The Case for Emerging Markets Small-Cap Equity

There are compelling reasons to consider emerging markets small-cap equities – and to lean into a focus on a quantitative approach. In this article, we look at the investment case for EMSC and how our systematic model zeros in on firms with attractive valuations, strong quality characteristics, and signs of improving fundamentals – unlocking new opportunities for investors.

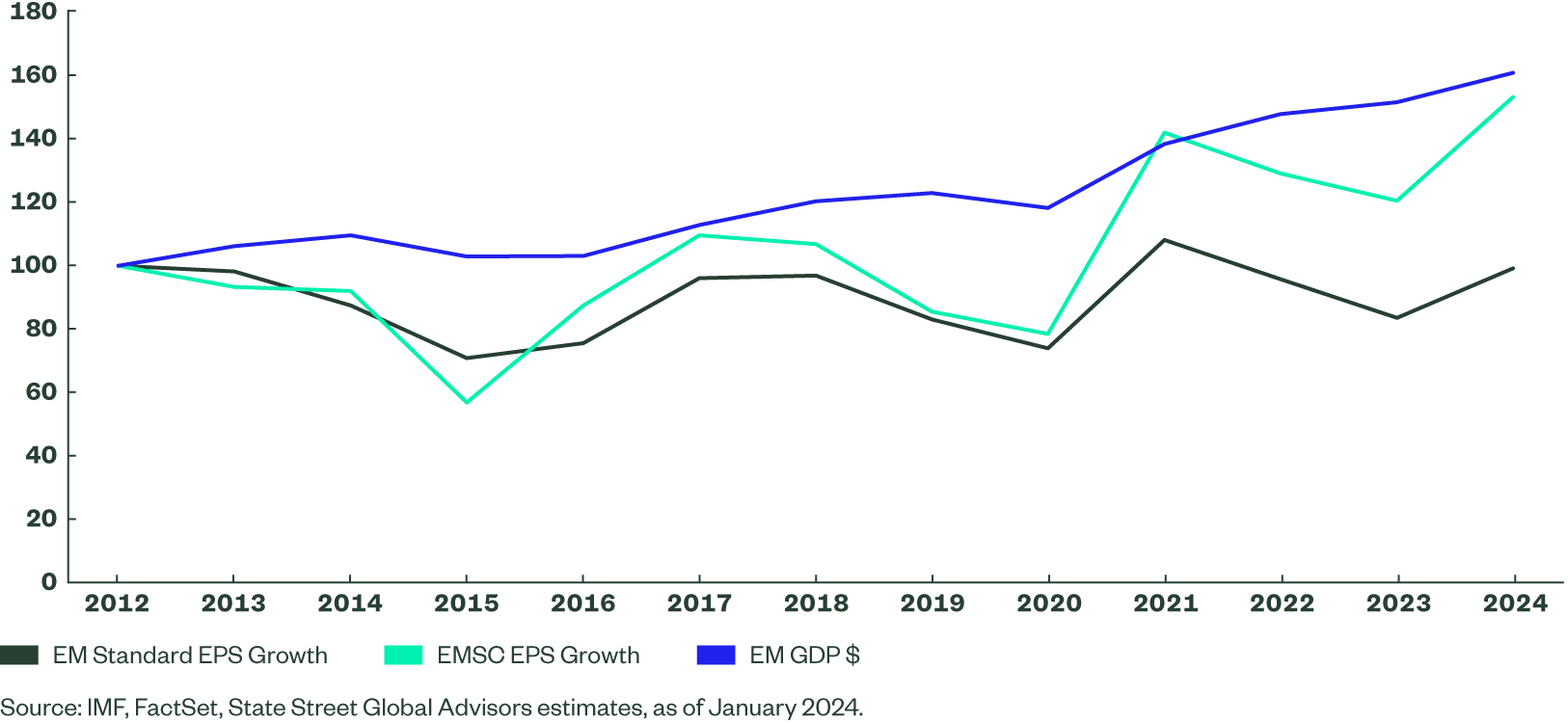

The emerging market growth story has been a key story of the global economy over the last few decades. After a couple of years of declining growth as compared to developed economies, the trend is set to change in 2023 with emerging market growth reaccelerating. While investors routinely make allocations to small-capitalization companies in developed markets, they often ignore their emerging market counterparts, despite the potential return enhancement and diversification benefits emerging market small-caps can offer. While we remain constructive on emerging market large-caps (EMLC), that universe is more reliant on global growth than economic growth in emerging markets, whereas small-cap names have greater exposure to domestic growth. State Street Global Advisors Systematic Equity Active (SEA) Team thinks it is time investors consider making an allocation to emerging market small-cap stocks — it is an area of the market that we believe offers the most direct link to the real emerging market growth story as seen below in Figure 1:

