Alpha Insights: Positioning for Peaking Yields

- The end of rate-hike cycles have historically been good for systematic factor investing

- We expect equity returns in 2024 to be less concentrated, i.e. market breadth to improve

- Stocks in ‘Quality Growth’ and ‘Defensive’ segments have some of the highest expected returns

The fundamental drivers that dominated global equities in 2023 continue to persist. The sharpest monetary policy tightening in decades has brought about weakening regional business cycles, stagnating earnings growth, and a highly concentrated equity market (typical ahead of a slowdown). Despite interest rates and bond yields that are now peaking, we anticipate more growth uncertainty ahead due to the lagging impact of monetary tightening –on both the consumer and leveraged corporates — as excess savings and COVID stimulus fade. The IMF estimates that 75% of the rate hikes in the US have been transmitted into the real economy, with the remainder to flow through in 2024. In Europe, rate hikes began later — so the transmission mechanism has further to run. From a corporate perspective, the recent disinflationary trend is increasingly becoming a margin headwind amidst sticky wage trends. In fact, in certain cyclical industries, we see pricing power turning outright deflationary after a period of elevated pricing power.

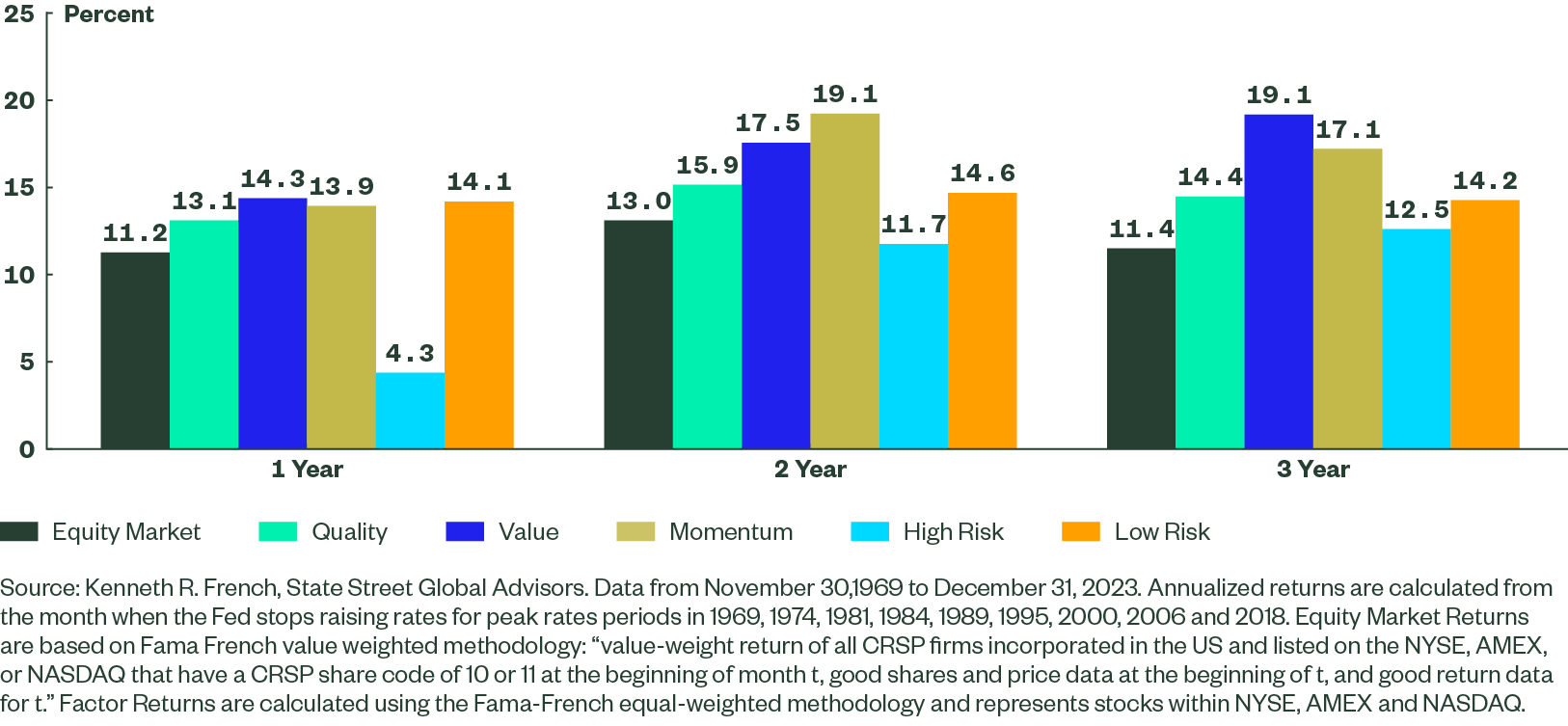

The late-cycle inflation dynamic bodes well for our systematic alpha-generating process — which favors attractively valued, high-quality companies that are benefiting from improving investor sentiment. While overall equity market returns will likely be dampened amid rich starting valuations and ongoing economic uncertainty, the end of rate hikes will provide a more positive backdrop for active stock selection. Figure 14 shows that the core factors in our active stock selection model — approximated by their academic definitions of Value, Quality (profitability) and Momentum, have historically outperformed in the one to three years following the end of rate hikes in the US. Peaks in rates generally coincide with broad economic slowdowns, which makes investing in high-beta (high-risk) stocks less attractive — and this is evident in their historical underperformance in such periods. In the current environment, we advocate for caution in higher-risk segments of the market, and prefer stocks that occupy the ‘goldilocks zone’, i.e. reasonably valued, Quality companies that are able to generate more consistent earnings alongside strong balance sheets.

