Building a Tactical Asset Allocation Overlay With Derivatives

Investors use tactical asset allocation overlays as a strategy for generating uncorrelated alpha and managing risk in their portfolios. While TAA overlays can be implemented using a variety of different vehicles, there has been an increased interest in using derivatives by Asian institutional investors. In this article, we share our insights on the pros and cons of using derivatives for designing and implementing a TAA overlay, and what to consider.

Why Tactical Asset Allocation?

A diversifying source of alpha…

Investors utilize TAA as a strategy that seeks to add alpha, or excess returns, to their portfolios. These excess returns are generated by identifying and capturing mis-valuations both within and across global asset classes, which can be driven by investor behavioral biases, fluctuations in risk appetite, and market frictions. Ideally, the alpha resulting from TAA will have low correlation to the alpha generated by other active managers within client portfolios.

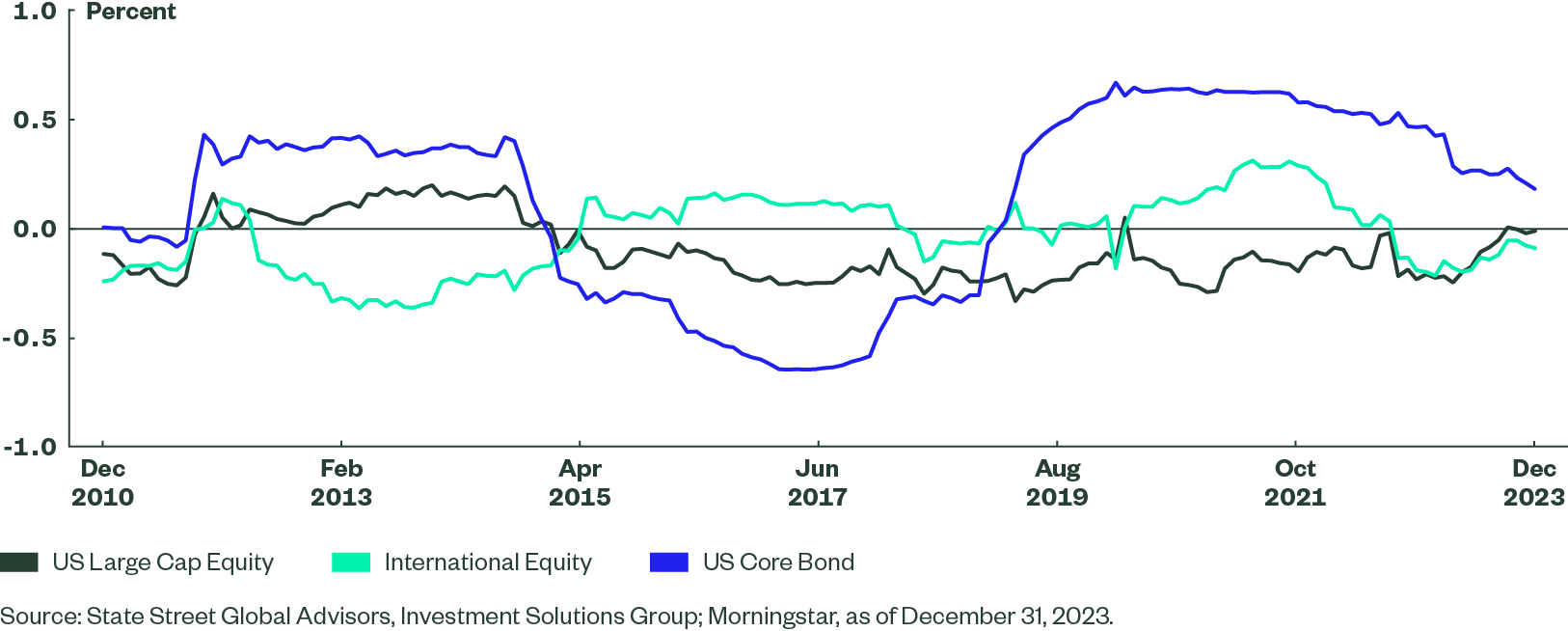

Figure 1: Rolling 3-year correlations: State Street Global Advisors TAA Alpha versus Median Active Manager Alpha (December 2010–December 2023)

