Striking a More Defensive Posture

Despite the rapid rebound from the equity market’s volatility in early August, the shift in Sentiment we noted last month seems to be becoming more entrenched. Even as global markets rebounded 9% from their lows to positive territory at the end of the month, it was the defensive sectors that led the way.

Prevailing Amid August Volatility

As we noted last month [Is Sentiment Turning? (ssga.com)], sectors traditionally considered defensive held up strong amid the early August market volatility and market drawdown. While the sectors that had fared the worst in the market fall reverted and led the subsequent rebound in the market. Over the course of the month of August, however, less volatile sectors were the strongest performers.

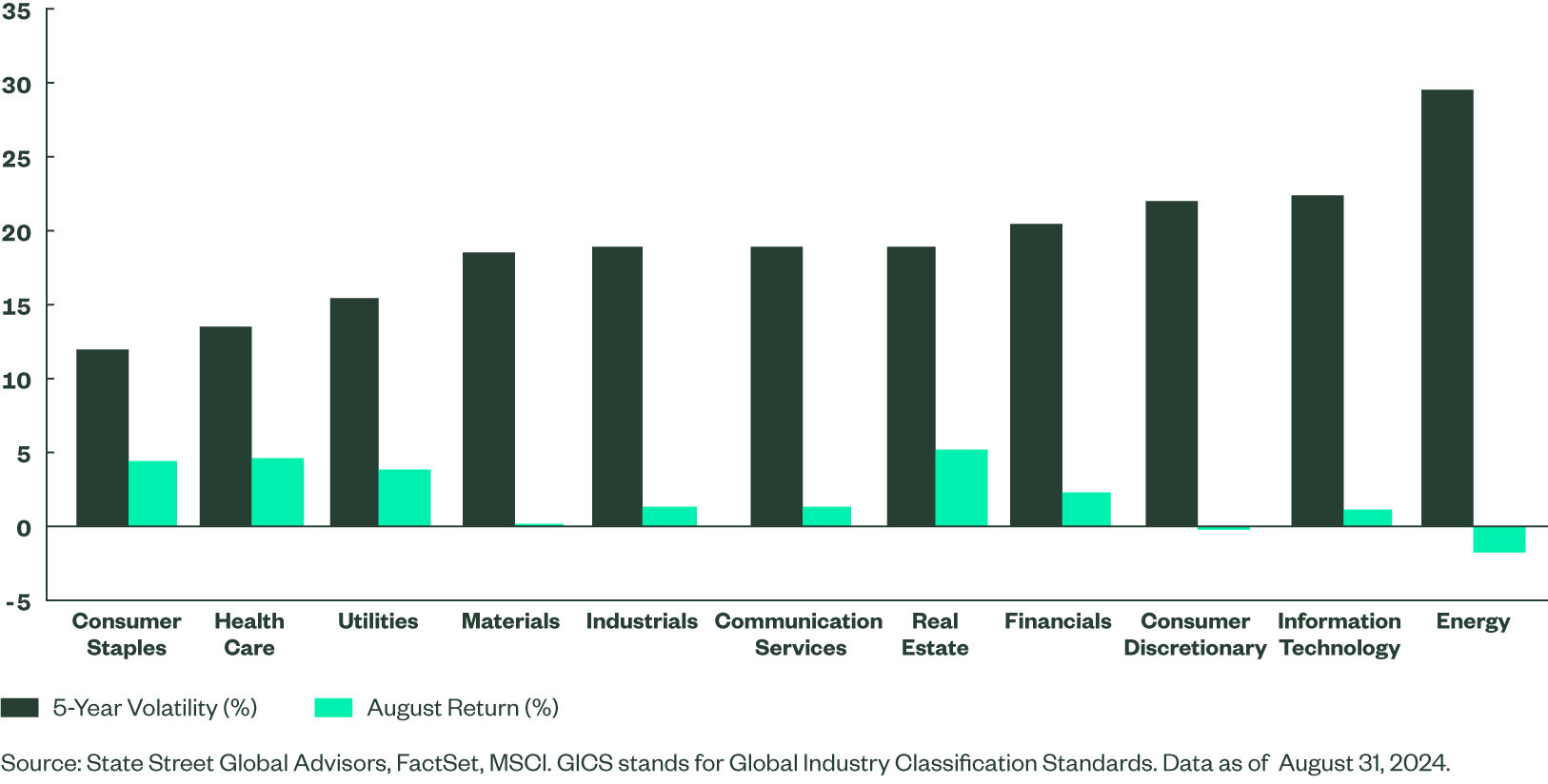

Sorting sector returns on five-year volatility measures, from low to high, we observe a high correlation with returns in August; lower volatility sectors performed better than the riskier cohort (Figure 1). The least volatile sectors, Consumer Staples, Healthcare and Utilities, notably outperformed. The Real Estate sector is also traditionally labeled a defensive sector, and similarly performed well. The Real Estate sector’s volatility over the past five years has been at median levels, largely due to idiosyncratic issues which linger and impact the sector after the COVID pandemic.

Figure1: Developed World 5-Year Volatility and August GICS Sector Returns

Broadly, we have been looking for a broadening out of the equity market rally, from the domination of a few technology-enabled superstars that have led markets in the post-pandemic period. We see increasing breadth as a healthy sign for markets overall. The current level of market concentration has, however, been at least partly driven by fundamentals, and the phenomenal earnings and cash-flow generation from a few mega-cap companies. After a brief dip in 2022, the past two years have seen earnings estimates peak at nearly 30% year-on-year growth for companies in the Information Technology (IT), Media and Retail industries. Defensive and traditionally-cyclical companies, on the other hand, have seen earnings growing at a more subdued rate.

