Sentiment Improves for Fixed Income

Each month, the SSGA Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) to guide near-term investment decisions for client portfolios. Here we report on the team’s most recent discussion.

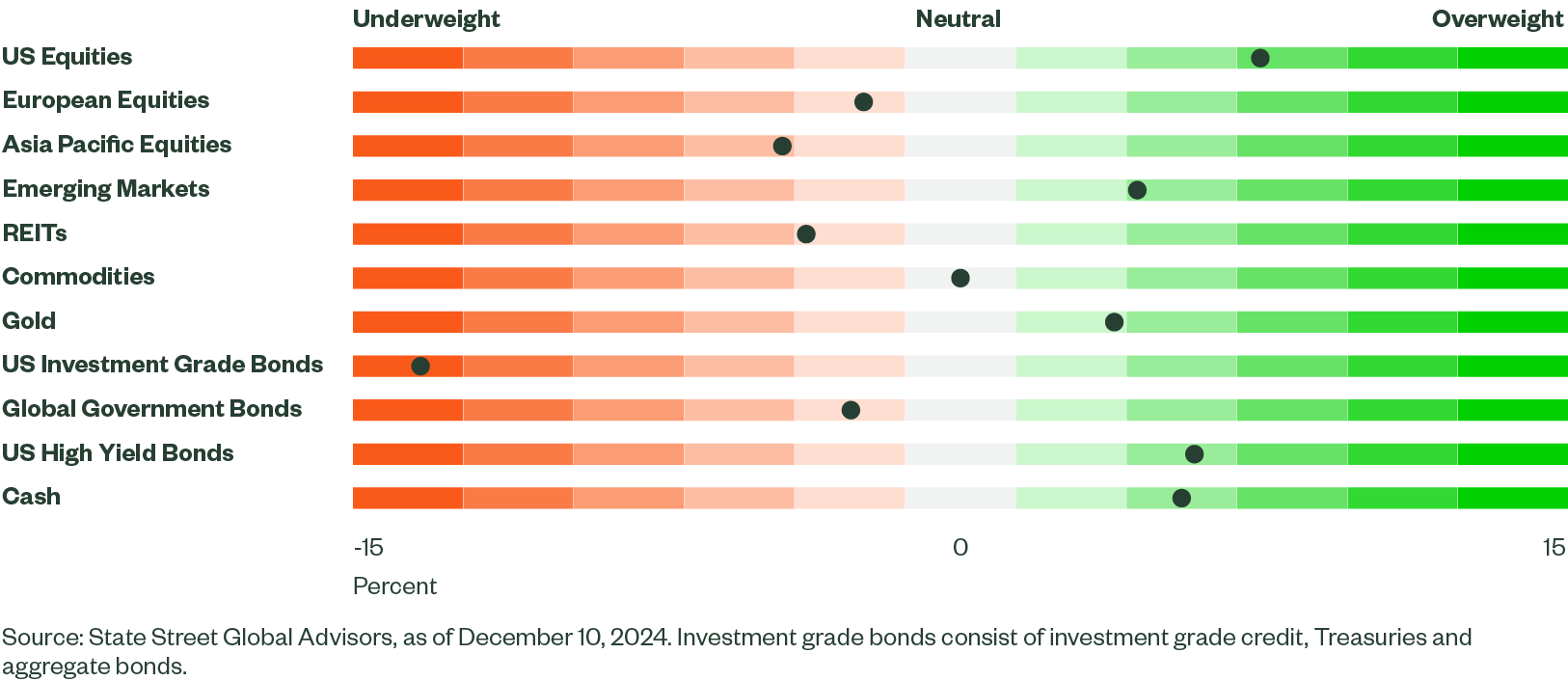

Figure 1: Asset Class Views Summary

Macro Backdrop

Looking back, 2024 provided no shortage of events for markets to navigate. The disinflation trend persisted, but early-year upside surprises and sticky service inflation worried investors, leading to frequent repricing of interest rate expectations. Central banks normalized monetary policy, with the Bank of Japan raising rates and other major central banks cutting rates numerous times.

US economic growth remained resilient, buoyed by strong consumer spending and rising fiscal deficits, but global weakness caused divergences. The war in Ukraine labored on, while geopolitical tensions intensified or emerged, including Iran-Israel conflict and the fall of the Assad regime. In the United States (US), a new administration took office, while France’s government collapsed and tensions simmered in both Germany and South Korea.

Looking ahead, our long-held view of a soft landing remains largely unchanged. Our US growth forecasts have marginally improved over recent quarters, and we still expect positive, though below-trend growth. Disinflation should persist, aided by rebalances in insurance, housing, and autos, though risks remain.

Central banks should continue to normalize rates next year, but there will likely be a divergence in pace. The Federal Reserve (Fed) will likely cut rates more slowly than previously expected and could face challenges in late 2025. Contrary to last year, upside risks to our forecasts have materialized, fueled by a combination of better income, savings, and the US election outcome.

US economic growth is expected to outpace other regions, supported by a solid starting point and pro-growth policies from the incoming administration. While details are uncertain, deregulation and extended tax cuts aim to increase domestic growth. Additionally, upward revisions to income and savings point to ongoing support for consumption.