Figure 1: For EM Growth, Look at Smaller-Cap Names

Why Investors Should Consider Emerging Market Small-Cap Stocks

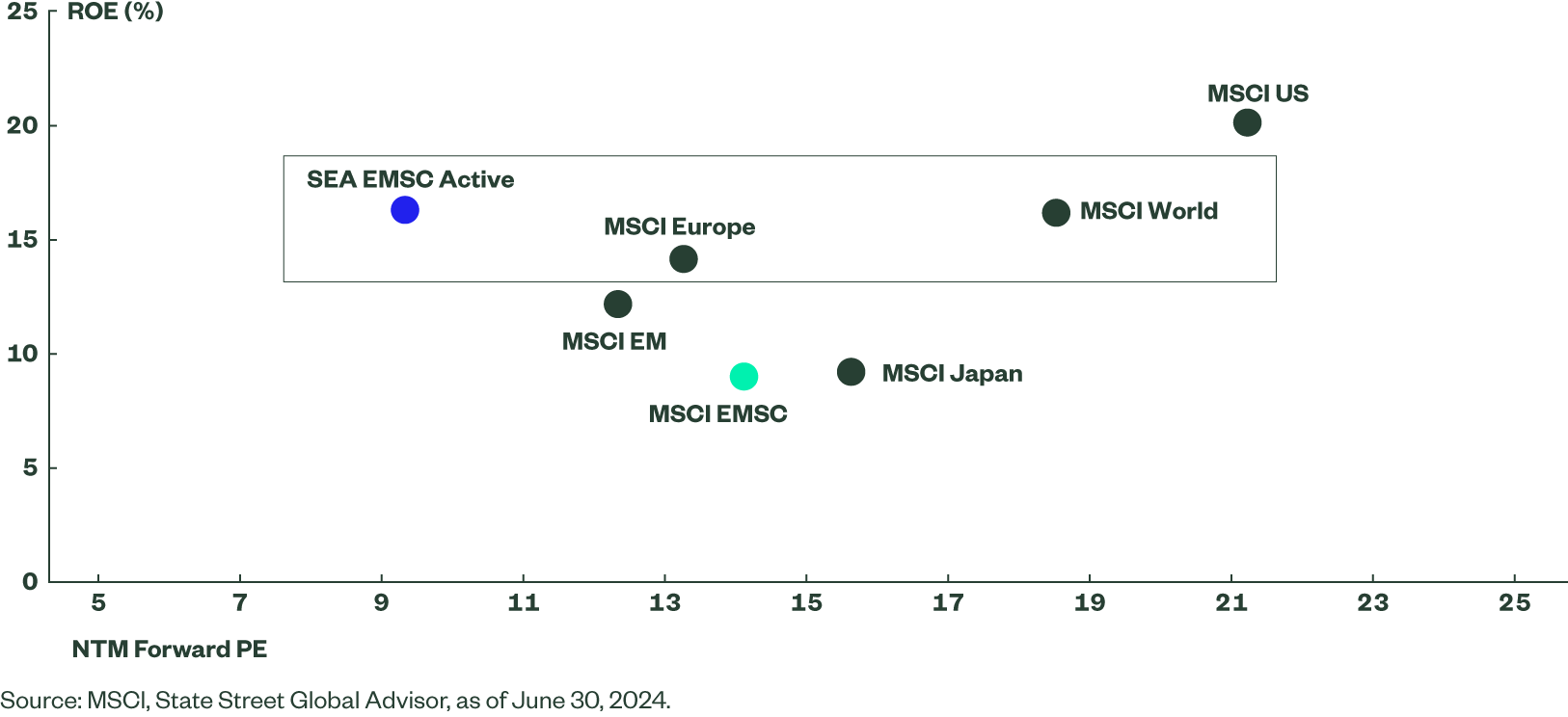

In many global markets, valuations remain quite lofty. While the high levels in certain areas may be justified given their high return on earnings (ROE), we think the EMSC space is an attractive area for active management. For example, as seen in Figure 2, our SEA team is able to construct our Active portfolios with an ROE at around 17% and with a price to earnings ratio (PE) of less than 10. That enables us to deliver MSCI World profitability levels at nearly half the valuations. This approach can save investors from having to choose between chasing stocks with lofty valuations or buying stocks with average quality.

