Liquid Real Assets in DC Pension Plans

In this paper we discuss how a strategic exposure to liquid real assets can be a useful component in a DC default investment strategy, providing not only further diversification but also long term protection in different inflation environments.

Real Assets are an asset class that covers investment in physical assets such as real estate, commodities, natural resources, precious metals, real estate, and infrastructure.

For DC investment strategies, there have been a number of barriers to investing in real assets. Many require large capital investment to be tied up for a long time, which conflicts with platforms requiring daily pricing and dealing. The cost for attaining these exposures along with close-ended fund structures can also be prohibitive. This complexity has dulled investor appetite.

However, liquid real assets are at the more accessible end of the real asset spectrum. The “liquid” component of Liquid Real Assets indicates that the investment can easily be bought and sold on an exchange through daily liquid mutual funds, index funds, and exchange-traded funds.

Four Main Categories of Liquid Real Assets:

Inflation-linked bonds is the most integrated Liquid Real Assets asset class so far in the DC investment design, allowing investors to mitigate inflation risks when purchased for the long term. However, in this paper we would like to focus on four additional main Liquid Real Assets categories, as shown below, that could be considered as well:

- Real Estate (REITs): A Real Estate Investment Trust or “REIT” is a fund that owns, operates, or finances income-generating real estate. Investors have the opportunity to earn dividends from real estate, without having to buy, manage, or finance the properties themselves.

- Commodities: The commodity universe includes grains, livestock, oil and natural gas, and precious and industrial metals. Commodity futures within a mutual fund or ETF are used to provide exposure to those assets without the costs of owning physical commodities.

- Infrastructure: This universe includes utilities, transportation, and telecommunication infrastructure. Infrastructure can be accessed through both equity (e.g. shares of listed infrastructure companies) and debt (e.g. infrastructure corporate bonds).

- Natural resources: These assets include exposure to agriculture, oil, energy, and metals. Again, a mutual fund, index fund or exchange-traded fund (ETF) will provide exposure to those assets with greater liquidity.

How Can Liquid Real Assets Protect DC Pension Pots from Inflation?

