PriceStats®: Inflation Trends Mixed

A look at quarterly measures of inflation, based on prices of millions of items sold by online retailers, to help investors anticipate and evaluate the impact of inflation.

Q3 2024

Trends Remain the Fed’s Friend

It appears more likely that the surge in Q1 inflation in the US was a temporary bump in the broader disinflationary trend. And while the Federal Reserve (Fed) and investors were caught off guard by the strength of resurging inflation, they are likely cheering the recent renormalization of some of these trends.

June PriceStats data indicates that inflation’s direction of travel remains friendly, settling in at only +3 basis points (bps) on the month, versus what would normally be a seasonal increase of +20 to +30 bps. Fuel costs are likely a large contributor to recent improvements, although most of the components that PriceStats tracks don’t show any alarming trends. The annualized 3-month averages show that the recent disinflation patterns remain intact (Figure 1), although the lower realized inflation in mid-2023 is likely to make annual comparisons a bit more challenging in the coming months.

Eurozone: Inflation at Your Service

The European Central bank (ECB) finally started its normalization process by cutting rates in June, but it did so with some trepidation. So, while growth concerns continue across the eurozone (EZ), inflation is proving a worthy adversary. In particular, services inflation was hotter and stickier than expected in May, which was reported just as the ECB started its cutting campaign.

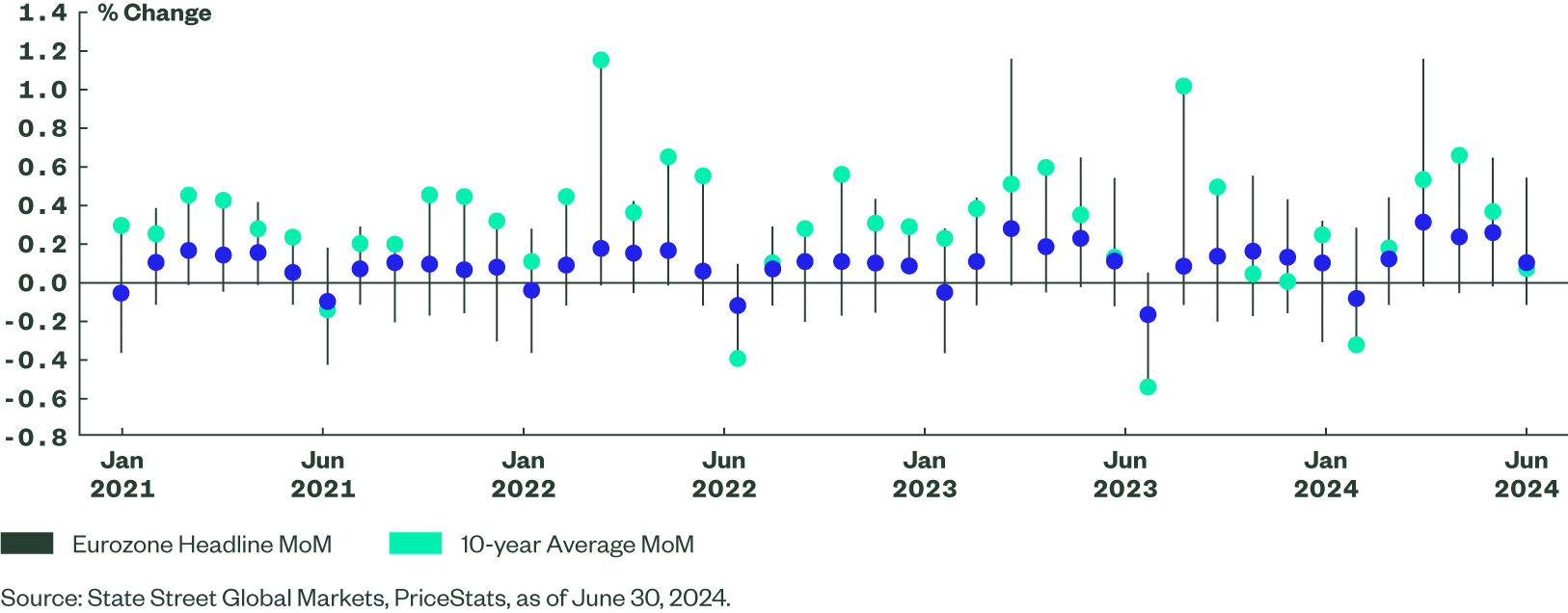

The market subsequently adjusted its rate cut expectations for the EZ, as it appears the ECB is trying to execute a hawkish cut. For our part, PriceStats data indicates that overall disinflation trends remain intact with realized data for June tracking close to historical averages (Figure 2). Seasonal summer discounting may support the ECB’s goal of additional rate cuts, although the fractured political process in France and across the European Union may prove complicating factors.

Figure 2: EZ Inflation Looks Easy

Japan: No Time Like the Present for BoJ to Act

There’s growing evidence that Japanese inflation has both reached its 2% target and is likely to stay at or above targeted levels. It has impressively risen toward the 2% goal with little intervention from the Bank of Japan (BoJ) from either a policy or currency perspective, as yen weakness remains a dominant market story.

Additionally, with PriceStats showing monthly data exceeding seasonal averages for the past quarter, it would seem an opportune time for the bank to take a step back from the extraordinary stimulus that has been in place for several decades. But it appears that the BoJ has little interest in hiking rates, even as the yen is again regularly trading above 160 versus the US dollar. Recent stress from underwater bond positions for some Japanese institutional investors dictates that the BoJ will need to tread carefully, although it’s increasingly obvious that there’s no time like the present for action (Figure 3).