Figure 1: Peak Rates Have Historically Been Precursors to Strong Factor Performance

Annualized US Equity performance post interest rate peaks (1969–2023)

Peak Rates Favor Quality Companies with Attractive Growth Prospects

Unlike 2023, 2024 will likely see a broadening of alpha opportunities beyond the AI theme. Valuations of US tech giants reached their tech-bubble highs during 2023, pricing in the potential future earnings growth of AI, despite rising discount rates. With discount rates now peaking, we find more compelling opportunities in high-quality stocks with attractive growth profiles in other segments of the market not dominated by the AI hype — notably in Communication Services and Healthcare. Alongside IT, these relatively defensive sectors also have the strongest 2024 EPS growth estimates. Our benchmark-aware portfolios are able to find numerous opportunities within these sectors, where highly attractive Quality scores intersect with strong growth profiles, but without an associated valuation premium. Examples include stocks within Broadcasting, Cable & Satellite, Health Care Distributors, Application Software and Internet Services/Infrastructure.

Peak Rates Favor Defensive Equities

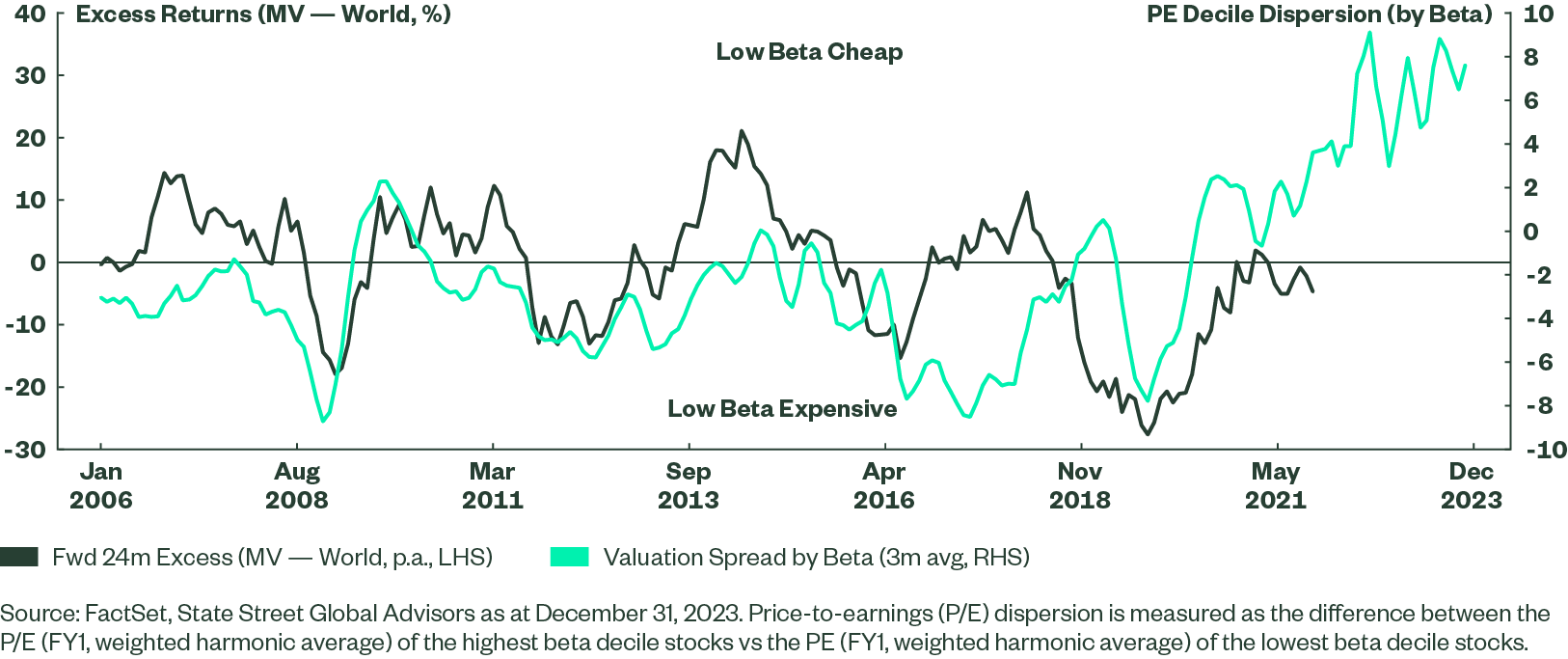

For 2024, we expect to see the following equity drivers: lower bond yields, softening GDP growth, disinflation and some downside risk to corporate profit expectations. Consistent with historical periods following the end of rate hikes, we expect lower-beta to outperform high-beta equities. With low beta currently trading at its cheapest level relative to high-beta stocks (as per Figure 15) in almost two decades, we see plenty of room for Defensive stocks to re-rate higher this year.

Figure 2: Valuation of Low-beta Looks Compelling as Rates Peak

The Bottom Line

Rich overall market valuations, coupled with wide gaps in valuations and between market leaders and the rest, suggest the market is growing less concentrated, making active stock picking more important. With central banks edging closer to an interest rate pivot and the business cycle moving into slowdown, our models are finding many attractively priced stocks with quality characteristics and capacity for sustained earnings growth. Our research shows that the next one to three years will likely present a positive backdrop for our systematic approach to active stock selection as well as defensive investing in global equities.