Figure 2: SEA EMSC: No Better Valuation-to-Profits

Less Dollar Dramatics

One attractive quality of Emerging Markets Small Caps we particularly like is the lower relative impact from the US Dollar. This goes hand in hand with the pure EM economic growth play, because revenues in EMSC companies are driven more by local demand than by global, and currency rates play a much smaller role than the more globally driven EMLC names. The most straightforward way to illustrate this relationship is by looking at the correlation between the twelve-month change in USD and the forward one-year estimated EPS growth rate. Using a trailing ten-year window, the correlation for EMSC is marginally negative at -0.2, while the EMLC correlation comes in at -0.6. Opinions vary widely with respect to the trajectory of USD rates, but irrespective of where the Fed lands, we see earnings growth of EMSC companies as more insulated from unfavorable moves.

Risks

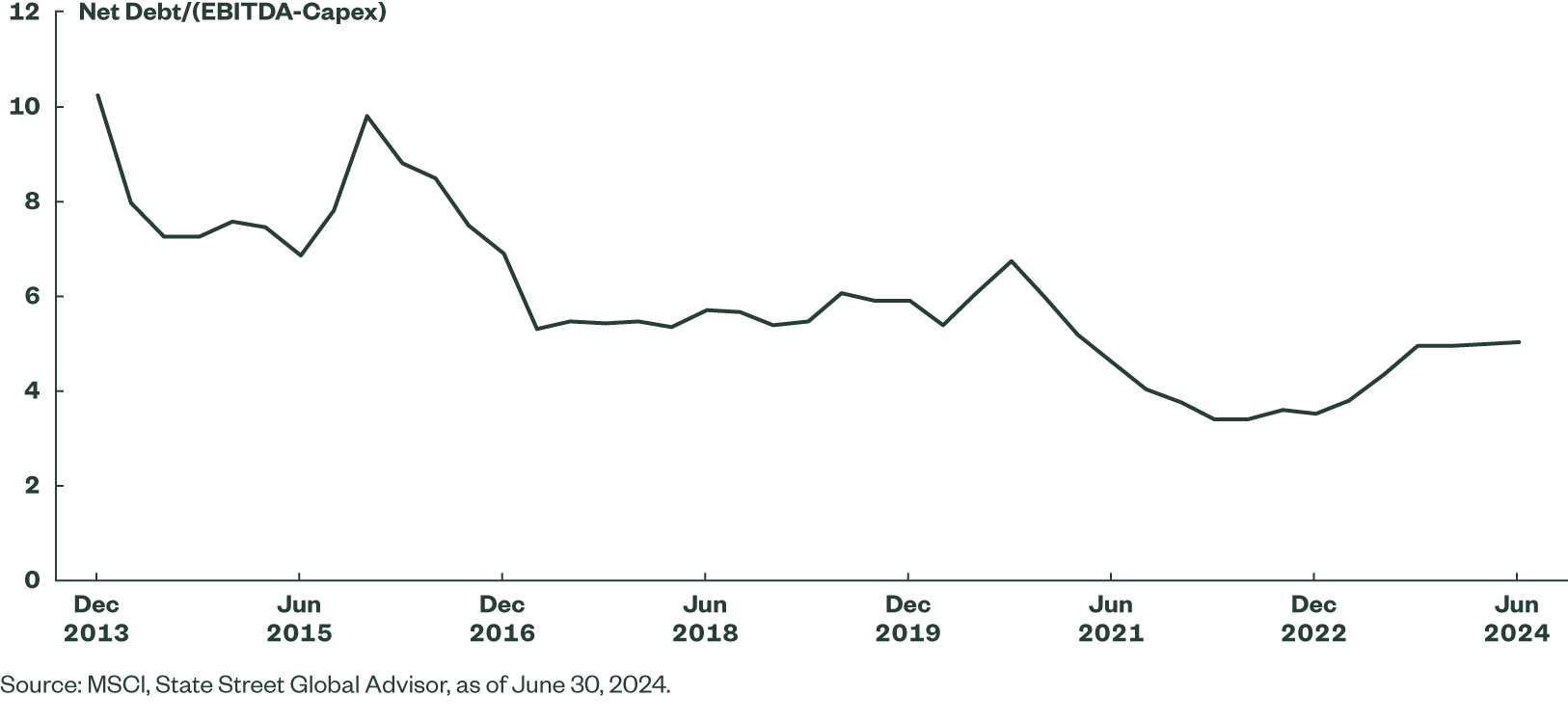

One of the concerns investors have about EM small caps is the risk environment. There is no question that risk is embedded across global equities, but some of the big risks at the forefront of investors’ minds are less relevant at the moment for emerging market small cap stocks. In the aftermath of the Global Financial Crisis (GFC), some emerging market companies took on a fair amount of leverage (2010–2; see Figure 3). Rates were low, capital plentiful, and there was a global recovery story in place. In truth, these companies probably invested a bit too much — which pushed down overall profitability. The good news is that net debt (as a function of cash flow) has been normalizing for some time and in fact, debt levels are lower now than at any point in the post-GFC period. We expect this trend to continue as companies face higher rates.

We have been in a rising interest rate environment since the early part of 2022. While the trend on interest expense does not show as much improvement as one would like (given the fall in net debt), it is worth noting that, directionally, interest expense is falling in a time of rising global rates and higher risk aversion. This may rise a bit in 2024, but we are already seeing signs of stabilization at manageable levels. Risks of a problematic drying up of credit access appears low in the standard EM equity index countries — even though some smaller countries, such as Egypt, may see some pressures. Other markets in the Frontier space will see a debt squeeze, but so far those linkages to MSCI Emerging Markets appear limited.

