Seizing the Opportunity in Australian Government Bonds

As fiscal and monetary policymakers continue to navigate the narrow path towards a soft landing Australian government bonds have emerged as both source of stability and opportunity Investors can both access attractive yields and manage the downside risk in their overall portfolio with an investment in an Australian Government bond ETF.

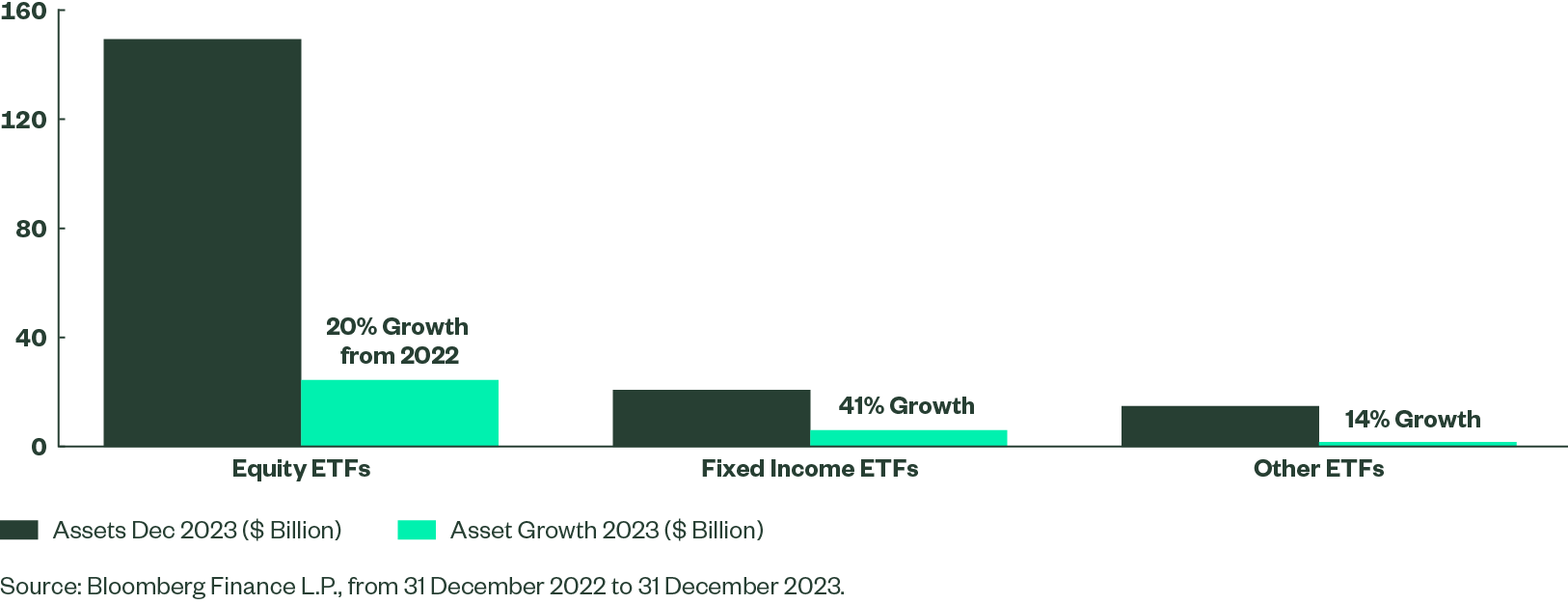

Australian-listed bond ETFs have seen tremendous growth over the last year, with asset growth of 41% as a percentage of the asset base at the start.

Growth of Australian Bond ETFs over 2023

Investor interest was likely driven by the sharp increase in bond yields in 2022 followed by more measured rises over the course of 2023. Bond yields can often be an indicator of future income and potential total returns, and they are at the highest levels that we have seen in the past decade.

Role of Bonds in a Multi-Asset Portfolio

High quality core bond assets, comprising primarily government bonds, can play a role as a portfolio diversifier, when blended with equities and other risk assets, potentially resulting in a smoother ride in volatile markets.

Since 2022, a unique combination of factors resulted in equity and bond returns becoming correlated. To many investors, bond assets may appear to have – at least temporarily – lost some of their ability to help offset the losses in equities within a multi-asset portfolio. However, longer term analysis shows diversification benefits still hold.

Over a time horizon that encompasses a variety of market environments, one could have invested solely in growth assets such as Australian equities, and been quite well compensated for taking the risk. However, by introducing Australian core bonds (such as investment grade Australian composite bonds, which comprises primarily Australian government bonds) to the portfolio, and then global assets, we demonstrate that it would have been possible to achieve increasing levels of diversification, or in other words portfolio efficiency (as measured by the historical Sharpe Ratio). The robustness of the portfolio is tested by its performance in downmarket scenarios, most recently the inflation/rate shock during Q2 2022 and US bank collapses in March 2023. Compared against Portfolio 1, Portfolio 2 and 3 have higher Sharpe Ratios, and experience smaller drawdowns in stress scenarios.

