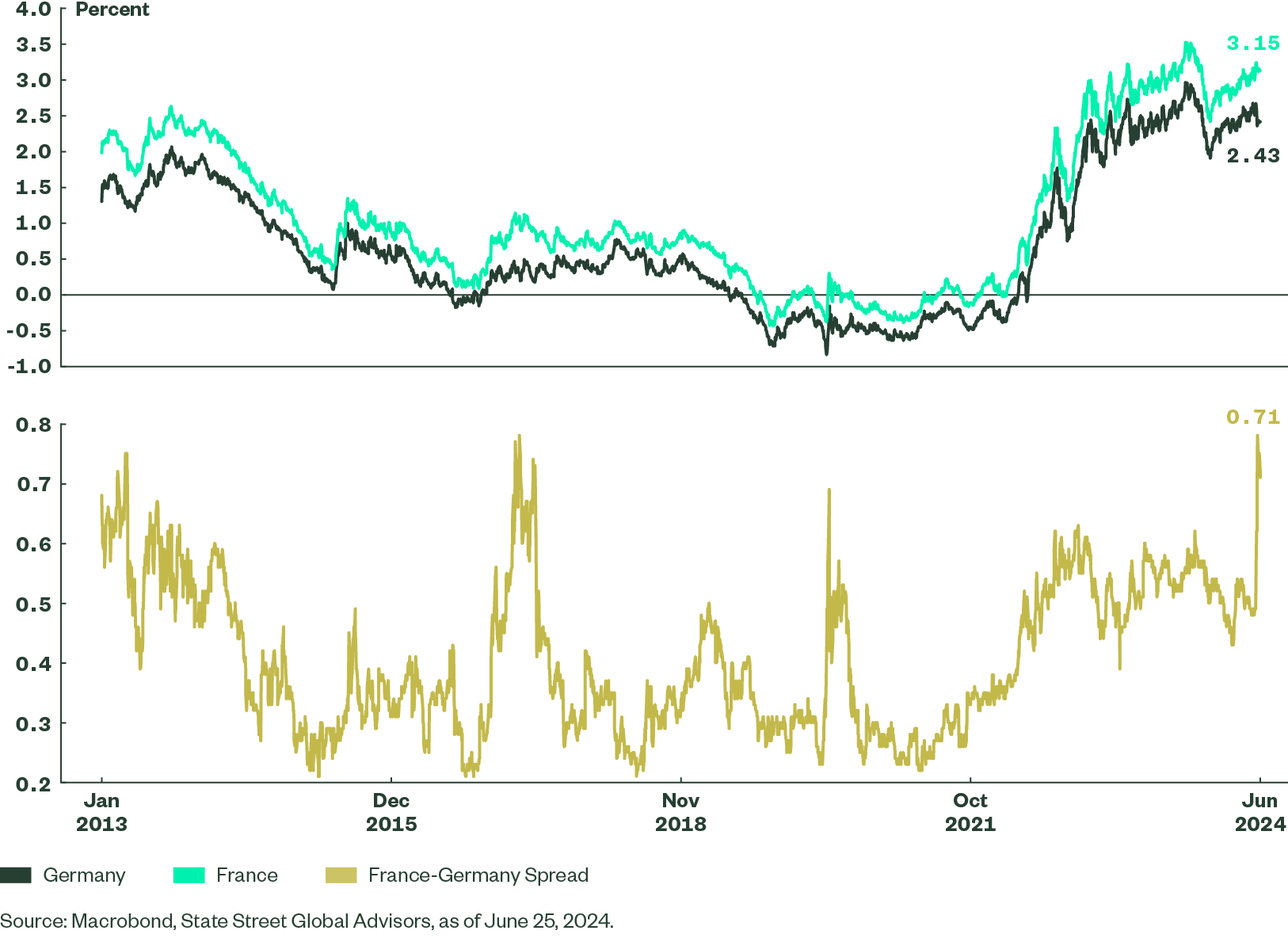

French 5-year sovereign credit default swaps are now 40% higher than before the election call. OAT-Bund spread (French government bonds over German ones) widened by 25 bp and remains at around 75 bp, a level last reached ahead of the French Presidential election in 2017, when Mr. Macron faced off against Marine Le Pen (Figure 1)