Figure 3 Debt to Cash Flow

Why One Should Consider an Active Quantitative Approach

While we are proponents of an active investing philosophy in this asset class, there are strong reasons to focus on a quantitative approach. Analyst research coverage of the emerging market small cap equity space is low, resulting in limited information. The brokerage community has not made major investments in covering these companies. In fact, just over 50% of the names in the universe have analyst coverage (versus nearly full coverage for names in the standard MSCI EM). Interestingly, this low level of analyst coverage has remained relatively stable since we launched our Emerging Markets Small Cap Active Strategy nearly fifteen years ago, and we see it as a competitive advantage for systematic managers. Fundamental investors often rely on sell-side support (data, forecasts) and/or investor relations departments (data, management meetings) to support their investment decisions. This potential neglect or lack of attention by other investors offers unique opportunities for active managers, especially those with information or insight across the full universe of securities.

A quantitative investment approach is much more independent. Our state-of-the-art data infrastructure collects the latest and most important publicly available information on nearly 4,000 emerging market stocks. On a daily basis, our models evaluate the optimal set of stocks to build a portfolio. Through this rigorous process, we minimize inertia or slippage when it comes to finding the best stocks to buy. Additionally, sell-side analyst coverage is heavily tilted towards the (much) larger names in the universe. Many of our team’s best investments are off the beaten path. Our model zeros in on firms with attractive valuations, strong quality characteristics, and signs of improving fundamentals. If we can find these names before other investors, that is an even better outcome.