Figure 2: Correlation for State Street Global Advisors TAA Alpha versus Median Active Manager Alpha, January 2008–December 2023 (Model Portfolio)

| Median US Large Cap Equity Universe of Active Managers Excess Return | -0.03 |

| Median International Equity Universe of Active Managers Excess Return | -0.05 |

| Median US Core Bond Universe of Active Managers Excess Return | 0.16 |

Source: State Street Global Advisors, Investment Solutions Group; Morningstar, as of December 31, 2023.

…And a way to manage risk

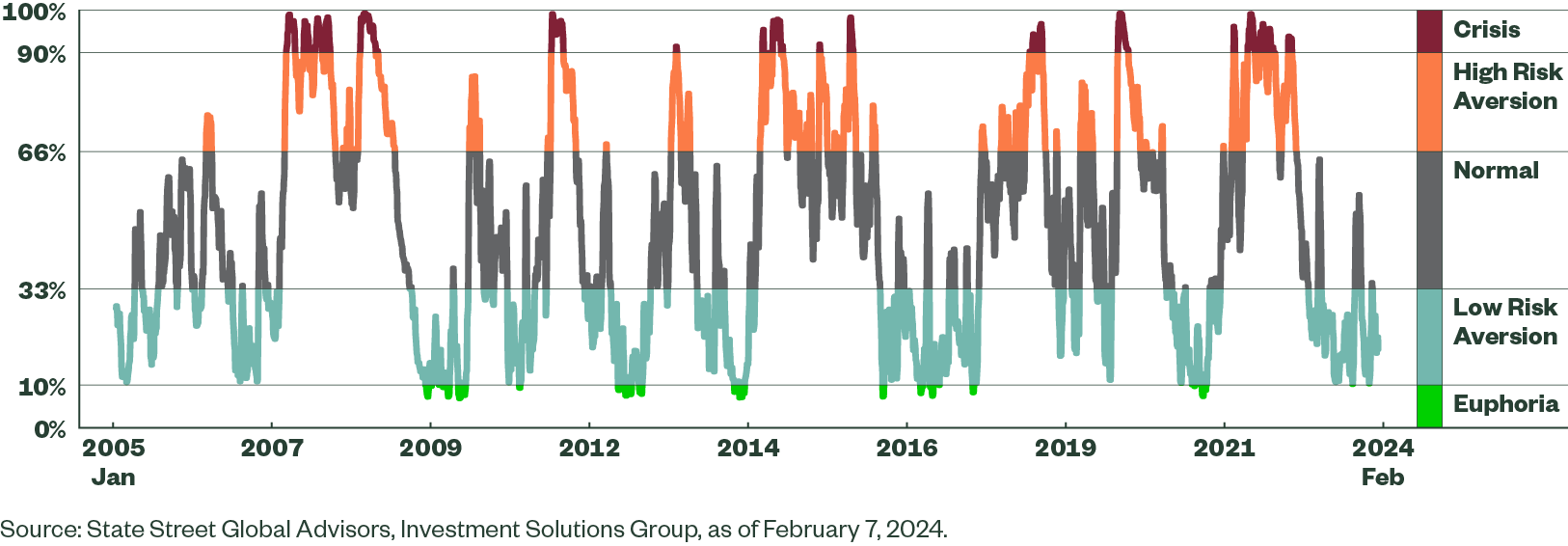

While TAA tends to be associated with a focus on adding excess returns to a portfolio, it can also be used as a way to manage portfolio risk. Understanding the level of risk aversion inherent in the capital markets is an important part of tactical asset allocation. This is because when there are above-normal levels of risk aversion, risky assets tend to perform poorly and when there are below-normal levels of risk aversion, risky assets tend to perform strongly.