Although the expected earnings growth differentials are still extreme, the gap if anything, is closing with a pick-up in earning expectations for the defensive and cyclical names and flattening of the trajectory of the technology superstars (Figure 2). This new dynamic suggests that there may be opportunities for cheaper, defensive, and less glamourous companies and sectors to join, or takeover, the market leadership.

What Price for Growth?

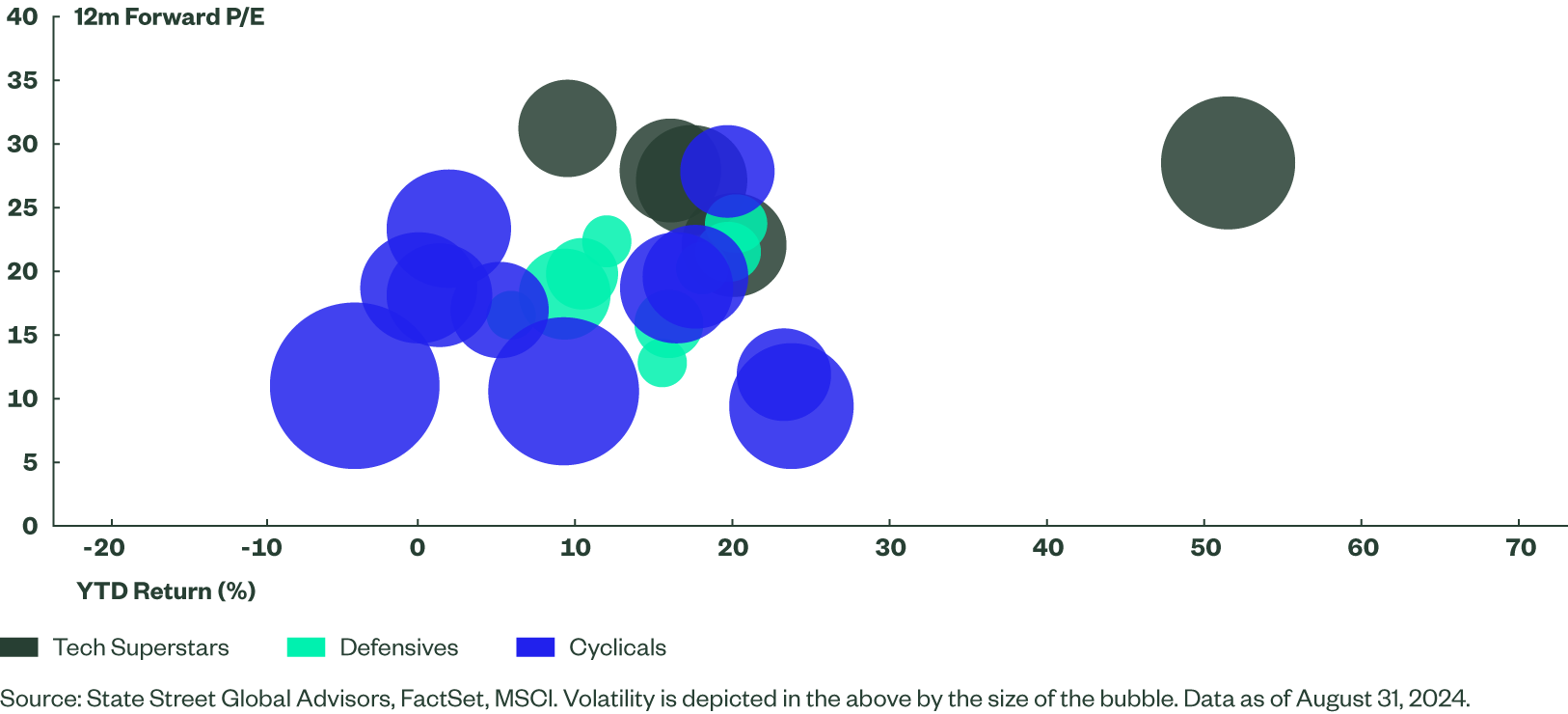

While the fundamentals still look attractive for the current market leaders, there is no doubt after a recent run of very strong returns that valuations have moved to reflect that growth, particularly in the IT sector. The cyclical parts of the market are, on average, sitting at a noticeable valuation discount to the technology superstars. Both the cyclicals and the tech-leadership segments tend to be more volatile than the market on average, increasing the risk of holding them, particularly in an environment where investors are concerned about slowing growth.

In comparison, the defensive parts of the market currently occupy the happy middle ground between these two extremes. The volatility of the segment, is of course, significantly lower than the current market leadership and the cyclical names; and as we saw in August this may offer some protection against future spells of volatility and market drawdown. Valuations of the defensive cohort are, on average, cheaper than the technology-driven companies. However, valuations of the defensive grouping are a bit more than the most volatile cyclical segments, where investors are potentially being paid more to bear that additional risk. In an uncertain world, we think this middle ground approach is increasingly appealing.

Figure 3: Valuation, Year-to-Date Return, and Volatility

The Bottom Line

After an almost serene progression upwards for equity markets in the first half of this year, the last couple of months have reminded investors that markets can go down as well as up, and that volatility can surface at almost any time.

Despite recent outperformance of defensive sectors and lower-volatility investment strategies, we believe that it is not too late to think about risk and look at a more defensive portfolio allocation within an overall equity program. The defensive sectors offer valuation discounts to the current market darlings and can be a useful hedge against downside volatility, while also offering some of the long-term upside from equity investments.