Optimizing a Global Credit Portfolio

By using a “building block” approach, investors may be able to improve diversification, boost risk-adjusted returns and reduce implementation costs. However, the implementation of a hybrid building block approach, in which active strategies are combined with passive and systematic, should be performed with careful consideration of each investor’s risk tolerance and goals.

Building Blocks: From Theory to Action

Data shows that fixed income investors may benefit from a “building block” approach, in which various fixed income sectors and styles — active and passive — are combined to create a bespoke fixed income exposure. We previously showed how this approach may allow investors to tilt to a higher-returning allocation without increasing tracking errors or drawdowns (see Active and Index: Fixed Income Building Blocks). In this piece, we tackle the implementation of the building block approach.

How do clients most effectively implement building blocks in practice? Like so many questions related to strategic asset allocation, there is no one-size-fits-all answer. In practice, the mix of fixed income strategies should be suited to each investor’s specific goals and risk tolerances. In this piece, we focus on the investment grade credit segment and analyze how various building blocks — active, passive, and systematic — may be combined to optimize investors’ portfolios at specific risk budgets.

The portfolio modeling example we present shows that, depending on the investor’s risk budget, there is value in allocating to passive and systematic credit strategies. These help diversify the active allocations and make the most efficient use of the risk budget, resulting in better risk-adjusted returns. An additional benefit relative to a purely active approach is a reduced cost of implementation.

Background: Innovation and Competition Have Spawned Greater Investor Choice

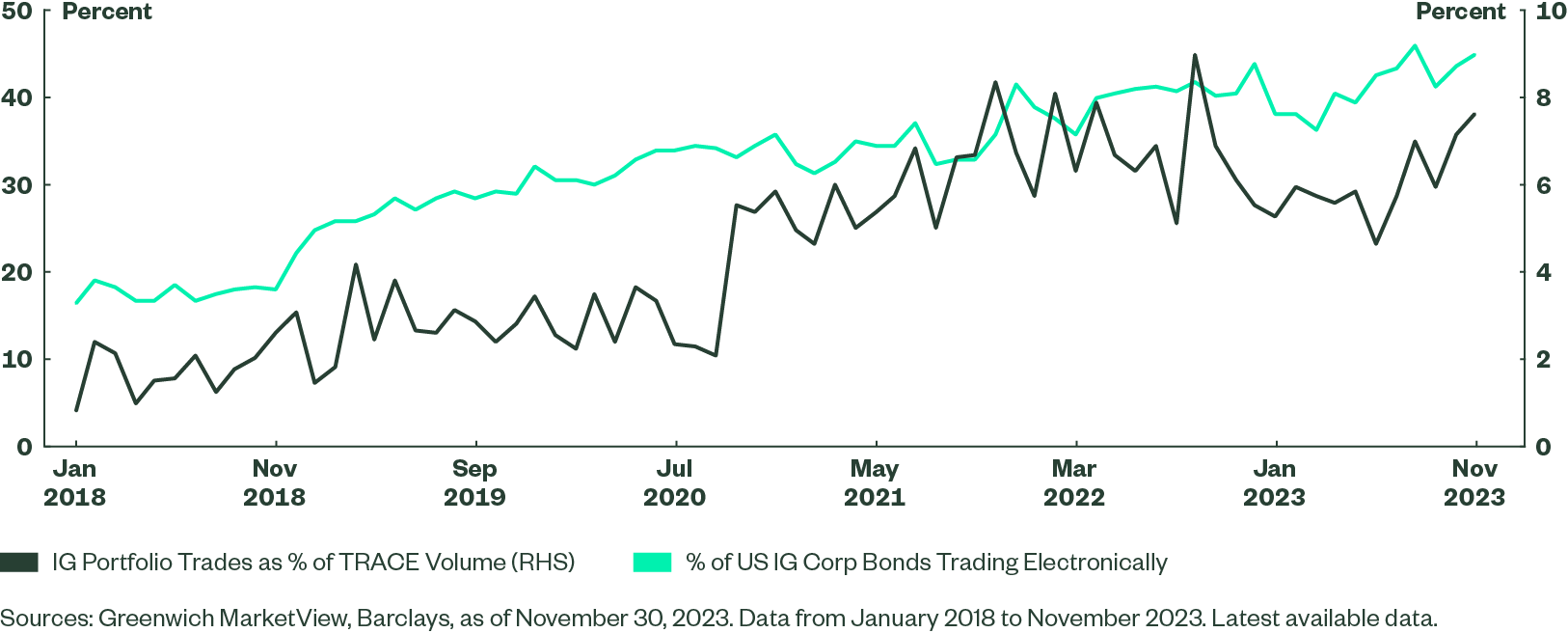

The menu of options for fixed income investors is long and made even more complex by the rise of fixed income exchange-traded funds (ETF) and systematic trading. Historically, systematic and index investing strategies have been much more widely adopted in equity markets than in credit markets because equities are far more liquid and standardized. Systematic and indexed strategies thrive on more data, transparency and breadth. However, recent innovations in fixed income markets have made it possible to overcome this liquidity barrier. As we discussed in The Modernization of Bond Market Trading and Its Implications, the “electronification” of fixed income trading has allowed passive fixed income strategies to become a more viable option for investors. In turn, systematic active fixed income and ETF strategies have received more inflows as the liquidity of underlying bonds in the cash market has improved (Figure 1).

Figure 1: The Roles of Electronic Trading and Portfolio Trading Have Risen for IG Corporate Bonds

Alongside this innovation, regulatory and competitive pressures have increased for institutional investors. This increased focus on fees and benchmark-relative performance has led to investors questioning their active management appetite. Fixed income markets are not immune to these forces. To date, the proportion of fixed income indexing strategies is estimated to have grown to 30%. As passive strategies continue to grow in market share, we encourage investors to examine how their own portfolios could be restructured.

Implementation of a Hybrid Approach

Our research shows that passive and active fixed income portfolios have performed differently over time, and certain fixed income sectors are more suited to one style versus the other. We take a data-driven look at how investors can use both styles to their advantage.

Fixed income market segments differ by their breadth, liquidity, and geopolitical sensitivity, as well as their compatibility with active management. The optimal combination of passive, systematic, and active fixed income strategies depends on these characteristics.

Our White Paper Outlines the Potential Benefits of a Modular Approach

We present a specific case study showing how investors can implement the active/hybrid approach within global investment grade credit. Our modeled results suggest that the best information ratio at lower tracking error budgets is achieved by combining active with passive and systematic allocations.