While the concept is simple, measuring risk appetite can be difficult to assess as it can diverge from fundamentals. Given the large amount of market data and signals, models are often used to assess the level of risk appetite across markets. As an example, one of the tools we use in our TAA process is our Market Regime Indicator (MRI) model, which incorporates market inputs across different global asset classes. This allows us to tactically shift our exposures to risky assets based on the prevailing level of risk appetite as shown in Figure 3 below.

Figure 3: Market Regime Indicator

Being able to tactically reduce exposure to risky assets during periods of market stress (when we are in periods of high risk aversion) can help reduce the overall volatility in the portfolio. Additionally, a basket of ‘tail risk1’ assets can be deployed to cushion against the worst of market moves, while still allowing investors to continue to hold growth assets in their portfolios, helping to smooth the path of returns.

Implementing a Tactical Asset Allocation Overlay

What are the pros and cons of using derivatives versus physical exposures?

TAA overlays can be implemented using a variety of different vehicles. Across Asia, index funds and ETFs tend to be the vehicles used most frequently, but there has been an increase in interest in implementation using derivatives, particularly from large asset owners who are looking for a capital-efficient way to generate additional portfolio excess returns. Given this interest, we look at some of the benefits and drawbacks of using derivatives over physical exposures for TAA overlays.

The Benefits of Using Derivatives

- Trade flexibility and execution

Derivatives allow investors to gain or shed market exposure quickly and easily. They can be traded outside of the market close, and they generally offer quicker trade execution as they do not settle like traditional funds. This is important as there can be different settlement cycles for different funds and regions. The flexibility to trade at market – or even during an overnight session for some specific contracts – is an important feature for implementing a tactical program using derivatives, offering the potential to decrease implementation lag or performance slippage due to potential instrument notification cut-offs. Because they are marked-to-market daily, their risk is limited to a single day’s market movement with relatively modest upfront administrative work needed to establish a trading account compared a solution using physical instruments. There is also the ability to cover margins with only one currency, rather than dealing with multiple currencies for physical assets.

- Reduced opportunity costs without disrupting underlying managers

Using derivatives in a tactical overlay program can mean less disruption to underlying managers. The unfunded nature of derivatives allows investors to free up capital so that there is no need to raise cash by selling down physical holdings. If tactical trades are implemented by shifting money across existing mandates, this would mean trading physical assets, which could result in higher transaction costs, a mis-match in terms of trading cycle representing a potential opportunity cost, or could lead to a crystallization of losses if assets of an underwater manager are shifted. An overlay would allow underlying active managers to generate alpha via security selection, while an additional layer of alpha could be harvested via TAA.

- Ability to manage portfolio liquidity to improve capital efficiency

Given the ability to leverage through the use of derivatives (more on this later), in addition to a tactical investment objective, there is also the ability to equitize receivables and external manager cash. This can help an investor improve their liquidity profile, reducing the cash drag, to create a more efficient capital allocation.

Liquidity for most investors is extremely important as there is a need for ready cash to provide regular payments to beneficiaries, meet expenses, satisfy regulatory requirements, and provide collateral for currency hedges or other instruments, etc. Investors often try to mitigate these challenges by holding only a little more cash in their portfolio than needed to cover their projected cash flows. Managing portfolio liquidity becomes even more challenging as allocations to less-liquid private investments increase.

Since futures do not need to be fully funded, an overlay strategy can be structured to maintain the desired market exposures without affecting cash holdings. In fact, this allows an investor to hold more in cash, making it easier to manage liquidity needs and reducing the potential for overdraws2. However, while futures have a low capital requirement, they do require investors to post initial and variation margin. An overlay manager should be well equipped to assist in setting up a liquidity program, including collateral requirements and liquidity buffers.