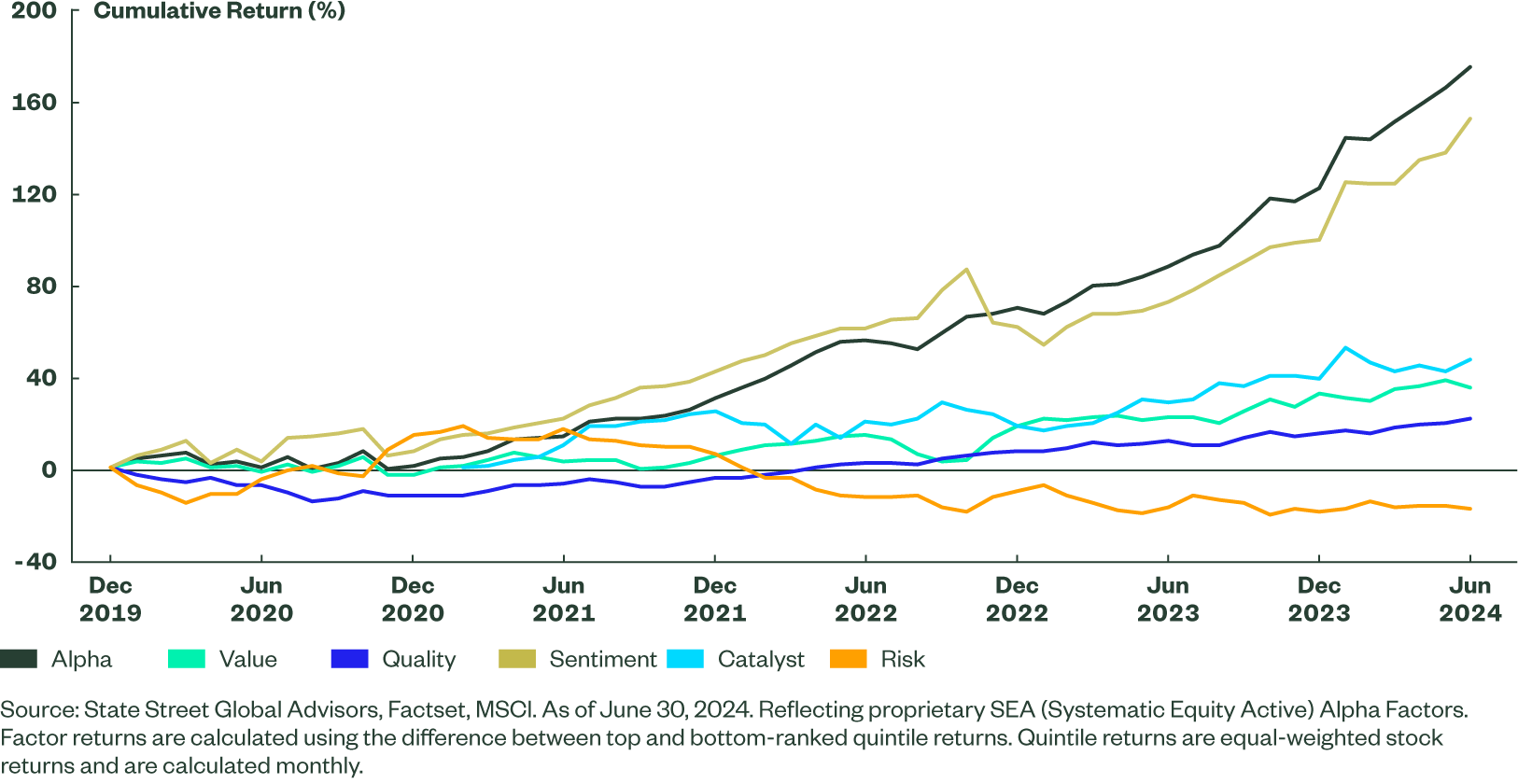

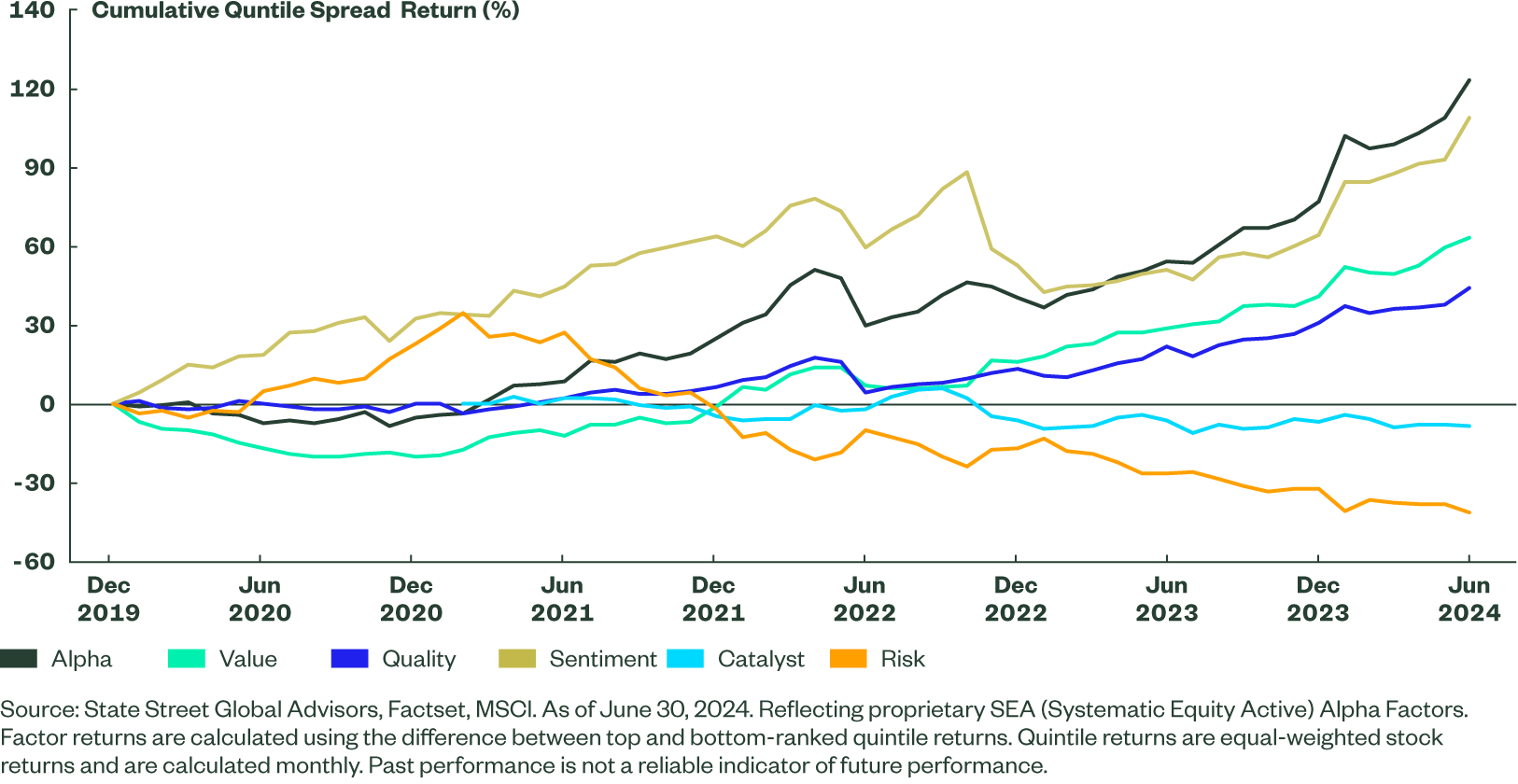

The graphs below are a representation of our success with that approach. They show the performance differential between the best and worst stocks based on our factor models. While this is not a direct example of how we might invest, it gives a very clear and unbiased tool to assess the performance of our models. The main dark blue line, our alpha – or investment signal – continues to perform exceptionally well, despite all the global volatility around Covid and geopolitical stress over the time period shown.

