Fiscal (In)Stability

Global debt has surged at an unprecedented pace since the onset of the pandemic, raising concerns around the fiscal sustainability of countries worldwide.

What are the major implications this fiscal backdrop will have for economies and investors in the coming years? Learn from our investment experts.

The Trends to Watch

Simona Mocuta

Chief Economist

Video (2:04 min)

Fiscal Debt in Motion

in 2020

increase since January 2020

as a share of government revenues

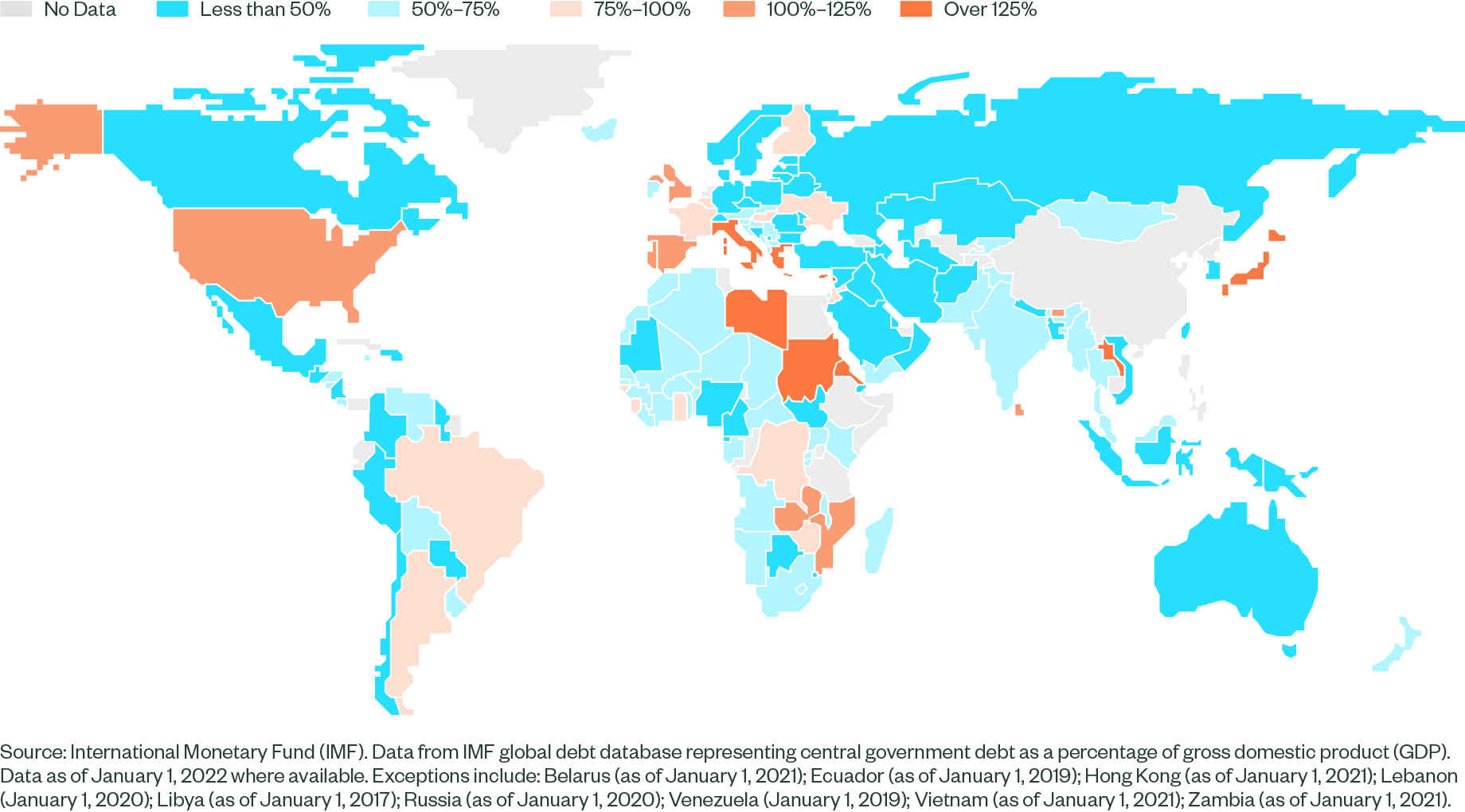

Global Hot Spots

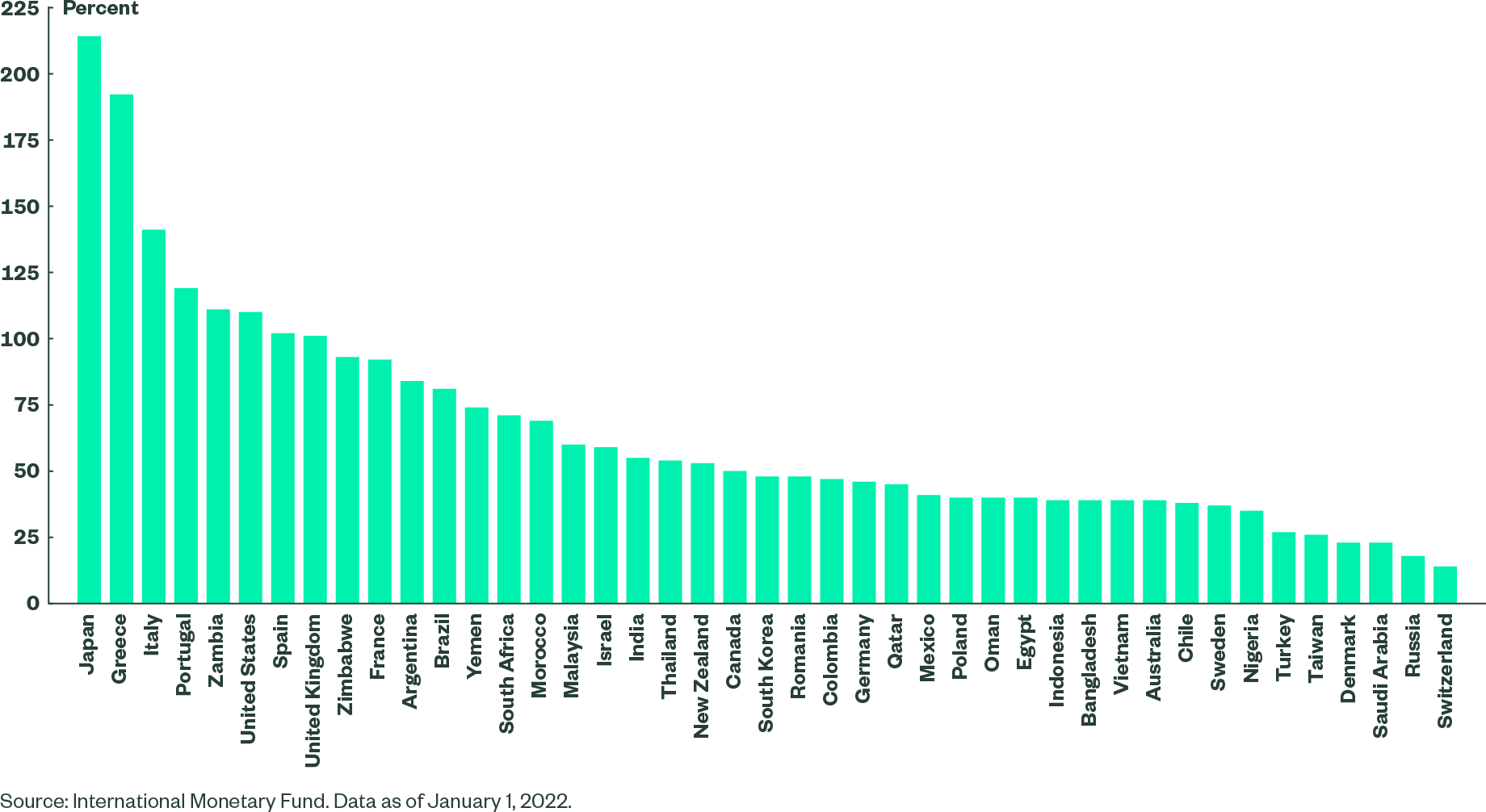

Debt Levels Across the Globe

Central Government Debt to GDP

Why Rising Fiscal Debt Matters

Higher Debt Service Costs

Higher interest costs reduce a government’s ability to make important public investments that can fuel economic growth areas such as education and infrastructure. A country saddled with debt will have less resources to invest for the future.

Inflationary Pressure

High and growing levels of public debt are likely to cause higher inflation as the increasing burden of debt and deficit financing raises political pressure to continue pursuing inflationary policy.

Lower Growth

Rising debt burdens can lead to less investment by businesses which results in curbing economic growth. Fiscal policy is expected to become a mild drag on economic performance over the medium term across many economies.

The UK announced its Autumn Budget, pitting the political priorities of a new Labour government against narrow fiscal space. We examine what this means for markets and investors.

Since the start of the Pandemic in 2020, the US has added approximately $11 trillion of public debt to its balance sheet.

In the second article of our Focus on Fiscal series, we examine the challenges facing the euro area, and France in particular, and consider what this fiscal landscape in the euro area means for investors.