- Ability to go short or take long/short positions

Having the ability to go short enables investors to reduce market exposure quickly without being forced to sell physical securities. This is particularly helpful during periods where market liquidity is low or to avoid disrupting an active manager in the underlying portfolio, where that manager can focus on picking stocks rather than raising cash to be redeployed elsewhere. Having the ability to go long/short provides the ability to isolate the alpha and off-set much of the equity beta or bond duration.

The use of derivatives allows investors to take long or short exposures to an asset class while the use of physical vehicles will only allow an investor to increase or reduce long positions. For example, using derivatives, an investor can go long or short a particular asset, even if they hold no underlying exposure in their portfolio. If physical vehicles are used, an investor can increase exposure to an underlying asset in the portfolio, or to an asset not included in the portfolio, but there is no ability to go short.

- Leverage can be used

To implement a derivatives solution, liquid futures contracts are generally used to match the asset mix. The use of derivatives allows a manager to implement an unfunded / levered solution. As futures have a low capital requirement, the cash needed to run such a solution is lower relative to a solution using only physical instruments. This can be beneficial during periods of very low volatility or strong appetite for risk, where an investor may want to seek out opportunities through a judicious use of leverage.

The Challenges When Using Derivatives

- More operational complexity to manage

Overlays are extremely flexible and customizable investment strategies, but some operational aspects make this structure more complex than standard securities portfolios. The complexity may vary based on the objective of the program, the instruments used, and any individual guidelines or restrictions.

Cash management is a key component of any overlay solution and can be one of the most challenging to manage. When running a derivatives-based overlay, there is the need to avoid overdrafts, optimize the yield of the cash, manage currency, and the initial margin / any additional margin calls required by the clearing house. For instance, the allocation of liquidity between cash instruments or clearing broker is carefully monitored by the overlay manager on a daily basis to both ensure an optimal yield for the cash exposure while maintaining a large enough liquidity buffer.

Overlays often need to reflect externally managed assets. This requires working with a client’s custodian to establish electronic data access to ensure accurate and timely data on the underlying managers. To ensure accuracy of portfolio exposure, overlays generally need to be supported by a well-integrated and complex information technology infrastructure, which rely on a multitude of market data services, allowing the system to extrapolate market values.

- Fewer vehicles available to replicate assets

There has been an increase in the number of listed derivative instruments available, making it easier to replicate traditional asset class exposure. For some asset classes, derivatives represent an easier and less operationally intensive way to access specific markets (in particular, Emerging Markets). Listed derivative instruments are a natural candidate for investors wanting to exclude currency fluctuations, and capture only the performance of the local market. Others can be replicated through over-the-counter instruments such as total rate of return swaps. However, costs can vary significantly depending on both the market and direction of trade, which can evolve quite quickly.

Despite this, there are still fewer instruments compared to funds and ETFs. For example, if derivative exposure is limited to futures within fixed income, investors should expect an uptick in tracking error, particularly versus broader benchmarks, given the limited ability to create full, global curves and access credit markets. For asset classes that cannot be replicated with low transaction costs and limited tracking error, proxies can be created which seek to match the key risk characteristics of the asset class using instruments that achieve a balance between cost and potential tracking error.

- Potential for tracking error relative to benchmarks

As index futures represent an unfunded forward transaction, performance disparity may be created through factors such as regulation, roll mispricing, funding disparity and dividend forecast error. Futures roll costs for many futures contracts, including the S&P500, can trade rich for quite some time. This is largely due to regulations resulting in higher charges to the balance sheets of financial firms that have acted as liquidity providers. Regulations such as the Dodd-Frank Act and Basel III capital requirements have had an impact on the banks who serve as liquidity providers and arbitrageurs in the futures market.

When evaluating the holding costs and tracking error of index futures on an ex-ante basis, roll costs/mispricing and funding disparity should be the primary focus. For longer time horizons, expiring positions would need to be closed out and new contracts purchased (i.e. roll futures forward). Rolling futures incurs costs, but also introduces additional tracking error to the portfolio, as investors usually have to trade the calendar spread, which can potentially be subject to mispricing between contracts. Each roll requires independent evaluation as implicit financing rates between contracts determines whether the roll is ”rich” or “cheap”. The ability to forecast holding costs becomes increasingly difficult as time extends and rolls are incurred.

