A Risk-Management Tool with Staying Power

Over the long term, gold stands out as a consistent source of portfolio diversification — a major reason why multi-asset portfolio managers can consider including gold in their portfolio allocations.

Over the long term, gold stands out as a consistent source of portfolio diversification — a major reason why multi-asset portfolio managers can consider including gold in their portfolio allocations. Gold’s diverse, global demand among both cyclical and countercyclical sectors can help drive two key strategic benefits for portfolios: its persistently low correlations to other asset classes and its ability to protect against tail risks. These characteristics may aid in providing efficient portfolio diversification while reducing portfolio drawdowns and volatility resulting in improved risk-adjusted portfolio performance. These benefits have been highlighted by the failure of fixed income to provide portfolio diversification in recent years.

All investments carry some degree of risk; the higher the potential return on investment, the more risk an investor must take. When building a multi-asset portfolio, investors must consider not only the potential or forecasted risk-return characteristics of a particular asset class, but also how that asset class or market segment behaves relative to other investments and the impact on the portfolio as a whole. Although many investors tend to focus on constructing portfolios with asset classes offering high forecasted risk-adjusted returns, there are potential benefits to including asset classes that may also move differently relative to one another.

A low correlation between the asset classes in a multi-asset portfolio can help lower portfolio volatility and therefore, all else being equal, increase diversification and enhance the overall risk-adjusted return of a portfolio. Comparing gold’s behaviour to global equity and fixed income indices highlights its low correlation over the last 25 years. Among major equity markets including the ASX 200, the correlation to gold ranges from near zero to negative (see Figure 1), while the highest fixed income index correlation (0.34 to Australian composite bonds) is still relatively low (see Figure 2).

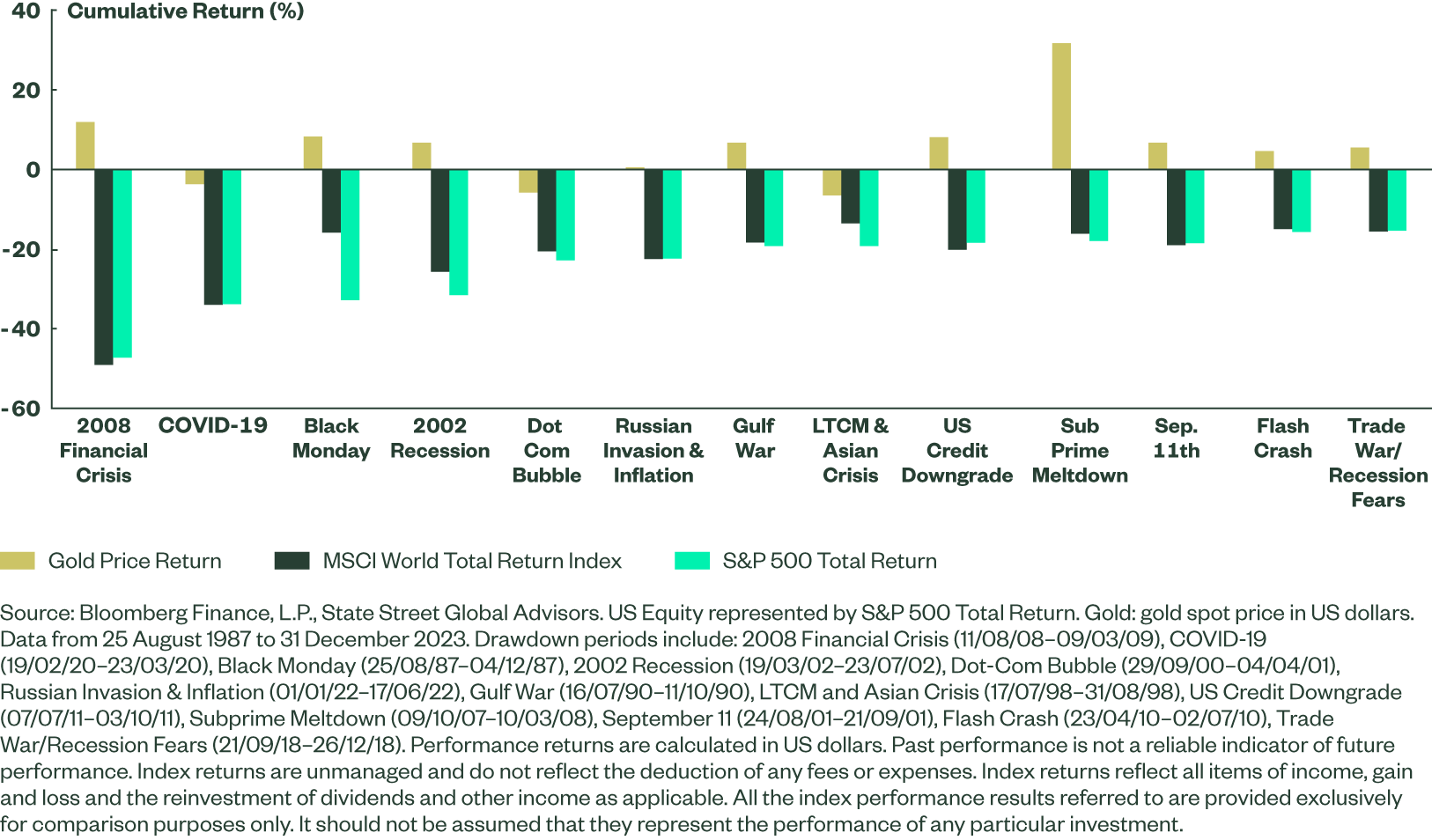

Beyond providing low correlations to financial assets over multiple market cycles, gold has a strong track record of protecting against both short- and long-term market volatility. Its ability to protect portfolios against systemic market shocks and tail events emanating from various catalysts (financial, health-related, economic, geopolitical, credit/liquidity) may help reduce portfolio drawdowns, resulting in potential improvement of portfolio performance over time.

When evaluating major drawdowns in US equity markets, gold has outperformed US equities. As detailed in Figure 3, during peak-to-trough drawdowns greater than 15% on the S&P 500 index, gold averaged 5.8%, compared to -24.2% total return on the S&P 500. Furthermore, during these 13 drawdown events, gold experienced positive returns during 10 of them. During the three periods when gold’s return was negative, it still reduced portfolio drawdowns and volatility when compared to a portfolio with no allocation to gold (maximum drawdown of -6.4%). Furthermore, gold tends to maintain gains over time even as markets recover.

Figure 3: Gold Has Outperformed Relative to US Equities During Drawdowns Greater Than 15%

Gold not only helps mitigate risk during sustained equity market drawdowns, but also may help protect against shorter-term bouts of volatility driven by market technicals or transient events. During trading weeks exhibiting elevated implied volatility for US equity, US Treasury, and foreign exchange (FX) markets, gold’s average weekly performance was positive and outperformed defensive assets like bonds and the US dollar, on average.

Read the full whitepaper: Gold For Australian Investors: A Portfolio Diversifier With Staying Power.