Figure 4 Our Systematic Equity-Active Methodology Delivers Strong Results

Emerging Markets Small Cap

Emerging Markets Large Cap

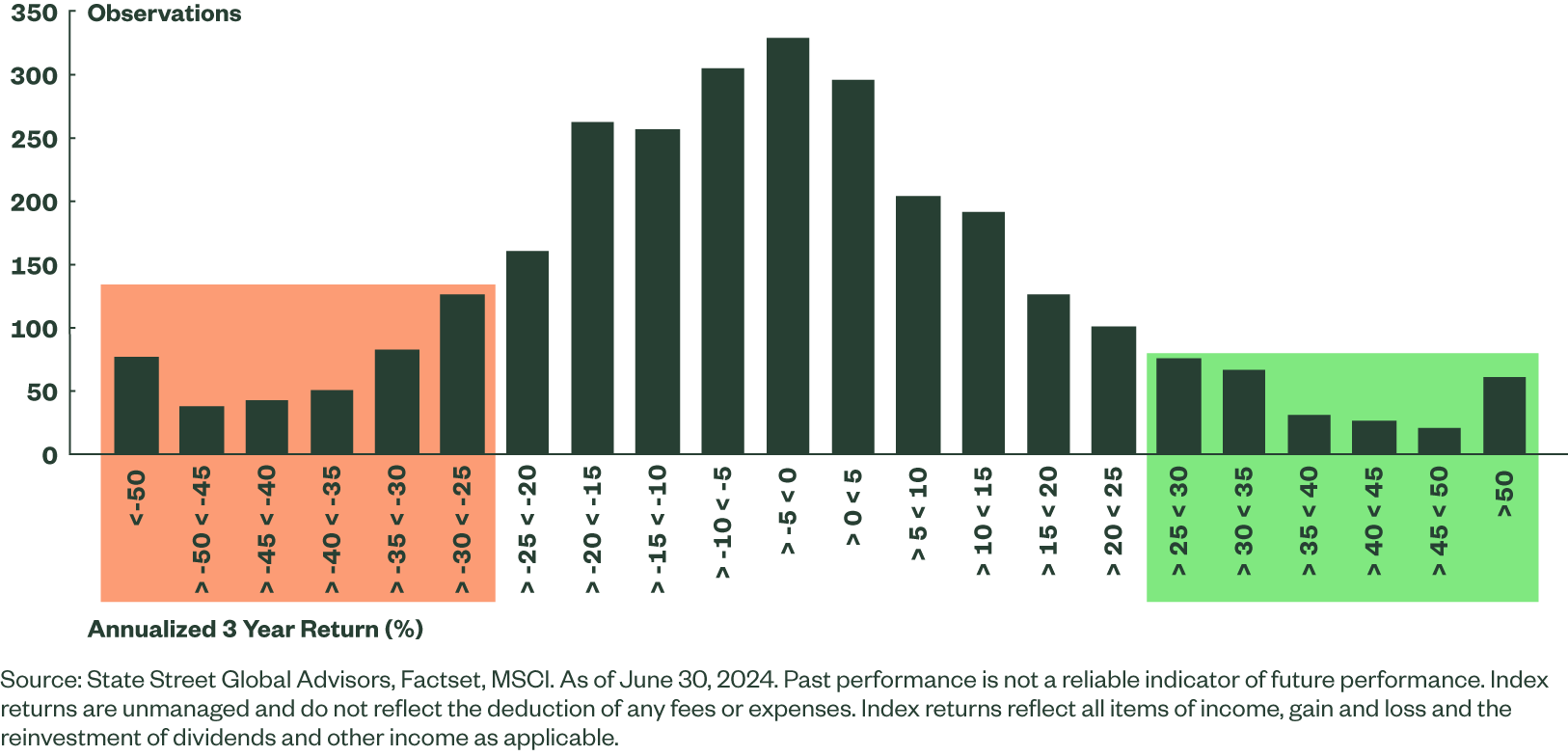

Most investors understand that the returns of financial assets are often skewed. What this means is that there are scenarios of outcomes, or fat tails, that are larger than otherwise anticipated, and there are extremely unlikely scenarios, or black swans. While this is true across nearly all segments of the market, it is doubly so in emerging market small-cap equities. In Figure 5 below, stock returns in the emerging market small-cap space exhibit a non-normal distribution, specifically concentrated tails. However, the weight in the negative tail is much fatter than the weight in the positive one. For managers who have the skills to pick a few good stocks, they can generate strong returns. However, if a manager running a concentrated portfolio gets a position wrong, there can be a very long recovery period. Our philosophy is to be diversified and to carefully limit the position in any one name, an approach which can only help a portfolio with this distribution profile.