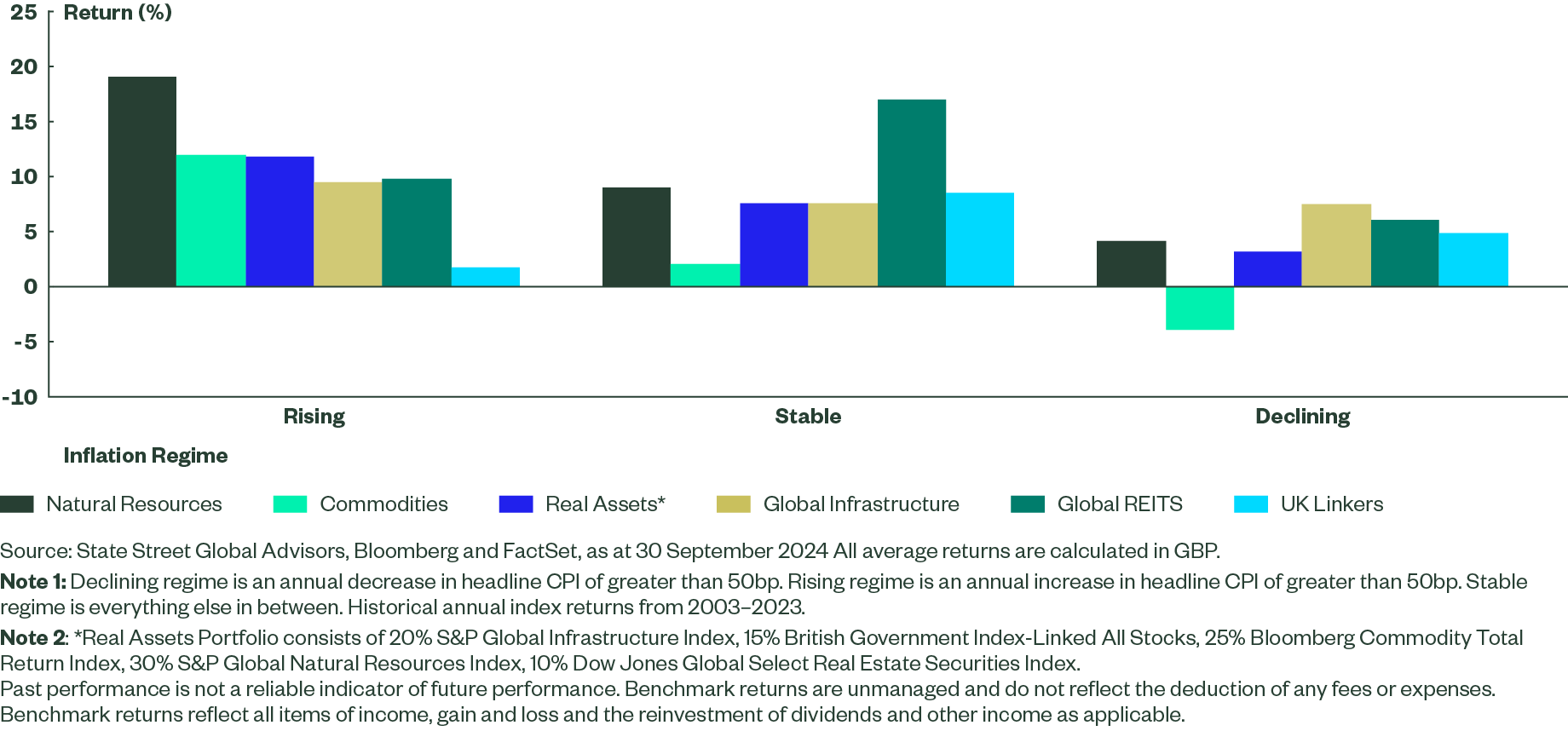

Inflation can eat away at nominal asset returns in DC pension pots over time. It is important to understand how asset classes perform across different inflation regimes. Figure 1 shows the quarterly real asset returns over the last 20 years for three discrete inflation regimes: rising, stable, and declining.

As seen in Figure 1, real assets provided attractive returns not only in rising inflationary regimes, but also during stable regimes. Even in declining regimes, many real assets may generate attractive returns compared to equities, offering an element of downside protection.

Figure 1: Average Return v/s Inflation Regimes (2003 – 2024)

- Real estate investment trusts (REITs) perform well in stable, and even declining, inflationary environments. Their inflation-hedging ability is embedded in their rental agreement structures, which generally include inflation-linked adjustments or fixed percentage increases in rents.

- Infrastructure also performed well in stable and declining inflationary environments. Their revenues for “pureplay” infrastructure are typically stable and predictable given their long-dated underlying contracts and monopolistic assets.

- Commodities and natural resources provide efficient protection against unexpected and rising inflation. Commodity futures and natural resource equities have a strong, direct relationship to inflation given the nature of their businesses models (raw materials inputs).

Liquid Real Assets’ Role in DC Plans

As DC funds grow in size in the UK, their investment strategies continue to evolve from investing in listed equities and bonds. Liquid real assets can provide an effective asset allocation tool in DC pension plans that not only protects against inflation, with a solid income, but also provides diversification benefits and downside protection.

Liquid Real Assets Key Advantages:

- Inflation protection: Real assets have historically provided an inflation hedge in different inflationary environments, helping investors maintain purchasing power while ensuring adequate retirement income via stable and predictable income streams.

- Performance: Allocating to a diversified group of liquid real assets can potentially provide additional returns relative to traditional assets.

