Annual Rebalance for the S&P 500 ESG Leaders Index

The S&P 500 ESG Leaders Index has just completed its annual rebalance, and a total of 85 stocks are changing places. Here we’ll review some of the big names involved and how this impacts the index composition.

Overview

The S&P 500 ESG Leaders Index is designed to exclude controversial business activities and favour stocks with best-in-class ESG scoring. With similar industry group weights to the S&P 500, tracking error is kept low. The index has proved popular given its broad allocation, its simple methodology and similar risk-return characteristics to the S&P 500® Index.

The index is rebalanced annually, at which time stocks may be reclassified as either eligible or ineligible for inclusion. The changes take place before the open of trading on Wednesday, 1 May.

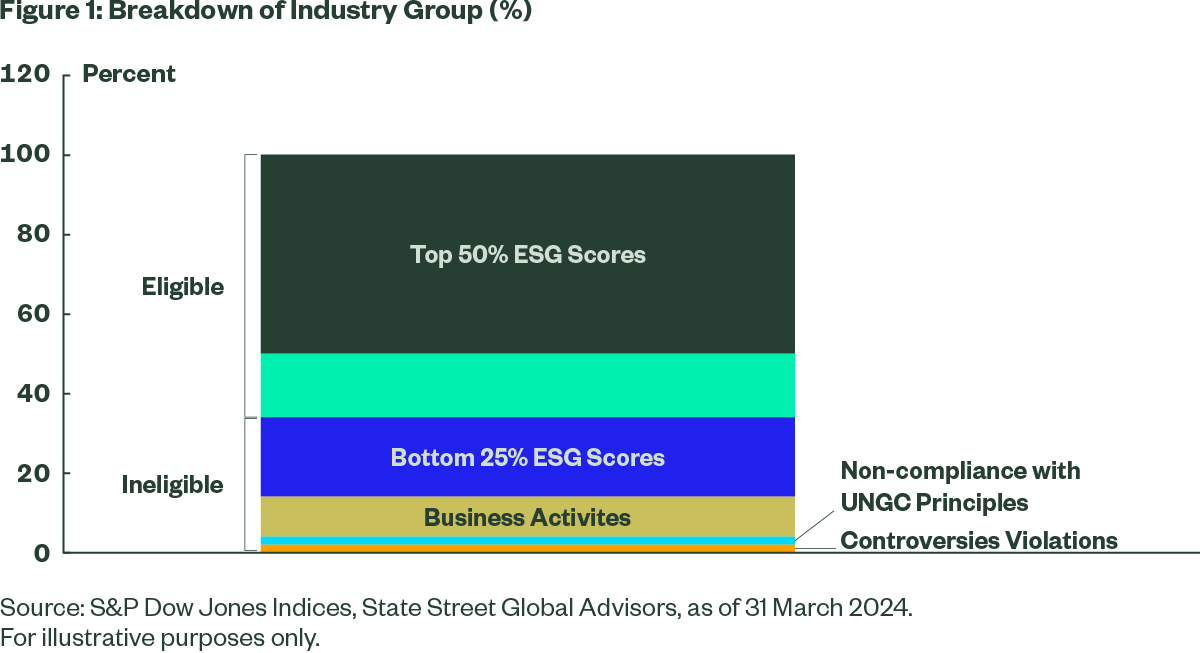

The index methodology combines exclusions with best-in-class ESG scoring. Ineligibility for index inclusion can be owing to controversy, a lack of ESG coverage, business involvement (e.g., tobacco manufacturing), or a very low ESG score. Eligible stocks are ranked within their GICS Industry Group by their S&P Global ESG Score. The top 50% of stocks by float-adjusted market cap are selected for index inclusion. Figure 1 illustrates this.

For more details on the index methodology, please refer to our index guide: Why & How S&P 500 ESG Leaders Works.