Figure 1: France-Germany 10-Year Yield Spread

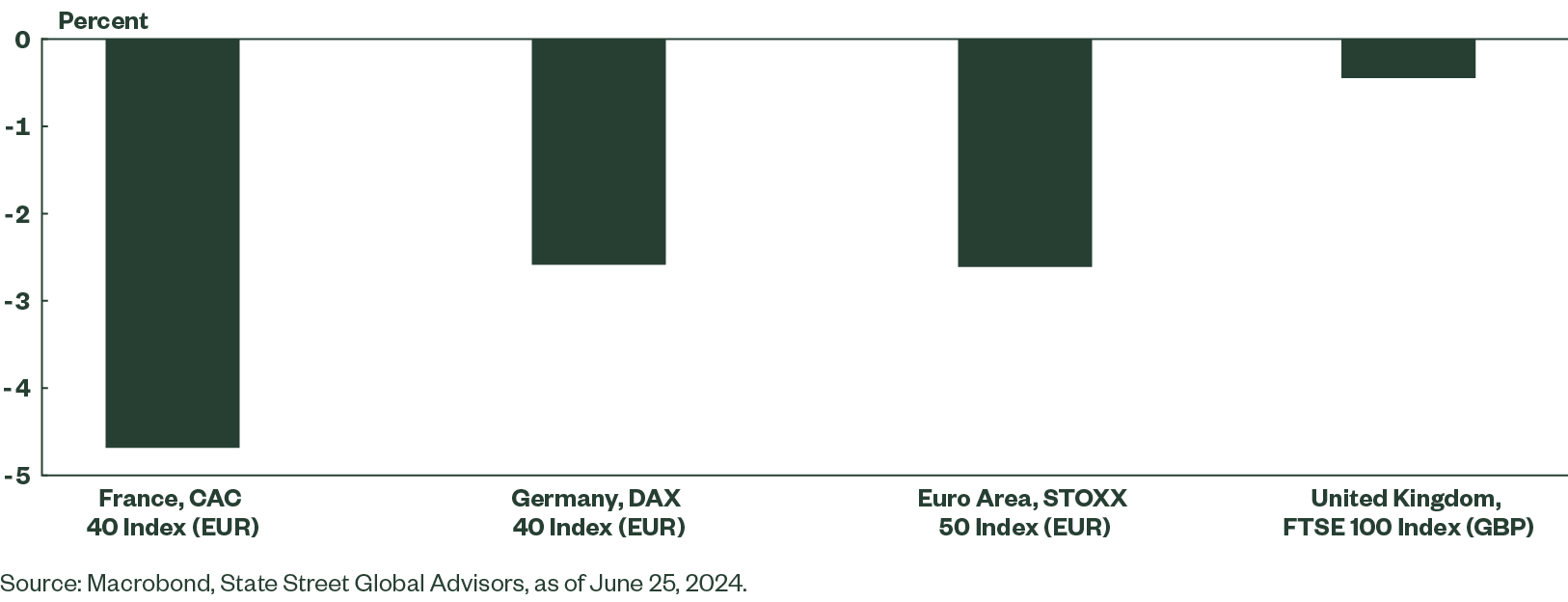

The CAC-40, the benchmark French stock market index, has been trending down since the call for early elections, with Euro STOXX 50 following suit. That some of the decline in the European index is driven by a drawdown in other European economies suggests that concerns over the election extend regionally (Figure 2). The euro was down against the US dollar during the same period.

Figure 2: Equity Returns Since Call for Election

All indices have pared back some of the drawdown in recent days, but based on our estimates, options markets are telegraphing more pain to come with Euro Stoxx volatility diverging from VIX and demand for puts exceeding demand for calls.