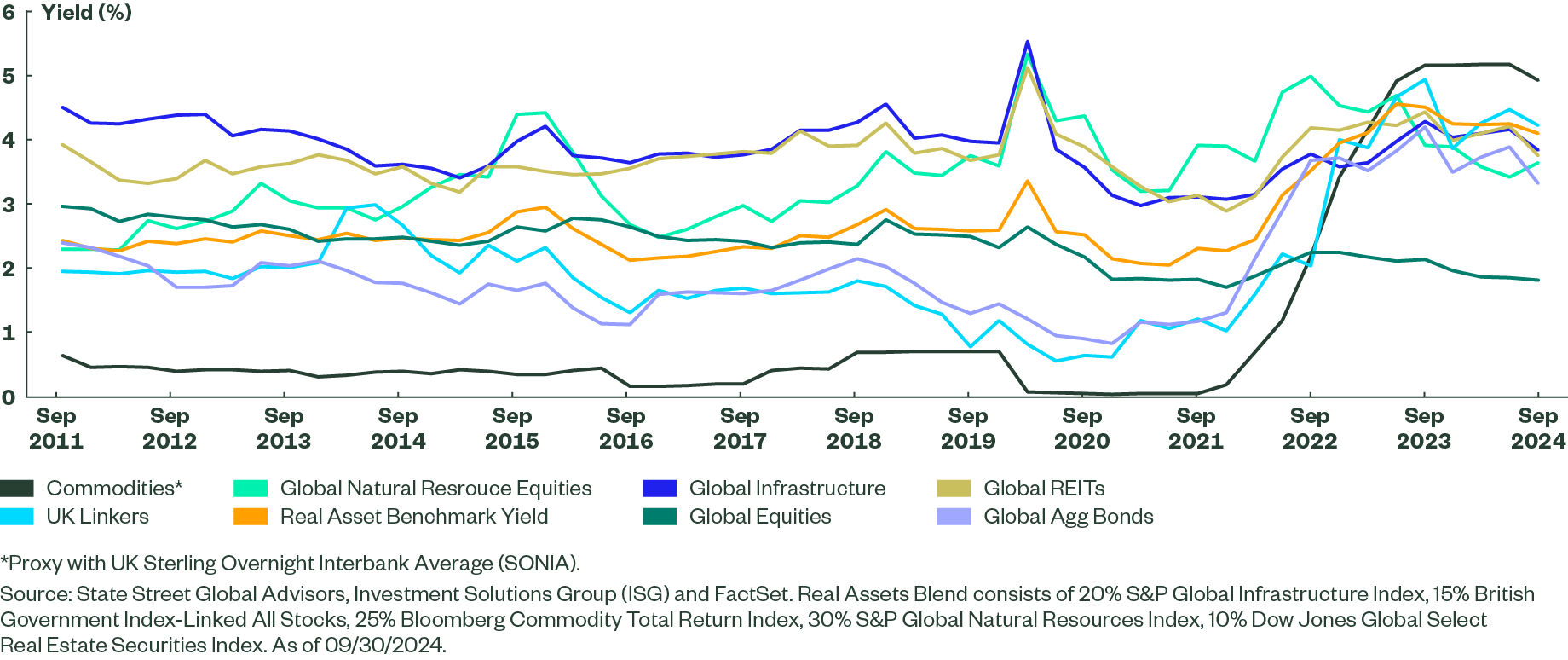

Figure 2: Historical Yields of Real Assets Components and Benchmark

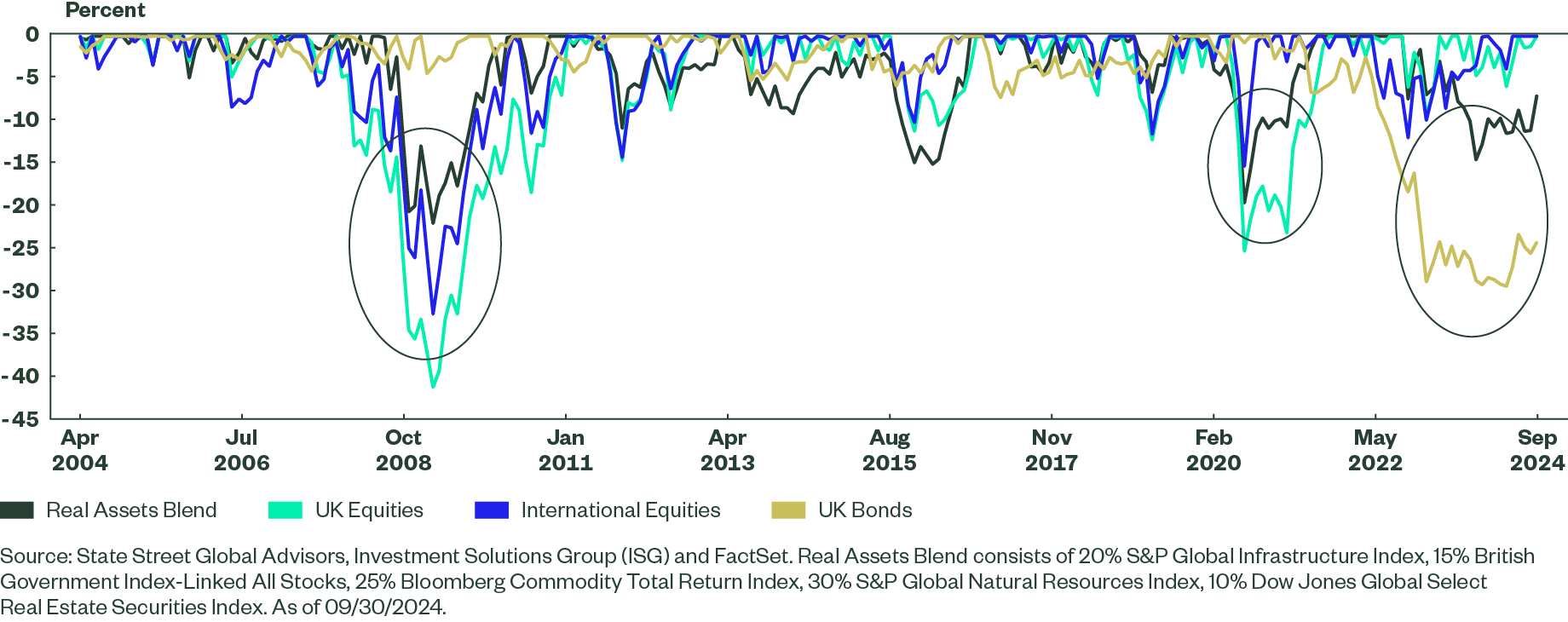

- Downside protection: Furthermore, liquid real assets have shown effective downside protection versus traditional asset classes, ensuring member pension values have been less impacted during broad market selloffs (e.g., equity market selloff in ’08 and the recent UK Bond crisis in ’22).

Figure 3: Drawdown Analysis: Real Asset Portfolio v/s UK Equites

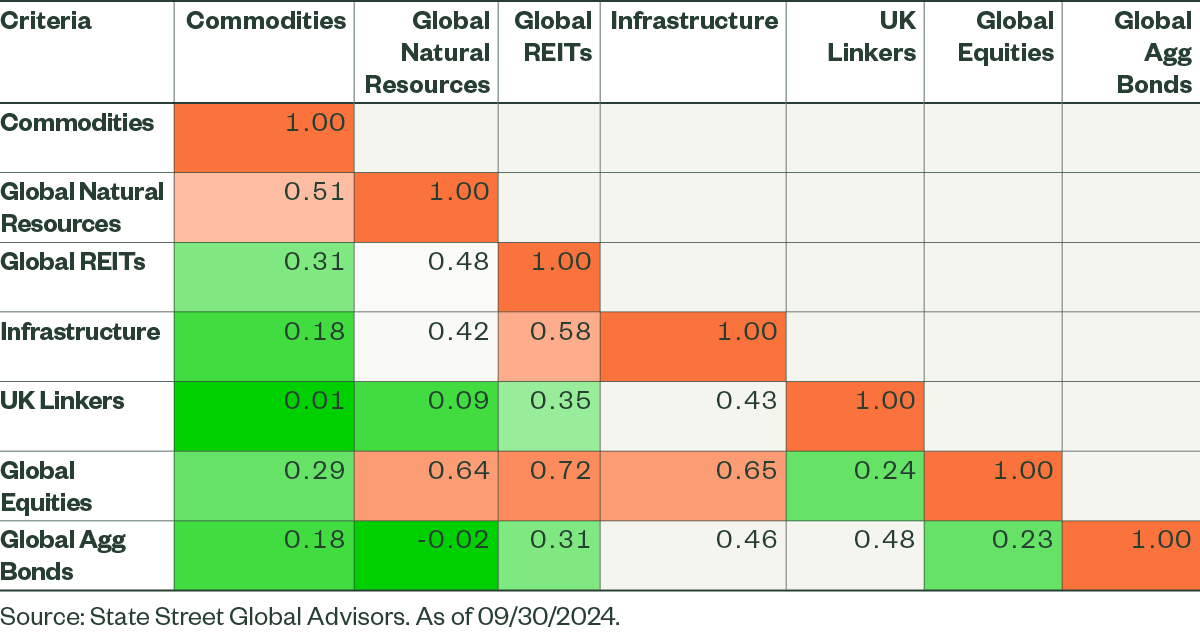

Diversification: Liquid real assets have historically demonstrated correlation benefits vis a vis traditional asset classes, as well as with each other.

Figure 4: Liquid Real Assets Correlation

- Cost efficient: Real asset exposure can be obtained individually or managed as a composite strategy. Access through low-cost and liquid vehicles enables DC schemes to meet daily pricing and dealing requirements.

- DC pensions friendly: The investment concept is easily understood by members (contractual income from tangible assets and assets indirectly linked to inflation, e.g. commodities), while at the same time reducing complexity of compliance reviews for Trustees versus other alternative investments.

Liquid Real Asset Strategies at State Street

State Street’s Investment Solutions Group has managed real asset strategies since 1994. We are whole of market, utilising passive liquid building blocks and focus on combining exposures to a broad array of liquid real asset securities that have inflation linkages to their realised returns. This provides investors with diversified, liquid exposure covering commodities, global natural resource equities, global infrastructure equities and real estate. Our real asset strategies are designed to complement traditional equity and bond assets, providing further diversification, attractive risk-adjusted returns whilst aiming to protect portfolio returns from inflation.