Hypothetical Portfolio Scenarios – A Comparison

| Hypothetical Portfolio 1 Australian Equities |

Hypothetical Portfolio 2 + Australian Bonds |

Hypothetical Portfolio 3 + Global Diversification |

|

| Description | 100% Australian Equities | 60% Australian EQ / 40% Australian FI | 30% Australian EQ / 30% Global EQ / 20% Australian FI / 20% Global FI |

| 15 Year Return (Annualised) | 9.42% | 7.35% | 7.97% |

| Realised Volatility (Annualised) | 15.72% | 9.22% | 6.85% |

| Sharpe Ratio | 0.44 | 0.53 | 0.81 |

| Global Financial Crisis (Nov 2007 - Mar 2009) | -50.58% | -29.11% | -25.60% |

| Covid Crisis (Feb 2020 - Mar 2020) | -35.93% | -22.22% | -18.66% |

| 2022 Inflation Rate Shock (Apr 2022 - Jun 2022) | -14.90% | -11.27% | -9.09% |

| Bank Collapses US (Mar 2023) | -0.16% | 1.29% | 2.25% |

Source: State Street Global Advisors, Bloomberg Financial L.P., as of 31 December 2023. Global Financial Crisis refers to the period from the portfolio 1 performance peak to trough, November 2007 to March 2009. Covid-19 Crisis refers to the period from portfolio 1 peak to trough, February 2020 to March 2020. 2022 Inflation Rate Shock refers to the period from portfolio 1 peak to trough, April 2022 to June 2022. Bank Collapses US from 1 March 2023 to 31 March 2023. Past performance is not a reliable indicator of future results. Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. Australian Equities = S&P/ASX 200 Index | Australian Fixed Income = S&P/ASX Australian Bond Index | Global Equities = MSCI AC World Index (unhedged) | Global Fixed Income = Bloomberg Global Aggregate Index (AUD hedged). Diversification does not ensure a profit or guarantee against loss.

Sample portfolio returns shown above are hypothetical and were achieved by mathematically combining the returns of the underlying market indices in the proportions shown above, and rebalanced monthly. Market indices are unmanaged and not subject to fees and expenses which would lower returns. Neither index performance nor sample portfolio performance is intended to represent the performance of any particular mutual fund, exchange-traded fund or product offered by State Street Global Advisors. State Street Global Advisors has not managed any accounts or assets in the strategies represented by the sample portfolios above. Actual performance may differ substantially from the hypothetical performance presented.

What is the Opportunity in Australian Government Bonds?

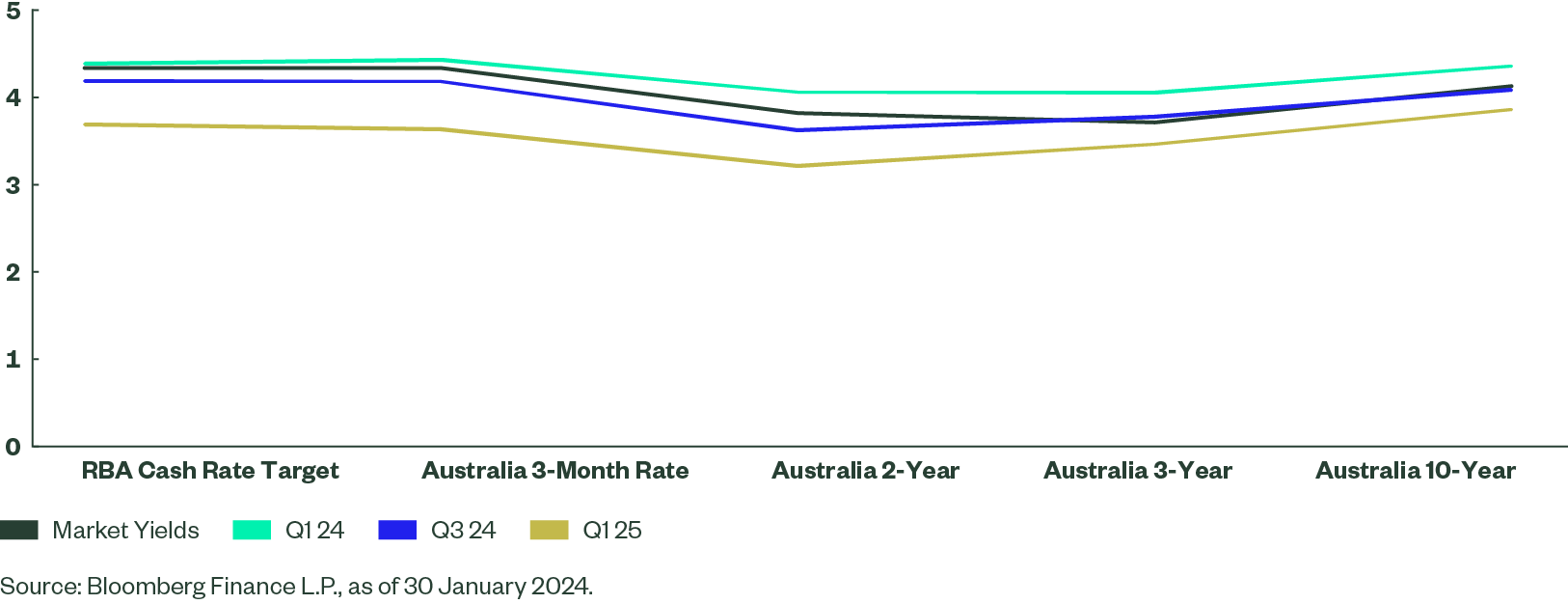

Not only are broader ETF growth trends and diversification benefits supportive, Australian government bonds may also be attractive from a market timing perspective if the Reserve Bank of Australia (RBA) pivot occurs in H2 2024 as broadly anticipated, with consensus forecasts indicating yields near or at their peak.

Australian Government Bond Yield Curve and Forecasts

With these consensus expectations in mind, it is perhaps little wonder that institutional investors have increased their portfolio allocations to Australian government bonds on average by 1.1% of the overall portfolio so far this year.1

What are the Risks?

Investing inherently involves risk, whether due to changing economic conditions, market fluctuations or unforeseen events. Also, central banks are not immune from making policy mistakes; there is a risk of cutting too soon as markets witnessed during the Great Inflation in the US. Investors can benefit from a thorough understanding their investment goals and risk tolerance, while some investment risk may be mitigated through diversification and by setting an appropriate investment horizon.

Related ETFs