2024 Rebalance

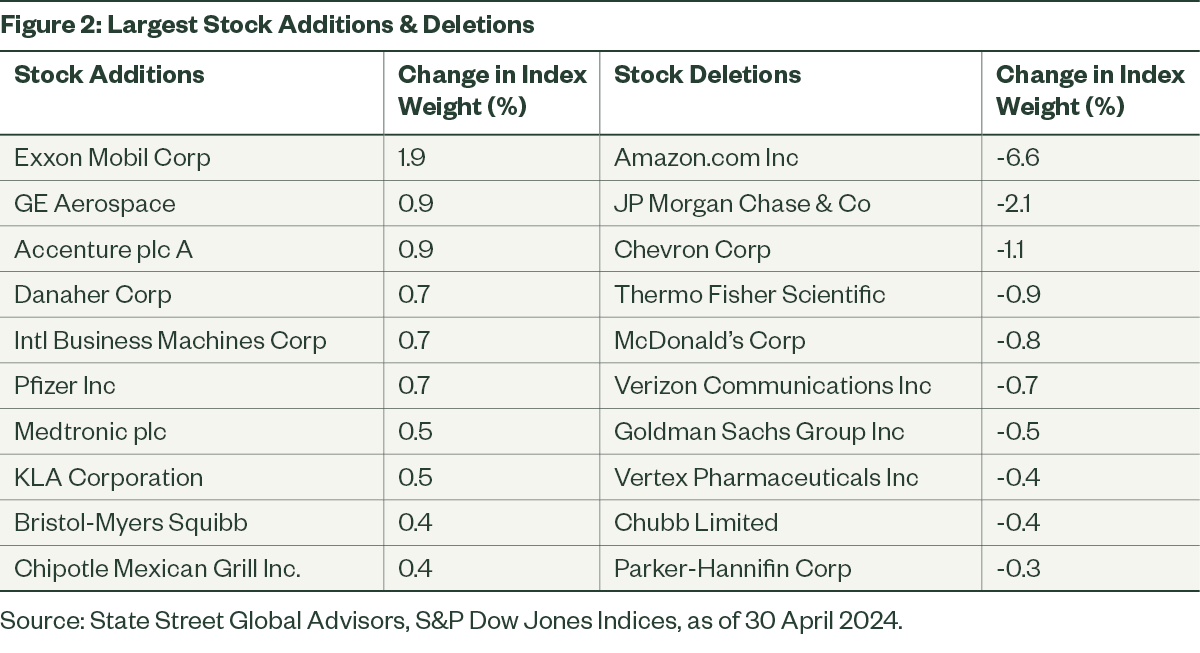

In the most recent rebalancing exercise, 47 stocks were added to the S&P 500 ESG Leaders Index and 27 were dropped, giving the index a total of 216 stocks and incurring a one-way turnover of 13%. In most cases, the stock changes were made because of a move in the rankings by ESG score within an industry group — meaning these stocks were already eligible but not necessarily selected for inclusion.1

One such example of an intra-industry group move involves oil & gas majors Exxon Mobil and Chevron. Although eligible, because its fossil fuel activities do not fall within the excluded categories such as thermal coal and Artic drilling, Exxon Mobil was not a member of the index last year because of its relatively low ESG score compared to oil-producing peers. The company has improved its relative ranking against the industry group average, and now replaces Chevron in the index, with a weight of 1.9%.1

An interesting example of a stock that has become ineligible is Amazon. It has been dropped from the index due to its low S&P DJI ESG Score. The company has been marked down particularly with regards to social controversies and a lack of information provided on environmental policies. Given the size of Amazon — the fourth-largest US quoted stock with a previous weight of 6.5% in the Leaders index — its exclusion makes a significant difference to the index composition. The weight of the Consumer Discretionary sector in the S&P 500 ESG Leaders Index has dropped to 9.2%from the previous weight of 14.2%, with relative exposure now below that of the S&P 500 Index.1

Mega-cap exposure (as measured by a market capitalisation greater than $100bn) has reduced by 4%. Nevertheless, the index still contains five of the Magnificent Seven names (Meta is also excluded) and these are all held at overweight positions against the S&P 500 Index. This is one reason why the largest sector overweight versus the S&P 500 remains Information Technology.1

One sector beneficiary of the rebalancing is Health Care, which has increased its weight from 9.7% to 12.0%, bringing it close to neutral with the S&P 500. New stock additions to the index include life science company Danaher and pharmaceuticals company Pfizer.1

How to Access the Theme

The SPDR® S&P® 500 ESG Leaders UCITS ETF cut its TER to just 0.03% on 1 November 2023. Since then, it has taken in US$1.2B, increasing total AUM to more than US$2.4B.2