Index futures can also create basis risk between the instrument used to gain market exposure and its benchmark. In the case of futures contracts, they can experience tracking error relative to the underlying assets as the contract trades above or below fair value due to short-term factors. Or, this can happen when proxy vehicles are used (e.g. Treasury futures are often used to replicate a global aggregate exposure which, aside from US government exposure, includes non-US government, ABS, and credit exposures). This can happen if the asset class universe is broad compared to the outstanding derivative instrument universe for the TAA benchmark exposures. This may not be a significant issue as long as alpha is generated. However, if proxies used do not provide a good asset replication, performance could be impacted.

- Potential need to post collateral during adverse market environments

Given the underfunded nature of derivative investments, investors are required to post collateral and, as the amount is linked to the volatility of the asset, it can move higher during adverse market environments. As markets move against investor positions, margin calls will reduce the cash held in collateral accounts necessitating additional funding. The investor needs to provide funds on a T+1 basis, requiring a plan for sourcing additional liquidity during these periods. It is also important to know that exchanges can increase initial margin requirements for futures contracts in periods of market stress, requiring additional funding from the overlay manager to maintain existing derivatives exposures.

How to Structure a Tactical Overlay

To successfully install a derivatives-based overlay program, it’s important that all the logistical and operational aspects of the plan are carefully set at the outset in order to manage the asset class and currency exposures in line with objectives. This starts with setting guidelines, the instrument universe, and any constraints. This includes clearly defining the scope of services, the necessary communication channels across the various parties involved (investor, overlay manager, custodian, clearing broker, and executing broker) so that standard operating procedures are aligned to effect smooth daily operations, and an appropriate benchmark (simple published or custom) against which performance is measured.

Collateral management and cash buffer calibration

An appropriate collateral management policy needs to be outlined. The approach is largely dependent on the ultimate goal of the program and the specific securities or instruments used to achieve the target exposures. This policy should provide details about how liquidity is being managed, the expected split between cash and cash equivalent instruments, as well as creating a contingency plan in case of adverse market conditions when additional funds would be needed to supplement collateral.

A minimum cash threshold is generally established, which serves as a trigger for raising additional liquidity. This threshold is monitored on a daily basis. It’s important that the framework be flexible while ensuring access to cash during challenging market conditions. The cash buffer is calibrated based on the ability of an investor to quickly raise cash.

In order to optimize the yield of the overall cash portfolio, securities can be posted as collateral at the clearer (to cover margin requirements) and then excess cash can be allocated to instruments with better yield. This can help keep a higher cash balance on hand, reducing the need to raise cash each time a payment is due, without giving up market participation. Direct cash kept within the clearing account generally yields a discounted short-term interest rate (e.g. the Federal Reserve Fed Funds Rate minus 25bps for US cash), so there is a strong incentive to post securities like T-bills as collateral.

Instrument optimization and trading strategy development

The universe of permissible instruments needs to be defined based on any specific constraints, regulatory restrictions, and liquidity of each instrument. Here, an instrument or basket of instruments is assigned to each asset class with instrument weights either determined by an optimization framework (using a risk system) or a rules-based approach (using parameters like geographical location, duration etc.).

An optimization framework is utilized when there is no ‘perfect’ instrument which replicates an asset. A basket of instruments is constructed with the main objective of minimizing tracking error. The optimization utility function can be customized to include mandate specific constraints – for example, introducing caps on the weights of any illiquid futures contracts. The overlay manager should work closely with their trading team to understand the liquidity and potential transaction costs before adding exposure to any contract.

The design of the basket and the selection of instruments needs to incorporate liquidity considerations, particularly with a larger program. Consideration needs to be given to understanding the frequency of trading and maximum trade sizes on any given day in order to understand the characteristics and liquidity of the instruments used. A trading strategy can then be fine-tuned to mitigate market impact.