Indeed, the outcomes of the French election raise a lot of questions. France is a pillar of European policymaking, and the policy preferences of the future French government are relevant to the broader agenda. It is European Union’s (EU) second-largest economy as well. Moreover, France faces serious fiscal challenges and falls foul of EU’s fiscal rules and the country’s fiscal path will weigh on their credibility. In other words, what happens in France does not necessarily stay in France.

Is There Merit in Repricing of Risk Premiums?

Some of the repricing is an uncertainty premium on the future parliament and the fiscal risks associated with the various outcomes. But what will drive this premium going forward?

Here are the main scenarios to consider, ranked from best to worst based on our view of the magnitude of the market impact in terms of risk premia and volatility associated with each outcome:

1. Base case/best case – Hung parliament – Current polling suggests that a hung parliament is the most likely outcome. But French parliamentary elections have two rounds, so the outcome is incredibly hard to model as the respective voters have different second-round behavior. This means high uncertainty until the second round is done on 7 July.

If the election delivers a hung parliament, one could imagine a caretaker/minority government. It could take months to form. However, critically, it would fail to generate any credible fiscal path. The upside is that from Brussels’ perspective, this is the best option. Such an arrangement would not threaten the EU policy agenda. The European Commission will push France over its budget. But cognizant of the politics, it would take a less confrontational path. In other words, under this scenario, France can continue to muddle along.

This outcome would therefore probably stabilize current (elevated) pricing on French government bonds, but with a weak government and still fragile politics, downside risks would dominate. The risk premium in non-French markets should recede – German bunds would sell off on lower risk aversion and the euro should recover most of the lost ground, all else being equal.

2. Downside case – Left-wing coalition majority – A left-wing bloc would attempt to embark on a sizable and largely unfunded fiscal expansion. We expect another repeat of 10 June, with French sovereign bonds selling off and taking French stocks and the euro along with it. EUR/USD at <1.05 should be a certainty in that scenario. There may be spillovers to other European markets as well.

However, that this is an overreaction should become evident by the end of the year. The left-wing coalition is tactical, fragmented, and conflict prone. Its program is therefore largely unimplementable. We therefore expect markets to recover close to where they would be under the first scenario. Fiscal risks under this scenario would be moderately higher, leading French bonds to underperform, relative to those of other European governments.

3. Worst case – Rassemblement National (RN) majority – The debate over RN focuses on its fiscal ambitions. But this misses two broader points. The first is that RN would never pare back as much as Brussels would want. The second is about RN’s potential to disrupt EU policy agenda.

Should RN project an image of fiscal responsibility, markets may even welcome its election. However, its election tees up a conflict with the Commission later in the year when they negotiate over France’s fiscal path. It is clear that the positions will be far apart and stakes high.

The market fallout could therefore be material, taking down French and regional assets, with euro/USD approaching close to 1. The European Central Bank is the natural backstop, but we do not yet know what its pain point will be. The central bank would not like it and will be acutely aware of the moral hazard. However, better to bail out France than preside over the collapse of the euro.

To what extent RN would disrupt EU policy is unknown. Its policy instincts are at odds with that of the Commission. It has ways to do so, for instance, by way of the Council of the EU (to which its ministers will contribute). For Europe, the prospect of a country as large as France acting the spoiler would be a major political headache. Critically, for markets, it could forestall efforts to strengthen Europe’s long-run competitiveness. This would be a drag on all European assets, not just French.

In a Nutshell

The higher risk premium on France is warranted, and downside risks dominate. The best-case outcome, which is also the base case (though low conviction), is a hung parliament, which would allow the country to muddle along and markets to settle, particularly those outside of France. We see downside risks to regional assets from alternative scenarios, particularly the election of a far-right majority, which tees up potential market turbulence later in the year and could weigh on European assets more broadly.