Decoding the Market Reaction to Trump’s Win

Market volatility is up with US election results. What does a Trump win signal for debt, deficits, and inflation risks, and what is the path ahead for equities?

With the result of the US elections, US Treasury 30-year yields rose 24 basis points (bps) November 6 to 4.68%, the highest level since May, marking the largest increase since March 2020. The move largely reflects investors’ expectations that Trump’s stated policies on tariffs and immigration control will be inflationary.

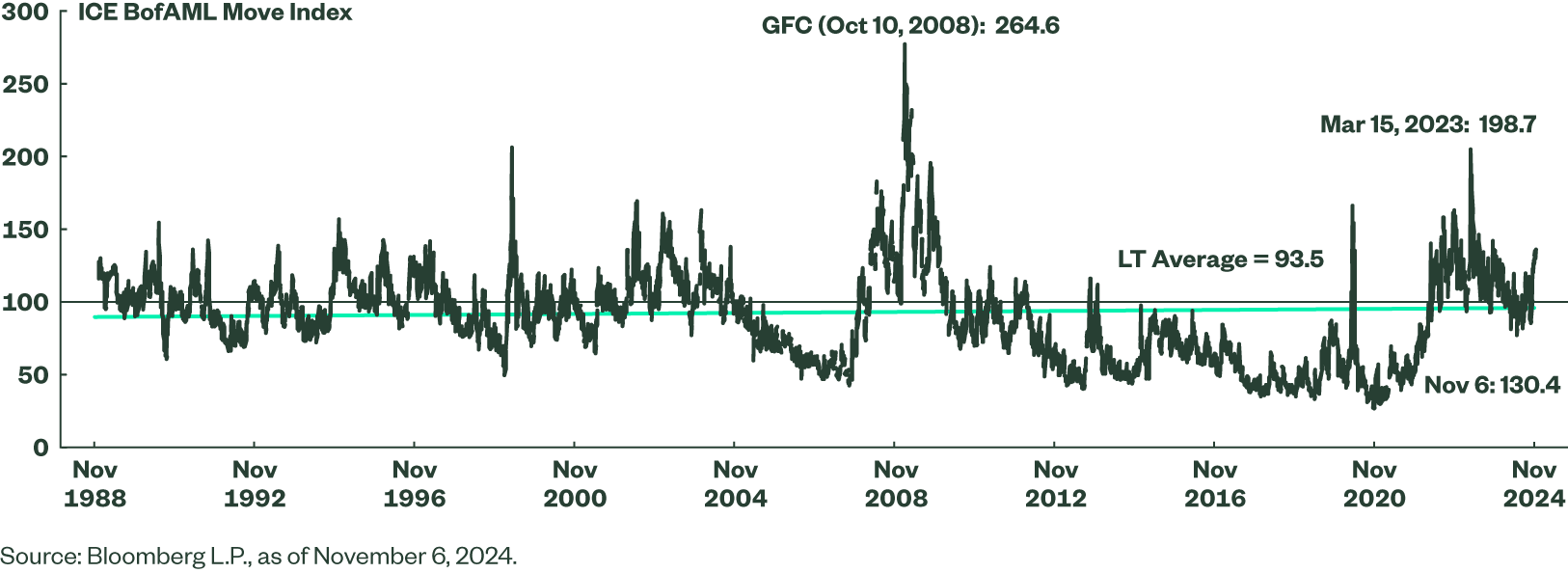

The Merrill Lynch Option Volatility Estimate (MOVE Index), shown below, tracks volatility in Treasuries. The spike on November 6 brings volatility figures back up to similar levels we saw in 2021-2022. According to our Global Head of Active Fixed Income, Matt Nest, the MOVE Index rising back to levels we saw during the pandemic should not be a surprise. Long-term yields have been between 4-5% for over a year now as the market’s perception of various risks have gone from one extreme to another. Clearly, the results of the election have refreshed the market’s worst fears, particularly around debt, deficits, and inflation risks. However, current levels of yields in relation to underlying growth and inflation trends continue to offer a reasonable risk premium for investors.

While the evolution of those trends over the next several years is important, they are anything but straightforward. We remain overweight duration and are focused on intermediate Treasuries, while avoiding longer maturities in recognition of potential tail risks associated with rising debt levels and inflation fears

Figure 1: Volatility in Treasuries Jumps1

Is Inflation Headed Higher?

Many policy experts have pointed out that tariffs only incur a one-time price hike. Given this school of thought, if Trump were to enact the tariffs he has floated, the accompanying increase in inflation would be a temporary shock, rather than a persistent increase. Whether prices continue to rise after that depends on whether the US can replace those goods with domestic production (or remaining favored trading partners) and how much it will cost to do so.

There are other reasons to think that inflationary pressures have a ceiling. Advocates of artificial intelligence (AI) point to the potential efficiencies that it and other types of technological innovations could bring— i.e., it could make goods cheaper to make in the future. Also, the US continues to have less reliance on oil (a significant source of inflation historically), both through its domestic natural gas production and the gradual shift to cleaner energy which should (after the transition is done) result in lower energy prices.