Once everything related to the daily management of the overlay has been established, the program can be implemented. While a lot of work is done up front before implementation, the cash calibration, instrument optimization, and trading strategy needs to be reviewed regularly, depending on the market environment.

Example of TAA program implemented using derivatives

To illustrate how a TAA program is implemented using derivatives, Figure 4 below shows an example of a directional trade based our trade decisions in February 2024. At that time, global equity exposure was increased by 3%, while Global Aggregate bond exposure was reduced by the same amount, largely driven by improving market risk appetite.

Figure 4: TAA Trades Implemented Using Futures (February 2024)

| Long 3% MSCI World | Short 3% Global Aggregate Fixed Income | ||||

| Futures | Basket % | TAA Trade | TAA Trade | Basket % | Futures |

| S&P / TSX 60 index future | 4.00% | 0.12% | -1.41% | 46.85% | 2/5/10/20/30 -Year US T- Note Futures |

| + Eurostoxx 50 index Future | 9.30% | 0.28% | -0.64% | 21.49% | Euro-Schatz/Bobl/Bund/Buxl/OAT/BTP |

| Topix Index Future | 6.20% | 0.19% | -0.10% | 3.47% | Long Gilt |

| SMI index Future | 3.00% | 0.09% | -0.73% | 24.36% | 10 year JGB |

| FTSE 100 Index Future | 3.80% | 0.11% | -0.08% | 2.59% | 10 year Canadian Govt Bond |

| E-Mini S&P 500 Index Future | 70.65% | 2.12% | -0.04% | 1.24% | 3/10-Year Australia Bond Futures |

| S&P / ASX 200 index Future | 3.05% | 0.09% | - | - | - |

| Total | 100.00% | 3.00% | -3.00% | 100.00% | - |

Source: State Street Global Advisors Investment Solutions Group as of 02/29/2024.

In the equity basket, a mix of regional/country building blocks to proxy MSCI World exposure could be used, with the breakdown between equity futures contracts defined by an optimized framework. On the fixed income side, the primary focus is on selecting futures with the best liquidity, defining proxy instrument as required. A basket is constructed composed of Treasury futures weighted to match the overall modified duration exposure of the underlying index, matching the contribution to duration of each part of the benchmark’s curve (1-3 years, 3-5 years, etc.). To gain global exposure, we blended US and non-US future exposures, but for some key markets, like Japan, part of the duration curve cannot be accessed through derivatives, which will lead to some tracking error.

Given the focus during this time was driven by a bearish view on duration rather than taking a view on credit spreads, the Global Aggregate benchmark could be replicated using only Treasury contracts. In general, credit derivative liquidity is often poor compared to Treasuries, so exposures to credit/mortgage-backed securities (which would be traded via over-the-counter (OTC) or to-be-announced (TBA) securities) can sometimes be proxied using treasuries. The use of Treasury futures only can be an adequate compromise given the efficiency and flexibility they provide when implementing short-term tactical trades. While this adds to tracking error (along with the inability to fully replicate the duration curve across non-US country exposures), the market beta of the basket and the correlation to the Global Aggregate index have been historically high, suggesting that it is largely Treasury exposures which drive index performance.

Once the trading baskets have been defined, the next step is to assess how much cash may be needed to implement these trades with the minimum amount of cash equivalent to the initial margins. The overlay would also have to build in a conservative cash buffer to cover potential negative daily margin calls. As the deposit required by exchanges is about 5-6% for the equity basket and close to 2% for the fixed income basket, at least 20-25bps would be needed in cash/collateral to cover the initial margin and 25-30bps as an extra cash buffer. Therefore, the total cash/collateral buffer needed would be 45-55bps for a 6% gross notional trade. Then the optimal cash allocation can be decided with cash or other collateral like T-bills transferred from the custody agent to the clearing house.