Labor markets — which are key to both economic growth and Fed policy — while cooler now, remain firm despite recent mixed signals. Four-week moving averages for jobless claims are above pre-COVID levels but not alarming, and initial claims continue to decline. Job openings have recently increased, the number of workers quitting rose, and layoffs and discharges remain low. Wage growth, measured by the average hourly earnings, has also trended higher and is still above pre-COVID levels. Overall, the US growth outlook remains constructive, as shown by the Atlanta Fed’s GDPNow tracking 3.3% for Q4 2024.

Outside of the US, a combination of policy uncertainty and weak domestic consumption weigh on outlook. Europe remains stuck amid poor consumption and political crisis in France and Germany. France faces fiscal challenges, while Germany will need greater fiscal spending to stimulate growth. Although risks of further downside are low given strong labor markets, wages, and household balance sheet dynamics, Europe needs pro-growth policies to spur consumption as households are reluctant to spend their savings.

In Japan, positive wage growth and the government’s supplementary budget are expected to support growth, but uncertainty surrounding the Upper House elections could challenge the outlook. China, already grappling with structural issues like housing, weak domestic consumption, and deflationary threats, faces the added challenge of higher tariffs in 2025. Further stimulus will be needed, though the extent of government action remains uncertain.

Despite geopolitical risks and policy uncertainty overhang in major economies, solid labor and wage dynamics combined with further central bank rate cuts should support global economies in 2025.

Directional Trades and Risk Positioning

Our Market Regime Indicator (MRI) suggests improving risk sentiment as risk aversion moderates. While our quantitative framework shows mixed signals, it generally reflects moderate support for risk appetite.

The collapse of the French government and other geopolitical tensions have brought uncertainty and angst to markets. However, central bank interest rate cuts, stronger US economic data, solid labor and wage indicators, along with rising consumer confidence have bolstered risk sentiment. Credit market sentiment and risk support measures continue to reflect risk aversion, though implied volatility has slightly improved, but remains neutral.

Equity trend signal, based on nine combinations of short- and long-term moving averages, remain strongly supportive of risk appetite. Additionally, sentiment spreads (risk-on vs risk-off market segments) continue to improve, signaling a slight risk-on environment. Overall, our MRI now points to a moderately positive risk environment.

Despite improved investor risk sentiment, our equity forecast has softened, while our expectations for fixed income have strengthened.

Deterioration across multiple factors drove our weaker equity forecast. While price momentum remains positive, it has eased from very strong readings. Quality factors remain positive and sentiment indicators have turned positive, but stretched valuations continue to deteriorate. Overall, our equity forecast stays slightly positive.

In bond markets, our model prefers high yield, cash, and intermediate bonds, with a preference for credit over US Treasury bonds. Near-term interest rate changes are expected to be minimal, as resilient economic data (supporting higher rates) balances out incremental improvements in rates momentum (favoring lower rates).

Our model expects curve steepening due to lower inflation expectations and weaker leading economic indicators compared to our historical trends. For credit — both high yield and investment grade — lower equity volatility, positive seasonality, and lower government bond rates buoy our forecast.

Commodity markets have mostly marked time this year – ebbing and flowing in an environment of decent global economic growth and geopolitical conflict. While we previously held an underweight position in broad-based commodities, we have shifted to a neutral stance. Although we still give the edge to financial assets such as equities, our modeling for commodities is pointing to favorable carry (ex-energy) and potential exhaustion in anti-commodity investor bias based on signals derived from futures prices.

Given the better commodity forecast, we increased our exposure to neutral, funding the allocation by reducing equities while keeping a small overweight. Additionally, we sold aggregate bonds, moving further underweight.

Relative Value Trades and Positioning

Within equities, our regional rankings remained largely unchanged, though forecasts for non-US equities, particularly the Pacific region, improved. In our latest rebalance, we reduced our emerging market overweight and bought Pacific equities. While macroeconomic and quality factors for Pacific remain negative, they show improvement. Price momentum is now positive and sentiment indicators for sales and earnings are strong.

Emerging markets still have a positive outlook, but that softened this month, with weaker support from price momentum and macroeconomic indicators. Sentiment indicators and quality measures remain moderate but less robust than earlier in the year. Macro and geopolitical headwinds also weigh on the outlook. Overall, we maintain our overweight allocations to US and emerging market equities, with corresponding underweights to non-US developed equities.

On the fixed income side, we initiated an overweight to intermediate corporate bonds due to an improved forecast. The expectation for tighter spreads and lower yields supports the asset class. To fund this, we reduced our cash position and sold more aggregate bonds which are less attractive on a relative basis.

At the sector level, we maintained full allocations to communication services and financials. We removed our split allocations in energy and technology in favor of consumer discretionary. Communication services continues to rank well across most factors with strong sentiment, solid price momentum, and attractive valuations buoying the sector. Financials are supported by robust price momentum, steady sentiment indicators, and positive macroeconomic factors. While forecasts for energy and technology remain positive, energy is weighed down by weak price momentum and poor sentiment and technology suffers from unappealing valuations. Consumer discretionary was upgraded due to improved sentiment and price momentum indicators.