Figure 5 MSCI Emerging Markets Small Cap

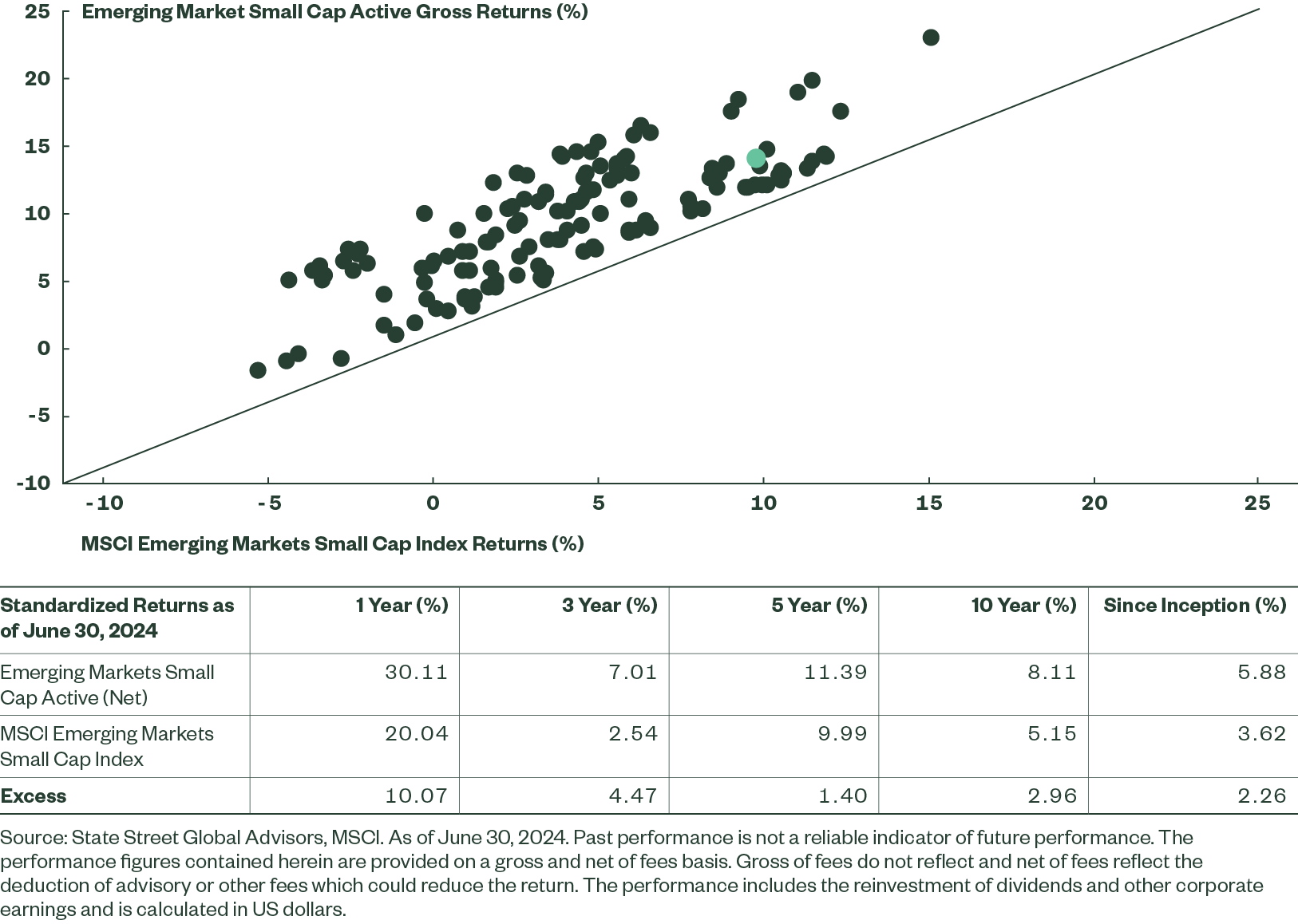

Our recommendation is simple: be diversified. Our SEA team believes that incorporating, as exhaustively as possible, security level risk and return factors in the portfolio optimization process is one of the most effective ways to mitigate idiosyncratic tail risk. The SEA team’s approach in the EMSC space has experienced many market cycles and we can confidently state it has delivered a track record of attractive and consistent risk-adjusted returns for investors. This record can be demonstrated by viewing a scatter plot of rolling five-year excess returns for our Emerging Markets Small Cap Active Strategy (Figure 6). The scatter illustrates the strategy’s trailing five-year excess return against its respective benchmark rolling back monthly to its inception on October 1, 2007. On a gross basis, our Emerging Markets Small Cap Active Strategy has delivered a 100% gross batting average, outperforming the index in every five year period since its inception (86% net batting average).

Figure 6 The EM Small-cap Active Strategy Has Outperformed Consistently

The Bottom Line

Emerging markets small-cap equities are certainly a distinct universe of securities with an abundance of opportunities for the right investor, using the right method. Due to the greater breadth, lower concentration, lack of analyst attention and non-normal returns, we believe that employing a quantitative investment process with robust breadth of information is the optimal approach to capitalizing on these opportunities.