Finally, an appropriate trading strategy would be set based on the size of the trades and the nature of the strategy. With all contracts trading at the same time, the two legs would be executed simultaneously at market. This is where having global scale and regional trading desks can be beneficial. The ability to trade in large volumes, net exposures across client portfolios, using a wide panel of global and local trading counterparties, can help reduce spread costs and improve trade execution.

While this example focuses only on directional trades across two different asset classes (equity and fixed income), directional trades can happen across a broader array of asset classes including things like commodities. Additionally, trades can be implemented within different asset classes across the different sub-segments. For example, within equities - across regions, countries and sectors, and within fixed income - across regional treasuries, along yield curves, and within credit.

(See Appendix A for a list of potential derivative instruments which could be used based on our TAA benchmark universe.)

Going beyond a TAA overlay

As we’ve outlined, a TAA overlay implemented via derivatives can be a capital efficient way to quickly gain or shed exposure with the main objective focused on alpha generation. However, once a program is in place, it’s quite easy to customize the overlay objectives over time. The programs can be extended for the overlay to act as a completion program which may include more dynamic cash equitization and liquidity management strategies, strategic rebalancing and beta replication.

Completion programs can be designed in relation to a benchmark and based on risk factors by seeking to fill or exploit any gaps in portfolio exposures. Overlay solutions can also include risk management strategies that can take the form of downside protection with either hedging, volatility management strategies and/or a protective equity option overlay. These different types of overlays are additional tools that enable investors to align their exposures within their risk budget through the use of derivatives.

The Bottom Line

The use of derivatives can provide a number of benefits relative to cash instruments. In particular, they offer a lot of flexibility and are capital efficient. However, challenges include more operational complexity and fewer vehicles, which can lead to higher tracking error relative to benchmarks. This may not be a significant issue as long as alpha is delivered.

Given the higher level of complexity involved when using derivatives, it’s important that all the logistical and operational aspects of the plan are carefully set at the outset in order to manage the asset class and currency exposures in line with objectives. An experienced manager should have both breadth and depth of knowledge across the many dimensions of the investment universe and implementation options in order to successfully identify and develop the right solution for their clients.

Appendix: List of Potential Instruments That Can Be Utilized Based on Our TAA Benchmarks

| Tactical model portfolio Benchmarks | Potential Instruments |

| Total Equities | |

| Russell 1000 | S&P500 EMINI FUT Mar24 |

| Russell 2000 | Russell2000 EMINI FUT Mar24 |

| MSCI Europe | MSCI Europe Mar24 |

| MSCI Pacific | MSCI Pacific (NTR Mar24) |

| MSCI Emerging Markets | MSCI EM NTR BI Mar24 |

| Dow Jones US Select REIT | DJ US REAL ESTATE Mar24 |

| Total Fixed income | |

| Bloomberg US Aggregate Bond | US 2YR / 5YR / 10 YR / 20 YR / 30 YR NOTE (CBT) Mar24 and TBAs |

| Bloomberg Long Treasury | US 20 YR / 30 YR NOTE (CBT) Mar24 and US 20 YR / 30 YR NOTE (CBT) Mar24 |

| Bloomberg US Credit | Cboe iBoxx iShares $ IG Corporate Bond Index Futures Feb24 or TBAs |

| Bloomberg Intermediate Treasury | US 2YR / 5YR NOTE (CBT) Mar24 |

| Bloomberg US High Yield | Cboe iBoxx iShares $ High Yield Corporate Bond Index Futures Feb24 or CDXs |

| FTSE Non-USD WGBI (USD) | EURO BUND/BUXL/SHCATZ/OAT/BTP Mar24, UK GILT Mar24, AU 10 YR Mar 24 … |

| Total Commodities | |

| Bloomberg Commodity Index | Bloomberg Com. Index MAr24 |

| GOLD – Bloomberg Gold TR | GOLD 100 OZ FUTR Feb24 |

| Total Cash | |

| Bloomberg 1-3 M T-Bill | SOFR Futures Mar24 |

Contributors: Michael O. Martel