We see inflationary versus deflationary pressures being uncertain for some time, a bit like a seesaw or pendulum that is resetting itself. Which side will win out may not be very clear for some time.

Looking Ahead for Equities

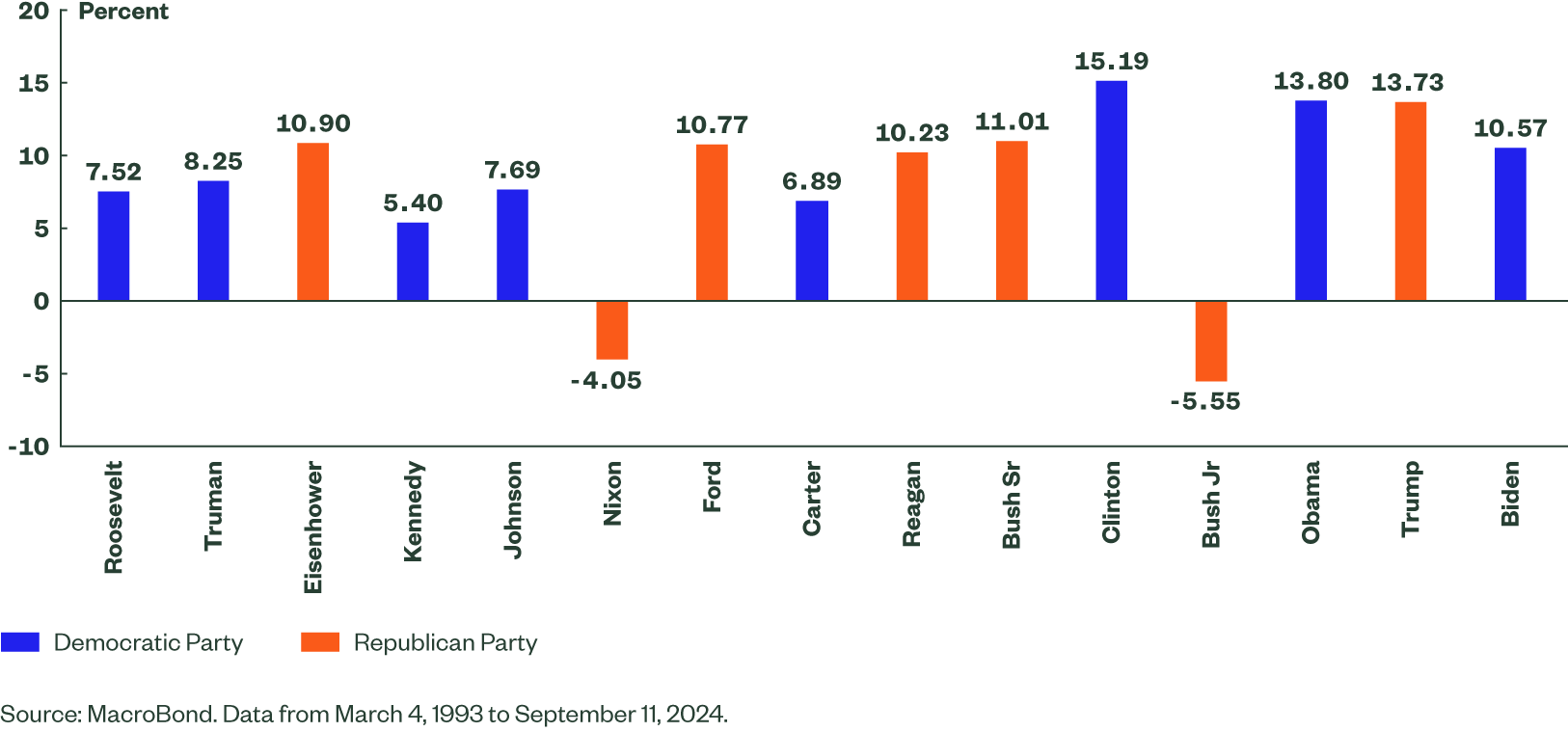

At the very least the path forward for equities looks clearer. Historically soft landings, which we appear to be in the middle of given the latest economic readings, tend to bolster equity markets. Resilience in US corporate earnings adds to this healthy picture and Trump policies, such as an extension of the Tax Cuts and Jobs Act (TCJA), are likely to keep these tailwinds going for equities. We show S&P 500 Index compound annual growth rates (CAGR) during presidential periods below to illustrate the variability among administrations (Figure 2).

Figure 2: S&P 500 CAGR Comparisons During Presidential Periods

The drag on the S&P 500 Index’s growth under Republicans stemmed from the terms of Nixon and Bush Jr., where they both presided over two recessions each. Trump’s first presidency saw strong equity performance and given the soft landing outlook, the chance of a downturn appears minimal.

For more analysis of election outcomes, please see our recent piece, US Elections Finish Line in Sight: Revisiting Our Outlook.